costing

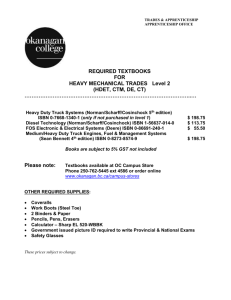

advertisement

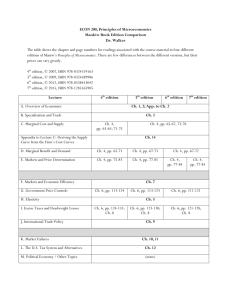

Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Traditional costing techniques developed in capital intensive industries, e.g. steelworks Principal costs: – Raw material – Depreciation charges for physical assets – Labour Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Example: greetings card Direct costs include the following: • Direct materials: card, ink, envelopes etc. • Direct labour: labour to operate printing and cutting machinery, and to package • Direct expense: design cost Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Example: greetings card (continued) Indirect costs include the following: • Indirect production costs (overheads): factory rental, supervision wages • Other indirect costs (overheads) administration costs, sales salaries Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning • • • • Absorption costing Job costing Product costing Batch costing NB: Cost unit Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Cost of raw materials transferred into production • First In, First Out (FIFO) • Last In, First Out (LIFO) • Weighted average cost (AVCO) Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Example: Potts Pilchard Limited Opening stock: 25 units @ £1.50 each in February 20X3: Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Complexities in costing • Employee performs combination of indirect and direct labour tasks • Variation in payment methods – overtime or unsocial hours payments – piece rates – bonuses • Idle or non-productive time Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Allocation of overheads to cost centres where precise information is available Allocation of overheads to cost centres where costs cannot be allocated they must be apportioned e.g. apportionment of factory rent amongst cost centres based on sq.metres occupied Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Common approaches to apportionment Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Apportionment - example Cost centres: – metal machining (6000 sq.metres) – brush fitting (2000 sq.metres) – painting and finishing (2000 sq.metres) Total square metres = 10 000 Factory rental cost = £33 970 to be apportioned on the basis of sq.metres of floor space Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Apportionment - example Metal machining: Brush fitting: Paint and finishing: Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning A method of transferring overhead costs to cost units Example: Production = 5400 machines Production overhead = £142 950 Production overhead attributable to each machine = Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Methods of calculating overhead absorption rates: • • • • • Unit of production Machine hour Labour hour Percentage of direct labour Percentage of direct materials Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Basic principle: cost units should bear the cost of the activities they cause. Costs are ‘driven’ by activities that take place in the business environment, e.g: Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Example: Sallis Weller Limited - indirect production overheads = £113 000 Direct labour hours for the month are 5000 Overhead absorption rate = Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Example: (using traditional overhead absorption) Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Example: (identifying cost drivers) Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Example: Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Example: Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning Example: (comparison of traditional/ABC) Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning FOR: AGAINST: ABC improves quality of information so results in better planning and control of activities ABC is a system of great complexity and is costly to implement Use with Business Accounting and Finance Second Edition by Catherine Gowthorpe ISBN 1-84480-200-0 © 2005 Thomson Learning