Change Frozen Concentrate Orange Juice (MM PS)

advertisement

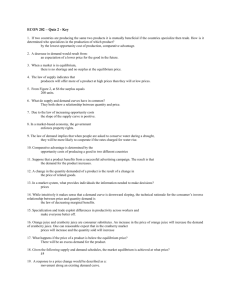

SITUATION AND OUTLOOK FOR THE 2013/14 FLORIDA CITRUS SEASON DECEMBER FORECAST FCM Board Meeting january 8, 2014 FLORIDA ORANGE CROP, 2013-14. DECEMBER FORECAST FACTORS OF PRODUCTION UTILIZATION AND JUICE IMPORTS JUICE SUPPLY, AVAILABILITY, MOVEMENT AND INVENTORY RETAIL SALES AND PER CAPITA CONSUMPTION NURSERY PROPAGATIONS SOURCE: FDACS, BUDWOOD ANNUAL REPORTS. Season 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 Orange Propagations 2,362,829 3,069,515 3,348,479 2,391,375 2,541,410 3,172.966 3,898,083 % Change % Oranges NA 30% 9% -29% 6% 25% 23% 91% 87% 89% 80% 81% 81% 83% ORANGE BEARING TREE INVENTORY FDACS/FASS. FLORIDA CITRUS STATISTICS, 2012-13. Season 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 Bearing Trees (000) % Net Change NA 63,950 61,742 60,754 59,561 58,158 57,459 57,146 56,794 -3.5% -1.6% -2.0% -2.4% -1.2% -0.5% -0.6% % Mortality NA NA NA -5.1% -4.9% -4.6% NA NA FACTORS OF PRODUCTION SOURCE: FDACS/NASS REPORTS. Early and Mid Valencia Season Pieces Drop Size Pieces Drop Size 2006-07 690 8% 233 426 15% 198 2007-08 1,058 8% 264 676 15% 221 2008-09 1,082 11% 257 575 15% 219 2009-10 866 8% 246 480 14% 218 2010-11 932 7% 280 598 16% 227 2011-12 918 13% 235 567 19% 212 2012-13 1,034 18% 274 661 22% 231 2013-14F (Dec) 918 21% 287 614 19% 243 FLORIDA ORANGE CROP UTILIZATION (1,000,000 BOXES) FCOJ COJ Fresh Other Total 2005/06 49.1 90.2 4.5 3.9 147.7 2006/07 46.0 75.2 5.0 2.8 129.0 2007/08 78.0 85.1 4.4 2.7 170.2 2008/09 71.2 82.8 5.5 3.0 162.5 2009/10 51.3 75.1 4.5 2.8 133.7 2010/11 50.3 82.6 4.5 3.1 140.5 2011/12 63.9 75.5 4.6 2.6 146.7 2012/13 47.5 79.2 4.5 2.4 133.6 2013/14 Nov 41.1 77.0 4.5 2.4 125.0 2013/14 Dec 39.1 75.0 4.5 2.4 121.0 NFC needs are basically fixed for relevant crop sizes. The residual market is FCOJ. US ORANGE JUICE IMPORTS OCTOBER THROUGH SEPTEMBER Million Single Strength Gallons 11-12 12-13 % Chg All Imports 11-12 $ Value/SSG 12-13 % Chg 223.3 420.5 88% $ 1.76 $ 1.35 -23% NFC 41.8 49.8 19% $ 1.66 $ 1.49 -10% Concentrate 60.5 187.5 210% $ 1.54 $ 1.11 -28% NFC 4.2 6.2 48% $ 2.76 $ 2.40 -13% Concentrate 116.9 177.0 51% $ 1.87 $ 1.53 -18% Brazil All Others Brazilian prices need to have duties added, whereas ‘Others’ (Mexico and Costa Rica) do not. FCOJ beginning inventory is priced ~$1.40/ssg! Source: US Dept of Commerce. US ORANGE JUICE IMPORTS OCTOBER 2013 Million Single Strength Gallons 12-13 13-14 % Chg All Imports 55.5 12-13 $ Value/SSG 13-14 % Chg 47.8 -14% $ 1.23 $ 1.37 12% Brazil NFC 5.9 7.7 30% $ 1.43 $ 1.71 20% Concentrate 41.1 31.9 -22% $ 1.06 $ 1.22 15% NFC 0.0 0.0 - 0.0 - Concentrate 8.5 8.2 -4% 1.63 -13% All Others 0.0 $ 1.88 $ Concentrate prices are $.10 per gallon higher than where they closed in 2012/13. Brazilian NFC prices are >$.20 per gallon higher. Source: US Dept of Commerce. FL OJ AVAILABILITY, MOVEMENT & INVENTORY CURRENT SEASON FORECAST VS YEAR AGO Item 12-13 13-14 F. (Dec) % Change Frozen Concentrate Orange Juice (MM PS) Beginning Inventory Million Boxes Utilized Juice Production Other Supplies Availability Movement Ending Inventory Weeks Supply 254.13 47.0 316.41 199.59 770.13 450.66 319.47 37 319.47 39.1 261.75 130.00 711.22 421.07 290.15 36 26% -13% -17% -35% -8% -7% -9% -3% After 12 wks -55.6% -33.5% -12.5% 11.2% Chilled Orange Juice (MM PS) Beginning Inventory Million Boxes Utilized Juice Production Other Supplies Availability Movement (incl. evap) Ending Inventory Weeks Supply Source: FDOC Processor Statistics Reports. 