AN EMPIRICAL STUDY ON THE EXPECTATIONS HYPOTHESIS OF

THE PHILIPPINE TERM STRUCTURE OF INTEREST RATES,

THE BOND RISK PREMIUM,

AND ITS MACROECONOMIC DETERMINANTS

A Thesis

Presented to the

Faculty of the School of Economics

University of Asia and the Pacific

In Partial Fulfillment

of the Requirements for the Degree of

Master of Science in Industrial Economics

By

Ivy T. Zuñiga

April 2015

© Ivy T. Zuñiga. 2015. All Rights Reserved.

ACKNOWLEDGMENTS

These words will never be enough to express my gratitude to the people

who made this accomplishment worth remembering. This page is not a simple list

of persons who are very dear to me, but a note for others to know how kindhearted

and selfless these people are. They are my true inspirations.

Above all, I humbly offer this work to our Lord. This is His more than mine.

If not for His continuous graces and guidance, I would not have survived every trial

and handled every success that came my way. He is the real source of my strength.

To my adviser who (discreetly) treats me as his favorite student, Dr. Victor

Abola, thank you for greatly believing in me. I’ve never felt so appreciated by a

professor until you came along. You did not only share your academic expertise,

but you taught me that hard work really does pay off.

To the ever diligent and genuine Mr. Edwin Pineda, thank you for taking

time to read and study my thesis. I know that you’ve had a hard time understanding

my seemingly “abstract” topic, but your eagerness and enthusiasm towards my

work encouraged me to keep the discussion simple and sweet. I have learned from

you that equations will be senseless if their worth are not explicitly explained.

To my patient and cheerful external reader, Mr. Reynaldo Montalbo, Jr.,

thank you for imparting your expertise as a practitioner in the field. I am grateful

for the persistent effort to improve my work by allowing me to present the thesis to

the FMIC traders. That opportunity was a memorable one, and I will forever be

thankful for introducing me to the “real world”.

To Ms. Jovi Dacanay, my professional mentor, even though we rarely had

our mentoring sessions in my last year in the University, I have always kept your

pieces of advice close to my heart. Your motherly instincts toward us are wellvalued because we have understood that you only want what’s best for us and for

the Industrial Economics Program.

To the most loved fathers of the School of Economics: Dr. U, Dr. Terosa,

Dr. Manzano, and Sir Perry, thank you for taking good care of the Industrial

Economics Program. You are living proofs that the School of Economics is, indeed,

the best choice we’ve ever made. Your simple “How are you?” and support to our

education mean so much to us.

To the other Industrial Economics Program Staff and School of Economics

Faculty, thank you for sharing your warm greetings and sweet smiles whenever we

enter the SEC Faculty room. Even though we, thesis writers, take up your working

space and add unnecessary noise in the office, especially during break times, we

are still thankful for the service you provide us and for facilitating things well for

the students of IEP. You are the reasons why the SEC continues to prosper all these

years.

To my best friends, the IEP fifths, namely: Chela, Jose, Rey, Mon, Keren,

Sarmie, Apple, Jo, Rige, Keng, Francis, Mar, German, Rose, Althea, Raf, Rap, and

Lyndon, you are the best reasons why I cherished my college life. I look forward to

each day, not to solely work on my thesis, but to see you, listen to your unique

stories, and just laugh to even the pettiest things. You bring out the cheerfulness

and optimism in me (even though I was sometimes rude to you, guys… Sorrryyy).

As we part ways, let’s not forget each other and always try our best to catch up. I

will surely miss you and our bonding moments, but I shall look forward to the day

we meet each other again – with our dreams with us.

To my Chocoholics family back in Naga: Meg, Charm, Micah, Jenoi, Beno,

Camcam, Lala, Nille, Cathoi, and Rizza, you did not cease to be my constant

confidants even though I am 8 hours away from you. I always get touched when

you tell me you’re excited to see me in our reunions and anniversaries, and I always

get crushed inside when I tell you I can’t be there because of school requirements.

But now, I shall make it a point to spend my vacation with you, guys. We shall have

our legendary hang outs – like in our high school days.

To my family and relatives, thank you for being there no matter what. I

would not be the person that I am if not for the upbringing you provided me.

Remember that all of the fruits of my labor are because of you and for you.

To my second family, my Balanghai and Capinpin friends, you are the best

favors I received from God. You have been my closest sisters – my home away

from home – and I will always be grateful for the love and concern. Thank you for

watching over me and making sure that I always have that smile on my face. Your

overflowing prayers lifted me up but your sincerity kept my feet on the ground.

And lastly, to my UA&P friends: Sabio, Peer Facilitators, University

Student Government (USG) 2013-2014, and the Business Economics Association

(BEA), thank you for making my stay in the University the best so far. I have always

told others that my best decision yet was to go to UA&P, but I think that you made

my decision even more fulfilling. Your friendships kept me sane amidst the tons of

academic work. I have learned so much from you and our experiences together will

forever stay in my heart. All I can say is, I am blessed to have met all of you.

For all of these, I could not ask for more. Indeed, this thesis is an answered

prayer. The experience was heaven sent – just like the people in these pages.

TABLE OF CONTENTS

Page

Acknowledgments

List of Tables

List of Figures

Executive Summary

x

xi

xii

CHAPTER

I

INTRODUCTION

A. Background of the Study

B. Statement of the Problem

C. Objectives of the Study

D. Significance of the Study

E. Scope and Limitations

F. Definition of Terms

1

1

7

8

8

10

11

II

REVIEW OF RELATED LITERATURE

A. The Expectations Hypothesis

1. Term Spread Regression Models

a) Derivation of Term Spread Regression Model for

Projection of Long Rates

b) Derivation of Term Spread Regression Model for

Projection of Short Rates

2. Forward Spread Regression Models

B. Empirical Tests of the Expectations Hypothesis

1. Term Spread Regression Results

2. Forward Spread Regression Results

3. Why the Expectations Hypothesis Tests Failed

C. Bond Risk Premium

1. Estimating the Bond Risk Premium

a) Observable Proxy for the BRP

b) Term Premium Specification Based on a Term

Structure Model

D. Macroeconomic Variables and the Bond Risk Premium

21

21

24

III

THEORETICAL FRAMEWORK AND

METHODOLOGY

A. Theoretical Framework

1. Term Spread Model for Predicting Changes in the

Short Rate

2. Term Spread Model for Predicting Changes in the

Long Rate

24

25

26

27

28

31

34

36

38

38

40

42

46

46

48

49

IV

V

3. Model for Predicting Excess Holding Period Returns

4. Bond Risk Premium

5. Macroeconomic Factors and the Bond Risk Premium

B. Conceptual Framework

C. Empirical Methodology

D. Data Requirements

50

52

53

63

63

72

RESULTS AND DISCUSSION

A. Preliminary Analysis of Data

B. Current Developments of the Philippine Bond Market

1. Size and Composition

2. Liquidity

C. Expectations Hypothesis Testing using Term Spread

Models

D. Expectations Hypothesis Testing using Forward Spread

Models

E. Estimation of the Bond Risk Premium

F. Macroeconomic Variables and the Bond Risk Premium

1. Whole Sample Test

2. Periodical Sample Test (Crisis and Post-Crisis

Periods)

3. Short Rate Bond Risk Premium and Macroeconomic

Variables

4. Long Rate Bond Risk Premium and Macroeconomic

Variables

G. Economic Implications of Macro-BRP Relationship

74

74

80

80

85

SUMMARY, CONCLUSIONS, AND

RECOMMENDATIONS

A. Summary of Results and Conclusions

B. Limits of the Study and Recommendations

89

94

97

105

107

108

110

112

116

124

124

131

APPENDIX

A. Zero Coupon Bond Yields Obtained from the

Bloomberg Terminal

B. Data for Two-Period Case

C. Data for N-Period Case

D. Two-Period Case Term Spread Regression Model

Results using HAC Newey-West Test

E. N-Period Case Term Spread Regression Model Results

using HAC Newey-West Test

F. Computed Excess Holding Returns of Bond Yields

under the Two-Period Case

G. Computed Excess Holding Returns of Bond Yields

under the N-Period Case

133

142

146

150

152

154

158

H. Term Spread Regression Model Results of Predicting

Excess Bond Returns using HAC Newey-West Test

(Two-Period and N-Period Case)

I. Two-Period Case Forward Spread Regression Model

Results using HAC Newey-West Test

J. N-Period Case Forward Spread Regression Model

Results using HAC Newey-West Test

K. Forward Spread Regression Model Results of

Predicting Excess Bond Returns using HAC Newey-West

Test (Two-Period and N-Period Case)

L. Term Spread Regression Model with Moving Average

Bond Risk Premium Results using HAC Newey-West

Test (Two-Period and N-Period Case)

M. Term Spread Regression Model with Squared Excess

Returns Bond Risk Premium Results using HAC NeweyWest Test (Two-Period and N-Period Case)

N. Term Spread Regression Model with GARCHGenerated Standard Deviation Bond Risk Premium

Results using HAC Newey-West Test (Two-Period and

N-Period Case)

