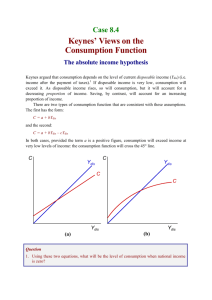

income expenditure

advertisement

In-class example Mr. A owns a fishing company. He catches 50 fish for $1 per fish. He employs Mr. B and Mr. C and pays each $10 in wages. He pays $15 to rent a boat to Ms. J. Mr. D produces wood. He produces 100 units for $2 per unit. He rents land from Ms. E for $40. Mr. F builds boats. Each new boat uses 40 units of wood and 20 units of nails costing $0.50 per unit. He produced 1 boat which was sold to Mr. A for $80. (The boat was not sold until the end of the year, and was not used by A to catch this year’s fish.) The Government purchases 15 units of wood, collects $35 of taxes, and pays out $10 in pensions each to Ms. H and Ms. I. 10 fish are exported. 20 units of nails and 2 pineapples ($3 each) are imported. Incomes: A B C D E F $15 $10 $10 $160 $40 -$10 G H $10 I $10 J $15 Sub-total: $260 Gross Output by Industry (units): Fish 50 Minus Intermediate Goods: 0 Final Goods Output (units): 50 Value of Final Goods Wood Boat Nail Pineapple 100 1 0 0 40 0 20 0 60 1 -20 0 50 120 40 45 80 -10 0 Total Value 2 136 sum = 240 By use of output: Consumption Investment 1 Gov’t Expenditure 80 15 Net Exports 10 Total units 50 30 60 1 -20 -2 -6 -20 0 240 Note: Government’s income is taxes, it spends it on Gov’t expenditure and transfer payments. If we want to count the incomes of H and I (who receive pensions) because it can be spent, we should subtract taxes from the incomes of everyone else (since the taxes paid cannot be spent or saved by the individuals.) Then we should count the government’s net income as Tax Receipts minus transfer payments (it is what the government has left over to save or spend). Therefore to fix the income approach – we can either not count income from Government transfers which brings the total down to 240; or we can subtract the tax collections of 35 from persons A through J, then add the government’s disposable income: Total personal income Subtract taxes 260 35 Personal disposable income Government’s disposable income = 35-20 = 225 15 National Income 240 Suppose Mr. K went on work-and-travel during the year and came home with $25. Is it part of our country’s income? Is it part of our country’s GDP? Answer: In this case, it is income, but it is not GDP. It is net factor payments received, or NFP. NFP are payments we receive for helping produce something counted in some other country’s GDP. Next: Show how national savings are computed.