Tax Revenue Recognition

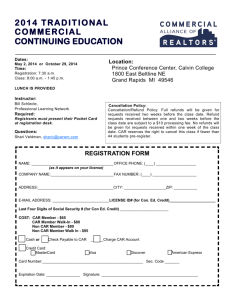

advertisement

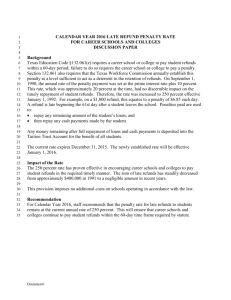

TOPIC: Tax Revenue Recognition OFFICE: Office of State Comptroller QUESTION / ISSUE: STATE: NH DATE: 10/12/2011 Regarding tax revenue recognition in the governmental funds (modified accrual basis), please respond on behalf of your state as to which of the following practices/policies are employed: 1. Accrue/reserve reductions in tax revenue by measuring the impact of refunds, paid through the entire financial statement preparation period, on reporting year revenues. 2. Accrue/reserve reductions in tax revenue by estimating the impact of refunds on reporting year revenues, using another estimation technique. 3. Recognize revenue on a ‘net of revenues paid’ basis through the standard revenue measurement period only (generally 60 days) and make no other provision for revenue impairment. 4. Some other policy for revenue recognition. Please describe any ‘other’ technique or policy, and cite literature you find applicable. *We are not speaking of monthly remittance sales and tobacco taxes, but rather annual taxes imposed on income. When a state collects a tax in quarterly estimates and receives an annual return which results in a final payment/refund to taxpayer. Alabama Estimations Colorado Colorado is closest to number 2 in your list. We accrue tax revenue and refunds for the General Fund based on economic estimates of taxpayer earnings during the reporting year that will be received or paid within our one year availability period. We use a symmetrical concept on the expenditure side. We have a calendar tax year and a June 30 fiscal year. Our accrual policy allows us to report revenues net of refunds for the taxpayer’s tax liability associated with the first six months of the calendar year that are the last six months of our fiscal year. This policy was put in place several years before I came to the state in 1989. I estimate the new proposed PV on recognition and measurement approaches will cost the state of Colorado $300 to $400 million because our tax receivable to be collected in the next year exceeds our tax refunds payable in the next year. Idaho Idaho recognizes income (and other) taxes as revenue when they become susceptible to accrual, that is, when they are both measurable and available. Income (and other) taxes are considered measurable and available and are recognized if they are collected within the current period or soon enough thereafter (within 60 days of the end of the fiscal year, June 30th). For income taxes, an "estimate of refunds" amount is subtracted from the total income taxes due at June 30th to arrive at a Taxes Receivable amount, which is subsequently recorded for CAFR reporting purposes. An Allowance for Uncollectible Taxes Receivable is also recorded resulting in Taxes Receivable, Net. Applicable guidance includes: GASBS 38: paragraph 13, and GASBS 33: paragraphs 7a, 16, 29 and 30a. Indiana For modified accrual, we accrue taxes receivable and taxes payable based on the receipts and refunds recorded in the month of July. Most of the taxes have a due date following month end. Iowa Iowa employs the second practice/policy. We accrue tax revenues and refunds processed on the accounting system through our 60 day accrual period related to the fiscal year. Then, an adjustment is made to accrue additional tax receipts (revenues are deferred in the fund statements and recognized in the government-wide statements) and refunds payable related to the fiscal year. These amounts are projections based on the analysis of tax receipts and tax refunds for the prior three years. Missouri Missouri uses a 60 day revenue recognition policy. New Mexico Attached is information from New Mexico. FY11 Revenue Recognition Rules.doc Ohio I am attaching our Tax policies. I’m not sure that they fall into any of the categories mentioned. Tax Accruals.DOC The document explains all of Ohio’s tax policies so hopefully it will be useful. It is long but it should be searchable for “refunds” and other key words throughout the document. Virginia Virginia is in category 2. The estimation methodology is fairly complicated but our CAFR Deferred Tax footnote basically explains what we do: Q. Deferred Taxes Deferred taxes represent the deferral of income taxes withheld or received for the period January through June 2010. This amount is the estimate to be refunded (overpayments by taxpayers) reduced by the estimate to be received (underpayments from taxpayers) that will be finalized when income tax returns are filed in subsequent years. Individual income tax estimated overpayments total $855,115,266 and estimated underpayments total $290,900,524. This results in deferred taxes of $564,214,742. Corporate income tax estimated overpayments total $62,966,911 and estimated underpayments total $60,282,315. This results in deferred taxes of $2,684,596. Wyoming Wyoming does not have taxes imposed on income.