PPT

advertisement

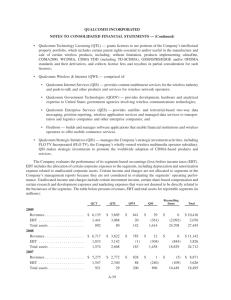

Qualcomm´s Multi-lemma 1) Introduction to the highly systemic wireless industry 2) Challenges that Qualcomm faces – Within the Cellular industry Qualcomm faces the challenge of a new standard - WCDMA. – Within the larger Wireless Industry Qualcomm faces the challenge of another new standard – WI-FI (802.11) 3) Wireless data opportunities December 8, 2003 2 Cellular System Components Overview Mobile Phone Air Interface & Frequency Antenna & Base Station T1, T3 lines Backend Equipment – Switching, Billing etc. December 8, 2003 3 Cellular Technologies • Analog – Uses the complete frequency for one call. • Time Division Multiple Access (TDMA) – Divides the frequency into time slices, e.g. US-TDMA and GSM. • Analogous to many pairs of people speaking with pauses that are so small that no one notices the delay. • Code Division Multiple Access (CDMA) – Call signals are transmitted simultaneously, but using different orthogonal codes. • Analogous to many pairs of people speaking simultaneously in mutually exclusive languages. Advantages of CDMA • 10-15 Times the Capacity Improvement • Lower power usages => longer battery life and less over heating issues • Geared for Data December 8, 2003 4 Cellular Systemic Industry – 2G Technology Chips & Software Stack Phone Equipment Service Providers December 8, 2003 CDMA GSM (20% of World Market) (70% of World Market) QCOM – 5% royalties Nokia, Ericsson, Siemens, etc. QCOM – 95%, MOT, LSI, Samsung etc. Nokia, Ericsson, Siemens,etc. Samsung, LG, Sanyo, Sony-Eric, Motorola. Nokia, Ericsson, Motorola etc. LU, NT, Eric etc. Nokia, Ericsson, Siemens, Alcatel etc. Verizon, Sprint PCS, South Korea etc. Nextel, Cingular, T-Mobile, Europe etc. 5 Mobile Market GSM market CDMA December 8, 2003 6 Cellular Systemic Industry – 2.5/3G Technology CDMA-2000 WCDMA GSM (1X- 256Kbits/s 2.4 Mbits/sec (GPRS – 40Kbits/s EVDO-2.4 Mbits/s) 2005 EDGE-70Kbits/s) QCOM – 5% royalties Nokia, Eric, Siemens, QCOM- 5% royalties. Nokia, Ericsson, Siemens etc. Chips & Software Stack QCOM – 95%, MOT, LSI, Samsung etc. TI, Nokia, QCOM, LSI, Samsung etc. Nokia, Eric, Siemens etc. Phone Samsung, LG, Sanyo, Sony-Eric, Motorola. Samsung, LG, Nokia, Sony-Eric, MOT etc. Nokia, Ericsson, Motorola etc. LU, NT, Eric etc. LU, NT, Eric, Nokia, Siemens, Alcatel etc. Nokia, Eric, Siemens, Alcatel, Motorola. Some parts of Europe Cingular, T-Mobile, ATT, Europe etc. Equipment Service Providers Verizon, Sprint PCS, Nextel, South Korea China, India, Japan, South America etc. December 8, 2003 7 Qualcomm`s current business QCOM CDMA Technologies Revenues (52% of total $3B) $1.5B Operating Margin (28%) $500MM QCOM Technology Licensing Revenues (34% of total $3B) $1B Operating Margin (89%) $900 MM * 2002 Annual Report December 8, 2003 Market share TOTAL market 12.5% $12B -Qcom - 95% of the market -Scale (partnered with IBM) CDMA2000 √ ? -Nokia/Ericsson have an advantage √ -5% royalties – guaranteed WCDMA √ -There are more patent holders. How will they be compensated? 8 WCDMA Forecast December 8, 2003 9 Pros and Cons supporting WCDMA Advantages WCDMA will be the only technology accepted in Europe (license) Upside - Royalty revenues from WCDMA up to $10 Billion Early adoption of WCDMA implies early increases in royalty streams Disadvantages QCOM less likely to be a major player in the chip market – cannibalize existing CDMA 2000 chip sales growth Potential adopters of CDMA2000 will adopt a wait and see approach. High uncertainty regarding demand (see previous slide) December 8, 2003 10 Qualcomm Strategy in WCDMA Qualcomm is assisting in the early development and adoption of WCDMA This will cost Qualcomm significant dollars in R&D, specifically in optimizing WCDMA systems. Partnering with a major chip manufacturer to achieve scale. Hedging the bets Qualcomm is also rigorously pushing CDMA2000, and also its solution of GSM/1x to convert existing non-European GSM providers to CDMA2000 December 8, 2003 11 Wireless Convergence Cellular Laptop (3G) WI-FI (802.11/.15) Frequency Exclusive Shared; Free Coverage Excellent Coverage; Mobility Growing Coverage; No Mobility Manufacturers Cellular Manufacturers D-Link, Cisco, Intel etc. Service Providers Cellular Service Providers Airports, McDonalds, Individuals? Etc. Services Voice, 3G Data Data, Voice over IP Costs Service charge to end user Free to end user, Service provider pays ISP December 8, 2003 12 Wireless Data User Segment Analysis Wireless Access Corporate Access Commercial Services Communication Speed Wireless LAN √ Mobile Service Providers X High Medium Low Reach Wireless LAN X Mobile Service Providers √ Low High Medium Mobility Wireless LAN X Mobile Service Providers √ Medium High Medium Affordability Wireless LAN ? Mobile Service Providers ? Low Medium High December 8, 2003 13 Qualcomm WI-FI Strategy Qualcomm may incorporate WI-FI into its chips. Reasons : • WI-FI can never directly compete with 3G cellular because – Low Coverage – No Mobility – Less security • WI-FI can add the following benefits to Qualcomm’s chips – Cheaper last mile solution for service provider – Higher data rates without mobility • Anything that grows the demand for data services is good. December 8, 2003 14 The Wireless Data Revolution Wireless Data development phases: 1. Person to Person 2. Person to Machine 3. Machine to Machine Cellular Data Strengths: 1. Mobile 2. DSL like Data rate Cellular Data Weaknesses: 1. Input/Output Constraints 2. Lack of the “Killer Application” December 8, 2003 15 Conclusion The wireless industry is a very systemic industry, composed of various other systemic chains within chains. However, it is in everyone’s interest to grow consumer demand for wireless, specially wireless data, and this is what in the end drives the overall strategy of all the wireless companies, cellular and non-cellular. The upcoming wireless data boom shall create great opportunities for the prepared entrepreneur. December 8, 2003 16