Chapter 12

Income Taxes, Unusual Income

Tax Items, and Investments in

Stocks

Financial and Managerial Accounting

8th Edition

Warren Reeve Fess

PowerPoint Presentation by Douglas Cloud

Professor Emeritus of Accounting

Pepperdine University

© Copyright 2004 South-Western, a division

of Thomson Learning. All rights reserved.

Task Force Image Gallery clip art included in this

electronic presentation is used with the permission of

NVTech Inc.

Some of the action has been automated,

so click the mouse when you see this

lightning bolt in the lower right-hand

corner of the screen. You can point and

click anywhere on the screen.

Objectives

1. Journalize the entries for corporate

income taxes,

deferred income

Afterincluding

studying this

taxes.

chapter, you should

2. Prepare an income

reporting

be ablestatement

to:

the following unusual items: fixed asset

impairments, restructuring charges,

discontinued operations, extraordinary

items, and changes in accounting

principles.

3. Prepare an income statement reporting

earnings per share data.

Objectives

4. Describe the concept and the reporting

of comprehensive income.

5. Describe the accounting for

investments in stocks.

6. Describe alternative methods of

combining businesses and how

consolidated financial statements are

prepared.

7. Compute and interpret the priceearnings ratio.

Corporate Income Taxes

Corporate Income Taxes

A corporation

Assume that

makes

a corporation

four income

tax

estimates

installment

its taxes

payments

for the

throughout

year to bethe

$84,000.

year.

Corporate Income Taxes

On April 15, the first of four estimated

annual tax payments of $21,000 is made.

Apr. 15 Income Tax Expense

Cash

To record quarterly payment of

estimated income tax.

21 000 00

21 000 00

Corporate Income Taxes

Ratio of Reported Income Tax Expense to Earnings

Before Taxes for Selected Industries

Automobiles

33%

Banking

35

Computers

35

Food

35

Integrated oil

39

Pharmaceutical

30

Retail

39

Telecommunication

17

Transportation

38

Allocating Income Taxes

1. Revenues or gains are taxed after they are

reported in the income statement.

2. Expenses or losses are deducted in

determining taxable income after they are

reported in the income statement.

3. Revenues or gains are taxed before they are

reported on the income statement.

4. Expenses or losses are deducted in

determining taxable income before they are

reported in the income statement.

Temporary Differences

Differences in tax law and GAAP create some

temporary differences that reverse in later

years.

Temporary differences do not change or

reduce the total amount of tax paid, they

affect only the timing of when the taxes are

paid.

Temporary Differences

MACRS (tax

depreciation)

Straight-line (financial

statement depreciation)

Total

Temporary Differences

Temporary Differences in Reporting Revenues

Revenue

Reporting

Financial

Reporting

Report Now

EXAMPLE: Income

reporting methods.

EXAMPLE: Cash

collected in advance.

Point-of-Sale

Method

Tax

Reporting

Taxable Later

Installment

Method

Report Later

Taxable Now

When

Earned

When

Collected

Temporary Differences

Temporary Differences in Reporting Expenses

Expense

Deductions

Financial

Reporting

Deduct Now

EXAMPLE: Product

warranty expense.

EXAMPLE: Methods

of depreciation.

When

Estimated

Tax

Reporting

Deduct Later

When

Paid

Deduct Slower

Deduct Faster

Straight-Line

Method

MACRS

Method

Temporary Differences

At the end of the first year of operations, a

corporation reports $300,000 income before income

taxes. With a 40% tax rate, the firm faces a tax of

$120,000. Using tax planning, the net income is

reduced to $100,000 and the actual income tax due is

$40,000. The difference is deferred to future years.

Temporary Differences

The entry to record income taxes on April 15

reflects the deferred amount of $80,000.

Apr. 15 Income Tax Expense

Income Tax Payable

Deferred Income Tax Payable

To record income tax for the

year.

120 000 00

40 000 00

80 000 00

Temporary Differences

If $48,000 of the deferred tax reverses and becomes due in

the second year, the entry will reflect this fact.

Apr. 15 Deferred Income Tax Payable

Income Tax Payable

To record current liability for

deferred tax.

48 000 00

48 000 00

Permanent Differences

Differences between taxable income and

income before taxes reported on the

income statement may be the result of

differences that never reverse.

Permanent Differences

These differences are referred to as

permanent differences. Interest on

municipal bonds is an example of this

type of timing difference.

