SIMPLE INTEREST

McGraw-Hill/Irwin

Chapter Ten

Copyright © 2014 by The McGraw-Hill Companies, Inc. All rights reserved.

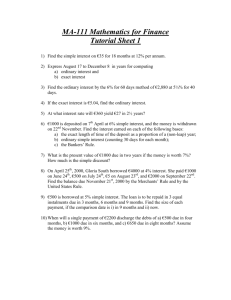

LEARNING UNIT OBJECTIVES

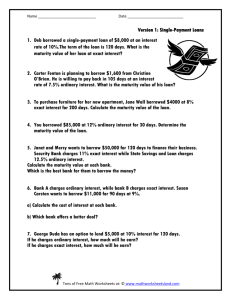

LU 10-1: Calculation of Simple Interest and Maturity Value

1.

Calculate simple interest and maturity value for months and years.

2.

Calculate simple interest and maturity value by (a) exact interest

and (b) ordinary interest.

LU 10-2: Finding Unknown in Simple Interest Formula

1.

Using the interest formula, calculate the unknown when the other

two (principal, rate, or time) are given.

LU 10-3: U.S. Rule -- Making Partial Note Payments before Due Date

1.

List the steps to complete the U.S. Rule.

2.

Complete the proper interest credits under the U.S. Rule.

10-2

MATURITY VALUE

Maturity Value (MV) = Principal (P) + Interest (I)

The amount of the loan

(face value)

Cost of borrowing

money

10-3

SIMPLE INTEREST FORMULA

Simple Interest (I) = Principal (P) x Rate (R) x Time (T)

Stated as a

Percent

Stated in

Years

Example: Jan Carley borrowed $30,000 for office furniture. The loan was for 6

months at an annual interest rate of 8%. What are Jan’s interest and maturity

value?

I = $30,000 x .08 x 6 = $1,200 interest

12

MV = $30,000 + $1,200 = $31,200 maturity value

10-4

SIMPLE INTEREST FORMULA

Simple Interest (I) = Principal (P) x Rate (R) x Time (T)

Stated as a

Percent

Stated in

years

Example: Jan borrowed $30,000. The loan was for 1 year at a rate of 8%.

What is interest and maturity value?

I = $30,000 x .08 x 1 = $2,400 interest

MV = $30,000 + $2,400 = $32,400 maturity value

10-5

TWO METHODS OF CALCULATING SIMPLE

INTEREST AND MATURIT Y VALUE

Method 1: Exact Interest

Used by Federal Reserve banks and the federal government

Exact Interest (365 Days)

Time = Exact number of days

365

10-6

METHOD 1:

EXACT INTEREST

On March 4, Peg Carry borrowed $40,000 at 8%. Interest and principal are due

on July 6.

Exact Interest (365 Days)

I=PxRxT

$40,000 x .08 x 124 = $1,087.12 interest

365

MV = P + I

$40,000 + $1,087.12 = $41,087.12 maturity value

10-7

TWO METHODS OF CALCULATING SIMPLE

INTEREST AND MATURITY VALUE

Method 2 : Ordinary Interest (Banker’s Rule)

Ordinary Interest (360 Days)

Time = Exact number of days

360

10-8

METHOD 2

ORDINARY INTEREST

On March 4, Peg Carry borrowed $40,000 at 8%. Interest and principal are

due on July 6.

Ordinary Interest (360 Days)

I=PxRxT

$40,000 x .08 x 124 = $1,002.22 interest

360

MV = P + I

$40,000 + $1102.22 = $41,102.22 maturity value

10-9

TWO METHODS OF CALCULATING SIMPLE

INTEREST AND MATURITY VALUE

On May 4, Dawn Kristal borrowed $15,000 at 8%.

Interest and principal are due on August 10.

Exact Interest (365 Days)

I=PXRXT

Ordinary Interest (360 Days)

I=PXRXT

$15,000 x .08 x 98 = $322.19 interest

365

$15,000 x .08 x 98 = $326.67 interest

360

MV = P + I

$15,000 + $322.19 = $15,322.19

MV = P + I

$15,000 + $326.67 = $15,326.67

10-10

FINDING UNKNOWN IN SIMPLE

INTEREST FORMULA: PRINCIPAL

Principal = Interest

Rate x Time

Example: Tim Jarvis paid the bank $19.48 interest at 9.5% for 90 days. How

much did Tim borrow using the ordinary interest method?

P =

$19.48

. = $820.21

.095 x (90/360)

.095 times 90 divided by 360. (Do

not round answer.)

Interest (I) = Principal (P) x Rate (R) x Time (T)

Check 19.48 = 820.21 x .095 x 90/360

10-11

FINDING UNKNOWN IN SIMPLE

INTEREST FORMULA: RATE

Rate =

Interest

Principal x Time

Example: Tim Jarvis borrowed $820.21 from a bank. Tim’s interest is $19.48

for 90 days. What rate of interest did Tim pay using the ordinary interest

method?

$19.48

.

R = $820.21 x (90/360) = 9.5%

Interest (I) = Principal (P) x Rate (R) x Time (T)

Check 19.48 = 820.21 x .095 x 90/360

10-12

FINDING UNKNOWN IN SIMPLE

INTEREST FORMULA: TIME

Time (years) =

Interest

Principle x Rate

Example: Tim Jarvis borrowed $820.21 from a bank. Tim’s interest is $19.48 for

90 days. What rate of interest did Tim pay using ordinary interest method?

T =

$19.48

= .25.

$820.21 x .095

.25 x 360 = 90 days

Convert years to days (assume 360 days)

Interest (I) = Principal (P) x Rate (R) x Time (T)

Check 19.48 = 820.21 x .095 x 90/360

10-13

U.S. RULE - MAKING PARTIAL NOTE

PAYMENTS BEFORE DUE DATE

Any partial loan payment first covers any interest that has

built up. The remainder of the partial payment reduces the

loan principal.

Allows the borrower to receive proper interest credits.

10-14

U.S. RULE

(EXAMPLE)

Joe Mill owes $5,000 on an 11%, 90-day note. On day 50, Joe pays $600 on the

note. On day 80, Joe makes an $800 additional payment. Assume a 360-day year.

What is Joe’s adjusted balance after day 50 and after day 80? What is the ending

balance due?

Step 1. Calculate interest on principal from

date of loan to date of first principal

payment.

Step 2. Apply partial payment to interest due.

Subtract remainder of payment from

principal.

$5,000 x .11 x 50 = $76.39

360

$600 -- 76.39 = $523.61

$5,000 – 523.61 = $4,476.39

10-15

U.S. RULE

(EXAMPLE, CONTINUED)

Joe Mill owes $5,000 on an 11%, 90-day note. On day 50, Joe pays $600 on the note.

On day 80, Joe makes an $800 additional payment. Assume a 360-day year. What is

Joe’s adjusted balance after day 50 and after day 80? What is the ending balance due?

Step 3. Calculate interest on adjusted

balance that starts from previous

payment date and goes to new

payment date. Then apply Step 2.

$4,476.39 x .11 x 30 = $41.03

360

$800 -- 41.03 = $758.97

$4,476.39 – 758.97 = $3717.42

Step 4. At maturity, calculate interest from

last partial payment. Add this

interest to adjusted balance.

$3,717.42 x .11 x 10

360

= $11.36

$3,717.42 + $11.36 = $3,728.78

10-16