3520-8-updated 2013

advertisement

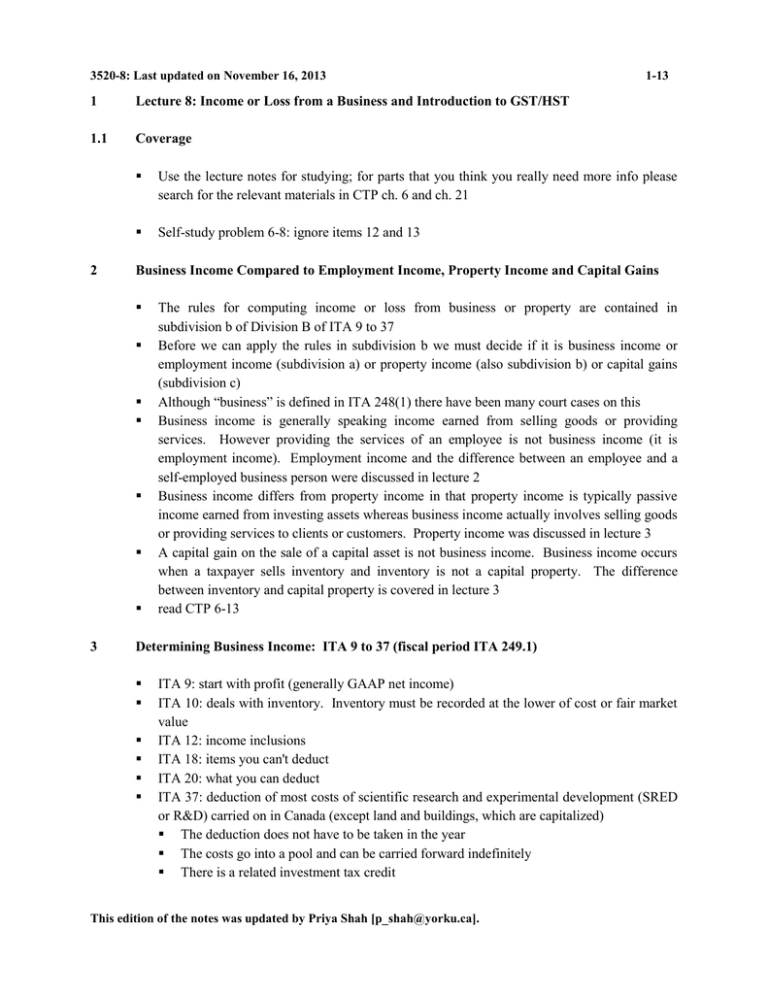

3520-8: Last updated on November 16, 2013 1 Lecture 8: Income or Loss from a Business and Introduction to GST/HST 1.1 Coverage 2 Use the lecture notes for studying; for parts that you think you really need more info please search for the relevant materials in CTP ch. 6 and ch. 21 Self-study problem 6-8: ignore items 12 and 13 Business Income Compared to Employment Income, Property Income and Capital Gains 3 1-13 The rules for computing income or loss from business or property are contained in subdivision b of Division B of ITA 9 to 37 Before we can apply the rules in subdivision b we must decide if it is business income or employment income (subdivision a) or property income (also subdivision b) or capital gains (subdivision c) Although “business” is defined in ITA 248(1) there have been many court cases on this Business income is generally speaking income earned from selling goods or providing services. However providing the services of an employee is not business income (it is employment income). Employment income and the difference between an employee and a self-employed business person were discussed in lecture 2 Business income differs from property income in that property income is typically passive income earned from investing assets whereas business income actually involves selling goods or providing services to clients or customers. Property income was discussed in lecture 3 A capital gain on the sale of a capital asset is not business income. Business income occurs when a taxpayer sells inventory and inventory is not a capital property. The difference between inventory and capital property is covered in lecture 3 read CTP 6-13 Determining Business Income: ITA 9 to 37 (fiscal period ITA 249.1) ITA 9: start with profit (generally GAAP net income) ITA 10: deals with inventory. Inventory must be recorded at the lower of cost or fair market value ITA 12: income inclusions ITA 18: items you can't deduct ITA 20: what you can deduct ITA 37: deduction of most costs of scientific research and experimental development (SRED or R&D) carried on in Canada (except land and buildings, which are capitalized) The deduction does not have to be taken in the year The costs go into a pool and can be carried forward indefinitely There is a related investment tax credit This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 2-13 ITA 249.1: deals with the fiscal period (individuals must generally use the calendar year, corporations can choose a non-calendar year end but must be consistent once they choose one) 3.1 Some other rules that apply for all purposes of the ITA are also applicable to the calculation of business income including: 3.1.1 The Reasonable Requirement 3.1.2 ITA 67 says that expenses in excess of a reasonable amount cannot be deducted e.g. if a salary in excess of a reasonable amount is paid (e.g. to a family member), the excess amount is not deductible The 50% meals and entertainment rule 3.1.2.1 ITA 67.1 says that you can only deduct 50% of meals and entertainment This includes meals claimed as a traveling expense and business deductions for taking clients to the ballet, opera, plays, sporting events, etc. Different rules apply to truck drivers (not discussed in this course) There are a few exceptions to the 50% rule that mean that the outlay is 100% deductible, these include: 3.1.3 events generally available to all employees at a work location e.g. Christmas party, not exceeding six per year The 50% rule in ITA 67.1 would apply to the 7th and all subsequent such events events to raise funds for registered charities e.g. cost of a ticket to a charity dinner/fundraiser where taxpayer was compensated by someone else for the meals e.g. the accountant who bills the meals to a client can claim 100% of the cost as a deduction (as long as they include in income the amount billed to their client) where meals and entertainment are provided as a part of normal course of business, etc (e.g. the cost of meals to a hotel, resort or airline) Fines and Penalties ITA 67.6 says there is no deduction allowed for fines and penalties levied by a country, province or municipality e.g. parking tickets, government fines for pollution, etc This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 3.1.4 Car restrictions 4 There are various restrictions on the deduction of items related to automobiles, designed to restrict deductions on expensive cars (covered in ADMS 4561) tax-free car allowances [ITA 18(1)(r), Reg. 7306] CCA