O. Term Spread Regression Model with GARCHGenerated Variance Bond Risk Premium Results using

HAC Newey-West Test (Two-Period and N-Period Case)

P. Macroeconomic Variables for the Panel Regression

Q. Results of the Fixed Effects Panel Regression for the

Whole Sample Case (All Variables & Selected Variables)

R. Results of the Fixed Effects Panel Regression for the

Periodical Case (2006 to 2010 & 2011 to 2014) (All

Variables & Selected Variables)

S. Results of the Fixed Effects Panel Regression for the

Short Rate BRP and Long Rate BRP (2006 to 2014) (All

Variables & Selected Variables)

T. Results of the Fixed Effects Panel Regression for the

Short Rate BRP with Periodical Tests (All Variables &

Selected Variables)

U. Results of the Fixed Effects Panel Regression for the

Long Rate BRP with Periodical Tests (All Variables &

Selected Variables)

BIBLIOGRAPHY

162

165

167

169

172

175

178

181

184

188

189

191

193

195

197

LIST OF TABLES

Table

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

Page

McCallum’s Collection of Empirical Results, Change in Long

Rates

McCallum’s Collection of Empirical Results, Change in Short

Rates

Regressions of Change in the Spot Rate on the Forward Rate

Spread

Regressions of Change in the Spot Rate on Adjacent Forward

Rates

Explanatory Variables, Definitions, and Expected

Relationship with BRP

Correlations of Bond Yields

Statistical Details of Bond Yields (Whole Sample &

Subsamples)

Term Spread Prediction of Future Changes in the Short Rate

Term Spread Prediction of Future Changes in the Long Rate

Term Spread Prediction of Excess Returns

Forward Spread Prediction of Changes in Short Rate and

Long Rate

Forward Spread Prediction of Excess Returns

Term Spread Prediction of Future Changes in the Short Rate

with Bond Risk Premium

Term Spread Prediction of Future Changes in the Long Rate

with Bond Risk Premium

Regression Results of Whole Sample

Regression Results of Periodical Sample

Regression Results of Short Rates (2006 to 2014)

Regression Results of Short Rates (2006 to 2010 and 2011 to

2014)

Regression Results of Long Rates (2006 to 2014)

Regression Results of Long Rates (2006 to 2010 and 2011 to

2014)

Summary of Macro-BRP Regressions

x

29

31

32

33

61

75

77

91

92

93

95

96

101

103

108

110

111

112

114

116

123

LIST OF FIGURES

Figure

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

Page

Federal Funds Rates vs. 10-year Bond Yield During the

Interest Rate Conundrum

Decomposition of the 10-Year US Treasury Yield

Philippine 91-Day T-Bills and 10-Year T-Bonds

Risk & Return Tradeoff Principle

Supply and Demand in the Money Market

Framework for Real and Financial Markets

Relationship of Macroeconomic Determinants of the Bond

Risk Premium

Conceptual Framework of the Study

Summary of Methodologies of the Study

3-month to 10-year Monthly Bond Yields (2006 to 2014)

Philippine Yield Curve (2006 to 2014)

3-month vs. 10-year Yield Spread (Yearly Average)

Size of Philippine Bond Market in LCY Billions

Size of Philippine Bond Market (% of GDP)

Outstanding Bonds in Foreign Currency (Local Sources)

Size of Bond Market of ASEAN +1 (% of GDP) (as of

December 2014)

Bills-to-Bond Ratio of the Philippines

Bills-to-Bonds Ratio of ASEAN +3 (as of December 2014)

Trading Volume of Philippine Government Bonds (2013

Average)

Trading Volume of Government Bonds in the ASEAN

Market +3 (2013 Average)

Turnover Ratio of Philippine Government Bonds (Yearly

Average)

Bonds Turnover Ratio in ASEAN Market +4 (as of June

2013)

Estimated Bond Risk Premium Using Moving Average

Method

Estimated Bond Risk Premium Using Squared Excess

Returns

Conditional Standard Deviation of Excess Returns from

GARCH (1,1)

Conditional Variance of Excess Returns from GARCH (1,1)

xi

2

4

5

55

56

59

60

65

73

74

79

80

81

81

82

83

84

85

87

87

88

88

99

99

100

100

EXECUTIVE SUMMARY

The Expectations Hypothesis (EH) is one of the main theories that explain

the term structure of interest rates. It postulates that the yield curve is formed

through investors’ expectations – such that the long rate is the simple average of

the current short rate, the expected future short rates over the life of the long bond,

and a risk premium. The traditional form of the EH assumes that the bond risk

premium is constant or zero, making long-term rates purely based on the outlook

of rational investors. Hence, the Expectations Hypothesis is also known as the Pure

Expectations Hypothesis (PEH), Traditional Expectations Hypothesis (TEH), or the

Rational Expectations Hypothesis (REH).

More than a theoretical concept, the EH is a helpful framework used by

academics, researchers, and financial analysts in further investigating the condition

of a country’s interest rates. Common empirical tests are called term spread

regression models, where the term spread (the difference between the long rate and

the short rate) are used to predict changes in the short rates and long rates. A 𝛽

coefficient of 1 is required to confirm that a 1% change in the term spread would

induce short rates and long rates to change by an equal magnitude.

However, empirical tests performed by various authors (using data abroad),

found out that the strict or pure form of the Expectations Hypothesis did not hold

true. The resulting 𝛽 coefficients did not achieve the required values. For the short

rates, 𝛽 values were significantly lower than 1, which implies that a 1% change in

the term spread translates to a “less-than-1” change in the short rates. For the long

rates, 𝛽 coefficients were significantly greater than 1 while some even reached

xii

negative values. This implies that a 1% change in the term spread induces long rates

to increase by more than 1 or to decline.

These results gained mixed explanations from authors. Some say that the

errors came from inaccurate econometric treatments, while others comment that it

is due to the overreaction of long rates to the current short rates. Among these

explanations, the reason that gained the most attention from researchers is the

exclusion of the bond risk premium (BRP) in the estimation of the EH. For them,

the bond risk premium should not be zero or constant, but present and time-varying.

Since the BRP is unobservable and cannot be directly measured, several studies

have focused on various ways of estimating it, and then inputting these estimates

into the EH regression tests to see if the results would improve.

Due to the limited number of researches done on the Philippine term

structure of interest rates, this thesis aimed to provide a benchmark study about the

condition of the country’s interest rates in conformity with the requirements of the

Expectations Hypothesis. This study is also motivated by the developing

government debt market in the country, the growing importance of interest rates in

investment and trading decisions, and the flourishing potential of the EH as a

framework for monitoring interest rates.

For the empirical tests, calculated Philippine zero coupon yields were used.

The tests were divided into two based on McCallum’s study: the two-period case

(which involves one-period bonds and two-period bonds) and the n-period case

(which includes one-period bonds and bonds with maturities more than twoperiods). Term spread regression models were employed to test if Philippine bond

xiii

yields will satisfy the following conditions: 1) The term spread must perfectly

predict changes in short rates; 2) The term spread must perfectly predict changes in

long rates; and 3) The term spread must not forecast excess bond returns (as we are

assuming a zero/constant bond risk premium). All of these will be achieved if the

value of the 𝛽 coefficients appeared to be 1 for the first and second condition, and

0 for the third.

Results of the tests show that Philippine bond yields do not conform to the

implications of the Expectations Hypothesis. This is because the term spread did

not “perfectly” forecast changes in the short rates and in the long rates. For the short

rates, the term spread only predicted up to 52% of the changes in the short rate –

such that for every 1% change in the term spread, short rates may only change by

0.52%. The tests on the long rates, on the other hand, produced negative 𝛽 values,

signaling a fall on the long rates when the term spread increases. Moreover, the

term spread was able to predict excess bond returns (as the 𝛽 values were not zero).

This suggests that the bond risk premium may not really be zero (as required by the

EH). All of these findings point to the rejection of the Expectations Hypothesis.

Due to the failure of the EH tests, this study readily assumed (as suggested

also by various literature) that the distortion came from the exclusion of a timevarying bond risk premium in the term spread regression models. Hence, the bond

risk premium for the Philippine bond yields was estimated. The BRP can be

modeled using proxies for risk, and to represent risk, interest rate volatility was

measured. Three different measures of volatility were obtained as adopted from the

study of Boero and Torricelli (2000). These are the: 1) moving average of absolute

xiv

changes in the short rate over the previous six periods; 2) square of expected excess

holding period return; and estimates of conditional standard deviations and

variances from the univariate GARCH (Generalized Autoregressive Conditional

Heteroskedasticity) (1,1) model.

The BRP values obtained from each estimation technique were inputted into

the term spread regression models and their effects were evaluated using goodnessof-fit tests by Gujarati (2011). These are the Adjusted R2, F-statistic, Akaike

Information Criterion (AIC), and Schwarz Information Criterion (SIC). The

Adjusted R2 and F-statistic must have large values for they are measuring the

significance of the variables in explaining the dependent variable, whereas the AIC

and SIC represent estimates of information loss so lower values are needed. The

improvement of the 𝛽 coefficients were also considered.

