College Accounting, by Heintz and Parry

advertisement

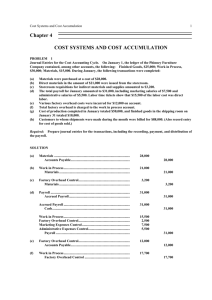

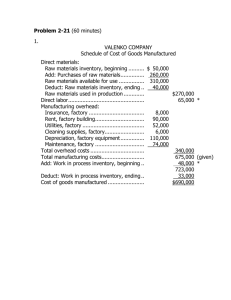

College Accounting, by Heintz and Parry Chapter 27: Manufacturing Accounting: The Job Order Cost System When Eddie entered on Monday, he headed straight for Nick’s office. “How did your meeting with Rick Swagger go this weekend? Did he like your idea of selling videos as well as CD’s?” “Eddie, he said my idea wasn’t bad, but he had an idea that was really intriguing. If we take back the whole building, we could open a recording studio. Rick says we can afford the machine that actually stamps out the recorded CD’s. That means we can offer local bands recording and mixing services and multiple copies of their CD, all for one price. With my connections as a promoter and Rick’s recording expertise, it’s a logical fit for us. In fact, Forever Run could make their next CD here, which would create great publicity.” “Wow, that’s exciting. Of course, it means you’ll be venturing into the exciting world of cost accounting. In a strange way, making the CD would be a manufacturing operation for us.” “Manufacturing? Eddie, we’ll be making art! How will we be like a manufacturer?” “Manufacturers produce a product, and they incur three types of manufacturing costs: 1) Materials: Direct materials are the physical pieces that end up in the finished product. With CD’s, it seems like it’s a lot of plastic, and maybe a thin film of some other material in the middle. Indirect materials are items the company uses that aren’t part of the final product, like the digital master copy of the tape that the studio produces. 2) Labor: Direct labor is the pay for people who make the product, like the mixing engineer and the person who runs the CD stamping machine. Indirect labor would include everyone involved in the process who doesn’t actually participate in assembling the product, like supervisors, janitors in the production area, or product testers. 3) Factory overhead: This category includes all indirect costs needed to support production, including indirect materials, indirect labor, utility expenses, and depreciation and repairs on the equipment.” “Manufacturers also have three types of inventories: 1) Materials Inventory: Direct and indirect materials that the company has purchased but that haven’t yet been used in the production process. These are usually kept in a materials storeroom. 2) Work in Process Inventory: Items that have been started but not completed. These are usually found somewhere along an assembly or production line. 3) Finished Goods Inventory: This category includes all items ready for sale. These are usually found in a warehouse or in a storeroom near the shipping dock or customer pick-up area. “The flow of costs looks like this: Materials Indirect Direct Labor Work in Process Finished Goods Indirect Direct Inventory Inventory Factory Overhead “A manufacturer’s financial statements are pretty much like ours, except that cost of goods sold is calculated in a different way. The calculation would look like this (differences in red).” The CD Side of Town Partial Income Statement For Year Ended Dec. 31, 2001 Cost of Goods Sold: Finished Goods Inventory, Jan. 1, 2001 Cost of Goods Manufactured Goods Available for Sale Finished Goods Inventory, Dec. 31, 2001 Cost of Goods Sold $ 20,000 85,000 $105,000 18,000 $ 87,000 “A separate statement or schedule is used to calculate cost of goods manufactured. The cost of goods manufactured is calculated by totaling manufacturing costs (direct materials, direct labor, and factory overhead) and subtracting any increase (or adding any decrease) in work in process. The statement looks like this.” The CD Side of Town Statement of Cost of Goods Manufactured For Year Ended Dec. 31, 2001 Work in Process, Jan. 1, 2001 Materials inventory, Jan. 1, 2001 Materials purchases Materials available for use Materials inventory, Dec. 31, 2001 Direct labor Overhead Total manufacturing costs Total work in process during the period Work in process, Dec. 31, 2001 Cost of Goods Manufactured $ 9,000 21,000 $30,000 7,000 $23,000 31,000 34,000 $ 14,000 88,000 $102,000 17,000 $ 85,000 “Of course, the entries made are impacted by which type of cost accounting you use: Job order cost accounting keeps separate records of the cost of individual batches or orders prepared to customer specifications. We would use this method, because each band’s order might involve different numbers of studio and mixing hours, and a different quantity of CD’s as well. Process cost accounting accumulates costs by process. For example, a chair company might accumulate costs in the cutting, routing, sanding, assembling, and staining departments. This system is generally used when the product is standardized and produced in high volumes, like toothpaste, televisions, or notebooks. The entries in cost accounting follow the flow of costs through the inventory accounts. For example, the first entry would be to purchase the materials the company uses. If they’re purchased on account, the entry is pretty simple: #1 Materials Work in Process Indirect Direct Finished Goods Inventory Inventory Factory Overhead Date Description 2001 Sept.10 Materials Accounts Payable P. R. Debit 370.00 Credit 370.00 A document called a materials requisition is used to report the transfer of materials from the materials storeroom to the production floor. When the transfer involves direct materials, the requisition is the source document for this entry: #1 Materials Indirect Direct #2 Work in Process Finished Goods Inventory Inventory Factory Overhead Date Description 2001 Sept.15 Work in Process (Job 45) Materials P. R. Debit 127.00 Credit 127.00 When the materials storeroom issues indirect materials instead, the materials requisition is the source document for this entry: #1 Materials Indirect Direct #3 #2 Work in Process Finished Goods Inventory Inventory Factory Overhead Date Description 2001 Sept.17 Factory Overhead Materials P. R. Debit 76.00 Credit 76.00 Time sheets or time tickets are the