Unusual Items Affecting the

Income Statement

Unusual Items Affecting

Income from Continuing

Operations

Unusual Items Affecting the

Income Statement

Fixed Asset Impairments

Decrease in market price of fixed assets

Significant changes in the business or

regulations related to fixed assets

Adverse conditions affecting the use of fixed

assets

Expected cash flow losses using fixed assets

Unusual Items Affecting the

Income Statement

Fixed Asset Impairments

On March 1, Jones Company consolidates

operations by closing a factory. As a

result of the closing, plant and equipment

is impaired by $750,000.

Unusual Items Affecting the

Income Statement

Fixed Asset Impairments

Mar. 1 Loss on Fixed Asset Impairment

750 000 00

Fixed Assets—Plant

400 000 00

Fixed Assets—Equipment

To record impairment of fixed

assets due to plant closing.

350 000 00

Jones Corporation

Partial Income Statement

For the Year Ended December 31, 2006

Net sales

$12,350,000

Cost of merchandise sold

5,800,000

Gross profit

$ 6,550,000

Operating expenses

$3,490,000

Restructuring charge

1,000,000

Loss from asset impairment

750,000

5,240,000

Income from continuing operations

before income tax

$ 1,310,000

Income tax expense

620,000

Income from continuing operations

$ 690,000

Unusual Items Affecting the

Income Statement

Restructuring charges are costs associated

with involuntarily terminating employees,

terminating contracts, consolidating facilities,

or relocating employees.

Unusual Items Affecting the

Income Statement

Fixed Asset Impairments

The management of Jones Company

communicate a plan to terminate 200

employees from the closed manufacturing

plant on March 1. The plan calls for a

termination benefit of $5,000 per employee.

Unusual Items Affecting the

Income Statement

Restructuring Charges

Mar. 1 Restructuring Charge

1000 000 00

Employee Termination

Obligation

To record restructuring charge

due to plant closing.

1000 000 00

Unusual Items Affecting the

Income Statement

Restructuring Charges

Mar. 1 Restructuring Charge

1000 000 00

Employee Termination

Obligation

Mar. 25 Employee Termination Obligation

Cash

1000 000 00

125 000 00

125 000 00

Unusual Items Not Affecting Income

From Continuing Operations

Closed

Discontinued Operations

A gain or loss from disposing of a

business segment is reported as a gain

or loss from discontinued operations.

Jones Corporation

Income Statement

For the Year Ended December 31, 2006

Net sales

Income from continuing operations

before income tax

Income tax

Income from continuing operations

Loss on discontinued operations (Note B)

Income before extraordinary items and cumulative

effect of a change in accounting principle

Extraordinary item:

Gain on condemnation of land, net of

applicable income tax of $65,000

Cumulative effect on prior years of changing to

different depreciation method (Note C)

Net income

$12,350,000

$ 1,310,000

620,000

$ 690,000

100,000

$

590,000

150,000

$

92,000

832,000

Extraordinary Items

Extraordinary items result from events and

transactions that (1) are significantly different

from the typical or the normal operating

activities of the business AND (2) occur

infrequently.

Jones Corporation

Income Statement

For the Year Ended December 31, 2006

Net sales

Income from continuing operations

before income tax

Income tax

Income from continuing operations

Loss on discontinued operations (Note B)

Income before extraordinary items and cumulative

effect of a change in accounting principle

Extraordinary item:

Gain on condemnation of land, net of

applicable income tax of $65,000

Cumulative effect on prior years of changing to

different depreciation method (Note C)

Net income

$12,350,000

$ 1,310,000

620,000

$ 690,000

100,000

$

590,000

150,000

$

92,000

832,000

Accounting Changes

Accounting changes occur when a

business voluntarily change from one

generally accepted accounting principle

to another.

Accounting Changes

Another type of accounting change occurs

when businesses are required to change the

way they treat an accounting situation when

the FASB issues a new accounting standard.

Jones Corporation

Income Statement

For the Year Ended December 31, 2006

Net sales

Income from continuing operations

before income tax

Income tax

Income from continuing operations

Loss on discontinued operations (Note BA)

Income before extraordinary items and cumulative

effect of a change in accounting principle

Extraordinary item:

Gain on condemnation of land, net of

applicable income tax of $65,000

Cumulative effect on prior years of changing to

different depreciation method (Note C)

Net income

$12,350,000

$ 1,310,000

620,000

$ 690,000

100,000

$

590,000

150,000

$

92,000

832,000

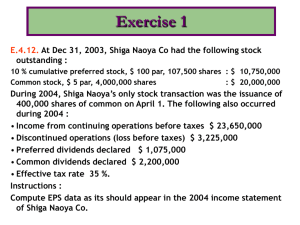

Earnings per Common Share

Earnings per share (EPS) is the net income per

share of common stock outstanding. When

unusual items exist, EPS should be reported for:

Income from continuing operations

Income before extraordinary items and the

cumulative effect of a change in accounting

principle

Extraordinary items and the cumulative effect

of a change in accounting principle

Net income

Earnings per Common Share

If there is no preferred stock:

Net Income

Earnings per

=

common share

Number of common shares outstanding

If there is preferred stock:

Net Income – Preferred stock dividends

Earnings per

=

common share

Number of common shares outstanding

Jones Corporation

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations

$690,000

Net income

$832,000

Earnings per common share:

Income from continuing operations

$ 3.45

Loss on discontinued operations (Note B)

.50

Income before extraordinary item and cumulative

effect of a change in accounting principle

$2.95

Extraordinary item

.75

Cumulative effect on prior years of changing

to a different depreciation method

.46

Net income

$ 4.16

Jones Corporation

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations

$690,000

Net income

$832,000

Earnings per common share:

Income from continuing operations

$ 3.45

Loss on discontinued operations (Note B)

.50

Income before extraordinary item and cumulative

effect of a change in accounting principle

$2.95

Extraordinary item

.75

Cumulative effect on prior years of changing

to a different depreciation method

.46

Net income

$ 4.16

Jones Corporation

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations

$690,000

Net income

$832,000

Earnings per common share:

Income from continuing operations

$ 3.45

Loss on discontinued operations (Note B)

. 50

Income before extraordinary item and cumulative

effect of a change in accounting principle

$2.95

Extraordinary item

.75

Cumulative effect on prior years of changing

to a different depreciation method

.46

Net income

$ 4.16

Jones Corporation

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations

$690,000

Net income

$832,000

Earnings per common share:

Income from continuing operations

$ 3.45

Loss on discontinued operations (Note B)

.50

Income before extraordinary item and cumulative

effect of a change in accounting principle

$2.95

Extraordinary item

.75

Cumulative effect on prior years of changing

to a different depreciation method

.46

Net income

$ 4.16

Jones Corporation

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations

$690,000

Net income

$832,000

Earnings per common share:

Income from continuing operations

$ 3.45

Loss on discontinued operations (Note B)

.50

Income before extraordinary item and cumulative

effect of a change in accounting principle

$2.95

Extraordinary item

.75

Cumulative effect on prior years of changing

to a different depreciation method

.46

Net income

$ 4.16

Comprehensive Income

Companies may report comprehensive

income on the income statement, in a

separate statement, or in the statement of

stockholders’ equity.

Comprehensive Income

However, comprehensive income does

Comprehensive

income

is by

defined

as

not

include changes

caused

issuing

all

changes

in

stockholders’

equity

dividends or from stockholders’

during

a period.

investments.

Stockholders’ Equity Section

Stockholders’ equity:

Common stock

Paid-in capital in excess of par

Retained earnings

Accumulated other

comprehensive income

Total stockholders’ equity

2006

2005

$ 20,000 $ 20,000

36,000

36,000

165,500 157,000

1,290

1,200

$222,790 $214,200

ACCOUNTING FOR

INVESTMENTS IN STOCKS

Trading securities are securities that

management intends to actively trade

for profit.

Available-for-sale securities are securities

that management expects to sell in the

future, but which are not actively

traded for profit.

Short-Term Investments in Stocks

Temporary investments are

recorded in the current

asset account, Marketable

Securities, at their cost.

Short-Term Investments in Stocks

On June 1, Crabtree Company purchased 2,000

shares of Inis Corporation common stock at

$89.75 per share plus a brokerage fee of $500.

June

1 Marketable

$89.75

x 2,000 Securities

shares +

$500

Cash

Purchased 2,000 shares of Inis

Corporation common stock.

180 000 00

180 000 00

Short-Term Investments in Stocks

On October 1, Inis declared a $0.90 per

share dividend payable on November 30.

Nov. 30 Cash 2,000

shares x $0.90

Dividend Revenue

Received dividend on Inis

Corporation common stock.

1 800 00

1 800 00

Short-Term Investments in Stocks

On the balance sheet, temporary

investments are reported at their fair market

value. Any difference between the fair

market value and the cost is an unrealized

holding gain or loss.

Short-Term Investments in Stocks

At year-end, the total cost of Crabtree

Co.’s four temporary investments is

$690,000. The current market for these

four items totaled $750,000 at year-end.

Thus, Crabtree Co. had a before tax

unrealized gain of $60,000.

Short-Term Investments in Stocks

Crabtree Co.