192.00 79.2 519.48 45.06 756.54 537.26 219.28 21 219.28 75.0 502.08 34.00 755.36 522.68 232.68 23 14% -5% -3% -70% unch -3% 6% 9% -22.1% -72.1% -2.3% -0.2% US RETAIL ORANGE JUICE SALES – ALL CATEGORIES FDM PLUS WALMART In 2003/04, Branded Recon comprised 17% of all retail sales, equivalent of 23mm boxes. The pace for 2013/14 equates to 11%, or 7mm boxes. 70,000,000 60,000,000 50,000,000 SSE Ga. 40,000,000 30,000,000 20,000,000 10,000,000 0 NFC PL/Generic Top 3 Recon FCOJ RETAIL ORANGE JUICE SALES BY CATEGORY: IMPORTANCE AND STD % CHANGE Gallon Sales 127.1 MM ssg 10.0% Percent Change vs Last Season STD: 12/21/13 5.0% 0.0% -5.0% -10.0% -15.0% -20.0% NFC Recon FCOJ SS NFC COMPRISES 59% OF ALL RETAIL VOLUME AND 68% OF THE REVENUE, WHERE AS. RECON RTS COMPRISES 37% AND 28%, RESPECTIVELY. NFC Recon Gallon Revenue FCOJ ALL OJ Pricing RTS PRICES ARE LOWER THAN PREVIOUS YEAR, YET VOLUME CONTINUES TO TREND DOWNWARD FOR BOTH NFC AND RECON. NFC REVENUES ARE LOWER FOR THE FIRST TIME SINCE 2009-10. Source: FDOC, Nielsen Retail Sales, Monthly Top-line Report, period ending 12/21/13. U.S. OJ SUPPLY & CONSUMPTION Presumed Beg. Fla End. Consumption Season Inv. Prod. Inv. Per IMP EXP TOTAL Capita - - - - - - - - - - - - million SSE gallons - - - - - - - - - - - - Gallons Other U.S. Prod. U.S. 08-09 680 1,035 32 317 125 722 1,217 4.0 09-10 713 806 41 328 147 588 1,153 3.7 10-11 588 864 56 265 214 422 1,138 3.7 11-12 422 928 39 223 152 463 996 3.2 12-13p 463 839 30 421 169 539 1,045 3.3 13-14f 539 742 50 290 180 524 917 2.8 FLORIDA GRAPEFRUIT CROP, 2013-14. DECEMBER FORECAST FACTORS OF PRODUCTION UTILIZATION JUICE SUPPLY, AVAILABILITY, MOVEMENT AND INVENTORY PRODUCTIVITY SUB-FACTORS. AVERAGES AND DEVIATIONS FROM THE AVERAGE. SOURCE: FASS. CITRUS CROP ESTIMATE ADVISORY COMMITTEE REPORT, SEPTEMBER 19, 2013. USDA/NASS CITRUS CROP ESTIMATES. Pieces of Fruit Statistic Average Average Average Period White Red % Harvested White Red Fruit per Box White Red 10-year 414 415 86% 85% 95 104 414 415 86% 85% 95 104 489 457 84% 84% 108 115 6-year 3-year 2013/14 November 555 500 80% 80% 122 122 2013/14 December 555 500 81% 77% 124 131 FLORIDA GRAPEFRUIT CROP UTILIZATION (1,000,000 BOXES) FCGJ CGJ Fresh Other Total 2005/06 8.0 4.1 6.2 1.0 19.3 2006/07 11.6 4.4 10.3 0.9 27.2 2007/08 10.4 5.2 9.9 1.0 26.6 2008/09 8.4 3.7 8.7 0.9 21.7 2009/10 6.0 4.6 8.7 0.9 20.3 2010/11 7.0 4.2 7.7 0.9 19.8 2011/12 6.9 3.8 7.2 0.9 18.9 2012/13 6.1 4.2 7.1 0.9 18.3 2013/14 Nov 5.9 4.0 7.0 0.9 17.8 2013/14 Dec 5.4 3.8 6.7 0.9 16.7 NFC needs are basically fixed for relevant crop sizes. The residual market is FCGJ. FL GJ AVAILABILITY, MOVEMENT & INVENTORY CURRENT SEASON FORECAST VERSUS YEAR AGO Item 12-13 13-14F. (Dec) % Change After 12 wks Frozen Concentrate Grapefruit Juice (MM PS) Beginning Inventory Million Boxes Utilized Juice Production Other Supplies Availability Movement Ending Inventory Weeks Supply 22.1 6.1 29.2 2.8 54.1 33.4 20.7 32 20.7 5.4 25.4 0.2 47.7 29.0 18.3 33 -7% -12% -13% -93% -12% -12% -11% 1% 11.2 3.8 17.7 0.1 29.0 17.5 10.0 30 -8% -11% -14% -91% 14% -10% -10% unch -38% -14.9% -13.5% Chilled Grapefruit Juice (MM PS) Beginning Inventory Million Boxes Utilized Juice Production Other Supplies Availability Movement (incl. evap) Ending Inventory Weeks Supply Source: FDOC Processor Statistics Reports. EMRA Forecasts for 2013-14, 12/2/13. 12.1 4.2 20.5 1.1 33.7 22.5 11.2 30 49% -20.2% 7.1% THANK YOU!