From the three proxies of the BRP, the GARCH-generated conditional

variances were deemed to be the best BRP estimates for the short rates, while the

GARCH-generated conditional standard deviations best fitted the BRP of the long

rates. This is because of the large Adjusted R2 and F-statistic values and the least

AIC and SIC values they generated from the regression tests.

For the short rates, the GARCH-generated conditional variances increased

the 𝛽 values of the term spread by a couple of points while improving the predictive

power of the model. For the long rates, the GARCH-generated standard deviations

made the 𝛽 coefficients positive (from their previously negative values) and the

model’s predictive power also increased. Even though the 𝛽 values were not exactly

1, the resulting 𝛽 coefficients from the regression tests still signify that the term

xv

spread can be a powerful tool in forecasting changes in interest rates. The resulting

positive 𝛽 values from the regression tests signal increases of interest rates for an

increase in the term spread. Hence, it would be safe to assume that when long rates

rise, short rates may also increase; and short rates may fall when long rates decline.

The next objective of the study is to identify the various macroeconomic

variables that significantly influence the estimated BRP. Several economic data and

some yield indicators were used as explanatory variables of the BRP. These were

the: Meralco sales (as a proxy for economic growth), Philippine inflation, pesodollar rate, money supply (M2), OFW remittances, BSP policy rate, US inflation,

gross international reserves, federal funds rate, budget deficit as a percent of GDP,

government debt as a percent of GDP, Philippine Stock Exchange Index, lagged

values of the bond risk premium, and the spread of the bond pairs.

The analyses was divided into crisis (2006 to 2010) and post-crisis (2011 to

2014) periods for both the short rate BRP and long rate BRP. Results show that

world macroeconomic factors had more dominant effects on the BRP during the

crisis periods. This finding highlights the vulnerability of the country’s financial

system to global shocks during the global financial crisis. Some of these foreign

variables are the gross international reserves, US inflation, and peso-dollar

exchange rate.

On one hand, for the post-crisis periods (2011 to 2014), the effect of foreign

economic variables have died down and only domestic factors were observed to

significantly influence the estimated BRPs. This only confirms the country’s

increased resiliency against global shocks after the 2008 financial crisis. This may

xvi

be due to the intensified macroprudential measures implemented by the Bangko

Sentral ng Pilipinas (BSP), so that players in the financial system may be cautious

when undergoing risky deals. Large domestic savings from overseas Filipino

workers (OFW) and business process outsourcing (BPO) remittances also fortified

the country from external shocks.

Additionally, it was also observed that among the explanatory variables, the

most persistent predictors of the BRP are its lagged values (𝐵𝑅𝑃(−1)) and the bond

spread. This denotes that investors or traders are highly sensitive to the past

condition of bond rates and the relationship of long-term yields with short-term

yields, more than economic factors. Investors closely watch the situation of the

financial market in requiring respective BRPs, thus exhibiting the so called adaptive

expectations (AE). This behavior hypothesizes that people form their current

decisions from the direction of past data.

Overall, the findings of the macro-BRP relationship tests imply that the

country’s bond market have gained sufficient resistance from external shocks after

the global financial crisis. The country has learned a lesson from its past, and in

order to prevent any mistakes, it is doing its best to build up its defenses. A factor

that may have contributed to this is the fact that the Philippine bond market is still

relatively small and young compared to other developing nations. The government

debt market is also less integrated into the international scene making it less

affected by global macroeconomic variables.

xvii

Furthermore, it is noticed that unlike the interest rates of some developed

countries such as the US, Philippine interest rates are very hard to predict. This

observation strengthens the idea that that Philippine bond yields (especially, the

short rates) are not yet strongly anchored on macroeconomic variables. This is the

reason why the country must intensify researches about Philippine interest rates to

develop an appropriate framework that investors and policymakers can rely on.

Such effort would make interest-rate monitoring easier and estimation of interest

rates and of the bond risk premium possible.

Even though Philippine bond yields rejected the implications of the

Expectations Hypothesis, the term spread regression tests still suggest that the slope

of the yield curve may be an effective predictor of changes in short-term and longterm bond yields. Moreover, despite the fact that the relationship of the BRP and

macroeconomic variables were not consistent through time, the tests still show that

the estimated bond risk premium of the Philippines is, one way or another, related

to some macroeconomic data. This is a good indication that the debt market is

gradually being characterized by rational investor decisions. Thus, as the country’s

bond market moves towards advancements and increased participation in the

international arena, we can only hope for a more competitive and efficient debt

system.

xviii

CHAPTER I

INTRODUCTION

A. Background of the Study

The Expectations Hypothesis (EH) is one of the most explored theories

when studying the term structure of interest rates. Basically, the EH asserts that

long-term rates are determined by the movement of short-term rates, and vice-versa

via expectations. This theory, therefore, suggests that investors cannot profitably

exploit arbitrage opportunities between short rates and long rates because long rates

and short rates are perfect substitutes.

Academics and researchers have been very interested in the dynamics of the

EH as evidenced by the numerous studies done on data abroad. Most of these

studies came from developed countries such as US, Canada, UK, Germany, etc.

This is because the study of the EH tells a lot about the real conditions of the

financial market. One concrete phenomenon where the study of the EH proved most

useful was during the advent of the so-called “interest rate conundrum” or

“Greenspan’s conundrum” in the US from 2004 to 2006, which appears to be

bothering the US economy at present.

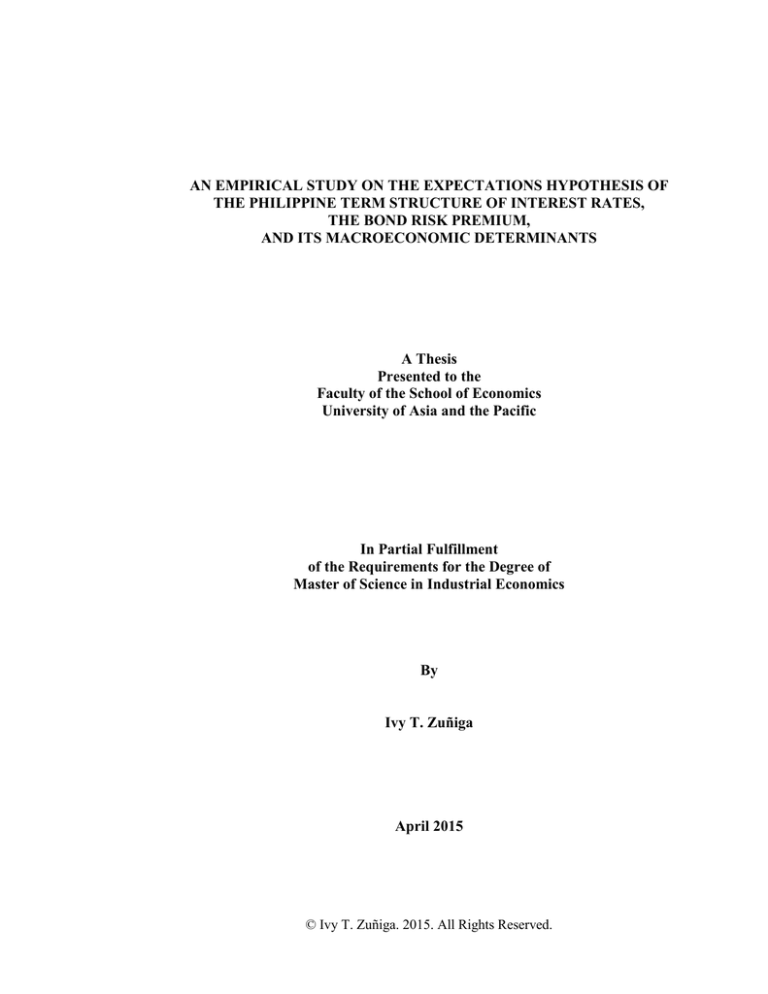

The interest rate conundrum pertains to the strange and unexpected plunge

of long-term interest rates despite the increase of the Federal Funds Rate and

improving economic conditions in the US. This occurrence baffled the economy

because it went against one implication of the EH, which is the no-arbitrage

principle. According to theory, an upward-sloping yield curve (i.e., long-term rates

1

are greater than short-term rates) must induce expected future short-term rates to

rise in order to produce equal returns. Unfortunately, when the Fed (under the

supervision of Alan Greenspan) increased its federal funds rate in 2004 from 1.0%

to 5.25%, long maturity rates eventually fell.1 It was on August 2006 that 10-year

bond yields at 4.88% were outperformed by the federal funds rate (which stayed at

5.25% for quite some time). With this, Greenspan failed to tighten credit and

restrain excesses that contributed to the global financial crisis.

7

6

Percent

5

4

3

2

1

2000-01

2000-07

2001-01

2001-07

2002-01

2002-07

2003-01

2003-07

2004-01

2004-07

2005-01

2005-07

2006-01

2006-07

2007-01

2007-07

2008-01

2008-07

2009-01

2009-07

2010-01

2010-07

2011-01

2011-07

2012-01

2012-07

2013-01

2013-07

2014-01

2014-07

2015-01

0

Federal Funds Rate

10-Year Bond Yield

Figure 1. Federal Funds Rates vs. 10-year Bond Yield During the Interest Rate

Conundrum

Source of Basic Data: Federal Reserve Bank of New York

This might have arrived as a surprise to policymakers, but to some financial

researchers and academics who have been studying the EH, the conundrum might

have been predicted to happen soon. Earlier studies observed that real data did not

conform to the empirical tests of the EH theory. Historical bond rates proved that

Roger Craine and Vance Martin, “Interest Rate Conundrum” Coleman Fung Risk Management

Research Center Working Papers 2 (2009): 1.

