Economics R. Glenn Hubbard, Anthony Patrick O'Brien, 2e.

advertisement

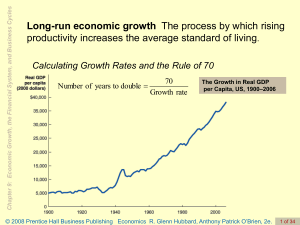

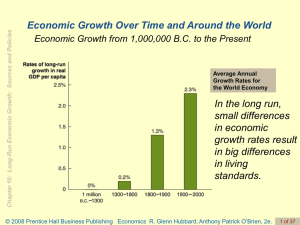

Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.1 What we learned in our last class Review on supply and demand (graph). Loanable funds market: How do loanable funds supply and demand curves shift. Crowding out effect: Government spending and loanable funds market. Business cycle: four phases. Effects of business cycle: Airline industry, durable goods, interest rate, inflation rate, unemployment rate. American economy became more stable: Services, Government transfer program, Active policy © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 1 of 37 MySpace Meets the Chinese Economic Miracle Learning Objectives 10.1 Define economic growth, calculate economic growth rates, and describe global trends in economic growth. 10.2 Use the economic growth model to explain why growth rates differ across countries. 10.3 Discuss fluctuations in productivity growth in the United States. 10.4 Explain economic catch-up and discuss why many poor countries have not experienced rapid economic growth. …per capita GDP in China will double every eight years. 10.5 Discuss government policies that foster economic growth. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 2 of 24 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.1 Economic Growth Over Time and Around the World Economic Growth from 1,000,000 B.C. to the Present FIGURE 10-1 Average Annual Growth Rates for the World Economy © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 4 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.1 Economic Growth Over Time and Around the World Small Differences in Growth Rates Are Important In the long run, small differences in economic growth rates result in big differences in living standards. The process is COMPOUNDING The value of $100 deposit after 50 years: with interest rate of 1.3% : $191 with interest rate of 2.3% : $321 Why Do Growth Rates Matter? Growth rates matter because an economy that grows too slowly fails to raise living standards. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 5 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.1 Economic Growth Over Time and Around the World Why Do Growth Rates Matter? Growth rates matter because an economy that grows too slowly fails to raise living standards. An example: Real GDP per capital (2000 dollars) 1950: Argentina: $6,942 France: $5,921 Growth rates: Argentina 0.8%, France: 2.8% 2004: Argentina: $10,939 France: $26,168 © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 6 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.1 Making The Benefits of an Earlier Start: the Connection Standards of Living in China and Japan CHINA Sustained high rates of economic growth have helped Japan attain high living standards. JAPAN Life expectancy at birth 71.9 years 82.2 years Infant mortality (per 1,000 live births) 23 3 Percentage of the population surviving on less than $2 per day 47% 0% Percentage of the population with access to treated water 77% 100% Percentage of the population with access to improved sanitation 44% 100% Internet users per 1,000 people 73 587 © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 7 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.1 Economic Growth Over Time and Around the World “The Rich Get Richer and . . . ” FIGURE 10-2 GDP per Capita, 2006 © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 8 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.2 What Determines How Fast Economies Grow? Economic growth model A model that explains growth rates in real GDP per capita over the long run. Labor productivity The quantity of goods and services that can be produced by one worker or by one hour of work. Increases in Capital per Hour Worked Technological change A change in the quantity of output a firm can produce using a given quantity of inputs. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 9 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.2 What Determines How Fast Economies Grow? There are three main sources of technological change: • Better machinery and equipment. • Increases in human capital. Human capital The accumulated knowledge and skills that workers acquire from education and training or from their life experiences. • Better means of organizing and managing production. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 10 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.2 What Determines How Fast Economies Grow? The Per-Worker Production Function Per-worker production function The relationship between real GDP per hour worked and capital per hour worked, holding the level of technology constant. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 11 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.2 What Determines How Fast Economies Grow? The Per-Worker Production Function FIGURE 10-3 The Per-Worker Production Function © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 12 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.2 What Determines How Fast Economies Grow? Which Is More Important for Economic Growth: More Capital or Technological Change? Technological change helps economies avoid diminishing returns to capital. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 13 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.2 What Determines How Fast Economies Grow? Technological Change: The Key to Sustaining Economic Growth FIGURE 10-4 Technological Change Increases Output per Hour Worked © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 14 of 37 Learning Objective 10.2 Chapter 10: Long-Run Economic Growth: Sources and Policies Making the Connection Why Did the Soviet Union’s Economy Fail? The fall of the Berlin Wall in 1989 symbolized the failure of Communism. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 15 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.2 Solved Problem 10-2 Using the Economic Growth Model to Analyze the Failure of the Soviet Union’s Economy © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 16 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.2 What Determines How Fast Economies Grow? New Growth Theory New growth theory A model of long-run economic growth which emphasizes that technological change is influenced by economic incentives and so is determined by the working of the market system. Key determinant: Knowledge capital Physical capital: diminishing return Knowledge capital: increasing return at the level of the economy!! Free ride: Transistor technology developed by Bell laboratory in 1950 © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 17 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.2 What Determines How Fast Economies Grow? New Growth Theory Government policy can help increase the accumulation of knowledge capital in three ways: • Protecting intellectual property with patents and copyrights. Patent The exclusive right to a product for a period of 20 years from the date the product is invented. • Subsidizing research and development. • Subsidizing education. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 18 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.1 What we learned in our last class The world economy grew much faster in last century than before. Small difference in growth rates matters a lot! Compounding process. France vs. Argentina Gap between rich and poor countries exists What determines the speed of economic growth? Growth model Technological change and capital per hour worked Main sources of technological change © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 19 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.1 What we learned in our last class Technological change is more important than captial per hour worked Per-worker production function The key to sustain economic growth an example: Soviet Union New growth theory Knowledge capital is crucial to technological change Knowledge capital is influenced and determined by market system Government can do something to help increase knowledge capital !! © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 20 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.3 Economic Growth in the United States Economic Growth in the United States since 1950: Fast, Then Slow, Then Fast Again FIGURE 10-5 Average Annual Growth Rates in Real GDP per Hour Worked in the United States © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 21 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.3 Economic Growth in the United States What Caused the Productivity Slowdown of 1973–1994? • Measurement problems • High oil prices • A decline in labor quality Was It a Measurement Problem? Was It the Effect of High Oil Prices? Was It the Declining Quality of Labor? The Productivity Slowdown Affected All Industrial Countries © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 22 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.3 Economic Growth in the United States The Productivity Boom: Are We in a “New Economy”? Why Has Productivity Growth Been Faster in the United States than in Other Countries? FIGURE 10-6 Productivity Growth in the Leading Industrial Economies, 1996–2006 © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 23 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? Catch-up The prediction that the level of GDP per capita (or income per capita) in poor countries will grow faster than in rich countries. Intuition: Diminishing return © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 24 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? Catch-up: Sometimes, but Not Always FIGURE 10-7 The Catch-up Predicted by the Economic Growth Model © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 25 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? Catch-up: Sometimes, but Not Always Catch-up Among the Industrial Countries FIGURE 10-8 There Has Been Catch-up among Industrial Countries © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 26 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? Catch-up: Sometimes, but Not Always Are the Developing Countries Catching Up to the Industrial Countries? FIGURE 10-9 Most of the World Hasn’t Been Catching Up © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 27 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Solved Problem 10-4 The Economic Growth Model’s Prediction of Catch-up COUNTRY REAL GDP PER CAPITA IN 1960 (2000 DOLLARS) ANNUAL GROWTH IN REAL GDP PER CAPITA, 1960–2004 Taiwan $1,443 Tunisia 2,102 3.13 Brazil 2,643 2.36 Algeria 3,843 1.04 Argentina 7,838 0.76 COUNTRY Japan REAL GDP PER CAPITA IN 1960 (2000 DOLLARS) $4,509 6.26% ANNUAL GROWTH IN REAL GDP PER CAPITA, 1960–2004 3.94% Italy 7,167 2.70 France 8,531 2.58 10,323 2.19 United Kingdom © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 28 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? Why Don’t More Low-Income Countries Experience Rapid Growth? Failure to Enforce the Rule of Law Property rights The rights individuals or firms have to the exclusive use of their property, including the right to buy or sell it. Rule of law The ability of a government to enforce the laws of the country, particularly with respect to protecting private property and enforcing contracts. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 29 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? Why Don’t More Low-Income Countries Experience Rapid Growth? Failure to Enforce the Rule of Law FIGURE 10-10 The Rule of Law and Growth © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 30 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? Why Don’t More Low-Income Countries Experience Rapid Growth? Wars and Revolutions Wars have made it impossible for countries such as Afghanistan, Angola, Ethiopia, the Central African Republic and the Congo to accumulate capital or adopt new technologies. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 31 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? Why Don’t More Low-Income Countries Experience Rapid Growth? Poor Public Education and Health Many low-income countries have weak public school systems, so many workers are unable to read and write. People who are sick work less and are less productive when they do work. Low Rates of Saving and Investment The low savings rates in developing countries contribute to a vicious cycle of poverty. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 32 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? The Benefits of Globalization Foreign direct investment (FDI) The purchase or building by a corporation of a facility in a foreign country. Foreign portfolio investment The purchase by an individual or a firm of stock or bonds issued in another country. Globalization The process of countries becoming more open to foreign trade and investment. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 33 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.4 Why Isn’t the Whole World Rich? The Benefits of Globalization FIGURE 10-11 Globalization and Growth © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 34 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies Learning Objective 10.5 Growth Policies We have seen that even small differences in growth rates compounded over the years can lead to major differences in standards of living. Therefore, there is potentially a very high payoff to government policies that increase growth rates. Enhancing Property Rights and the Rule of Law Improving Health and Education Policies with Respect to Technology Policies with Respect to Saving and Investment Is Economic Growth Good or Bad? © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 35 of 37 Chapter 10: Long-Run Economic Growth: Sources and Policies An Inside LOOK Entrepreneurship and Sustained Economic Growth in Europe Feeling Brighter Figure 1. To increase output per worker during the aftermath of World War II, Europe increased capital per worker. Figure 2. To increase output per worker today, Europe must find new and innovative ways to produce. © 2008 Prentice Hall Business Publishing Economics R. Glenn Hubbard, Anthony Patrick O’Brien, 2e. 36 of 37