on passenger vehicles [ITA 13(7)(g), Reg. 7307] interest payments on car loans [ITA 67.2, Reg. 7307] car lease payments [ITA 67.3, Reg. 7307] Business Income and Accounting Financial Statements 4.1 3-13 When you prepare a tax return reporting business income, you generally start with the accounting (financial statement) net income The next step is to make adjustments (you add back certain items and deduct others) to convert the accounting net income to the tax net income (called Division B net income or net income for tax purposes) This applies when you are computing business income for an individual or a corporation ITA 9 says that to compute business income, you start with "Profit" and adjust as the ITA requires Corporate tax returns (T2s) reporting business income must contain: a reconciliation (Schedule 1) between financial statement (accounting) income and net income for tax purposes; and must include the financial statements of the business prepared using the CRA's standardized financial statement format, the "General Index of Financial Information" (GIFI) = a standard way of categorizing financial statements The adjustments required to reconcile financial statement income to business income for tax purposes are mostly add backs – there are very few deductions There is case law on whether a taxpayer has to follow GAAP (generally accepted accounting principles) when the ITA is silent The Supreme Court of Canada has said no in Canderel Ltd. v. Canada, [1998] 1 SCR 147 Taxpayer has to provide an “accurate picture of profit” that does not necessarily have to be in accordance with GAAP An example is the treatment of tenant inducements paid by a landlord (fully deductible for tax but amortized over the lease term for accounting purposes) Finally, profits of an illegal business are taxable and damages are taxable if they replace amounts that would have been income Add back and deduct items in adjustments Note: if an item is deducted in the computation of accounting net income and not deductible for tax purposes then you “add it back” to accounting net income (in order to determine net income for tax purposes) This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 4.2 4-13 read 6-69 for ITA 18(1)(a) any amounts that are not incurred to earn income (and that have been deducted in accounting net income) would have to be added back under ITA 18(1)(a), personal expenses are also specifically denied under ITA 18(1)(h) read 6-73 for ITA 18(1)(b) see CTP Figure 6-3 Depreciation and amortization Depreciation or amortization (the two words mean the same thing) are a way of deducting the cost of a capital asset over a number of years The method used by an accountant and the method used in the Regulations of the ITA are quite often different (sometimes they will be the same) So the accounting amortization or depreciation expense is added back (because ITA 18(1)(b) requires amounts on account of capital to be added back) and the tax number (CCA or CECA) is deducted There are other timing differences between accounting and tax but this is the main one Permanent differences such as meals and entertainment For obvious tax policy reasons (i.e. there is a personal benefit relating to meals and entertainment), the government has decided that only 50% of meals and entertainment is tax deductible [ITA 67.1] The U.S. tax system has the same rule So it is important to find out how much (if any) of the business person’s advertising and promotion account is meals and entertainment If the financial statements reported capital gains and losses, it’s important to add back the accounting loss (deduct the accounting gain) and compute the net taxable capital gain (i.e. 50% capital gain net of 50% of capital losses) Example of an Unincorporated Business: business of a doctor or accountant There are sales or revenues (from services provided to patients or clients) and these amounts must be included whether the doctor or accountant receives the cash immediately or at a later date (from the client or OHIP) The typical expenses of a doctor or accountant (or dentist or consultant or any other individual providing a service business) might be salaries and benefits to employees (e.g. receptionist, etc.), office rent and expenses (e.g. rent and utilities, paper and other supplies, professional fees, conferences, etc), advertising and promotion (e.g. ads, flyers, cost of taking clients out), depreciation or amortization on equipment (e.g. computers, etc.) and interest on borrowed money used in the business Assume: CCA