1

2

long rates are not purely the average of expected short rates. Hence, a rise in the

long rates may not prompt an equal increase in future short rates, and vice-versa.

Some studies even found out that the relationship can be negative at times – which

implies a fall in the expected short rates even though the long rates are rising, and

vice-versa.

Findings of these papers showed that there is some distortion present in the

data that needs to be incorporated into financial models to accurately satisfy the

hypothesis. Several experimental methods have emerged to solve this puzzle, but

most of them point to the distortion caused by the so-called bond risk premium

(BRP). Ben Bernanke, in his speech in the Annual Monetary/Macroeconomics

Conference in March 2013, pointed out that “the largest portion of the downward

move in long-term interest rates since 2010 is due to a fall in the term premium”.2

Figure 2 shows that the BRP/term premium fell dramatically during the conundrum

and even reaching negative after 2011. This may indicate that investors are

confident enough that bonds would not be too vulnerable to interest rate risks.

Bernanke enumerated two factors that may have contributed to the general

downward trend of the term premium. These are the: 1) decline in the volatility of

Treasury yields because of the zero-interest rate policy (and still expected to remain

there for some time); and the 2) increasing negative correlation of bonds and stocks

Ben Bernanke, “Long-Term Interest Rates” (online copy of speech, Annual Monetary/

Macroeconomics Conference: The Past and Future Monetary Policy, Federal Reserve Bank of San

Francisco, San Francisco, California, March 1, 2013)

http://www.federalreserve.gov/newsevents/speech/bernanke20130301a.htm (accessed April 4,

2015).

2

3

implying that bonds have become more valuable as a safe-haven instrument against

risks than other assets.

Figure 2. Decomposition of the 10-Year US Treasury Yield

Source: Board of Governors of the Federal Reserve System

Why is a conundrum dangerous in the first place? Since short rates are

difficult to manage there can be a possibility that an inverted yield curve may

appear, such that the returns of short-term bonds exceed those of long-term bonds

– which is a conventional indicator of a recession. An inverted yield curve suggests

that market players are more willing to buy long-term instruments even if they

receive a lower yield. Investors find the short-term state of the economy too risky

to make investments, prompting a rise in the short-term rate due to increased

inflation or increased term premium.3 According to an article, inverse Treasury

yield curves had forecasted the recessions of 1981, 1991, 2000, and even the 2008

Gary North, “The Yield Curve: The Best Recession Forecasting Tool” Gary North’s Specific

Answers, http://www.garynorth.com/public/department81.cfm (accessed April 4, 2015)

3

4

financial crisis.4 Because of such forecasting power, the yield curve and its

underlying assumptions must be studied and closely monitored so that anomalies

(or even recessions at worst) in the financial market may be prevented.

In the case of the Philippine interest rates, an interest rate conundrum has

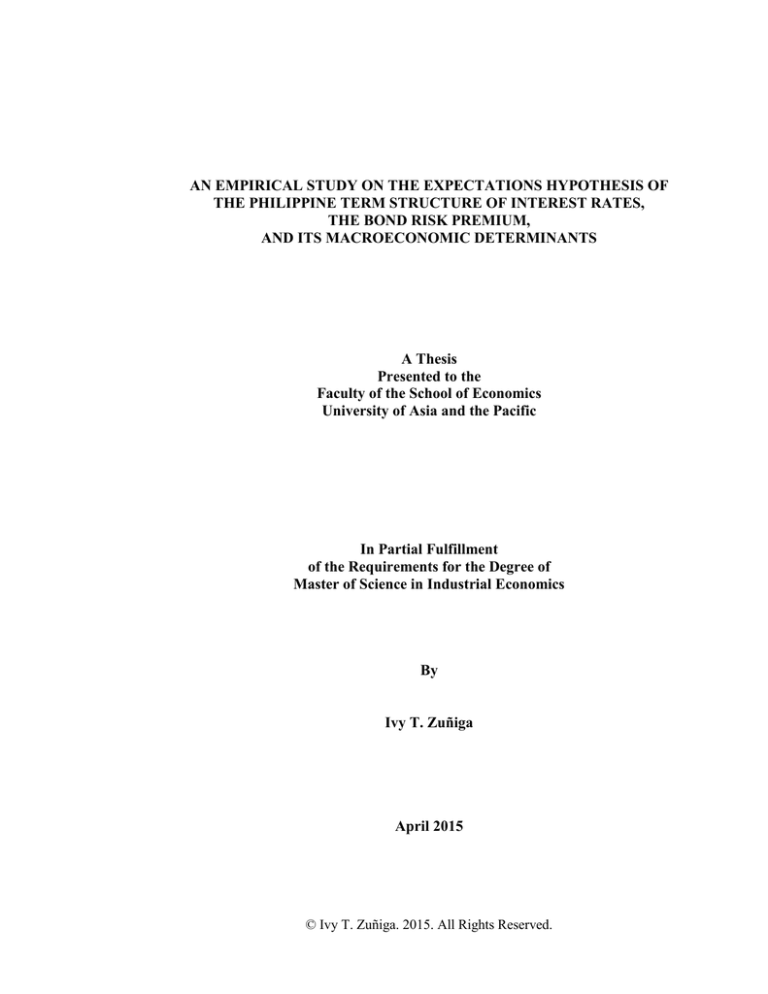

not happened yet. Figure 3 shows that since 1991, long-term bonds are still greater

than short-term bonds. Moreover, yield curves are still concave upwards. All of

these still point to a relatively healthy and normal financial system.

20

18

16

Percent

14

12

10

8

6

4

2

1999M01

1999M08

2000M03

2000M10

2001M05

2001M12

2002M07

2003M02

2003M09

2004M04

2004M11

2005M06

2006M01

2006M08

2007M03

2007M10

2008M05

2008M12

2009M07

2010M02

2010M09

2011M04

2011M11

2012M06

2013M01

2013M08

2014M03

2014M10

0

91-Day T-Bills

10-Year T-Bonds

Figure 3. Philippine 91-Day T-Bills and 10-Year T-Bonds

Source of Basic Data: Bloomberg, Philippine Dealing Systems (PDS)

Nonetheless, the “normality” of the movement of interest rates should not

be a reason for researchers and policymakers to become complacent about the

market. Besides, the Bangko Sentral ng Pilipinas (BSP) has not been very detailed

about its framework when it comes to monitoring the rates of the debt market since

it is highly focused on inflation targeting. Hence, the BSP may not have the

Kimberly Amadeo, “How an Inverted Yield Curve Predicts a Recession,” about news,

http://useconomy.about.com/od/glossary/g/Inverted_yield.htm (accessed April 4, 2015).

4

5

appropriate paradigm to tackle interest rate gyrations since the country has not

experienced an interest rate conundrum. But, what if an interest rate conundrum in

the Philippines happens? How would the BSP, the market participants, and the

overall financial market reach to it? In the first place, are Philippine interest rates

even vulnerable to such a conundrum?

For us to find out, empirical tests on the term structure of interest rates must

primarily be done, specifically anchored on a theory that explains the relationship

of short rates and long rates or perhaps a framework that incorporates the estimation

of the bond risk premium. The theory that has the implications closest to these

topics is the Expectations Hypothesis (EH).

However, the abundance of literature on the empirical tests of the EH on

data abroad comes in stark contrast with the Philippine case. As far as the EH is

concerned, no basic and focused studies have been done yet on the Philippine term

structure of interest rates. Perhaps, the value of doing a study on the EH has not

been emphasized yet for developing countries like ours. Nevertheless, it is worth

noting that a study on the EH is not only useful to policymakers as a framework for

monitoring the condition of the domestic interest rates, but also to investors as a

guide for making the right decisions when trading in the free market. On this

ground, it is essential to provide a benchmark study using Philippine data that other

researchers can develop on.

This thesis, therefore, aims to perform the basic econometric tests of the

Expectations Hypothesis on Philippine domestic interest rates using bond rates.

Knowing that the financial market is not frictionless, and that the Philippine bond

6

market is not as efficient as in developed countries, it is hypothesized in this study

that distortions would be present. This would allow empirics to dissatisfy the theory

and thus, an estimation of the bond risk premium is necessary. The same tests are

replicated to assess if the BRP indeed plays a major role in the relationship of the

EH and the term structure of interest rates. Lastly, macroeconomic factors affecting

the BRP are identified to highlight the interconnectedness of elements within the

financial system. But beyond all these, this study ultimately hopes to explore the

implications of the results and findings on the bond market and interest rates of the

country.

