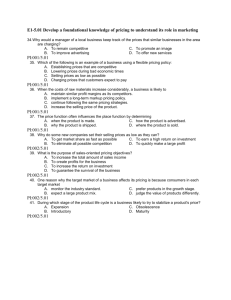

Chapter 10

advertisement

Chapter 10 Pricing Off Premise Events 1 Pricing The “Science” of Pricing – determining the actual costs of goods and labor The “Art” of Pricing – how much mark up can be successfully negociated 2 Market Variables Determine how much can be charged Supply of Caterers in Market Demand for Services Types of caterers Market research is key – Analyze clients and their needs 3 Pricing Many caterers can use pricing as an effective sales tool Good pricing is not a “win – lose” but rather a “win – win” Pricing should take a long term view 4 Pricing for Profit Main goal is to maximize the bottom line while maintaining the pricing “win win” Find the “middle ground” between good profit and reasonable prices As a rule – 50 – 75 % of proposals should be accepted When negotiating, try not to lower a price without reducing something in the event 5 Common Cost Ranges Of Gross Sales Food Cost 20 to 40 % Payroll and Benefits 15 to 30 % All other expenses 10 to 30% Includes “fixed” costs Net profit before Taxes 10 -40 % 6 Prime Cost Prime cost is the sum of the company’s food cost and it’s direct labor costs Should be no more than 60% of Gross Sales 7 How Much will it Cost? Quoting a price without asking qualifying questions is asking for trouble If pressed – quote a broad range based on your previous experience – then proceed to ask for details Prices that change can create suspicion and animosity 8 Costing Develop Cost Basis lines for Food Cost Commissary Labor Costs All costs to deliver, set up, serve and clean up Equipment Costs Other costs (Flowers, décor, music) 9 Computing Food Costs Accurately estimate the actual cost of the food necessary to produce the event Costs are volatile – especially meat and seafood – the so - called “Center of the Plate” Maintain recipe cards – update with current prices Use a spread sheet To price event multiply by number of guests expected (don’t forget planned overages) 10 Labor Costs Labor Costs Commissary Set up and service Tear down and clean up Office overhead – sales commissions Remember to figure in all Benefits and taxes 11 Equipment Costs Equipment costs can be structured differently Owned equipment can be marked up as if it were rental Can use to secure an event Price for profit or discount to underbid competition Rentals and Mark Ups Rental Companies will offer discounts off retail Mark ups cover losses and damage 12 Accessory Services Add mark up if directly serving as an intermediary 10 to 25 % is common Commission for a referral? Ethical or Not? 13 Calculating Markups Two Methods to calculate Divide the food cost by desired cost percentage Cost/% = Selling Price Food Cost Food Cost % $1,590 25% Selling Price Margin $6,360 $4,770 14 Calculating Markup Multiply by Markup Factor Food Cost X Markup Factor = Selling Price Food Cost Markup Factor $1,590 4 Selling Price Margin $6,360 $4,770 15 Pricing Labor Some caterers mark up labor by adding it to the food cost then applying a markup factor Others markup food and at labor at cost or slightly marked up 16 Determining the Markup Market Factors Competitor Prices Previous Prices Charged to clients How many Guests are expected How badly is the business needed Other bidders Client’s perceived value of event Do Clients expect to negotiate Clients expecting a discount 17 Common Pricing Techniques Mark up more for smaller parties Mark up more for lower cost parties Mark up more for fewer guests Special Events, or Holidays Probability of negotiations or discounts Inexpensive parties lead to more inexpensive parties Value of time Looking beyond the price 18 Service Charges, Gratuities, Sales Taxes Each State has laws regarding service charges, gratuities and sales taxes Surveys indicate many caterers do not charge Service Fees and build it into the cost of the event In Florida, gratuities are not taxed if all monies are given to service personnel 19 Charitable Events Keep Records Be Aware of tax implications Do not compromise quality – guests will notice Make sure you have proper sales tax exemption forms 20 Other Pricing Methods Budget Pricing Client sets the price Cost Plus Method Calculate costs and add profit Range Pricing Typically for future events Package Pricing Can add value 21 Next Week Quiz Chapter 10 Project Due 22