is $6,000, Meals & entertainment expenses included in the promotional expenses are $4,000 A financial statement might look like the following: Sales or revenues Expenses This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. $110,000 3520-8: Last updated on November 16, 2013 Salaries and benefits to employees Office expenses Advertising and promotion Depreciation or amortization Income 5-13 $30,000 10,000 6,000 5,000 (51,000) $59,000 The reconciliation would be Income per financial statements Add 50% of meals and entertainment Add depreciation or amortization Deduct CCA Income for tax purposes $59,000 $ 2,000 5,000 (6,000) $60,000 5 No adjustment is needed if an item is treated the same way for both accounting and tax 5.1 Interest on bank loan used to purchase an investment (e.g., common shares, factory, etc.) or used to finance business operations (e.g., working capital etc.) [ITA 20(1)(c)] 5.2 Costs incurred to dispute an income tax assessment [ITA 60(o)] 5.3 are deductible for accounting and for tax purposes Prepaid expenses (e.g., prepaid rent, insurance or advertising) [ITA 18(9)] 5.5 are deductible for accounting and for tax purposes Most expenses such as salaries and benefits for employees, rent, supplies, etc. 5.4 is deductible for accounting and for tax purposes but interest paid on late-paid income taxes is not deductible [ITA 18(1)(t)] these are amounts paid in advance and are not deducted until the applicable period they relate to has occurred. Same treatment for accounting and for tax purposes Bad debt allowances and write offs of accounts receivable As long as the allowance is reasonable and is based on a review of the accounts receivable, it is deductible, even though it is an estimate [ITA 20(1)(l)]. Actual write-offs of bad debts are also deductible [ITA 20(1)(p)] This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 5.6 Landscaping deducted for accounting purposes 5.7 Many items that are capitalized for accounting purposes are treated the same for tax Examples are: Costs of investments plus outlays or expenses (commissions, legal fees) paid on the purchase of an investment (shares, factory, land, etc.) A good accountant would not deduct them and would instead add them to the cost of the investment ITA 18(1)(b) also requires the amount to be capitalized Appraisals If the appraisal relates to the purchase of property, it becomes part of the cost of the asset under ITA 18(1)(b) again, a good accountant would treat it this way as well, so it will generally not be deducted for accounting purposes If the appraisal is incurred for the purpose of gaining or producing income (e.g., to get insurance), the cost is deductible for accounting and tax purposes Add back cost of articles of incorporation under ITA 18(1)(b) CECA deduction is available (discussed in lecture 8) Site investigation costs (e.g. costs of investigating land prior to purchase) 5.9 Landscaping paid in the year is deductible for tax purposes under ITA 20(1)(aa) Sometimes landscaping is capitalized and amortized for accounting purposes and in this case we do make an adjustment by adding back the amortization and deducting the full amount paid in the year Accountants may or may not deduct the item depending on what it is e.g. flowers vs. stone retaining walls Capital items 5.8 6-13 Site investigation costs paid in the year are deductible for tax purposes under ITA 20(1)(dd) Sometimes site investigation is capitalized for accounting purposes and in this case the adjustment is to add back any amortization and deduct the full amount when paid Utilities service connection Utilities service connection costs paid in the year are deductible for tax purposes under ITA 20(1)(ee) Sometimes it will be capitalized and in this case the adjustment is to add back any amortization and deduct the full amount when paid This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 5.10 6 7-13 Convention Expenses Taxpayers earning business income can deduct the cost of attending up to 2 conventions (related to the business) per year [ITA 20(10)]. If a portion of the cost of the convention is for food, beverages and/or entertainment then this portion is only ½ deductible (i.e., the usual 50% deduction for meals and entertainment applies). If the cost of food, beverages, and/or entertainment is included in the convention cost and unknown then the cost will be deemed to be $50 per day [ITA 67.1(3)] Add back amounts deducted for accounting purposes (that are not deductible for tax purposes) These add backs are needed when you use