source document that is used to allocate direct labor to the jobs worked on. The entry looks like this: #1 Materials Indirect Direct Labor Indirect Direct #3 #2 Work in Process Finished Goods Inventory Inventory #4 Factory Overhead Date Description 2001 Sept.20 Work in Process (Job 45) Wages Payable P. R. Debit 215.00 Credit 215.00 Time sheets or time tickets are also used to summarize indirect labor and place it in the factory overhead account like this: #1 Materials Indirect Direct Labor Indirect Direct #5 #3 Factory Overhead #2 Work in Process Finished Goods Inventory Inventory #4 Date Description 2001 Sept.20 Factory Overhead Wages Payable P. R. Debit 86.00 Credit 86.00 Factory overhead also occurs when bills for utilities, rent, property taxes, and various other costs are received: #1 Materials Indirect Direct Labor #6 Indirect Direct #5 #3 Factory Overhead #2 Work in Process Finished Goods Inventory Inventory #4 Date Description 2001 Sept.20 Factory Overhead Accounts Payable P. R. Debit 118.00 Credit 118.00 “To apply factory overhead to production, a predetermined overhead rate is developed so that a reasonable amount of overhead is applied to each job. The rate is set at the start of the fiscal year based on estimates of annual factory overhead and production activity. Production activity can be measured in many ways. Three of the most common measures are direct labor hours, direct labor costs, and machine hours (the last one is appropriate if the production process is highly automated). For example, if factory overhead is expected to be $20,000 and direct labor costs are expected to be $50,000, the rate would be estimated factory overhead 20,000 estimated direct labor costs = 50,000 = 40% of dir. labor $ Question: If direct labor for Job 45 was $215, how much factory overhead would be applied to that job? Answer: Factory overhead applied to that job would be $215 direct labor X 40% rate = $86.00 The entry would look like this: #1 Materials Indirect Direct Labor #6 Indirect Direct #5 #3 Factory Overhead #2 Work in Process Finished Goods Inventory Inventory #4 #7 Date Description 2001 Sept.22 Work in Process (Job 45) Factory Overhead P. R. Debit 86.00 Credit 86.00 A job cost sheet is prepared for Job 45 accumulating the direct materials ($127), direct labor ($215), and factory overhead ($86) costs of the job. When the job is completed, the job cost sheet is the source document for the entry to transfer the job to finished goods: #1 Materials Indirect Direct Labor #6 Indirect Direct #5 #3 Factory Overhead #2 Work in Process #8 Finished Goods Inventory Inventory #4 #7 Date Description PR Debit 2001 Sept.29 Finished Goods (Job 45)($127 + 215 + 86) 428.00 Work in Process (Job 45) Credit 428.00 When the job is sold (or shipped), two entries are needed: one for the sale, and one to remove the finished goods from inventory and expense it as cost of goods sold. The entry for Job 45 is: #1 Materials Indirect Direct Labor #6 Indirect Direct #5 #3 Factory Overhead #2 Work in Process #8 Finished Goods Inventory #4 #7 Date Description 2001 Oct. 5 Cash (or Accounts Rec.-Joe Shmoe) Sales Cost of Goods Sold Finished Goods (Job 45) Inventory #9 Cost of Goods Sold PR Debit 600.00 428.00 Credit 600.00 428.00 At the end of the year, factory overhead is likely to have a balance. This is due to the fact that we have been debiting it for actual costs, and crediting it at a rate based on estimates of factory overhead costs and production activity. If the balance is a debit, factory overhead has been underapplied: Factory Overhead Actual Applied 19,900 19,090 Bal. 810 Although some of this balance theoretically belongs in Work in Process and Finished Goods, it is easiest and reasonably accurate to close the balance to Cost of Goods Sold: Date Description 2001 Dec. 31 Cost of Goods Sold Factory Overhead P. R. Debit 810.00 Credit 810.00 Of course, factory overhead is equally likely to have a credit balance. When this is true, factory overhead has been overapplied: Factory Overhead Actual Applied 19,900 20,873 Bal. 973 Although the accounts would be reversed and we would be reducing our expenses, we would still close the balance to Cost of Goods Sold: Date Description 2001 Dec. 31 Factory Overhead Cost of Goods Sold P. R. Debit 973.00 Credit 973.00 “I’ll have to recommend a grade of ‘A’ to your cost accounting professor, Eddie. That will be your first one since you showed you could ’play well with others’ in kindergarten, right? Actually, I did want to ask how process cost accounting is different.” “Good question, Mister ‘C- for Humor.’ The biggest difference is that each processing department has it’s own work in process account. Department 2’s work in process account might get debits and credits like this (assuming no beginning or ending inventories in Department 2): Work in Process (WIP) - Dept. 2 WIP from Dept. 1 1,200 WIP sent on to Dept. 3 2,900 Dept. 2 Materials added 600 Dept. 2 Labor incurred 700 Dept. 2 Fact. Overhead 400 Total debits 2,900 Each department would also have its own: 1) overhead application rate, and 2) cost per unit calculations for materials, labor, and overhead. “By the way, Nick, let’s see what kind of a grade you get on my review quiz: Questions: 1) What are the the two types of cost accounting systems? 2) What are the three types of manufacturing costs? 3) What are the three types of inventory for a manufacturer, and in what order do costs flow these three inventory accounts? 4) What are the accounts debited and credited when factory overhead is applied to jobs? Answers: 1) The the two types of cost accounting systems are job order cost accounting and process cost accounting. 2) The three types of manufacturing costs are direct materials, direct labor, and factory overhead. 3) The three types of inventory for a manufacturer (in the order that the costs flow) are materials inventory, work in process inventory, and finished goods inventory. 4) The accounts debited and credited when factory overhead is applied to jobs are work in process (debit) and factory overhead (credit).