Chapter 8:

Translation of

Foreign

Currency

Financial

Statements

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

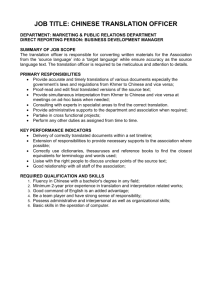

Chapter Topics

Conceptual issues of foreign currency financial

statements translation

Difference between balance sheet exposure and

transaction exposure

Methods of financial statement translation

Temporal and current rate methods illustrated

U.S. GAAP, IFRS, and other standards related to

translation

Hedging of balance sheet exposure

8-2

Learning Objectives

1. Describe the conceptual issues involved in translating

foreign currency financial statements

2. Explain balance sheet exposure and how it differs from

transaction exposure

3. Describe the concepts underlying the current rate and

temporal methods of translation

4. Apply the current rate and temporal methods of

translation and compare the results of the two methods

5. Describe the requirements of applicable International

Financial Reporting Standards (IFRS) and U.S. generally

accepted accounting principles (GAAP)

6. Discuss hedging of balance sheet exposure

8-3

Two conceptual issues

Appropriate exchange rate to be used in translating

each financial statement item

How should the translation adjustment that inherently

arises from the translation process be reflected in the

consolidated financial statements

8-4

Balance Sheet Exposure

Assets and liabilities translated at the current

exchange rate are exposed to risk of a translation

adjustment

When foreign currency appreciates, a net asset

exposure results in a positive translation adjustment

When foreign currency appreciates, a net liability

exposure results in a negative translation adjustment

Assets and liabilities translated at the historical

exchange rate are not exposed to a translation

adjustment

8-5

Translation Methods

Current/Noncurrent Method

Current assets and liabilities are translated at the

current exchange rate

Noncurrent assets and liabilities and stockholders’ equity

accounts are translated at historical exchange rates

There is no theoretical basis for this method

Method is seldom used in any countries and is not

allowed by U.S. GAAP or IFRS

8-6

Translation Methods

Monetary/Nonmonetary Method

Concerns with monetary assets and liabilities

Translated at the current exchange rate

Concerns with nonmonetary assets and liabilities and

stockholders’ equity accounts

Translated at historical exchange rates

The translation adjustment measures the net foreign

exchange gain or loss on current assets and liabilities

as if these items were carried on the parent’s books

8-7

Translation Methods

Temporal Method

Objective is to translate financial statements

As if the subsidiary had been using the parent’s currency

Items carried on subsidiary’s books at historical cost

Including all stockholders’equity items, are translated at

historical exchange rates

Items carried on subsidiary’s books at current value are

translated at current exchange rates

Income statement items are translated at the exchange

rate in effect at the time of the transaction

8-8

Translation Methods

Current Rate Method

Objective is to reflect that the parent’s entire investment

in a foreign subsidiary is exposed to exchange risk

All assets and liabilities are translated at the current

exchange rate

Equity accounts are translated at historical exchange

rates

Revenues and expenses are translated at the exchange

rate in effect at the date of accounting recognition

8-9

Translation of Retained Earnings

Stockholders’ equity items are translated at historical

exchange rates under both the temporal and current

rate methods

This creates somewhat of a problem in translating

retained earnings, which is a composite of many

previous transactions:

Revenues, expenses, gains, losses, and declared dividends

occurring over the life of the company

8-10

Complicating Aspects of the Temporal Method

Keeping track of the historical rates for inventory,

prepaid expenses, fixed assets, and intangible assets

is necessary under temporal method and not under

current rate method

Translating these assets at historical rates makes

application of the temporal method more complicated

than the current rate method

Calculation of Cost of Goods Sold (COGS)

Application of the Lower of Cost or Market Rule

Fixed Assets, Depreciation, Accumulated Depreciation

8-11

DISPOSITION OF TRANSLATION ADJUSTMENT

Translation gain or loss in net income

Translation adjustment is considered to be a gain or loss

analogous to the gains and losses arise from foreign

currency transaction

Should be reported in income in the period in which the

fluctuation in exchange rate occurs

Cumulative translation adjustment in stockholders’

equity

The alternative to reporting the translation adjustment as

a gain or loss in net income is to include it in

stockholders’ equity as a component of other

comprehensive income

This treatment defers the gain or loss in stockholders’

equity until it is realized in some way

8-12

Temporal and Current Rate Methods

Translation methods illustrated

U.S. Inc. owns Juarez, SA, a subsidiary in Mexico

which was established January 1, 2010

Juarez’s balance sheet items as of 12/31/10, in

pesos:

Cash

Accounts rec.

Inventory

Fixed assets

Accum. depr.

1,000

2,000

2,500

8,000

1,000

Accounts payable

Long-term debt

Capital stock

Retained earnings

2,000

6,000

3,000

1,500

8-13

Temporal and Current Rate Methods

Translation methods illustrated

Juarez’s income statement items for 2010, in pesos:

Sales

COGS

S,G,&A exp.