B. Statement of the Problem

Due to the abundance of literature on the Expectations Hypothesis (EH) of

bond yields gained from developed countries, this study replicates the basic

empirical studies of the EH using Philippine data. In order to learn more about the

condition of the Philippine domestic interest rates with respect to the EH, the

existence of the bond risk premium and its macroeconomic determinants, and their

implications on the financial market, this research aims to answer the main

question:

1. Do Philippine bond yields conform to the Expectations Hypothesis (EH)

with the inclusion of an estimated bond risk premium (BRP)?

7

C. Objectives of the Study

In order to answer the principal question of this study, the following

objectives must be satisfied:

1. To empirically test the validity of the Expectations Hypothesis using

Philippine bond yields;

2. To estimate the bond risk premium in the term structure of Philippine

bond yields;

3. To assess if an estimated bond risk premium improves or does not

improve the empirical tests done on the Expectations Hypothesis;

4. To identify the macroeconomic variables that influence the estimated

bond risk premium; and

5. To determine the implications of the study’s findings on the Philippine

bond market.

D. Significance of the Study

There are several reasons why this study should done. First and foremost,

the Expectations Hypothesis (EH) can be cited as one of the core theories that

explain the structure of interest rates. If there has been a limited study done on the

Philippine term structure of interest rates and the EH, it is possible that the market’s

knowledge about interest rates can still be inadequate. The findings of this study

can, thus, shed light to new information on how Philippine interest rates perform

under the assumptions of a theory. If the empirics were to reject the hypothesis,

then sources of distortions can be identified from where recommendations or

possible solutions can be aimed at.

8

Secondly, a deeper analysis of the Philippine bond rates can be useful from

the perspective of policy-making or regulations when it comes to interest ratetargeting. In the case of the US, during the interest rate conundrum, the Federal

Reserve did not expect that the strong link between the Federal Funds rate has

apparently weakened, therefore failing to manipulate long-term rates via short-term

nominal rates. If only researchers were able to communicate their findings that

long-term rates were not as reactive to short-term rates or that the relationship of

the two are negative, the Fed could have mitigated the effects of the conundrum

and helped save the financial system during the global crisis. In the same way, the

EH can be a promising framework that the Bangko Sentral ng Pilipinas (BSP) or

the Philippine Dealing Systems (PDS) Group can use when monitoring the

movement of short rates and long rates or when utilizing monetary policy facilities.

The outcomes of this study can signal any irregularity in the system that the BSP

or PDS Group can consider to implement the optimal response needed.

Lastly, the findings concerning the bond risk premium shall have substantial

informational value to bond investors and traders. Results of the study can show if

interest rates are only driven by market sentiment or if they move along other

macroeconomic variables as stated by theory. Hence, investors and traders can be

better informed whether they can use the EH as a model in taking their respective

positions in the market whenever new macroeconomic data have surfaced.

9

E. Scope and Limitations

This study aims to test the Expectations Hypothesis (EH) based on one of

the widely used empirical methods. These are the term spread regression models.

Forward spread regression models were also done to validate the results. Advanced

studies have featured several versions of these models but due to the limited tenors

of interest rates data we have in the Philippines, only McCallum’s (1994) EH

models are considered.5

In the estimation of the bond risk premium (BRP), only interest rate

volatility shall be considered as a proxy measure, as this thesis only aims to

establish a baseline study of the theory. Volatility was estimated in three ways,

which are the: 1) moving average of the short rate, 2) square of excess returns, and

3) simple univariate GARCH (1,1) model6 as replicated from the study of Boero

and Torricelli (2000). The value estimates gained from the three methods shall

represent the BRP for the respective long-term rates. Each of the estimated BRP

were plugged into the term spread regression models and goodness-of-fit criteria

were used to select the best BRP proxy.

Several macroeconomic variables that are hypothesized to affect the BRP

were also be included in the analysis to pinpoint which macroeconomic data have

significant (positive or negative) relationships with the BRP. These are electricity

sales (as a proxy for economic growth), inflation, peso-dollar exchange rate, excess

liquidity, OFW remittances, monetary stance, federal funds rate, budget deficit (as

5

See Chapter 2 and Chapter 3 for further elaboration about the models used in the study.

See Definition of Terms and Chapter 3 for an elaboration of the univariate GARCH (1,1)

method.

6

10

% of GDP), government debt (as % of GDP), stock market activity, and gross

international reserves. The lagged values of the estimated bond risk premium were

also included, along with the bond spread.

To simplify the testing of the EH, monthly yields of zero coupon bonds

from 2006 to 2014 would be used for the tests and analyses of the study. Since the

Philippines does not issue zero coupon bonds anymore, bond yields stripped off

their coupon effects were obtained using Bloomberg’s time series of calculated zero

coupon bond yields.7 The following bond tenors that will be included are: 3-month,

6-month, 1-year, 2-year, 3-year, 5-year, and 10-year.

F. Definition of Terms

ARIMA-GARCH

ARIMA-GARCH stands for Autoregressive Integrated Moving Average –

Generalized Autoregressive Conditional Heteroskedasticity, which is a

combination of ARIMA process of data and GARCH model. A time series

data is considered ARIMA (𝑝,𝑑,𝑞) when it has to be differenced 𝑑 times

and then the ARMA (Autoregressive and Moving Average) model is

applied to it – where 𝑝 denotes the number of autoregressive (AR) terms, 𝑑

denotes the number of times the series has to be differenced before it

becomes stationary, and 𝑝 is the number of moving average (MA) terms.

Thus, an ARIMA (2,1,2) time series has to be differenced once (𝑑 = 1)

before it becomes stationary and the first-differenced stationary time series

7

Coupon bond yields can be manually stripped off their coupon effects using a method called

bootstrapping.

11

can be modeled as an ARMA (2,2) process, that is, it has two AR terms and

two MA terms.8

GARCH enters the picture when the error variance of the time series data is

related to the squared error terms several periods in the past. This model can

have the GARCH (𝑝,𝑞) model in which there are 𝑝 lagged terms in the

squared error term and 𝑞 terms of the lagged conditional variances.9

Augmented Dickey-Fuller (ADF) Test

ADF is a test for unit root in a time series data. This is also a statistical test

for the stationarity or non-stationarity of the data. The usual rule is, if the

probability value obtained from the test is less than 0.05, the null hypothesis

(i.e., the data has unit root) must be rejected. Otherwise, the null hypothesis

must be accepted.

Bills-to-Bonds Ratio

This measure was used by the Asian Development Bank (ADB) as an

indicator of bond market size. This is calculated as:

𝑇𝑜𝑡𝑎𝑙 𝐵𝑖𝑙𝑙𝑠 𝑡𝑜 𝐵𝑜𝑛𝑑𝑠 𝑅𝑎𝑡𝑖𝑜 =

𝑇𝑜𝑡𝑎𝑙 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 𝐺𝑜𝑣𝑒𝑟𝑛𝑚𝑒𝑛𝑡 𝐵𝑖𝑙𝑙𝑠

𝑇𝑜𝑡𝑎𝑙 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 𝐺𝑜𝑣𝑒𝑟𝑛𝑚𝑒𝑛𝑡 𝐵𝑜𝑛𝑑𝑠

where bills pertain to government securities of 1 year or less in maturity

while bonds pertain to government securities of more than 1 year in

8

Damodar Gujarati, Basic Econometrics: International Edition (New York: McGraw-Hill, 2003),

840.

9

Damodar Gujarati, Basic Econometrics: International Edition (New York: McGraw-Hill, 2003),

862.

12

maturity. This also gives a hint if a country’s bond market is characterized

by short maturity bonds or long maturity bonds.10

Bond Pairs

This pertains to the pairing of a short rate and a long rate for the regression

models of the Expectations Hypothesis. The following bond pairs are as

follows: 3-month and 6-month bonds, 6-month and 1-year bonds, 1-year

and 2-year bonds, 1-year and 3-year bonds, 1-year and 5-year bonds, and 1year and 10-year bonds.

Bond Risk Premium (BRP)

According to Ilmanen (2012), the bond risk premium refers to the return

advantage of long-term bonds over short-term bonds. It is also known as the

compensation for risk that investors require in investing in long-term bonds

than short-term bonds. In this study, the bond risk premium was measured

by using the volatility of interest rates as a proxy. This implies that the more

volatile a certain bond is, the riskier it is, hence, a higher risk premium is

needed. Alternatively, the less volatile a certain bond is, the less risky it is,

hence, a lower risk premium is required.

Three measures of bond risk premium were done in this paper. These are

the: 1) moving average of the 1) moving average of the short rate, 2) square

of excess returns, and 3) univariate GARCH (1,1) generated measures of

“Bills-to-Bonds Ratio,” Asian Bonds Online,

http://asianbondsonline.adb.org/philippines/data/bondmarket.php?code=Bills_Bonds_Ratio_Total

(accessed April 5, 2015).

10

13

conditional standard deviations and conditional variances from the study of

Boero and Torricelli (2000).

