11.1 International Movement of Labor

advertisement

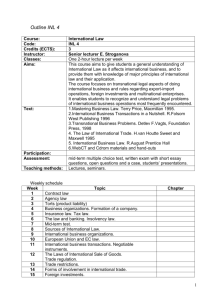

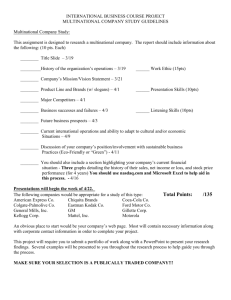

International Economics Chapter 11 International Factor Movements and Multinational Enterprises Chapter 11 International Factor Movements and Multinational Enterprises 11.1 International Movement of Labor 11.2 International Movement of Capital 11.3 Multinational Enterprises and Foreign Direct Investment Theories 11.1 International Movement of Labor Motives for International Labor Movement Most international labor migration, particularly since the end of World War II, has been motivated by the prospect of earning higher real wages and income abroad. The decision to migrate for economic reasons can be analyzed in the same manner and with the same tools as any other investment decision. The costs include the expenditures for transportation and the loss of wages during time spent relocating and searching for a job in the new nation. The economic benefits of international migration can be measured by the higher real wages and income. 11.1 International Movement of Labor Economic Effects of Labor Movement Assuming that Country A is labor-abundant, that Country B is capital-abundant, and that trade between the two follows the Heckscher-Ohlin pattern. the movement of labor from Country A to Country B is indicated by the outward shift of the Production Possibilities Frontier (PPF) for Country B and the inward shift of the PPF for Country A. Assume that Country A is labor-abundant and exports the labor-intensive good X and imports the capitalintensive good Y prior to the labor migration and that the two countries are small ones. 11.1 International Movement of Labor This change in relative labor supplies will lead Country A to contract production of X from t0 to t1 and expand production of Y from a0 to a1. Country B, on the other hand, will expand production of X from T0 to T1 with the newly acquired labor and reduce the production of Y from A0 to A1. Workers will move from the home country to the foreign country. This movement will reduce the home labor force and thus raise the real wage in the home country, while increasing the labor force and reducing the real wage in the foreign country. 11.1 International Movement of Labor Y (PX /PY ) Y (PX /PY ) A0 A1 a1 a0 O t1 Country A t0 X O T0 T1 Country B The Relation Between Labor Movement and International Trade X 11.1 International Movement of Labor The causes and effects of international labor mobility Given this allocation, the real wage rate would be lower in Country A than in Country B. If workers can move freely to whichever country offers the higher real wage, they will move from Country A to Country B until the real wage rates are equalized. The eventual distribution of the world’s labor force will be one with OAL2 workers in Country A, L2OB workers in Country B. As these adjustments occur, output falls in Country A and rises in Country B. 11.1 International Movement of Labor With the fall in the wage rate in Country B, labor is less well-off since its wage rate has fallen. Productivity of the other factors has risen with the increased use of labor, so owners of these factors are better off. The other factors in Country B gain Area ABFG, while Country B’s labor loses Area DBFG. The amount of income earned by the new migrants is L1L2AD. Finally, the world as a whole gains from this migration since the fall in total output in Country A (Area ACL1L2) is more than offset by the increase in output in Country B (Area ABL1L2) by the shaded area ABC. 11.1 International Movement of Labor WB, MPLB wA, MPLA MPLB MPLA B A D F G C OA L2 L1 OB The Economic Effect of International Labor Movement 11.1 International Movement of Labor Three points should be noted about this redistribution of the world’s labor force. It leads to a convergence of real wage rates. Real wages rise in Country A and fall in Country B. Country B’s output rises by the area under its marginal product curve from L1 to L2, while Country A’s output falls by the corresponding area under its marginal product curve. Those who would originally have worked in Country A receive higher real wages, but those who would originally have worked in Country B receive lower real wages. 11.1 International Movement of Labor Other Welfare Effects of International Labor Movement The new immigrant might transfer some income back to the home country. The nature of the immigration. The movement of skilled labor between developing and industrialized countries. The countries of origin of skilled migrants charge that they incur a great cost in educating and training these workers. The brain drain is often encouraged by developed countries. Chapter 11 International Factor Movements and Multinational Enterprises 11.1 International Movement of Labor 11.2 International Movement of Capital 11.3 Multinational Enterprises and Foreign Direct Investment Theories 11.2 International Movement of Capital U.S. Foreign Long-Term Private International Investment Position in Selected Years, 1950-2001 (billions of U.S. dollars) Year 1950 1960 1970 1980 1990 2000 2001 4.3 9.5 20.9 62.4 342.3 2,389.4 2,110.5 11.8 31.9 75.5 214.5 421.5 1,239.4 1,381.7 369.2 616.7 1,515.3 1,623.1 731.8 2,674.2 2,289.9 U.S. assets abroad Foreign securities Direct investments at Historical cost Current cost Market value Foreign assets in the U.S. U.S. assets 2.9 9.3 34.8 74.1 460.6 2,623.6 2,856.7 3.4 6.9 13.3 83.0 403.7 1,214.3 1,321.1 125.9 505.3 1,374.8 1,498.9 539.6 2,766.0 2,526.7 Direct investments at Historical cost Current cost Market value 11.2 International Movement of Capital Both the stock of U.S. direct investments abroad and foreign direct investments in the United States also increased very rapidly from 1950 to 2001 and were similar in amount at the end of 2001 when measured at market value. 