Patrick ten Brink - How green is the European Semester 1.3 MB

How green is the European Semester process?

Patrick ten Brink

Senior Fellow and Head of Brussels Office, IEEP with thanks for inputs by Sirini Withana, IEEP, &

Building, inter alia, on the study for the Greens/EFA Group of the European

Parliament by: Withana, S., Kretschmer, B., Farmer, A. (2013) Environmental

policy in the European Semester: Assessing progress to date. IEEP: Brussels.

24 November 2014 www.ieep.eu

@IEEP_eu

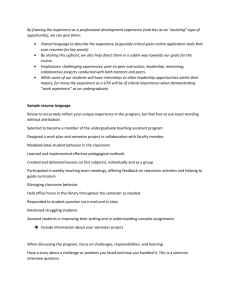

Presentation Structure

I. Key insights on mainstreaming environmental issues in the European Semester – overview

• Annual Growth Surveys (AGS)

• Country-specific recommendations (CSRs)

II. Inputs to the European Semester:

– Studies on EHS, ETR & EPR

III. Conclusions and Next Steps

2

Overview of environmental issues covered in

AGS

2014

Environmental issue addressed Link to economic policy context

MS should ensure longer-term investment inter

alia in energy and climate action

Priority area 1 ‘Pursuing differentiated growth-friendly fiscal consolidation’

Shift tax burden from labour taxes to inter alia taxes on pollution and reduce EHS

Full implementation of the third energy

package by 2014, complete the internal energy

market, inter alia to contribute to the cost effectiveness of renewable energy support schemes

Promote resource efficiency by improving waste and water management, recycling and energy efficiency

As above

Priority area 3 ‘Promoting growth and competitiveness for today and tomorrow’

As above

Improve waste and water management to exploit full growth potential of the green economy

Job opportunities through greening the

3 economy

As above

Priority area 4 ‘Tackling unemployment and the social consequences of the crisis’

4

AGS : Recurring environment-related themes

• Completion of the internal energy market and the economic benefits associated with it (e.g. enhanced security of supply, lower energy prices) as well as improving

energy efficiency with potential employment and competitiveness effects

• Infrastructure in the energy and transport sectors as growth-inducing investment, stimulating jobs in the short term and laying the foundation for future growth

• Reforming taxation by phasing out EHS and stimulating job markets by shifting taxes away from labour and towards less distorting taxes, e.g. environmental taxes

• Resource efficiency as well as the need to improve waste and water management

• The growth and job potential associated with the green economy

Environmental issues seen as facilitators for growth, economic and labour market recovery

Clear focus on consolidating budgets and creating growth and jobs rather than on the wider goals set out in the Europe 2020 Strategy

5

CSRs: Recurring environment-related themes

• Environmental tax reform

• Energy (and electricity) infrastructure

• Transport infrastructure

• Renewable energy and energy efficiency

• Better energy market design (completion of the internal market, implementation of the Third Package)

• Progress towards greenhouse gas emission reduction targets

• Limited number of recommendations on water and waste management

6

Assessment of CSRs

CSRs mirror AGS and their focus on fiscal consolidation and stimulating growth

Environmental coverage mostly in relation to climate change and energy

Resource efficiency not considered per se apart from

ETR and limited references to water and waste management

No full account taken of the growth-stimulating potential of environmental policy measures such as improved resource efficiency

Developing Inputs to the European Semester:

Examples of studies on EHS, ETR and EPR

Withana, S., ten Brink, P., Franckx, L.,

Hirschnitz-Garbers, M., Mayeres, I.,

Oosterhuis, F., and Porsch, L. (2012). Study supporting the phasing out of

environmentally harmful subsidies. A report by the Institute for European

Environmental Policy (IEEP), Institute for

Environmental Studies – Vrije Universiteit

(IVM), Ecologic Institute and VITO for the

European Commission – DG Environment.

Final Report. Brussels. 2012. http://ec.europa.eu/environment/enveco/t axation/pdf/report_phasing_out_env_harmf

7

Eunomia and Aarhus University (2014)

‘Study on Environmental Fiscal Reform

Potential in 12 EU Member States -

Final Report to DG Environment of the

European Commission’, http://ec.europa.eu/environment/integ ration/green_semester/pdf/EFR-

Final%20Report.pdf

Oosterhuis F., Ding H., Franckx L., P.

Razzini et al. (2014). Enhancing comparability of data on estimated budgetary support and tax

expenditures for fossil fuels. A report by IVM, Bio, VITO and IEEP for the

European Commission – DG

Environment. Final Report. Brussels.

2014.

Fedrigo-Fazio, D., Withana, S.,

Hirschnitz-Garbers, M., and

Gradmann, A. (2013). Steps towards greening in the EU, Monitoring

Member States achievements in

selected environmental policy areas -

EU summary report, prepared for DG

Environment. Brussels. 2013. http://ec.europa.eu/environment/env eco/resource_efficiency/pdf/Greening

Overview of needs for subsidy reform identified

8

There are no particular concerns relating to this aspect of the subsidy.

There are some concerns with this particular aspect of the subsidy and further attention is useful.

There are significant concerns with this particular aspect of the subsidy and further attention/reform is needed.

9

EHS Fossil Fuels Study – a further input

Direct budgetary support to energy users: EU ~ EUR 1 bn/yr.

