When expected inflation rises, interest rates will rise. - FMT-HANU

advertisement

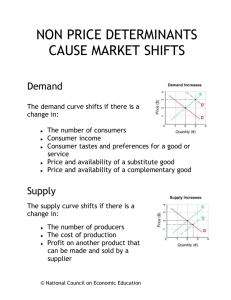

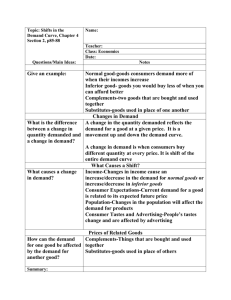

MONEY & BANKING Week 3: The behavior of Interest rates Chapter 5 1 Objectives Introduce the theory of asset demand Explain the determination of the interest rate using Demand and supply curves Understand factors affecting movements in interest rates: Factors create a shift in demand curve Factors create a shift in supply curve 2 Determinants of asset demand Determinants of asset demand Wealth: the total resources, including all assets Expected return: (for the next period) on one asset, compared to alternative assets. Risk: degree of uncertainty associated with the return on one asset relative to alternative assets. Liquidity: the ease and speed with which an asset can be turned into cash, compared to alternative assets . 3 Determinants of asset demand Wealth: When the wealth increases (more resources to spend), higher demand for assets, more quantity of assets demanded. Holding everything else constant, an increase in wealth raised the quantity demanded of an asset. 4 Determinants of asset demand Expected returns Holding everything else constant, an increase in an asset’s expected return relative to that of an alternative asset raises the quantity demanded of the asset. 5 Determinants of asset demand Risk Holding everything else unchanged, if an asset’s risk rises relative to that of alternative assets, its quantity demanded will fall. 6 Determinants of asset demand Liquidity Holding everything else constant, the more liquid an asset is relative to alternative assets, the more desirable it is, and the greater will be the quantity demanded. 7 Theory of asset demand Holding all of the other factors constant: Variable Wealth/Income Expected return (relative to other assets) Risk (relative to other assets) Liqudity (relative to other assets) Change in variable Change in quantity demanded Relationship Increase Increase Positive Increase Increase Positive Increase Decrease Negative Increase Increase Positive 8 Loanable Funds Framework Interest rates are determined by demand for and supply of bonds. (Demand and Supply curves) Assumptions: There is only one type of security (bond) and a single interest rate in the economy Except for the variable being analysed, other economic variables are held constant 9 Demand curve Demand curve: shows the relationship between the quantity demanded and the price (other economic variables constant) A particular value of the interest rate corresponds to each bond price. 10 Demand curve Discount bond Price of the bond $950 $900 $850 $800 $750 Pays $1,000 face value in one year Interest rate 5.30% 11.10% 17.60% 25.00% 33.30% Quantity demanded $100 billion $200 billion $300 billion $400 billion $500 billion 11 Supply curve Supply curve: shows the relationship between the quantity supplied and the price of the bond (all other economic variables constant) 12 Supply curve Discount bond Price of the bond $950 $900 $850 $800 $750 Pays $1,000 face value in one year Interest rate 5.30% 11.10% 17.60% 25.00% 33.30% Quantity supplied $500 billion $400 billion $300 billion $200 billion $100 billion 13 14 Market equilibrium Market equilibrium: when the amount that people are willing to buy (demand) equals the amount that people are willing to sell (supply) at a given price. The given price is called equilibrium or market-clearing price. The interest rate corresponding to the equilibrium price is called equilibrium or market-clearing interest rate. 15 Market equilibrium Excess supply: occurs when the quantity of bonds supplied exceeds the quantity of bonds demanded. Excess demand: occurs when the quantity of bonds demanded exceeds the quantity of bonds supplied. 16 Changes in equilibrium interest rates Changes in interest rates: due to shifting of demand and supplies curves Shift in demand (supply) curve: occurs when the quantity demanded (or supplied) changes at each given price (or interest rate) of the bond in response to a change in some other factors besides the bond’s price or interest rate 17 Factors affecting the Demand for Bonds 1. 2. 3. 4. Wealth Expected returns on bonds relative to alternative assets Risk of bonds relative to alternative assets Liquidity of bonds relative to alternative assets 18 1. Wealth Wealth and business cycle: In a business cycle expansion: wealth increases, the demand for bonds rises, demand curve for bonds shifts to the right In a recession, income and wealth are falling, the demand for bonds falls, the demand curve shifts to the left. 19 1. Wealth Wealth and propensity to save: More savings, wealth increases, demand for bonds rises, demand curve shifts to the right. Less savings, wealth falls, demand for bonds falls, demand curve shifts to the left. 20 2. Expected returns Expected returns for long-term bonds: Higher expected interest rates in the future, lower the expected return for long-term bonds, demand decreases, demand curve shifts to the left. And vice versa. 21 2. Expected returns Expected returns on other assets: Higher expected returns on other alternative assets shifts the demand curve for bonds to the left. An increase in the expected inflation rate lowers the expected return for bonds, demand curve for bonds shifts to the left. Higher expected inflation rate, higher expected returns on physical (real) assets (cars, houses), lower expected returns on bonds. 22 3. Risks Risks: Bonds become riskier, demand for bonds falls, demand curve shifts to the left Bond market more volatile Alternative assets become riskier, demand for bonds increase, demand curve shifts to the right. 23 4. Liquidity Liquidity Liquidity of bonds increases, increase in demand for bonds, demand curve shifts to the right Liquidity of alternative assets increases, decrease in demand for bonds, demand curve for bonds shifts to the left. 24 Factors affecting the Supply of Bonds 1. 2. 3. Expected profitability of investment opportunities Expected inflation Government activities 25 1. Expected profitability Expected profitability Business cycle expansion, higher expected profitability of investment opportunities, supply of bonds increases, supply curve shifts to the right. Recession, low expected profitability of investment opportunities, supply of bonds decreases, supply curve shifts to the left. 26 2. Expected inflation rate Expected inflation rate: Higher expected inflation rate, real cost of borrowing falls, supply of bonds increases, supply curve shifts to the right. 27 3. Government activities Government activities: Increase in government deficits, supply of government bonds increases, supply curve shifts to the right. 28 Changes in the interest rate: further consideration Changes in expected inflation: The Fisher effect Expected inflation rises, expected return on bonds (compared to real asset) falls, demand for bonds falls, demand curve for bonds shifts to the left. Expected inflation rises, real cost of borrowing falls, supply of bonds increases, supply curve for bonds shifts to the right. Result: Equilibrium bond price falls. Equilibrium interest rate rises. 29 Changes in the interest rate: further consideration Changes in expected inflation: The Fisher effect When expected inflation rises, interest rates will rise. 30 Changes in the interest rate: further consideration Business cycle expansion: Business cycle expansion, supply of bonds increases, supply curve shifts to the right. Business cycle expansion, wealth increases, demand for bonds increases, demand curve shifts to the right. 31 Changes in the interest rate: further consideration • Both demand and supply curves shift to the right, new equilibrium price (interest rate) moves to the right. If supply curve shifts more than demand curve, new equilibrium interest rate will rise. If supply curve shifts less than demand curve, new equilibrium interest rate will fall. 32 Loanable funds framework: Summary Interest rates are determined by demand and supply curves Interest rates will changes when demand and/or supply curves shift to the right or the left. Shift in the demand curve is due to changes in wealth, expected return, risks or liquidity Shift in the supply curve is due to profitability of investment opportunities, real cost of borrowing, or government activities. 33