Bond Turnover Ratio

This measure was used as an indicator of liquidity in the bond market by

the ADB. This is computed using the formula:

𝐵𝑜𝑛𝑑𝑠 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 𝑅𝑎𝑡𝑖𝑜 =

𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑏𝑜𝑛𝑑𝑠 𝑡𝑟𝑎𝑑𝑒𝑑

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑎𝑚𝑜𝑢𝑛𝑡 𝑜𝑓 𝑜𝑢𝑡𝑠𝑡𝑎𝑛𝑠𝑖𝑛𝑔 𝑏𝑜𝑛𝑑𝑠

The average amount of outstanding bonds is equal to the average amount

at the end of the previous and current quarters. The higher the turnover ratio,

the higher is the liquidity of the secondary bonds market.11

Bond Yields/Bond Returns

This figure refers to the return that an investor gets on a bond which usually

refers to yield-to-maturity, or the total return that one will receive if the

bond is held to maturity. In this study, however, zero-coupon bond yields

were used. The term “bond yield” was used interchangeably with “bond

return” in this study.

Correlogram Specification

This is a graphical and numerical display of autocorrelation statistics of time

series data. It is also a diagnostic test to determine if a certain time series

data has unit root or are non-stationary. It is also known as Autocorrelation

Function (ACF). If the ACF value is within the 95% confidence interval,

then there is sufficient statistical evidence for the null hypothesis to be

“Bonds Turnover Ratio,” Asian Bonds Online,

http://asianbondsonline.adb.org/philippines/data/bondmarket.php?code=Bond_turn_ratio

(accessed April 5, 2015).

11

14

rejected. This means that the data do not have unit root or are stationary.

Otherwise, the data are non-stationary.

Covariance

This is a measure of co-movement between two variables. A positive

covariance means that two variables move together while a negative

covariance means that the variables move in opposite directions. The

formula for covariance is:12

∑𝑛𝑖=1(𝑥𝑖 − 𝑥̅ )(𝑦𝑖 − 𝑦̅)

𝐶𝑂𝑉(𝑥, 𝑦) =

𝑛−1

where:

𝑦 = dependent variable

𝑥 = independent variable

𝑛 = number of data points in the sample

𝑦̅ = mean of dependent variable 𝑦

𝑥̅ = mean of independent variable 𝑥

Excess Bond Returns/Excess Holding Period Returns

Excess bond returns pertains to the return on a long-term bond relative to

the return on a short-term bond (risk-free investment). This paper adopted

the definition of excess bond returns or excess holding return by Mankiw,

Goldfeld, and Shiller (1986). The excess bond returns is expressed as:

𝐸𝐻𝑅 = 𝐻𝑡 − 𝑟𝑡

“Statistical Sampling and Regression: Covariance and Correlation,” PreMBA Analytical

Methods, https://www0.gsb.columbia.edu/premba/analytical/s7/s7_5.cfm (accessed April 17,

2015).

12

15

where:

𝑟𝑡 ≡ short-term bond yield

𝐻𝑡 ≡ holding period return

𝐻𝑡 was calculated as:

𝐻𝑡 ≈ 𝑅𝑡 −

𝑅𝑡+1 − 𝑅𝑡

𝜕

where:

𝑅𝑡 ≡ long-term bond yield at the current period

𝑅𝑡+1 ≡ long-term bond yield at the next period

𝜕 ≡ constant equal to the average long-term yield

Fixed Effects Panel Regression

Fixed effects is one of the specifications used when doing a panel

regression. A panel dataset contains observations on multiple entities

(individuals), wherein each entity is observed at two or more pints in time.13

This was used in the regression tests for the macroeconomic determinants

of the BRP. The fixed effects method was used, as opposed to the random

effects model, because we would want to take into account the time-variant

nature of the explanatory variables. The random effects specification is used

only when the effects of time-invariant variables should be included.

Forward Rates

Forward rates are the rates applicable to a financial transaction that will

happen in the future. In the context of bonds, they are calculated to

“Regression with Panel Data”

http://www.econ.brown.edu/fac/Frank_Kleibergen/ec163/ch10_slides_1.pdf (accessed April 25,

2015).

13

16

determine future yields. For example, an investor can either purchase a oneyear Treasury bill and hold it to maturity, or purchase a six-month T-bill

and buy another six-month bill once the former matures. Under the principle

of no-arbitrage, the investor will be indifferent between the two choices.

The spot rate of the one-year and six-month bonds will be known, but the

value of the six-month bill purchased six months from now shall be

unknown. Given the six-month and 1-year spot rates though, the forward

rate on a six-month bill can be computed. It is the rate that equalizes the

return between two types of investment tenors.14

Forward Spread

This refers to the difference between the forward rate of a long rate and the

forward rate of a short rate used for the forward spread regression models –

an alternative test of the Expectations Hypothesis done to validate and

compare with the results of the term spread regression models.

Kurtosis

This is a statistical measure that describes the variability of data around the

mean. A high kurtosis depicts a graph with fat tails signifying an even-out

data distribution, whereas a low kurtosis portrays a graph with skinny tails

indicating that the distribution is concentrated around the mean. It is also

called as the “volatility of volatility”.15 Kurtosis, in this study, was used to

describe the condition of the bond yields before, during, and after the global

“Forward Rate” Investopedia, http://www.investopedia.com/terms/f/forwardrate.asp (accessed

April 4, 2015).

15

“Kurtosis,” Investopedia, http://www.investopedia.com/terms/k/kurtosis.asp (accessed April 5,

2015).

14

17

financial crisis. Conventionally, higher kurtosis values appeared during the

crisis years signifying the high level of volatility and risk present.

N-Period Case

This pertains to the term spread regression model done by McCallum (1994)

on bonds with maturities more than two periods. The following bond pairs

were used for the n-period case regression tests: 1-year and 3-year, 1-year

and 5-year, and 1-year and 10-year.

One-Period Bond

This refers to the yield of a bond held for one period. In this study, the

following bond tenors were considered under the classification of a oneperiod bond: 3-month bond, 6-month bond, and 1-year bond.

Skewness

Skewness is also a statistical measure that describes the location of data,

which can be symmetrical or non-symmetrical. In the case of investment

returns, non-symmetrical or skewed distributions are more common –

which can be positively skewed or negatively skewed. Positively skewed

distributions (or long right tails) meant frequent small losses and a few

extreme gains or that extremely bad scenarios are unlikely to happen.

Negatively skewed distributions (or long left tails), on the other hand, meant

frequent small gains and a few extreme losses or greater chance for

extremely negative outcomes.16

“Quantitative Methods – Skew and Kurtosis,” Investopedia,

http://www.investopedia.com/exam-guide/cfa-level-1/quantitative-methods/statistical-skewkurtosis.asp (accessed April 5, 2015).

16

18

Term Spread

This refers to the difference between the bond pairs or the difference

between a long rate and a short rate used for the term spread regression

models in testing the Expectations Hypothesis.

Trading Volume

This was also used as an indicator of bond market liquidity by the ADB.

This pertains to the total traded value of local government bonds in the

secondary market in US dollars.17

Two-Period Bond

This refers to the yield of a bond held for two periods, which is usually twice

that of the period of one-period bonds. Hence, two-period bonds in this

study are the 6-month bond, 1-year bond, and 2-year bond.

Two-Period Case

This pertains to the term spread regression models done by McCallum

(1994) on one-period bonds and two-period bonds. The following bond

pairs were used for the two-period case regression tests: 3-month and 6month, 6-month and 1-year, and 1-year and 2-year.

Univariate GARCH (1,1) Model

GARCH

stands

for

Generalized

AutoRegressive

Conditional

Heteroskedasticity. This econometric technique is commonly used to model

the volatility of some financial time series data. GARCH assumes that the

“Trading Volume,” Asian Bonds Online,

http://asianbondsonline.adb.org/philippines/data/bondmarket.php?code=Trading_Volume

(accessed April 5, 2015).

17

19

variance of the error term (residual) is affected by its past values.

Furthermore, the GARCH specification asserts that the best predictor of the

variance in the next period is a weighted average of the long-run average

variance, the variance predicted for this period, and the new information in

this period that is captured by the most recent squared residual. Such an

updating rule is a simple description of adaptive or learning behavior.18

For this study, the volatility of excess returns was estimated using the

GARCH (1,1) model. This signifies that the excess returns might possess

an ARCH (1) effect (current volatility of the residuals is affected by the

previous residual) and a GARCH (1) effect (current volatility of the

residuals is affected by its previous volatility).

Zero Coupon Bonds

These are also called pure discount bonds which are bonds that have been

stripped off their coupons. They do not pay an interest during the life the

bond but the payment of the interest and principal happens at the end of the

bond’s maturity. According to some studies about the Expectations

Hypothesis (EH), zero coupon bonds are used to simplify the testing of the

term spread regression models. If zero coupon bonds are not available in

one’s financial market, coupon bonds can be converted to zero coupon

bonds via a process called bootstrapping. In this study, zero coupon

Philippine bonds with different tenors were directly obtained using the

Bloomberg terminal.

Robert Engle, “GARCH 101: The Use of ARCH/GARCH Models in Econometrics”, Journal of

Economic Perspectives 15 (2001), 159.