accounting net income as the starting point for determining net income for tax purposes and when an amount has been deducted in computing accounting net income that is not deductible for tax purposes 6.1 Tax expense 6.2 Depreciation and amortization 6.3 ITA 18(1)(e) disallows any deduction for income tax expense, including the tax provision. Interest or penalties paid/payable relating to income tax are not deductible for tax purposes due to 18(1)(t) Note that municipal taxes (also called property taxes), GST/HST, and provincial capital taxes are deductible if paid/payable. GST/HST registrants typically get any GST/HST paid back as an input tax credit (ITC); hence GST/HST paid/payable would typically not be deductible (after considering the ITC). HST, which applies in Ontario as of July 1, 2010, was discussed in lecture 1 ITA 18(1)(b) states that outlays on account of capital (assets) not specifically allowed by the ITA are not deductible so add back the cost of equipment or accounting depreciation and amortization and deduct capital cost allowance (CCA) according to ITA 20(1)(a) similarly, for tax purposes we do not deduct the amortization or write down of goodwill or deduct the costs of incorporation instead we add ¾ of the amount paid for these intangible assets to the cumulative eligible capital (CEC) account and deduct CECA (cumulative eligible capital amount) [ITA 20(1)(b)] Charitable Donations ITA 18(1)(a) denies this deduction because donations are not incurred to earn income charitable donations made by individuals are eligible for a tax credit This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 6.4 Life insurance premiums paid are typically not deductible for tax purposes because they are incurred to earn tax-free income (recall: that life insurance receipts are typically received tax free) and typically are not term insurance that serves as collateral for a loan Anything incurred to earn exempt (tax-free) income is not deductible under the ITA 18(1)(c) However if: the employee is the beneficiary, the premiums are considered part of employee benefits and are deductible to the employer (recall: the premiums paid would be a taxable benefit to the employee) the company is the beneficiary and the life insurance is required as collateral for a loan, it is deductible under ITA 20(1)(e.2) This is a common situation with small businesses since banks may not want to lend to a small business that is dependent upon an owner-manager for success without a life insurance policy existing on that owner-manger Golf club membership fees are not deductible [ITA 18(1)(l)] 6.6 charitable donations made by a corporation are eligible for a Division C deduction (i.e., they reduce taxable income but not net income for tax purposes) Life insurance premiums 6.5 8-13 ITA 18(1)(l) also applies to deny the deduction for the cost of maintaining a recreational property (e.g. yacht or golf club) or recreational club dues Warranties and contingencies ITA 18(1)(e) disallows reserves (expenses) for estimates of expenses relating to warranties and contingencies and other reserves except as specifically allowed by the ITA Examples: An estimate for a warranty (only the actual cost of servicing the warranty in the year is deductible) Cost of a lawsuit that is expected to be lost or the cost of severance that is likely to be paid (because the cost can only be deducted for tax purposes when it is a legal liability) Exceptions: bad debts expense and/or allowance for uncollectible accounts receivable (discussed above) if amounts received in advance have been included in income, a reserve for goods/services that will be delivered/provided after year end can be claimed a reserve can also be claimed on anticipated sales returns that will occur after year end on items sold to customers (that are returnable) This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 6.7 Cost of issuing Shares or Debt 6.8 e.g. just like charitable donations, they are not deductible in computing business income but there is other tax relief, that is, the political contribution tax credit in ITA 127(3). Note: corporations and unions are no longer allowed to make federal political contributions Home office expenses [ITA 18(12)] 6.11 e.g. the doctor or accountant in the example above cannot deduct any personal expenses including the cost of driving to the office (which is considered a personal expense) Political donations [ITA 18(1)(n)] 6.10 Expenses incurred to issue shares or debt (or partnership units) must be written off evenly over 5 