20,000

14,000

2,500

Depr. exp.

Interest exp.

Income tax exp.

1,000

500

500

8-14

Temporal and Current Rate Methods

Translation methods illustrated

There was no beginning inventory

Inventory, which is carried at cost, was acquired evenly

during the last quarter of 2010

Purchases were made evenly throughout year

Fixed assets were acquired on January 1, 2010

Capital stock was sold on January 1, 2010

8-15

Temporal and Current Rate Methods

Translation methods illustrated

Relevant exchange rates (U.S. dollar per Mexican

peso):

January 1, 2010

Average for 2010

Average for 4th quarter 2010

December 31, 2010

$0.10

$0.095

$0.09

$0.08

8-16

Temporal and Current Rate Methods

Current Rate Method – Income Statement

Income Statement – 2010

Sales

COGS

Gross profit

S,G,&A

Depreciation expense

Interest expense

Income tax expense

Net income

1,900

1,330

570

238

95

48

47

142

8-17

Temporal and Current Rate Methods

Current Rate Method – Balance Sheet

Balance Sheet – December 31, 2010

Cash

Accounts Rec.

Inventory

Fixed Assets, net

Total assets

80

160

200

545

985

Accounts payable

160

Long-term debt

480

Capital stock

300

Retained earnings

142

Cumulative translation adj. (97)

Total liab. & S.E.

985

8-18

Temporal and Current Rate Methods

Temporal Method – Income Statement

Income Statement – 2010

Sales

COGS

Gross profit

S,G,&A

Depreciation expense

Interest expense

Income tax expense

Remeasurement gain

Net income

1,900

1,343

557

238

100

48

47

101

225

8-19

Temporal and Current Rate Methods

Temporal Method – Balance Sheet

Balance Sheet – December 31, 2010

Cash

Accounts Rec.

Inventory

Fixed Assets, net

Total assets

80

160

225

700

1,165

Accounts payable

Long-term debt

Capital stock

Retained earnings

Total liab. & S.E.

160

480

300

225

1,165

8-20

Temporal and Current Rate Methods

Translation methods illustrated – Summary

Current Rate Method

All assets and liabilities are translated at current rate

This results in net asset exposure

Net asset exposure and devaluing foreign currency results in

translation loss

Translation adjustment included in equity

Temporal Method

Primarily monetary assets and liabilities are translated at

current rate

This results in net liability exposure

Net liability exposure and devaluing foreign currency result in

translation gain

Translation gain included in current income

8-21

U.S. GAAP

FASB ASC 830, Foreign Currency Matters( formerly

SFAS 52, Foreign Currency Translation) is the relevant

accounting standard

Requires identification of functional currency

Functional currency is the primary currency of the foreign

subsidiary’s operating environment

The standard includes a list of indicators as guidance

for the foreign currency decision

When functional currency is U.S. Dollar, temporal

method is required

When functional currency is foreign currency, current

rate method is required

8-22

U.S. GAAP Requirements

Highly Inflationary Economies – U.S. GAAP

U.S. GAAP defines such economies as those with

cumulative 100% inflation over a period of three years

(with compounding—average of 26% per year for

three years in a row)

Temporal method required—translation gains/losses

reported in income

8-23

IFRS

IAS 21, The Effects of Changes in Foreign Exchange

Rates is the relevant accounting standard

Uses the functional currency approach developed by

the FASB

The standard includes a list, similar to the FASB list, of

indicators as guidance for the foreign currency

decision

The standard’s requirements pertaining to

hyperinflationary economies are substantially

different from U.S. GAAP

8-24

IFRS Requirements

Hyperinflationary Economies – IFRS

IAS 21 and 29 use the term hyperinflationary economies

IAS 21 is not as specific in defining hyperinflationary

economies as is U.S. GAAP, but does suggest that a

cumulative three-year rate approaching or exceeding 100%

is evidence

IAS 21 requires restatement of the foreign financial

statements for inflation per IAS 29

IAS 21 then requires the use of the current exchange rate to

translate the restated financial statements, including all

balance sheet accounts as well as all income statement

accounts

IAS approach is substantially different from U.S. GAAP

8-25

Hedging Balance Sheet Exposure

Companies that have foreign subsidiaries with highly

integrated operations use the temporal method

Temporal method requires translation gains and losses

to be recognized in income

Losses negatively affect earnings, and both gains and

losses increase earnings volatility

These gains and losses result from the combination of

balance sheet exposure and exchange rate fluctuations

Foreign exchange gains and losses on foreign

currency borrowings or foreign currency derivatives

employed to hedge translation based exposure

(under the current rate method)

8-26

Hedging Balance Sheet Exposure

Companies can hedge against gains and losses by

using foreign currency forward contracts, options, and

borrowings

8-27

End of Chapter 8

8-28