• The largest single items identified are the tax reimbursements for energy intensive industries in Austria and Germany, and the Fuel Allowance in Ireland.

Direct support to producers (inc. public infrastructure) ~< 5 bn/yr.

• The main support schemes are for coal production (in Germany and Poland) and the Italian ‘CIP 6/92’ mechanism (mainly benefitting cogeneration).

Tax expenditures in excise taxes (using the benchmark of the tax

rates as proposed in Energy Tax Directive proposal) ~< 28 bn/yr

• For most Member States, the estimated support levels are between EUR 100 mln and several billions of euros per year.

Tax expenditures: using alternative benchmark highest

prevailing rate per unit of energy in the MS. ~> 200 bn/yr in EU

• This benchmark leads to much higher estimated amounts (more than EUR 10 billion per year in several Member States).

VAT reductions: fossil fuels

&/or fossil-based electricity - few MS.

• Total amounts particularly significant in UK (> EUR 4 bn/yr) & Italy (>EUR 1 bn/yr).

Tax expenditures: corporate income tax and royalty schemes:

• Estimates available only for two countries: Germany and the UK: royalty reductions available ~EUR 350 MEUR/yr in each of them.

ETR: Eunomia et al., I and II

10

Eunomia and Aarhus University (2014)

‘Study on Environmental Fiscal Reform

Potential in 12 EU Member States -

Final Report to DG Environment of the

European Commission’, http://ec.europa.eu/environment/integ ration/green_semester/pdf/EFR-

Final%20Report.pdf

European Policy Review, EPR

Advice and recommendations

Economic, fiscal and financial elements

• Budgetary expenditure

• Market-based instruments

• Environmentally harmful subsidies

• State aids

Waste management

Support to SMEs

Air quality

Source: Fedrigo-Fazio, D., Withana, S., Hirschnitz-Garbers, M., and Gradmann, A. (2013). Steps towards greening in the EU, Monitoring

Member States achievements in selected environmental policy areas - EU summary report, prepared for DG Environment. Brussels. 2013.

11

12

Conclusions and next steps

Conclusions…

• Mainstreaming of environmental issues limited so far

• Overriding concerns are growth, jobs and fiscal consolidation as apparent all along the process

• Where environment is mentioned, focus is on classical win-win

options such as ETR, energy and transport infrastructure etc.

• Exploitation of win-wins not comprehensive and key EU policy areas ignored:

– Biodiversity and ecosystem services (evidenced economic importance)

– Important Europe 2020 topics side-lined such as recycling, eco-innovation

• Range of initiatives inputting to the European Semester

13

• European Semester part of a context for resource efficiency

The European Semester in (ETR) Context

Legal approaches across the

European Union

Legislative specific minimum requirement : e.g. Energy Tax

Directive; value added tax (VAT)

Legislative general requirement : e.g. 'principle of recovery of the costs of water services' under the Water Framework Directive

Legislative possibility : e.g. strengthen Eurovignette Directive

Legal approaches for a subset of EU Member States:

Enhanced cooperation

Special legal framework: e.g. initial Schengen (limited number of countries under international treaty distinct from EU treaties).

Existing legal framework: e.g. Enhanced cooperation under EU

Treaties – little used to date (patents, discussion on financial transaction tax, FTT)

Political intention to promote

ETR: Open Method of

Coordination (OMC)

Formal/structured OMC: e.g. country specific recommendations under the European Semester

Flexible/light OMC: e.g. Green public procurement (GPP)

Voluntary policy coordination: e.g. Cars CO2; reform of EHS

Multi-country cooperation and coordination ‘Coalition of like-minded countries’ to be defined depending on interests: e.g. climate and energy, resource efficiency and circular economy, pollution and health etc.

National, regional and local approaches &

Learning from others

(copy-catting)

Inspired by and/or based on other countries’ & states’ initiatives

Own initiatives developed according to own needs

Withana, S., ten Brink, P., Illes, A., Nanni, S., Watkins, E., (2014) Environmental tax reform in Europe: Opportunities for the future, A report by the Institute for European Environmental Policy

14 http://www.ieep.eu/work-areas/environmental-economics/market-basedinstruments/2014/06/environmental-tax-reform-in-europe-opportunities-for-the-future

15

…and next steps - recommendations

• Future AGS: wider interpretation of priority areas and/or separate priority area for the environment

• Future CSRs: wider coverage of environmental issues in support of Europe 2020 Strategy (biodiversity, ES, water, air etc.)

• Increase ownership and engagement of MS, e.g. through regular exchanges between MS on best practices

• Engage the European Parliament

• Civil society and other stakeholders: take Commission’s

‘fact finding missions’ to MS as an opportunity to input

Thank you for your attention

Contact:

Patrick ten Brink, ptenbrink@ieep.eu

Reports citations: See links throughout.

IEEP is an independent not for profit institute dedicated to advancing an environmentally sustainable Europe through policy analysis, development and dissemination.

New Book! Paying the Polluter - Environmentally Harmful Subsidies and their Reform by F. Oosterhuis and P ten Brink (eds).

http://www.ieep.eu/news/2014/05/new-book-out-now-paying-the-polluter-environmentally-harmful-subsidies-and-their-reform www.ieep.eu

@IEEP_eu