Years [ITA 20(1)(e)] If the full amount has been deducted in the financial statements, you must add back 4/5 of the expense in the year incurred since only 1/5 is deductible deduct 1/5 in each of the subsequent 4 years These are fees charged by lawyers, accountants, banks, underwriters etc. incurred to obtain financing this is not the interest charged on a loan (interest expense was discussed above) Personal or living expenses [ITA 18(1)(h)] 6.9 9-13 the two main restrictions: one of which must be met in order to deduct home office expenses incurred to earn business income are the same as for employment income: the home office must be the principal place of business or exclusively used for business and a place where you regularly meet clients you cannot create or increase a loss by claiming home office expenses. Any such undeducted home office expenses can be deducted in the following taxation year a self-employed taxpayer can deduct additional amounts not allowed under the employment income home office deduction e.g. mortgage interest and CCA on equipment such as a laptop, printer, fax, photocopier Foreign Media Advertising (which is directed primarily to Canada) For tax policy reasons, there is no deduction for advertising in foreign media which is directed primarily to Canada [ITA 19, 19.01, 19.1] This rule protects Canadian magazines, newspapers, radio & TV by denying a deduction for foreign ads if the ad is directed primarily at a Canadian market This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 Foreign advertising aimed at a foreign market is deductible Advertising on the internet should not be affected by ITA 19, 19.01, and 19.1 since the internet is not a magazine, newspaper, radio or T.V. broadcast 7 For items to deduct, see Figure 6-3 8 GST/HST and Restrictions on Claiming GST/HST Input Tax Credits 10-13 The GST/HST registrant must remit any GST/HST collected (or collectible) less any ITCs to the federal government (for each applicable reporting period). If the GST/HST registrant has more ITCs than GST/HST collected (for the applicable reporting period) the GST/HST registrant will receive a refund from the federal government The key points are: Look at invoice date and remit GST /HST on sales (at 5%; 13% for Ontario HST)/claim ITC on purchases based on GST/HST paid on the invoice date In Ontario, as of July 1, 2010, HST (at 13%) will need to be collected and remitted. An ITC equal to any HST paid by an HST registrant will be available Where a GST/HST registrant imports a good (i.e., buys a good from outside of Canada) GST/HST must be paid on the purchase (to Canada Customs, i.e., to the federal government). Any GST/HST paid can be claimed as an ITC by the GST/HST registrant Imports to Ontario (from outside of Canada) as of July 1, 2010 are subject to HST Some rules parallel income tax: No ITC for use of recreational facilities & club dues [ETA 170(1)(a)] No ITC for personal or living expenses [ETA 170(1)(b)] Expenses must be reasonable [ETA 170(2)] GST/HST adjustments for 50% of meals & entertainment No ITC can be claimed for the portion of the cost of a passenger vehicle in excess of $30,000 (plus PST and GST or HST on $30,000). A similar restriction exists for leased luxury vehicles. Generally speaking, no ITC can be claimed for the portion of the lease cost of a passenger vehicle in excess of $800 per month Generally speaking, GST/HST registrants with annual sales greater than $6 million must file monthly GST/HST returns (and must remit any GST/HST owing at this time); GST/HST registrants with annual sales less than $6 million but more than $1.5 million must file quarterly GST/HST returns (and must remit any GST/HST owing at this time); and GST/HST registrants with annual sales less than $1.5 million may file annual GST/HST returns (and must remit any GST/HST owing at this time) The GST/HST return (and any tax owing) is due one month after the end of the reporting period for monthly and quarterly filers. For annual filers the GST/HST return (and any tax owing) is due 3 months after year end. Annual filers may have to make quarterly GST/HST instalment payments if their prior year GST/HST owing exceeded $3,000 This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 GST/HST registrants must maintain books and records in order to be able to adequately determine the amount of the person’s tax liability. Generally speaking, records must be retained for at least 6 years After a GST/HST registrant files a GST/HST return the taxation authorities will issue a notice of