CORPORATE STRATEGY

advertisement

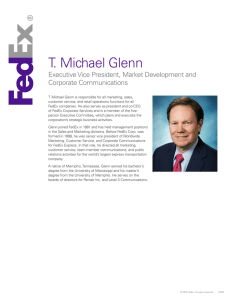

CORPORATE STRATEGY EXECUTIVE JULY 2008 1 IPMI Graduate School of Business Corporate Strategy Module Session 5-6 Session 7-8 Session 9-10 Session 11-12 Session 13-14 Session 15-16 2 Corporate Strategy Framework Corporate Strategy In Action Related and Unrelated Diversification Vertical Integration Merger and Acquisition Divestitures Session 17-18 Strategic Alliance Session 19-20 Final Exam (Group Case Work) Corporate Strategy Framework PORTFOLIO STRATEGY SKILL TRANSFER SHARING ASSETS RESOURCES (assets, skill, competence) BUSINESS MIX (industry, biz strategy, ownership) VISION OBJECTIVE SHARED ACTIVITIES TIGHT CONTROL 3 CORP HQ ROLE (organization, control, process) CORPORATE ADVANTAGE • ______ ____ • ______ ____ CORPORATE STRATEGY MODULE THE STRATEGY CONTROL FRAMEWORK (2) <- - - - - - PERCEPTION OF PROBLEM- - - - - - - > Internal/External Events < - - - - - - - - - - - - - - - - -- - - - - - - - APPRAISAL - - - - - - - - - - - - - - - - - - - -> Internal Appraisal Preliminary Objectives External Appraisal Continous Review Major - SWOT STRENGTHS, WEAKNESSES, THREATS, AND OPPORTUNITIES ( Core Skills) <-------------------------------------- CHOICES------------------ --- ---- -------------------------------------------------> < -- -FOCUS ON NEW BUSINESS AREA- - - - - - > MODIFIED OBJECTIVES STRATEGY PROD/MKT PORTFOLIO PLANS DEV of New Biz Ideas (NBA) EVALUATION of NBA < - - - - - - - - - - IMPLEMENTATION - - - - - - - - - - - - - - - - - - - - - - - - - > DEV. ORG. STRUCTURES 4 DESIGN CONTROL PROC and FUNCTIONAL PLANS EVALUATION of STRATEGY INTERNAL GROWTH or ACQUISITION Corporate Strategy Where to Compete • Product Scope Coca-Cola ; chinese-food restaurant ; contractors ; packaging • Geographic Scope Automobile ; cement ; ceramic products ; padang-food restaurant • Vertical Scope Cigarette ; automobile ; dairy produces ; textile 5 Strategy In Action • Concentric Diversification • Conglomerate Diversification • Horizontal Integration • Vertical Integration 6 Why Divest? • Problematic Business – – – • Active Portfolio Management – – – – • – – – REACTIVE, LOW VALUE HIGHER VALUE OF CORP Aligning with strategy Maintain a healthy portfolio of business, strengthen and rejuvenate company Avoid high cost of holding: limited growth oppty, limited support from CHQ, depressed exit price Divestiture is a normal act Creative “Destruction” – 7 Under-performing Hamper other divisions In many cases divestiture decision has been delayed many times Established business tend to be risk-averse, lack of entrepreneurship Return to shareholders deteriorate over time Hampers creativity in building new business May actually “liberate” the business unit BEST , BUT REQUIRE GUTS STRATEGIC ALLIANCE Sessions 17 + 18 8 Quick Test – Session 17: 9 When to Ally? • Modular or sequential synergies • Getting synergy out of “soft” resources • Low to medium amount of redundant resources • Medium to high uncertainty of the outcome • Low to medium degree of competition 10 Dyer, et.al, “When to Ally and When to Acquire” TYPES OF STRATEGIC ALLIANCES • Multi-organizational services alliances Group of firms to pursue a common goal. • Opportunistic alliances Joint ventures to quickly exploit a competitive advantage. • Complementary strategic alliances Firms with different positions in a value chain take advantage of complementary capacities via coordination of activities. 11 3 “Flawed” Alliances • Collision between Competitors • Alliance of the Weak • Alliance of ‘David & Goliath’ – Actually an acquisition (from Goliath) who feels more superior – “Bootstrap” alliance (from David) will not give much to contribute 12 Bleeke & Ernst, “Is Your Strategic Alliance Really a Sale?” Joint Venture • Types of JV: 13 – Consolidation – Skill-transfer – Coordination – New Business JOINT VENTURE Challenges and Key Success Factors Challenges KSF Strategy Governance Economics Organization • Parent companies may hold different strategic interests • Parents share control • Parents provide on-going resources to JV • Cultural differences, conflicting incentives • Align parent interest around JV objectives upfront • Apply loose-tight governance • Specify services provided by parents, establish fair transfer pricing • Secure commitment from key staff, especially parent company employees • Establish risk mgmt and performance mgmt • Create compelling value proposition for JV employees • Specify first year goal for JV • Parents have separate reporting • Transfer pricing systems • JV performance is not transparent • Create clear protocols for decision making Baumford, et.al., “Launching a World Class Joint Venture” 14 Case : IBM and Linux 15 Case : LAURA ASHLEY and FEDERAL EXPRESS 22 23 Laura Ashley and FEDEX Conceptual issues of case Leveraging information technology to drive customer-focused performance improvements, Using strategic alliances to solve problems. 24 Laura Ashley and FEDEX Conceptual issues of case Both LA and FedEx have expertise in different parts of the retail distribution value chain: LA : Design, Marketing, Selling of Branded Merchandise. FedEx : comprehensive expertise in physical logistics. The two companies have ‘complementary’ weaknesses: LA : Failed in managing own logistics. FedEx : Desire to jump-start its global marketing capability. 25 Laura Ashley and FEDEX Conceptual issues of case Difference in management styles FedEx/BLS is more centralized and formalized than at LA. Differences in the “life cycles” LA has a relatively established position in its markets, while BLS is in a more dynamic stage of development. 26 Case : LAURA ASHLEY and FEDEX TASK / QUESTIONS 1. Evaluate the decision to enter a strategic alliance from the perspective of both Laura Ashley and Federal Express. What are the real opportunities and risks of this approach ? 27 2. Evaluate the structure of the partnership. Do the financial arrangements make sense ? Is the loose nature of the partnership appropriate, or should a more structured approach have been taken ? What type of leadership was necessary to make a deal, and what leadership skills will be necessary to implement it successfully ? 3. How likely is it that the partnership will succeed over the long term, and what will it take for both companies to make it successful ? Are there specific organizational or human resources policy reforms that would enhance LA’s performance? 4. Assume that the partnership is successful. What new strategic capabilities will it provide for LA, and how, specifically, should they be used to expand its business ? Case: LAURA ASHLEY and FEDEX Lessons Learned Creative information technology applications can be crafted to improve international basis. customer services on an Breakthroughs in customer services need not come from company itself, but rather can be brought about via inter-organizational alliances. Outstanding customer service will require both parties to work according to a shared vision and mutual interest rather tha legalistic rules and procedures. 28 CORPORATE STRATEGY END OF MODULE 29