2–1 - Cengage Learning

advertisement

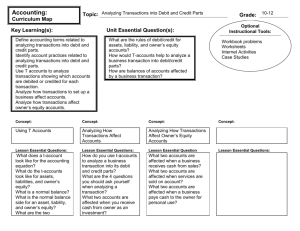

Chapter 2 T Accounts, Debits, and Credits, Trial Balance, and Financial Statements 1 College Accounting 10th Edition McQuaig McQuaig Bille Bille Nobles PowerPoint presented by Douglas Cloud Professor Emeritus of Accounting, Pepperdine University 2–1 © 2011 Cengage Learning LEARNING OBJECTIVES After this chapter, this you chapter, should be able Afterstudying you have completed you willto: be able to do the following: 1 Determine balances of T accounts having entries recorded on both sides of the account. 2 Present the fundamental accounting equation using the T account form, and label the plus and minus sides. 3 Present the fundamental accounting equation using the T account form, and label the debit and credit sides. (continued) 2–2 After you have completed this chapter, you will be able to do the following: 4 Record directly in T accounts a group of business transactions involving changes in asset, liability, owner’s equity, revenue, and expense accounts for a service business. 5 Prepare a trial balance. 6 Prepare (a) an income statement, (b) a statement of owner’s equity, and (c) a balance sheet. 7 Recognize the effect of transpositions and slides on the account balance. 2–3 Learning Objective 1 Determine balances of T accounts having entries recorded on both sides of the accounts. 2–4 The T-Account Form (continued) 2–5 The T-Account Form Normally, the footing on the increase (plus) side of an account will be larger than the footing 2–6 How to Determine Balances of T Accounts Step 1. Add each side separately and record the totals (called footing). Step 2. Subtract the large footing number form the small footing number. Step 3. Record the balance on the large footing side. 2–7 The T Account Form Title The T account has a title (such as Cash). (continued) 2–8 The T Account Form Cash + Assets (Cash, for example) increase on the left side. (continued) 2–9 The T Account Form Cash + – Assets, Cash in this example, decrease on the right side. 2–10 Owner’s Equity 2–11 Expanded Fundamental Accounting Equation Assets = Liabilities + Owner’s Equity Capital ‒ Drawing + Revenue ‒ Expenses Or, expanded out to include them as separate headings— Assets = Liabilities + Capital ‒ Drawing + Revenue ‒ Expenses 2–12 PRACTICE EXERCISE 1 2–13 PRACTICE EXERCISE 1 SOLUTION 2–14 Learning Objective 2 Present the fundamental accounting equation using the T account form, and label the plus and minus sides. 2–15 Restated Fundamental Accounting Equation Assets increase on the __________ left side. Liabilities increase on the __________ right side. Owner’s equity increases on the __________ right side. Revenue increases on the __________ side. right Expenses increase on the __________ side. left 2–16 PRACTICE EXERCISE 2 Using the fundamental accounting equation in T account form, label each side with plus and minus. PRACTICE EXERCISE 2 SOLUTION 2–17 Learning Objective 3 Present the fundamental accounting equation using the T account form, and label the debit and credit sides. 2–18 Debit and Credit What does debit mean? – Forget what you know about debit cards! What does credit mean? – Forget what you know about credit cards! Debit means “left.” Credit means “right.” Debit is abbreviated “DR.” Credit is abbreviated “CR.” 2–19 The T Account with Debits and Credits Title Debit The left side of the account is called the debit side. (continued) 2–20 The T Account with Debits and Credits Title Debit The left side of the account is called the debit side. Credit The right side of the account is called the credit side. 2–21 Fundamental Accounting Equation using Debits and Credits Capital – + Debit Credit Amounts invested (continued) 2–22 Fundamental Accounting Equation using Debits and Credits Drawing + – Debit Credit Amounts withdrawn 2–23 The Capital Account Concept Capital – + Debit Credit Drawing + – Debit Credit 2–24 The critical rule to remember is that the amount placed on the debit side of one or more accounts MUST equal the amount placed on the credit side of another account or accounts. (continued) 2–25 The + or – changes with the type of account. 