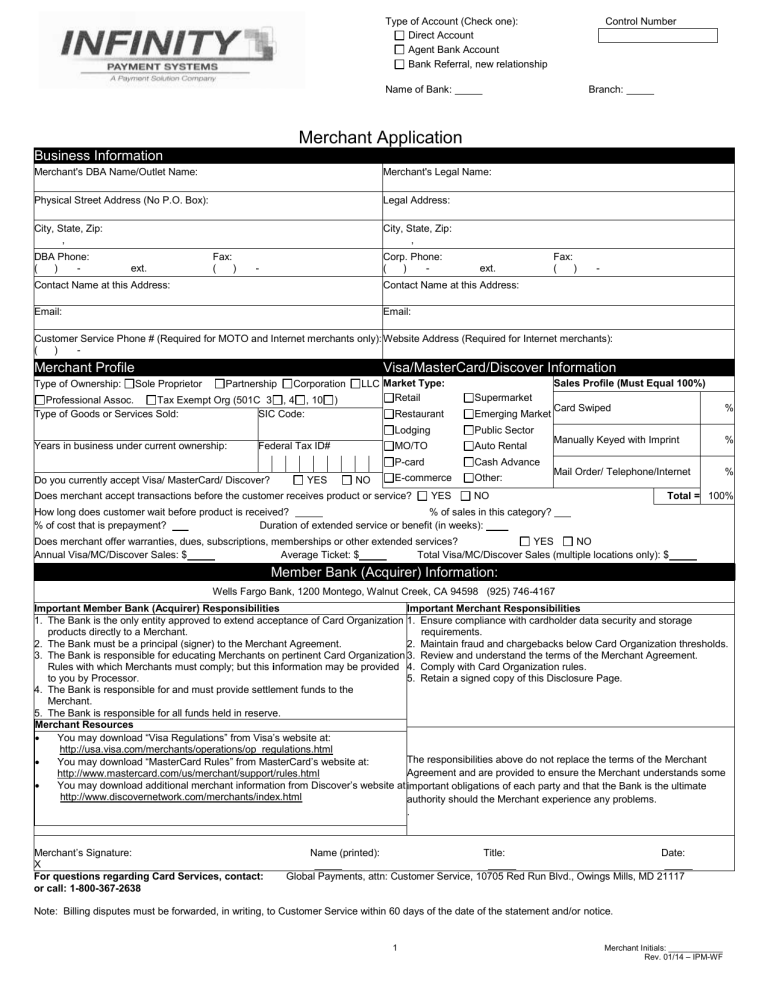

Merchant Account Application & Card Service Terms and Conditions

advertisement