Chapter 10

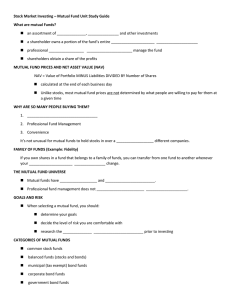

advertisement

Chapter 10 Investment Companies Types of Investment Companies • Open-end – Mutual fund – Price based on NAV • Closed-end – Stock publicly traded • Dual purpose investment company – two classes of shares • REITs and RELPs – Real estate applications (continued) Types of Investment Companies (continued) • Unit investment trusts – Unmanaged – Self-liquidating – Largely consisting of short-term debt securities • Hedge funds – Typically organized as offshore limited partnerships for qualified investors – Maximum investment flexibility • Variable annuities – Mutual fund type of instrument originating at insurance companies Net Asset Value (NAV) • Per-share market value of mutual fund’s portfolio: NAV = (total assets – total liabilities) number of shares outstanding Fair-Value Pricing • Problem created by asynchronous closing of markets • SEC mandated solution • funds should use what they believe is the appropriate price of securities with stale prices, rather than the official close Types of Mutual Funds • • • • • Common stock funds Hybrid funds Bond funds Money market funds Others Common Stock Fund • Mutual fund that holds portfolio primarily consisting of common stocks and perhaps a small number of preferred stocks • Subcategories include investments in: – conservative (defensive) stocks – growth stocks – aggressive growth stocks – foreign stocks Hybrid Fund • Mutual fund that owns portfolio of bonds, stocks, and other investment instruments. • Subcategories include – balanced funds – growth and income funds Bond Fund • Mutual fund that owns portfolio of bonds. Subcategories include funds that invest in: – – – – U.S. government issues Municipal issues Corporate issues Low-quality (junk) bonds • Subcategories can be short-term (up to 5 years), intermediate-term (5 to 10 years), or long-term (10 or more years) bonds Money Market Mutual Fund • Mutual fund that invests in short-term, highly liquid securities—that is, primarily or exclusively money market securities – Taxable – Tax-Exempt Index Fund • Mutual fund that owns a portfolio of either common stock or bonds that replicates a major market index, such as the S&P 500 or Lehman Brothers Aggregate Bond Index • Index funds are low-cost funds that are especially useful in passive investment strategies in which the investor is satisfied to match performance of index. Specialty Fund • Mutual fund designed for investors who seek special investment opportunities. • Examples include: – Sector or industry funds such as gold related stocks – Regional stocks such as sunbelt – Gimmick funds such as race car related stocks International Funds • Mutual fund that specializes in investments outside the U.S. and helps investor to further diversify his or her portfolio • May specialize in – Specific countries – Regions such as Pacific Rim Global Fund • Mutual fund that invests in U.S. and foreign markets • General philosophy: – We live in global economy and capital should flow toward regions that offer optimal riskreturn combinations. Asset Allocation Fund • Mutual fund that allows managers considerable flexibility in allocating portfolio among three major asset categories —stocks, bonds, and money market instruments—as market conditions change Life-cycle Fund • Appeals to investors in specific stages of life • Retirement date funds • Two approaches – Specific securities – Fund of funds Socially Responsible Fund • Mutual fund that invests only in corporations or other entities that maintain social and/or ethical principles consistent with those specified by fund. • Example: – Fund may elect not to invest in any company that produces tobacco products or other products associated with potential health hazards. Forms of Return • Price Appreciation: Increase in NAV • Dividends and Interest: Pass-through of dividends and interest received on portfolio – Regular dividend • Capital Gain Distribution: Payment of net capital gain recognized by fund during year Reinvestment Strategies • Reinvest regular & CG distribution – Makes most sense in a qualified account • Reinvest CG distribution & take regular as cash distribution – Concept of “not touching the principal” • Reinvest regular & take CG as cash – Rarely suggested • Same tax treatment on all Family of Funds • Group of mutual funds owned and marketed by same company • Advantages: – Exchange privilege – Convenience of dealing with one company Load • Selling fee applied to mutual fund purchase, similar to commission • Maximum load charge = 8.5% • Based on gross purchase price – $1,000 purchase means $915 invested if maximum load (continued) Load (continued) • Many funds have breakpoints for load charges • Rights of accumulation • Letter of intent • Back-end load (contingent deferred sales charge) Price of a Load Share PL = where PL = L = NAV/(1 – L) ask price including load load percentage Operating Expenses • Investment advisory fee • 12b-1 fee – trail commission or trailer • Brokerage fees – Measured by portfolio turnover ratio • Other Fees – Examples: exchange fees, account maintenance fees, reinvestment loads Switching • Money moved from one fund to another – Both inter- and intra- familty exchanges • If intra-family & paid load on initial purchase, waived on switch if second fund is also a load fund Classes of Shares • Class A: Usually large front-end load, and minimal or no 12b-1 fee – Best if plan long holding period • Class B: Back-end load and 12b-1 fees, usually convertible