2–26 PRACTICE EXERCISE 3 Using the fundamental accounting equation in T account form, label each side as debit and credit. PRACTICE EXERCISE 3 SOLUTION 2–27 Learning Objective 4 Record directly in T accounts a group of business transactions involving changes in asset, liability, owner’s equity, revenue, and expense accounts for a service business. 2–28 Steps in Analyzing a Transaction Step 1. Decide which accounts are involved. Step 2. Classify the accounts involved (asset, liability, capital, revenue, expense). Step 3. Decide if the accounts involved are increased or decreased. Step 4. Write the transaction as a debit to one account (or accounts) and a credit to another account (or accounts). Step 5. Check to see if the equation is in balance after the transaction has been recorded. 2–29 Analyzing Transaction (a) Transaction (a): Connor deposited $90,000 in a bank account in the name of the business. Step 1. Decide which accounts are involved. The two accounts involved are Cash and J. Conner, Capital. Step 2. Classify the accounts involved. Cash is an asset and J. Conner, Capital, is an owner’s equity account. (continued) 2–30 Step 3. Decide if the accounts involved are increased or decreased. Cash is being deposited in the bank account, an increase to Cash. The owner has invested that cash in the business and has increased J. Conner, Capital. Step 4. Write the transaction as a debit to one account (or accounts) and a credit to another account (or accounts). Since Cash is an asset and is increased, so Cash is debited. J. Conner, Capital is an owner’s equity account and increased by a credit. (continued) 2–31 Step 5. Check to see if the equation is in balance. There is at least one account debited and at least one account credited, and the total amount(s) debited equal the total amount(s) credited . You now have a debit equal to a credit, $ 90,000 debit to Cash and a $90,000 credit to J. Conner, Capital. 2–32 Resulting Transaction (a) in T Account Form 2–33 Transaction (b): Conner’s Whitewater Adventures bought equipment, paying cash, $38,000. 2–34 Transaction (c): Conner’s Whitewater Adventures bought equipment on account from Signal Products, $4,320. 2–35 Transaction (d): Conner’s Whitewater Adventures paid Signal Products, a creditor, $2,000. 2–36 Transaction (e): Conner invests her personal computer in the business with fair market value of $5,200. 2–37 Summary― Transactions (a) – (e) 2–38 Let’s pause to see if the debits are equal to the credits by listing the balances of the accounts. Equal 2–39 Transaction (f): Conner’s Whitewater Adventures sold rafting tours for cash, $8,000. 2–40 Transaction (g): Conner’s Whitewater Adventures paid rent for the month, $1,250. 2–41 Transaction (h): Conner’s Whitewater Adventures bought computer paper, ink cartridges, invoice pads, pens and pencils, folders, filing cabinets, and 10-key calculators on account, $675. 2–42 Transaction (i): Conner’s Whitewater Adventures bought a three-month liability insurance policy, $1,875. 2–43 Transaction (j): Conner’s Whitewater Adventures received a bill for newspaper advertisement from the Times, $620. 2–44 Transaction (k): Conner’s Whitewater Adventures signs a contract with Crystal River Lodge to provide rafting adventures for guests. Conner’s Whitewater Adventures provides 27 one-day rafting tours and bills Crystal River Lodge for $6,750. 2–45 Transaction (l): Conner’s Whitewater Adventures pays on account to Signal Products, $1,500. 2–46 Transaction (m): Conner’s Whitewater Adventures received and paid Solar Power, Inc. for the electric bill, $225. 2–47 Transaction (n): Conner’s Whitewater Adventures paid on account to the Times, $620. 2–48 Transaction (o): Conner’s Whitewater Adventures paid the wages of a part-time employee, $2,360. 2–49 Transaction (p): Conner’s Whitewater Adventures bought additional equipment from Signal Products, $3,780, paying $1,850 in cash and placing the balance on account. 2–50 Transaction (q): Conner’s Whitewater Adventures received $2,500 cash from Crystal River Lodge to apply against the amount billed in transaction (k). 2–51 Transaction (r): Conner’s Whitewater Adventures sold tours for cash, $8,570. 2–52 Transaction (s): J. Conner withdrew cash for her personal use, $3,500. 