18

20

CHAPTER II

REVIEW OF RELATED LITERATURE

A. The Expectations Hypothesis

The Expectations Hypothesis (EH) is one among the three major theories

that try to explain the term structure of interest rates.19 The key assumption of this

theory is that bonds, despite having different maturities, are “perfect substitutes”;

hence, bonds’ expected returns are equal. In practice, “the expectations theory

postulates that an investor can earn the same amount of interest by investing in a

one-year bond today and rolling that investment into a new one-year bond after a

year compared to buying a two-year bond today”.20

Munasib provided the following example to illustrate the no-arbitrage

assumption of the EH:21

1. Buy $1 one-year bond (short bond) and buy another one-year bond upon

maturity (also known as the Rolling Strategy)

2. Buy $1 of two-year bond and hold it (also known as the Maturity

Strategy)

19

The term structure of interest rates shows the relationship of yields across various maturities.

The graphical representation of it is called the yield curve. The two other theories that attempt to

describe the yield curve are the Liquidity Preference Theory and Market Segmentation Theory

which shall not be discussed in this paper.

20

“Expectations Theory,” Investopedia.

http://www.investopedia.com/terms/e/expectationstheory.asp (accessed September 26, 2014)

21

Abdul Munasib, “Term Structure of Interest Rates: The Theories”, Econ 3313 – Handout 03,

Middle Tennessee State University, http://raptor1.bizlab.mtsu.edu/sdrive/FMICHELLO/Fin%204910%20Options,%20Futures%20and

%20other%20Derivatives/Extra%20Readings/Term%20structure%20of%20interest%20rates.pdf

(accessed December 26, 2014).

21

For the EH, to hold true, Investment Strategy 1 must have an equal return

with Investment Strategy 2. Consider the following notations:

𝐸𝑅1 ≡ expected return for Investment Strategy 1 or the Rolling Strategy

𝐸𝑅2 ≡ expected return for Investment Strategy 2 or the Maturity Strategy

𝑖𝑡 ≡ interest rate of a one-period bond at time t

𝑒

𝑖𝑖+1

≡ expected interest rate of a one-period bond at time t+1

𝑖2𝑡 ≡ interest rate of a two-period bond at time t

For Investment Strategy 1 (Rolling Strategy), the expected return is:

𝑒

𝐸𝑅1 = [(1 + 𝑖𝑡 ) + (1 + 𝑖𝑡 )𝑖𝑖+1

]−1

𝑒

𝑒

𝐸𝑅1 = 𝑖𝑡 + 𝑖𝑖+1

+ 𝑖𝑡 (𝑖𝑡+1

)

𝑒

𝐸𝑅1 ≈ 𝑖𝑡 + 𝑖𝑖+1

𝑒 )

since 𝑖𝑡 (𝑖𝑡+1

≅0

For Investment Strategy 2 (Maturity Strategy), the expected return is:

𝐸𝑅2 = [(1 + 𝑖2𝑡 ) + (1 + 𝑖2𝑡 )𝑖2𝑡 ] − 1

𝐸𝑅2 = 𝑖𝑡 + (𝑖2𝑡 )2

𝐸𝑅2 ≈ 2𝑖2𝑡

since (𝑖2𝑡 )2 ≅ 0

By EH,

𝑒

𝑖𝑡 + 𝑖𝑖+1

= 2𝑖2𝑡

𝑖2𝑡 =

𝑒

𝑖𝑡 + 𝑖𝑡+1

2

(Eq. 1)

Equation 1 shows that the two-period interest rate must equal the average

of the current short-term rate and the future short-term rate expected to hold over

the two-period horizon. The same follows for a bond that is more than two-years in

maturity, as shown in Equation 2.

22

𝑖𝑛𝑡 =

𝑒

𝑒

𝑒

𝑖𝑡 + 𝑖𝑡+1

+ 𝑖𝑡+2

+⋯+ 𝑖𝑡+(𝑛−1)

𝑛

.

(Eq. 2)

Therefore, if the current short-term rate changes, so will the long-term rates.

Thus, the EH also posits that “interest rates for different maturities tend to move

together over time”.22 In summary, the EH asserts that

1

𝑚

𝑛,𝑚

𝑟𝑡𝑛 = ( ) ∑𝑘−1

𝑖=0 𝐸𝑡 𝑟𝑡+𝑚𝑖 + 𝜃

𝑘

(Eq. 3)

where:

𝑟𝑡𝑛 ≡ long-term (n-period) rate

𝑟 𝑚 ≡ short-term (m-period) rate

𝑛

𝑘 = 𝑚 ≡ is an integer

𝜃 𝑛,𝑚 ≡ term-specific but constant risk premium

Similar to Equation 1, Equation 3 states that the long rate is the simple

average of the current short rate and expected future short rates up to n-m periods

in the future. 𝜃 𝑛,𝑚 is the predictable excess return on the n-period bond over the mperiod bond. The term-specific premium may vary with m and n but is assumed to

be constant through time.23 The relationship between the n and m period rates in

Equation 3 implies that an upward-sloping yield curve predicts an increase in short

rates and consequently in long rates, and vice-versa. In order to investigate this,

Abdul Munasib, “Term Structure of Interest Rates: The Theories”, Econ 3313 – Handout 03,

Middle Tennessee State University. An empirical study on the Philippine term structure of interest

rates by Diaz (2012) confirmed this claim via cointegration tests between the benchmark 91-day

and 10-year rates.

23

Campbell & Shiller (1991) put the risk premium to be constant through time, but the stricter

version of the EH (known as the Pure Expectations Hypothesis) assumes that the term premium is

null or zero. This is because the PEH posits that interest rates are established strictly on the basis

of expectations about future rates. Secondly, the theory assumes that market players are riskneutral (i.e. indifferent to maturity because they do not view long-term bonds as being riskier than

short-term bonds). In this study, however, we shall test if the term premium of Philippine bond

rates is indeed zero or not.

22

23

various approaches have been developed. Two common methods are the term

spread regression models and the forward spread regression models.

1. Term Spread Regression Models

The term spread regression models aim to use the difference

between the long rate and the short rate (term spread) as a predictor of two

outcomes: a) future changes in the long rate and b) future changes in the

short rate. The studies of Mankiw, Goldfeld, and Shiller (1986), Campbell

and Shiller (1991), Campbell (1995), Tzavalis and Wickens (1997), Dai and

Singleton (2002), and many others, have used the term spread regression

models to test the EH. Equation 3 can be transformed into a regression

model to investigate these two assumptions.

a. Derivation of Term Spread Regression Model for Projection of Long

Rates

The first approach starts from the assumption that the one-period

return on an n-period bond must be equal to the one-period short rate and a

disturbance term known as the risk premium (Equation 4). Following

Geiger’s (2011) notations, the derivation is as follows:

𝐸𝑡 (𝑟𝑛,𝑡+1 ) = 𝑖1,𝑡 + 𝑥𝑟𝑛

(Eq. 4)

[𝑖𝑛,𝑡 − (𝑛 − 1)][𝐸𝑡 (𝑖𝑛−1,𝑡+1 )] − 𝑖𝑛,𝑡 = 𝑖1,𝑡 + 𝑥𝑟𝑛 (Eq. 5)

[𝐸𝑡 (𝑖𝑛−1,𝑡+1 )] − 𝑖𝑛,𝑡 =

(𝑖𝑛,𝑡 − 𝑖1,𝑡 )

(𝑛−1)

𝑖𝑛−1,𝑡+1 − 𝑖𝑛,𝑡 = 𝛼1,𝑛 + 𝛽1,𝑛

−

𝑥𝑟𝑛

(𝑛−1)

(𝑖𝑛,𝑡 − 𝑖1,𝑡 )

(𝑛−1)

+ 𝜃𝑛,𝑡

(Eq. 6)

(Eq. 7)

24

where Equation 6 tells us that the expected one-period change in the long

rate, [𝐸𝑡 (𝑖𝑛−1,𝑡+1 )] − 𝑖𝑛,𝑡 , is equal to the average term spread over the

remaining periods (n-1),

(𝑖𝑛,𝑡 − 𝑖1,𝑡 )

(𝑛−1)

, minus the average term premium over

𝑥𝑟

𝑛

the remaining periods, (𝑛−1)

.

Equation 7 transforms Equation 6 into a directly testable regression

model that can be consistently tested via ordinary least squares. This is

because the term premium, 𝜃𝑛,𝑡 , or the forecast error, under rational

expectations, is assumed to be orthogonal or uncorrelated to the current

information at time t. In this way, the term spread shall be uncorrelated also

with the errors. To satisfy the EH, the projection of the changes in the long

rate (left-hand side) onto the slope of the yield curve (right-hand side)

should give an 𝛼1,𝑛 coefficient of zero, and a 𝛽1,𝑛 coefficient of one.24

b. Derivation of Term Spread Regression Model for Projection of Short

Rates

Alternatively, Equation 3 can also be used to derive the formula for

testing if the term spread is able to predict expected changes in the short

rate. From the basic assumption that the long rate is a simple average of the

current short rate and the expected short rates in the future, plus an assumed

constant risk premium, as shown in Equation 8:

Felix Geiger, “The Theory of the Term Structure of Interest Rates,” in the The Yield Curve and

Financial Risk Premia, (Berlin: Springer-Verlag, 2011), 69-70.

