Presentation by John Magnay - Carnegie Endowment for

advertisement

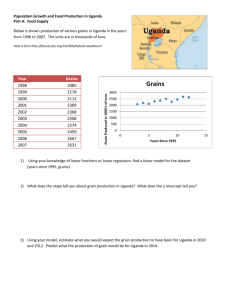

Capacity for Trade in Africa A Traders View from Africa John Magnay CEO, Uganda Grain Traders Ltd Biography Agricultural Economist from Wye College, University of London, ‘74-’77 Lived and Worked in Uganda since ’77 Supplied inputs and agro processing equipment since ‘79 Supported Emergency, Relief, Development programmes in Great Lakes Region since ‘83 Developed trade in food and seed Established Uganda Grain Traders Ltd. in 2001 2 Africa Today 830m people and rising 80% of population involved in Agriculture YET Food Import Bill $ 19 billion Food Aid / Commercial Imports per annum Food Insecurity increasing Food Aid Increasing Most of Continent on less than $ 1 per day Who needs a Farm Bill? 3 Uganda Land-locked, East Africa on Lake Victoria 70% Land / 70% above Semi-Arid Equatorial with majority of land 3-4000 feet above sea level 25 million people – 80% smallholder farmers 2 crops per year in most areas Non-maize dependant The Pearl of Africa & Source of the Nile 4 Exports / Balance of Payments Product Coffee mtonnes $ million Value Comment 140,000 160 25,000 75 Resource decreasing 30 20-30% growth per year 140,000 30 Relief food to Great Lakes 25,000 25 Tonnage increasing / price dropping 100,000 25 Border trade to region Tobacco 15,000 20 Tonnage down from 2004 peak of 35,000mt Cotton 16,000 16 Down from 40,000mt in 2004/5 Fish Cut Flowers / cuttings Maize / Beans formal Tea Maize / Beans informal Others 100 Exports 476 Personal Remittances 424 Donors 900 Balance of Payments 1,800 Tonnage dropping / Value increasing Gold / Minerals / Electricity 5 Uganda Grain Traders Ltd Formed in Sept 2001 by 16 grain trading companies Exported 31,000mt surplus Maize to Zambia Dec 2001 to May 2002 Member companies responsible for producing exportquality UGT responsible for finance, storage, marketing 6 Facilities 30-35,000 mt of bag storage capacity Rail-siding for 22 wagons / 880mt Weighbridges and parking area Capable of receiving and dispatching 1,000mt per day Built in 90 days !!! Room for expansion 100mt per day Cleaning & Drying Plant from June 2004 to receive crops direct from farmers / traders 7 Food Aid One of the largest recipients of Food Aid in Great Lakes region with up to 3 million IDP and vulnerable recipients One of the largest supplier of local purchased Food Aid in the Great Lakes region – now up to 160,000mt of food per year 8 Food for Peace 2003 Commodity Tonnage $ Value Cost per mt ex-USA Maize Meal 18,800 19,969,676 1,062.22 CSB 16,100 9,484,910 589.12 Pulses, Green whole 3,000 2,362,012 787.34 Maize, Bulk 56,360 25,223,290 447.54 Veg.Oil (6/4 L) 1,530 1,933,684 1,263.85 Peas, Green Split 500 n/a 94,260 57,039,888 What did this do to help production / markets in Uganda / Africa? 9 Food for Peace 2003 - CSB Commodity Tonnage $ Value Cost per mt exUSA CSB 16,100 9,484,910 589.12 IF PURCHASED IN UGANDA/EAST AFRICA UNIMIX 16,100 6,440,000 400 9,484,910 400 OR UNIMIX 23,710 AND It would have provided a market for another +/- 30,000mt of Maize / Soya 10 Opportunity for Trade Target Import Substitution Target the Regional markets Identify Niche markets outside Africa 11 Hit the Imports Crop Value $ million Target Export Potential *** Rice $ 20 Development of the Upland varieties has developed *** Sugar $ 12 In next 5 years Uganda will move from 20% import to surplus exporter *** Veg Oil $ 75 Both Palm Oil and Sunflower being developed to replace $ 100m-worth of imports *** Petroleum $ 300 Uganda struck Oil in Lake Albert valley in Dec 2005 and again in Mar 2006 *** Barley / Adjuncts $ 5-10 A UGTL / Uganda Breweries initiative is targeting substitution of 70% raw material imports for Breweries *** 12 Field to Bottle Only buy Export Quality product! – Maize & Beans for Export & Relief sales – Barley under contract for Brewing – Soya Bean for Export – Rice More than 50% from Farmers / Small Traders 13 The Regional Market Up to the early 80’s national grain boards held responsibility for food security Since early 90’s most markets have been seasonally / annually short Uganda is year-on-year surplus in grains and pulses But In absence of regional market and financing mechanisms, regional food security will be dependant on Food Aid and non-regional imports 14 Kenya Maize balance 1980 - 2004 (mt) 800, 000 Kenya Maize Balances 600, 000 400, 000 200, 000 0 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 -200, 000 -400, 000 -600, 000 -800, 000 -1, 000, 000 -1, 200, 000 -1, 400, 000 So u r c e : U G T / F E W SN E T 15 4 Grain Crashes in Uganda in 20 years 1987-8 – Govt sponsored increase in production – the Grow more Food Campaign 1995 – dramatic increase in demand for Relief food in 1994 for Rwanda followed by no demand in 1995. 2001 – loss of Kenya informal trade market, due a seasonal surplus (despite an annual deficit). 2005 – wet harvest / large surplus / unsympathetic purchase by WFP / short term surplus in Kenya – short term problems with impact on 2006 Food Security 16 The Ideal Scenario To reduce Food Aid requirements:Regional Market with Spot and Futures Markets Commercial Finance mechanism Commercial cleaning & drying as close to production areas to avoid the quality issues Strategic commercial storage facilities to access the regional markets Ethiopia – Kenya – Tanzania – Uganda – Rwanda – Burundi – Eastern Congo – Sudan ALSO Balancing with the Southern African Markets 17 The Road Political Will for regional markets from Govt & Donors Regional infrastructure / reduction of transaction cost Financial mechanisms to remove Price Risk for food commodities 18