Balance Sheet

December 31, 2006

Current assets:

Cash

Temporary investments in

marketable securities at cost

Plus unrealized gain (net of

applicable income tax of

$18,000)

$119,500

$690,000

42,000 732,000

Stockholders’ Equity

Accumulated other comprehensive income

42,000

Short-Term Investments in Stocks

Crabtree Co.

Statement of Comprehensive Income

For the Year Ended December 31, 2006

Net income

$720,000

Other comprehensive income:

Unrealized gain on temporary investments

in marketable securities (net of

applicable tax of $18,000)

42,000

Comprehensive income

$762,000

Long-Term Investments in Stocks

Long-term investments are

those investments made by a

firm that are not intended as a

source of cash in the normal

operations of the business.

Long-Term Investments in Stocks

Ownership

%

100%

Controlling

Interest

With less than 20% ownership the buyer

Equity

50%

does

not

usually have significant

Method

influence. The buyer uses

the cost method

Significant

to account for theinfluence

investment.

20%

Cost

Method

Not significant

influence

0%

Long-Term Investments in Stocks

Ownership

%

100%

Equity

Method

Ownership over 20%

Controlling

usually

indicates significant

Interest

influence. The buyer uses

50%

the equity method to

Significant

account

for the investment.

influence

20%

Cost

Method

No significant

influence

0%

Long-Term Investments in Stocks

On January 2, Hally Inc. pays cash of $350,000

for 40% of Brock Corporation’s common stock.

Jan. 2 Investment in Brock Corp. Stock

Cash

Purchased 40% of Brock Corp.

common stock.

350 000 00

350 000 00

Long-Term Investments in Stocks

For the year ending December 31, Brock

Corporation reports net income of $105,000.

Dec. 31 Investment in Brock Corp. Stock

Income of Brock Corp.

Recorded share (40%) of Brock

Corp. net income of $105,000.

42 000 00

42 000 00

Long-Term Investments in Stocks

On December 31, Brock Corporation declared a

$45,000 dividend, payable on December 31.

Dec. 31 Cash

18 000 00

Investment in Brock Crop. Stock

Recorded share (40%) of

dividends of $45,000 paid by

Brock Corp.

18 000 00

Long-Term Investments in Stocks

On March 1, an investment in Drey Inc.

stock that had a carrying amount of

$15,700 is sold for $17,500.

Mar. 1 Cash

17 500 00

Investment in Drey Inc. Stock

Gain on Sale of Investments

Sold investment in Drey Inc.

stock.

15 700 00

1 800 00

Business Combinations

Ownership

%

100%

Equity

Method

Controlling

Interest

50%

Significant

The corporation owning all or a majority of the voting

influence

stock is called the parent company. The controlled

20%

corporation is the subsidiary company. Consolidated

Cost

No significant

financial statements are prepared which combines the

Method

influence

operating results

of

the

two

entities.

0%

Business Combinations

A merger combines two corporations by one

acquiring the properties of another that is

then dissolved.

Many businesses combine in order to

produce more efficiently or to diversify

product lines.

A consolidation is the creation of a new

corporation, to which the combined assets

and liabilities of the old corporations are

transferred to the new corporation.

Business Combinations

Mergers

A

Consolidations

A

C

B

B

Mergers: Company A acquires company B. The assets

and liabilities of B are transferred to A and B is then

dissolved.

Consolidations: Company A acquires company B.

The assets and liabilities of both A and B are

transferred to a new company C and A and B are then

dissolved.

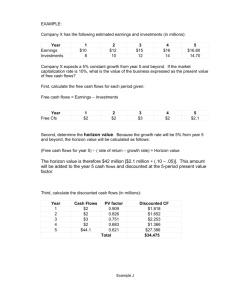

FINANCIAL

ANALYSIS AND

INTERPRETATION

A firm’s growth potential and future

earnings prospects are indicated by how

much the market is willing to pay per

dollar of a company’s earnings.

Accounting: Earnings Per Share

Earnings per

Net Income

= Share of Common

Common Shares

Stock

Investing: Price - Earnings Ratio

Market Price Per Share

Priceof Common Stock

= Earnings

Earnings Per Share of

Ratio

Common Stock

The price-earnings ratio represents how much the market

is willing to pay per dollar of a company’s earnings. This

indicates the market’s assessment of a firm’s growth

potential and future earnings prospects.

An example:

Market price per share

Earnings per share

Price-earnings ratio

2006

$20.50

$1.64

12.5

2005

$13.50

$1.35

10.0

The price-earnings ratio indicates that a share of common

stock was selling for 10 times earnings for 2005 and 12.5

times for 2006.

Chapter 12

The End