24

25

𝑖𝑛,𝑡 =

1

𝑦

∑𝑛−1

𝐸

(𝑖

)

+

∅

𝑡

1,𝑡+𝑗

𝑗=0

𝑛,

𝑛

(Eq. 8)

the short rate can be subtracted from both sides of the equation to achieve

the term spread regression model.

1

𝑛

1

𝑛

𝑦

∑𝑛−1

𝑗=0 [𝐸𝑡 (𝑖1,𝑡+𝑗 ) − 𝑖1,𝑡 ] = 𝑖𝑛,𝑡 − 𝑖1,𝑡 − ∅𝑛

(Eq. 9)

∑𝑛−1

𝑗=0 (𝑖1,𝑡+𝑗 − 𝑖1,𝑡 ) = 𝛼2,𝑛 + 𝛽2,𝑛 (𝑖𝑛,𝑡 − 𝑖1,𝑡 ) + 𝜀𝑛,𝑡 (Eq. 10)

Equation 10 implies that the yield spread, (𝑖𝑛,𝑡 − 𝑖1,𝑡 ), predicts the

expected changes in the short rate, specifically the weighted cumulative

expected change in the short rate over the life of the long rate,

1

𝑛

∑𝑛−1

𝑗=0 (𝑖1,𝑡+𝑗 − 𝑖1,𝑡 ). Based on the EH, the expression above also suggests

that whenever the long-term yield exceeds the current short-term yield (or

a rise in the term spread), future short rates are expected to rise so that the

returns between the two are equal. Similar to Equation 7, if the EH holds,

𝛼2,𝑛 must approach zero and 𝛽2,𝑛 should converge to unity so that an

observed positive term spread is associated with increasing future shortterm rates.25

2. Forward Spread Regression Models

Other studies have also explored the usefulness of forward rates26 in

investigating the EH. Some of these are Fama and Bliss (1987) and

Felix Geiger, “The Theory of the Term Structure of Interest Rates,” in the The Yield Curve and

Financial Risk Premia, (Berlin: Springer-Verlag, 2011), 69-70.

26

Walsh introduced forward rates as an equal measure of the expected one-period ahead rates

under the EH. He defined it in the case of a two-period bond and a one-period bond as: 𝑓𝑡1 =

25

(1+𝐼𝑡 )2

(1+𝑖𝑡 )

− 1.

26

Cochrane and Piazessi (2002). Geiger called this the “unbiased test of the

EH” since under the assumptions of the EH, forward rates proxy as unbiased

and optimal predictors of future interest rates”.27 Hence, current forward

rates should appropriately predict future short rates.28 The forward spread

regression model came from Equation 7 as a predictor of future short rate

changes:

𝑖1,𝑡+𝑛 − 𝑖1,𝑡 = 𝛼3,𝑛 + 𝛽3,𝑛 (𝑓𝑛,𝑛+1 − 𝑖1,𝑡 ) + 𝜀𝑛,𝑡

(Eq. 11)

where:

𝑖1,𝑡 ≡ interest rate of a one-period bond at time t

𝑖1,𝑡+𝑛 ≡ interest rate of a one-period bond during the life of the nperiod bond

𝑓𝑛,𝑛+1 ≡ forward rate that equalizes the returns of the one-period

bond and n-period bond

𝜀𝑛,𝑡 ≡ disturbance term/risk premium

If the EH holds, Equation 11 implies that 𝛼3,𝑛 must have a

coefficient of zero and a 𝛽3,𝑛 coefficient of one.

B. Empirical Tests of the Expectations Hypothesis

A multitude of studies have tested the EH’s empirical validity. Majority of

them used US bonds data while covered the term structure of other OECD29 and

Carl Walsh, “The Term Structure of Interest Rates,” in the Monetary Theory and Policy,

(Massachusetts: The MIT Press, 2010), 467.

28

Felix Geiger, “The Theory of the Term Structure of Interest Rates,” in the The Yield Curve and

Financial Risk Premia, 70.

29

Frederic Mishkin, “A Multi-Country Study of the Information in the Term Structure about

Future Inflation,” National Bureau of Economic Research (1989).

27

27

G730 countries. However, almost all of the basic empirical tests failed to satisfy the

EH with 𝛽 coefficients significantly different from one. For some, the 𝛽

coefficients were even significantly less than zero. The collection of literature on

the EH tests assembled by McCallum (1994) are shown in Tables 1 and 2.

1. Term Spread Regression Results

McCallum segregated the results for the change in short rates and

change in long rates.31 Table 1 shows the slope coefficients for the model

that predicts changes in long rates. Results of the regression tests show that

almost all of the 𝛽 coefficients were significantly below zero. The absolute

value of the slopes also increase with the maturity of the bond.32 The same

results were also arrived at by Hardouvelis (1994) for the study on G7

countries which analyzed the behavior of the 10-year and 3-month

government bond yields between the periods of 1968-1992. He found out

that the long rates move contrary to that implied by theory.33

The negative coefficients from the term spread models of the long

rates imply that as the yield spread increases, the long yield has the tendency

to fall. Campbell (1995) argued that when the long yields fall the short rates

have the tendency to decline even more (if the EH is followed), thereby

Gikas Hardouvelis, “The term structure spread and future changes in long and short rates in the

G7 countries: Is there a puzzle?,” Journal of Monetary Economics (1993).

31

Empirical tests for the term spread as a predictor of change in short rates was called the twoperiod case by McCallum, while testing the changes in long rates was called the n-period case.

The two-period case pertains to the relationship between yields on one-period and two-period

bonds, whereas the n-period case covers bonds with maturities of more than two periods.

32

Bennett McCallum, “Monetary Policy and the Term Structure of Interest Rates” NBER Working

Paper 4938 (1994), 4, 10.

33

The same results were also achieved by Mankiw, Goldfeld, and Shiller (1986).

30

28

resulting to a greater yield difference between the short rate and the long

rate. The EH, however, requires the future change in long yields to increase

to offset the corresponding rising of the yield curve.34

On the other hand, some EH tests produced results consistent with

theory. An example of which is the study on the German term structure of

interest rates by Boero and Torricelli (2000). Nearly all pairs of maturities

had coefficient estimates that were consistently positive, although not

always significantly so. For the authors, their results suggest that “it is easier

to predict changes in interest rates over longer horizons”. Boero and

Torricelli, nevertheless, overruled the previous statement after having very

low R2 values, indicating that the term spread has poor predictive content

for changes in the long rate.35

Table 1. McCallum’s Collection of Empirical Results, Change in Long Rates

Slope

Coefficient

Evans & Lewis (1994)

1964-1988

1 mo.

2

-0.17

Evans & Lewis (1994)

1964-1988

1 mo.

4

-0.70

Evans & Lewis (1994)

1964-1988

1 mo.

6

-1.27

Evans & Lewis (1994)

1964-1988

1 mo.

8

-1.52

Evans & Lewis (1994)

1964-1988

1 mo.

10

-1.89

Campbell & Shiller (1991)

1952-1987

1 mo.

2

0.00

Campbell & Shiller (1991)

1952-1987

1 mo.

4

-0.44

Campbell & Shiller (1991)

1952-1987

1 mo.

6

-1.03

Campbell & Shiller (1991)

1952-1987

1 mo.

12

-1.38

Campbell & Shiller (1991)

1952-1987

1 mo.

24

-1.81

Campbell & Shiller (1991)

1952-1987

1 mo.

48

-2.66

Campbell & Shiller (1991)

1952-1987

1 mo.

60

-3.10

Campbell & Shiller (1991)

1952-1987

1 mo.

120

-5.02

Hardouvelis (1994)

1954-1992

3 mo.

120

-2.90

Source: Bennett McCallum, “Monetary Policy and the Term Structure of Interest Rates” NBER

Working Paper 4938 (1994).

Study

Sample Period

Short Rate

N+1

John Campbell, “Some Lessons from the Yield Curve,” The Journal of Economic Perspectives

5, no. 3 (1995), http://www.jstor.org/stable/2138430.

35

Gianna Boero and Costanza Torricelli, “The Information in the Term Structure of German

Interest Rates” (2000).

34

29

Table 2 also shows McCallum’s collection of literature that tested

the term spread on future changes in the short rate. Similar to the results

from the long rates, majority of the 𝛽s were significantly different from the

desired coefficient of one. Some were greatly below than 1, negative at

times, and for some highly exceeding one. These results suggest various

implications for the relationship of the term spread and the future changes

of short rates. If 𝛽s are significantly below 1, increases in the term spread

may not be well-translated in the changes of short rates. If 𝛽s are

significantly negative, just like the case of the long rate regression results,

increases in the term spread will cause short rates to fall; and if 𝛽s

significantly exceed one, any increase in the term spread will result to an

overreaction of future short rates.36

Nevertheless, compared to the widely contradicting results for

changes in long rates, findings of the regression tests for predicting short

rate changes have been more unified and consistent. Most of the results

gathered by Mankiw, Goldfeld, and Shiller (1986), Boero and Torricelli

(2000), and Campbell and Shiller (1991), produced 𝛽 coefficients which are

positive (consistent with the relationship dictated by the EH theory), with

some closely approaching one. Additionally, some of the regressions, such