to Class A after load waived • Class C: Minimal or no front-end or back-end load, but substantial 12b-1 fee – Best if plan short holding period Distribution Systems • • • • direct marketing captive sales force broker-dealers financial planners Advantages of Mutual Funds • • • • • Professional portfolio management Diversification (risk reduction) Convenience Record keeping Other factors – Examples: liquidity, minimal investment requirements, regulation Disadvantages of Mutual Funds • Management fees, expenses, and loads for load funds reduce their returns. • Large investors, such as mutual funds, sometimes adversely affect the market when they trade. • Institutions usually restrict their analysis to a small percentage of traded stocks (i.e., the larger ones). Prospectus • • • • • the fund’s investment objectives the fund’s investment policies general information about risks tables showing the loads and other expenses additional information Governance • Like any other corporation – Inside director – Outside director • Funds where directors have more money invested do better! Closed-End Companies • Trade in secondary market (exchanges or OTC) – No prospectur • Rarely trades at NAV – Usually at discount, but occasionally at premium • Embedded tax liabilities • Some of holdings may not be marketable • Conversion to open-end form – May produce windfall gains for investors – Sometimes have exit fees for those redeeming immediately after conversion Managed Distribution Policy • A guaranteed cash distribution based on NAV at start of year – Provided even if have to return principal – Provides sense of safety because of guarantee of cash payout each year Dual Purpose Investment Companies • Two classes of shares – Income share (like a preferred stock) – Capital Appreciation share • Termination date of fund – Portfolio liquidated – Income share paid off at par – Residual goes to capital appreciation shares REITs, RELPs, & REMICs • Equity REIT: real estate investment trust that invests in office buildings, apartments, hotels, shopping malls, and other real estate ventures • Mortgage REIT: real estate investment trust that holds construction loans and/or mortgage loans (continued) REITs, RELPs, & REMICs (continued) • Hybrid REIT: real estate investment trust that is combination of equity and mortgage investments • RELP: type of investment organized as limited partnership that invests directly in real estate properties • REMIC: Real estate mortgage investment conduits Unit Investment Trusts (UITs) • Unmanaged, self-liquidating • Most UITs are debt (primarily short-term) but some are equity (may have liquidation date for portfolio) • Some UITs are equity – Liquidation date – Example: Dogs of the Dow portfolios Advantages of UITs • • • • • Convenience Low cost for holding diversified portfolio Stable portfolio Tax efficiency No or minimal management fees Disadvantages of UITs • May not find UIT to match investment goal • Front-end loads can be hefty • Lack of resale market Exchange Traded Funds • Portfolio mimics a specified index • Creation units ETFs: Advantages over Index Funds • • • • • Traded on daily basis like any other stock Can buy on margin Low management fees Extremely tax efficient Likely to track index more closely Index Funds: Advantages over ETFs • Most are no-loads • ETFs trade on bid-ask spread, in addition to commission • Always trade at NAV, ETFs sometimes trade at a slight discount Hedge Funds • Pooled portfolio instrument organized for maximum investment flexibility – Typically invest in derivatives, sell short, use leverage, and invest internationally – Take substantial risks, seeking correspondingly large rewards – Typically organized as limited partnerships and allow only “qualified investors” to participate Variable Annuities • Purchased from insurance company – Account separate from assets of the insurance company – Can be variable during the accumulation period or the payout period – Considered securities under federal law • Assets accumulate on a tax-deferred basis Alternative Ways of Organizing Pooled Portfolios • Operating or holding companies: Some operating or holding companies hold such large portfolios that their performances are more closely related to their security holdings than to their operations. • Partnerships: Some investment companies choose the partnership form, often a limited partnership, because of its greater flexibility and/or tax advantages. • Blind pools: Investors bankroll enterprises whose purposes will later be revealed; these pools are sometimes involved in takeover financing. SMAs and PMAs • Separately managed accounts & privately managed accounts – An SMA is a PMA opened through a broker or financial advisor who uses pooled money to buy individual assets – About 80% of SMAs sold via major brokerage firms – A mutual fund with personalized holdings Selecting a Mutual Fund • First step, identify appropriate category based on client’s objectives & risk tolerance • Third party evaluations • Fees & Expenses • Diversification/concentration • Experience, qualifications, and longevity of the fund’s manager When to Sell a Fund • Style Drift • Significant change in asset allocation • Extended poor performance (esp. if associated with high fees) – Should look at least at 3-year record Why Funds Underperform the Market • Hold a large part of the market & have a fee structure • Other institutional investors have the same advantages • Have some cash holdings due to cash inflows & outflows