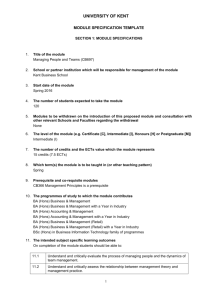

UNIVERSITY OF KENT Module Specification The title of the module

advertisement

UNIVERSITY OF KENT Module Specification 1. The title of the module Business Financial Management (CB715) 2. The School which will be responsible for management of the module Kent Business School 3. The start date of the Module September 2013 4. The number of students expected to take the module 20 5. Modules to be withdrawn on the introduction of this proposed module and consultation with other relevant Schools and Faculties regarding the withdrawal AC508 and AC502 (from Medway only) 6. Level of the module (e.g. Certificate [C], Intermediate [I], Honours [H] or Postgraduate [M]) H 7. The number of credits which the module represents 30 8. Which term(s) the module is to be taught in (or other teaching pattern) Autumn and Spring 9. Prerequisite and co-requisite modules CB365 Economics for Business 1 CB363 Economics for Business 2 CB362 Data Management for Business 10. The programme(s) of study to which the module contributes BA (Hons) Accounting & Management BA (Hons) Accounting & Management with a Year in Industry 11. The intended subject specific learning outcomes 11.1: 11.2: 11.3: 11.4: 11.5: Knowledge and understanding of the business entity and the capital markets contexts in which finance operates. Knowledge and understanding of the concepts and principles that underlie the investment and financing decision-making process, including the strengths and weaknesses of quantitative techniques. Ability to identify the nature of a problem and to make appropriate selection and application of quantitative techniques. Recognition and measurement of relevant cost/benefit data and presentation via appropriate financial documents. Ability to structure, develop and defend complex arguments, and to be critical and self-critical, orally and in writing. Ability to analyse structured and unstructured problems 1 UNIVERSITY OF KENT 11.6: 11.7: 11.8: Ability to record and summarise transactions and other economic events, including decision analysis, discounted cash-flow analysis and the analysis of financial risk. Knowledge and understanding of the financial aspects regarding the practical implications of investing on the stock market Ability to analyse, prepare and record projections regarding decisions on aspects such as portfolio theory, capital structure, dividend policy 12. The intended generic learning outcomes 12.1: 12.2: 12.3: 12.4: 12.5 Ability to structure and develop appropriate and effective communications, critically and self critically, orally and in writing. Appropriate formats are selected for presentation of work, which includes the acknowledgement and reference of sources. Ability to plan, work independently and use relevant resources. Ability to work in groups, listen, respond to different points of view and negotiate outcomes. Ability to receive and use criticism and advice Ability to develop suitable written and communication skills using appropriate formats. 13. A synopsis of the curriculum: The course begins by looking at the ever important financial management function. It then proceeds to cover key topics, including: - investment appraisal techniques under certainty and uncertainty - portfolio theory, CAPM, WACC and capital structure - the efficient market hypothesis - interaction of investment and financing decisions - decomposition of risk - options and pricing - dividends and dividend valuation models. The financial system within which business organisations operates is examined, followed by the specific sources of long and short-term capital, including the management of fixed and working capital. 14. Indicative Reading List: Main Texts Arnold, G. (2008), Corporate Financial Management. 4th or 5th edn. Harlow : Financial Times/Prentice Hall Brealey, R., Myers, S. and Allen, F. (2008) Principles of Corporate Finance. 9th (international) edn. London : McGraw-Hill McLaney, E. (2011). Business Finance Theory and Practice. 9th edn. Harlow : Financial Times Prentice Hall 15. Learning and Teaching Methods, including the nature and number of contact hours and the total study hours which will be expected of students, and how these relate to achievement of the intended learning outcomes: Teaching will be primarily by lectures and seminars. There will be two lectures and one seminar per week. Each seminar group will be approximately 20 in number, which will enable students to brainstorm key concepts and incorporate critical analysis. It is the expectation that students will spend about 10 hours on each module each week on average (including lectures and seminar attendance). 2 UNIVERSITY OF KENT Table 1: Learning & Teaching methods mapped to ILOs Method Hours Subject-specific ILOs Generic ILOs Lecture 44 11.1 – 11.8 - Seminar 21 11.1 – 11.8 12.1, 12.3 -12. 5 Preparation for seminars 30 11.1 – 11.8 12.2, 12.5 Preparation for exam 50 11.1 – 11.8 12.2, 12.5 Coursework preparation 100 11.1 – 11.8 12.2, 12.5 Independent study 55 11.1 – 11.8 12.2, 12.5 Total hours 300 16. Assessment methods and how these relate to testing achievement of the intended learning outcomes: 30% of the final grade will be based on coursework with a compulsory portfolio project worth 20%. The remaining 10% is allocated to either an essay question or an in-class test based on a computational question. Students can complete both the essay and in-class test if they wish with the best mark counting towards their overall mark (this would mean students would complete a minimum of 2 pieces of coursework and a maximum of 3). The portfolio project is compulsory as it plays an important role in the course as a whole. The computational questions are designed to allow students to demonstrate their ability to employ financial theories and analyse structured and unstructured problems. The discursive and essay questions are designed to allow students to demonstrate their ability to understand financial theories and concepts in a non-computational aspect; critically evaluate theories and show effective communication. 70% of the final grade will be based on a three hour written examination. The examination consists of two sections: Section A, where students must answer one essay question from three, and Section B, where students must answer two numerical questions from four. Table 2: Assessments mapped to ILOs Method Weighting Subject-specific ILOs Generic ILOs Essay Question See above 11.1 – 11.8 12.1 – 12.2, 12.412.5 Computational Question See above 11.1 – 11.3 12.1 11.6 – 11. 8 Portfolio Project 20% 11.7 – 11.8 12.1 – 12.5 Examination – 3 hour unseen 70% 11.1 – 11.8 12.1 – 12.2, 12.5 17. Implications for learning resources, including staff, library, IT and space The school (at Medway only) will be withdrawing two 30 credit modules (AC508 and 502) and introduce one 30 credit module instead. This would not require any additional resources including staff, library, IT or space. 18. The School recognises and has embedded the expectations of current disability equality legislation, and supports students with a declared disability or special educational need in its teaching. Within this module we will make reasonable adjustments wherever necessary, including additional or substitute materials, 3 UNIVERSITY OF KENT teaching modes or assessment methods for students who have declared and discussed their learning support needs. Arrangements for students with declared disabilities will be made on an individual basis, in consultation with the University’s disability/dyslexia support service, and specialist support will be provided where needed. 19. Campus(es) where module will be delivered : Medway Statement by the Director of Learning and Teaching: "I confirm I have been consulted on the above module proposal and have given advice on the correct procedures and required content of module proposals" ................................................................ Director of Learning and Teaching .............................................. Date ………………………………………………… Print Name Statement by the Head of School: "I confirm that the School has approved the introduction of the module and, where the module is proposed by School staff, will be responsible for its resourcing" ................................................................. Head of School .............................................. Date ……………………………………………………. Print Name Module Specification Template Last updated January 2013 4