2–53 Summary of Transactions (continued) 2–54 Summary of Transactions 2–55 2–56 PRACTICE EXERCISE 4 Record the following transactions directly into the appropriate T accounts. a. J. Molson deposited $90,000 in the name of the business. b. Bought equipment for cash, $38,000. c. Bought equipment on account, $4,320. d. Paid $2,00 on account. e. J. Molson invested his personal equipment, valued at $5,200 in the business. f. J. Molson withdrew $1,200 from the business for personal use. 2–57 PRACTICE EXERCISE 4 SOLUTION 2–58 2–5 Learning Objective 5 Prepare a trial balance. 2–59 Prepare a Trial Balance List the account balances in two columns. – Left column = Debits – Right column = Credits List the accounts in the same order as the chart of accounts. – First the balance sheet accounts – Then the income statement accounts 2–60 2–61 The Trial Balance Is not a financial statement Does not contain dollar signs Uses a single underline under the list of figures to be added Uses a double underline under column totals 2–62 PRACTICE EXERCISE 5 2–63 PRACTICE EXERCISE 5 SOLUTION 2–64 Learning Objective 6a Prepare an income statement. 2–65 The Income Statement The income statement shows total revenue minus total expenses, which yields the net income or net loss. The income statement reports how the business has performed over a period of time, usually a month or a year. When total revenue exceeds total expenses over the period, the result is a net income or profit. 2–66 2–67 Learning Objective 6b Prepare a statement of owner’s equity. 2–68 The Statement of Owner’s Equity The statement of owner’s equity shows how—and why—the owner’s equity or Capital account has changed over a stated period of time. This statement is prepared after the accountant has determined the net income or net loss on the income statement. 2–69 2–70 The Net Income Figure Use the net income figure on the income statement to complete the statement of owner’s equity. 2–71 Learning Objective 6c Prepare a balance sheet. 2–72 The Balance Sheet The balance sheet shows the financial condition of a business’s assets offset by claims against them as of a particular date. The balance sheet summarizes the balances of the asset, liability, and owner’s equity accounts on a given date (usually the end of a month or year). It is a “snapshot” of the financial condition of the business at that particular time. 2–73 2–74 Errors Exposed by the Trial Balance If the debit and credit columns in the trial balance are not equal, then it is evident that there is an error. Possible mistakes include— Making errors in arithmetic. Recording only half an entry. Recording both halves of the entry on the same side. Recording one or more amounts incorrectly. 2–75 Procedure for Locating Errors The best method of locating errors is to do everything in reverse, as follows: Look at the pattern of the balances to see if a normal balance was placed in the wrong column of the trial balance. Re-add the trial balance columns. Check the transferring of the figures from the accounts to the trial balance. Verify the footings and balances of the accounts. 2–76 PRACTICE EXERCISE 6 Use the trial balance in Practice Exercise 5 to prepare (a) an income statement, (b) a statement of owner’s equity, and (c) a balance sheet. Assume Collins Backpack Adventures started business on July 1, 20—. 2–77 PRACTICE EXERCISE 6 SOLUTION (continued) 2–78 (continued) 2–79 2–80 Learning Objective 7 Recognize the effect of transpositions and slides on account balances. 2–81 Transpositions and Slides A transposition means that the digits have been transposed, or switched around when the numbers were copied from one place to another, e.g. writing 619 for 916 (the difference of 297 is evenly divisible by 9). A slide is an error in placing the decimal point; in other words, a slide in the decimal point, e.g., writing 2,700 for 27,000 (the difference of 24,300 is evenly divisible by 9). (continued) 2–82 Transpositions and Slides An error may be a combination of a transposition and a slide, e.g., writing $54 for $450 (the difference of $396 is evenly divisible by 9). 2–83 PRACTICE EXERCISE 7 Identify the following errors as transpositions or slides, and indicate the amount of difference and whether it is divisible by 9. a. The amount of supplies bought totaled $341, but it was written as $431. b. Equipment was purchased for $3,500, but it was written as $35,000. c. An error was made in the trial balance because $35 was written for $530. 2–84 PRACTICE EXERCISE 7 SOLUTION 2–85 THE END 2–86