assessment. The Minister of National Revenue has 4 years to file a notice of assessment (or reassessment) from the later of: (1) the day the return is due; and (2) the day the return is actually filed If a GST/HST registrant disagrees with a notice of assessment (or reassessment) and if the GST/HST registrant cannot resolve their disagreement with the CRA the GST/HST registrant can file a notice of objection The notice of objection is due within 90 days after the date of the notice of assessment (or reassessment) If after filing a notice of objection the GST/HST registrant and the CRA are still in disagreement then the taxpayer can appeal to the Tax Court of Canada 9 Summary of Business Income 9.1 Calculation of Net Income for Tax Purposes 11-13 Start with net income per financial statements Add back any expenses in the financial statements which are not deductible for tax purposes Income tax provision on financial statements, reserves for contingencies (e.g. warranty, inventory) [ITA 18(1)(e)] Capital expenditures, depreciation and amortization of capital expenditures [ITA 18(1)(b)] Accounting losses Legal expenses and commissions etc. on purchase of an investment (shares, a factory, etc.) [ITA 18(1)(b)] Expenses relating to the issuance of shares, debt, partnership units [ITA 18(1)(b)] see ITA 20(1)(e) below Foreign taxes (if not already included in income; recall: gross foreign income must be included in net income for tax purposes) Interest and penalties on late income tax payments [ITA 18(1)(t)] Increase in the financial accounting reserve for expenses related to warranties and contingencies [ITA 18(1)(e)] Donations to registered charities [ITA 18(1)(a)] deducted later under Division C for corporations, individuals can get a personal tax credit 50% of meals and entertainment [ITA 67.1] Fines and penalties [ITA 67.6] This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 12-13 9.2 Deductions treated the same for tax and accounting purposes include 9.3 Expenses in excess of a reasonable amount [ITA 67] Club membership dues [ITA 18(1)(l)] Political donations [ITA 18(1)(n)] Accrued bonuses still unpaid 180 days after year end [ITA 78(4)] Advertising in foreign media directed primarily to Canada [ITA 19, 19.01, 19.1] Property taxes and interest on vacant land in excess of rental income [ITA 18(2)] Net cost of life insurance premiums (if corporation = beneficiary and not required for financing) [ITA 18(1)(c)] Car expenses in excess of maximum deductions for tax purposes [ITA 13(7)(g), 18(1)(r), 67.2, 67.3] Add Net taxable capital gains = Taxable (1/2) capital gains - allowable (1/2) capital losses Deduct amounts deductible for tax purposes which are not deducted on financial statements 1/5 Legal/accounting expenses related to the issuance of shares, debt (or partnership units) [ITA 20(1)(e)] Site investigation costs paid which have been capitalized [ITA 20(1)(dd)] Amounts paid for landscaping business premises that have been capitalized [ITA 20(1)(aa)] Capital cost allowance (CCA) [ITA 20(1)(a)] Accounting gains Arrive at net income under Division B (i.e., net income for tax purposes) Interest on bank loan used to purchase an investment (e.g., common shares, factory, etc.) or used to finance business operations (e.g., working capital etc.) [ITA 20(1)(c)] Legal costs incurred to dispute an income tax assessment [ITA 60(o)] Most costs of salaries and benefits (including insurance where employee is the beneficiary) Cost of term life insurance where co. is beneficiary & required as collateral for financing [ITA 20(1)(e.2)] Meals & entertainment where all employees at a location participate (e.g. Christmas party) [ITA 67.1(2)] Site investigation costs [ITA 20(1)(dd)], landscaping [ITA 20(1)(aa)], etc. that have been deducted for accounting purposes Recap re life insurance life insurance that is an employee taxable benefit (beneficiary = estate or family of employee) deductible as salary and wages [ITA 9] no difference between accounting and tax life insurance where beneficiary = employer not deductible since incurred to earn exempt income [ITA 18(1)(c)] This edition of the notes was updated by Priya Shah [p_shah@yorku.ca]. 3520-8: Last updated on November 16, 2013 13-13 life insurance where beneficiary = employer and use as collateral for bank loan the net cost of pure insurance (the cost of the premiums for term insurance, not whole life insurance) deductible under ITA 20(1)(e.2) no difference between accounting and tax This edition of the notes was updated by Priya Shah [p_shah@yorku.ca].