Merged Oct, 2014 - Better Boards Conference 2016

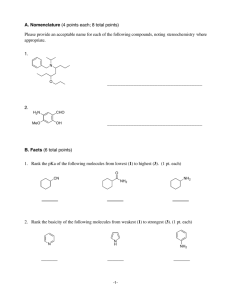

advertisement

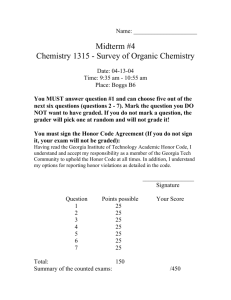

Better Boards Conference David Curd Executive General Manager – Strategy and Growth Sovereignty vs Sustainability NFP Mergers Damned if you don’t and possibly damned if you do Discussion issues 1. Community Solutions Group and Endeavour Foundation – A quick history 2. Strategic context for NFP M/A 3. NFP Sovereignty vs Sustainability 4. NFP M/A – Critical success factors 5. Shared Vision and Business Case 6. NFP M/A process 7. NFPs and Social Capital • Since 1951 • Since 1998 • QLD / NSW / VIC / SA • Regional Qld • Disability services and disability enterprise • Diversified • 2 M/As • 8 M/As • $210m+ – 3000+ people • $30m+ – 400+ staff Merged Oct, 2014 Additional M/As in progress 2. Strategic context for NFP M/A Service integration Increasingly, the complex needs of people and families (incl. those living with a disability) will be met via a holistic health and human services framework and integrated (bundled) service models. Providers will either be ‘full service’ or specialists. Person centred view Strategic context for NFP M/A Scale, systems and synergies are required to ensure service quality, value and price NDIS and other government funded services are increasingly implementing pricing models that assume scale, sophisticated system support and shared operational cost through service diversity. This has been particularly evident in the NDIS Launch Sites and the recent employment services contract (jobactive). Strategic context for NFP M/A Challenging operating environment • Competition • Service bundles • Compliance • Outcome only payments • $$ in arrears • Geographic area • Service price • Contract size • Indexation Increased scale and diversity with lower margin in an open market environment Strategic context for NFP M/A Competitor convergence with integrated health and human service markets • The inter-relatedness of disability, health, aged, home care and employment markets will bring many large and sophisticated providers to the open health and human services market. At present the disability market is highly fragmented, with 2200+ providers of which the largest providers (incl Endeavour Foundation) have less than 1% market share nationally. • Employment services have gone from 800+ providers, predominantly NFP prior to 2009 to now only 40 providers who are predominantly for profit. (ie Max Employment) 3. NFP Sovereignty vs Sustainability NFP boards and management should make a clear distinction and strategic choice between organisation sovereignty vs service sustainability. NFP Sovereignty vs Sustainability NFP Sovereignty vs Sustainability 1. Relevant in establishment 2. Does not ensure service quality 3. Limits strategic options 4. Increases operational cost 5. Does not attract/retain good people 6. People value / need services, not entities 7. Chairs, directors, CEOs, founders and long serving staff need to understand their potential conflict and influence NFP Sovereignty vs Sustainability Sustainability Sustainability NFP Sovereignty vs Sustainability 1. Focuses on quality of services 2. Opens up all strategic options 3. Develops scale and/or specialty 4. Creates career opportunities 5. Holistic and value service offering 6. Enduring legacy for founding members 7. Should be the primary focus for boards and management 4. NFP M/A – Critical success factors 1. M/A is a “means” not an “end” 2. Must be based on a Shared Vision and Business Case 3. Ideally creates a 1+1=3, not 1+1=2 or 1+1=1.5 4. Different to commercial M/A – don’t be convinced otherwise 5. Emotional and distracting – seek help and allocate resources to ensure desired outcomes are achieved, if not exceeded 5. Shared Vision and Business Case 1. Understands the attributes, needs, sacred cows and culture 2. Defines the shared aspirations and outlines the potential, but held accountable to a business case 3. Captures the formal/informal conversations – single source of truth 4. Serves as a reference for key and emotional decisions (i.e. Board, CEO, brand, assets, etc) 5. Utilise due diligence to plan transition, not just check details 6. Conceptually merge to the vision, not to each other 6. NFP M/A Process 1. Is a significant, complex and emotional decision 2. Not everyone copes well through the process 3. Should not be used to address past ‘sins’ 4. Has a number of key stages, but need not take too long… 3-6 months if the Vision and Business Case is sound 5. Each transaction should add value to an evolving narrative 6. Can strategically unleash an NFP 7. NFPs and Social Capital 1. NFPs are by nature proud, parochial and sovereign 2. This proud parochialism may cause our demise 3. Service value, flexibility and access will prevail, not the entity 4. NFPs must be a provider option along with faith based and ‘for profit’ 5. NFPs are critical in the facilitation and building of social capital NFPs and Social Capital In summary • M/A must be a strategic option • Is complex and requires commitment and resources • Must create ‘better’, not ‘more’ or ‘cheaper’ • Is worth the effort • Aspire for sustainability, don’t be constrained by sovereignty Thank you! David Curd Executive General Manager – Strategy and Growth Images courtesy of: http://hdscreen.me/wallpaper; http://wallpoper.com