11.2 International Movement of Capital U.S. Direct Investments Abroad by Area in Selected Years, 1950-2001 (billions of U.S. dollars, at historical cost, at year end) Year Total Canada Europe Latin America Asia and Pacific of which Japan Others 1950 11.8 3.6 1.7 4.6 0.3 0.0 1.6 1960 31.9 11.2 7.0 8.4 1.2 0.3 4.1 1970 78.2 22.8 24.5 14.8 8.3 1.5 7.8 1980 215.6 45.0 96.5 38.9 25.3 6.2 9.9 1990 421.5 68.4 204.2 72.5 63.6 21.0 12.8 2000 1,293.4 128.8 679.5 251.9 205.3 59.4 27.9 2001 1,381.7 139.0 725.8 269.6 216.5 64.1 30.8 11.2 International Movement of Capital From 1950 to 2001, the stock of U.S. direct investments in Europe grew much more rapidly than the stock of U.S. direct investments in Canada and Latin America. This was due to the rapid growth of the European Union and the United States’ desire to avoid the common external tariff imposed by the EU on imports from outside the EU. 11.2 International Movement of Capital Motives for International Capital Movement Firms will invest abroad in response to large and rapidly growing markets for their products. Tariffs and nontariff barriers in the host nation also can induce an inflow of foreign direct investment (FDI). It has also suggested that firms may want to invest abroad as a means of risk diversification. 11.2 International Movement of Capital Economic Effects of Capital Movement OAA belongs to Country A and OBA belongs to Country B. The MPKA and MPKB curves give the value of the marginal product of capital in Country A and Country B, respectively. Assume in the initial situation that Country A invests its entire capital stock OAA domestically at a yield of OAC. The total product is thus OAFGA, of which OACGA goes to owners of capital in Country A and the remainder of CFG goes to other cooperating factors, such as labor and land. Country B in isolation invests its entire stock OBA domestically at a yield of OBH. Total product is OBJMA, of which OBHMA goes to owners of capital in Country B and the remainder of HJM goes to other cooperating factors. 11.2 International Movement of Capital F MPKB MPKA M H E R N T G C OA J B A OB The Economic Effect of International Capital Movement 11.2 International Movement of Capital Since the returns on capital are higher in Country B (OBH) than in Country A (OAC), AB of capital flows from Country A to Country B so as to equalize at BE (=OAN=OBT) the rate of return on capital in the two countries. Total domestic product in Country A is now OAFEB, to which must be added ABER as the total return on foreign investments, giving a total national income of OAFERA (with ERG greater than before foreign investments). With free international capital flows, the total return on capital in Country A increases to OANRA, while the total return on other cooperating factors decreases to NFE. 11.2 International Movement of Capital The inflow of AB of foreign capital into Country B lowers the rate of return on capital from OBH to OBT. Total domestic product in Country B grows from OBJMA to OBJEB. Of the increase in total product of ABEM, ABER goes to foreign investors, so that ERM remains as the net gain in total product accruing to Country B. The total return to domestic owners of capital falls from OBHMA to OBTRA, while the total return to other cooperating factors rises from HJM to TJE. Total product increased from OAFGA+OBJMA to OAFEB+OBJEB, or by ERG+ERM=EGM. Thus, international capital flows increase the efficiency in the allocation of resources internationally and increase the world output and welfare. 11.2 International Movement of Capital Other effect on international capital movement The total and average return on capital increases, whereas the total and average return to labor decreases in the investing country. International capital transfers also affect the balance of payments of investing and host countries. Foreign investments, by affecting output and the volume of trade of both investing and host countries, are also likely to affect the terms of trade. Chapter 11 International Factor Movements and Multinational Enterprises 11.1 International Movement of Labor 11.2 International Movement of Capital 11.3 Multinational Enterprises and Foreign Direct Investment Theories 11.3 Multinational Enterprises and Foreign Direct Investment Theories Multinational Enterprises One of the most significant international economic developments of the postwar period is the proliferation of multinational enterprises (MNEs). These are firms that own, control, or manage production facilities in several countries. Operating in many host countries, MNEs often conduct research and development (R&D) activities in addition to manufacturing, mining, extraction, and business-service operations. MNE cuts across national borders and is often directed from a company planning center that is distant from the host country. Both stock ownership and company management are typically multinational in character. 11.3 Multinational Enterprises and Foreign Direct Investment Theories MNEs may diversify their operations along vertical, horizontal, and conglomerate lines within the host and home countries. Vertical integration often occurs when the parent MNE decides to establish foreign subsidiaries to produce intermediate goods or inputs that go into the production of the finished good. Horizontal integration occurs when a parent company producing a commodity in the home country sets up a subsidiary to produce the identical product in the host country. Besides making horizontal and vertical foreign investments, MNEs may diversify into unrelated markets, in what is known as conglomerate integration. 11.3 Multinational Enterprises and Foreign Direct Investment Theories The reasons for the existence of MNEs The basic reason for the existence of MNEs is the competitive advantage of a global network of production and distribution. This competitive advantage arises in part from vertical and horizontal integration with foreign affiliates. The competitive advantage of MNEs is also based on economies of scale in production, financing, research and development (R&D), and the gathering of market information. MNEs and their affiliates usually have greater access, at better terms, to international capital markets than do purely national firms, and this puts MNEs in a better position to finance large projects. 11.3 Multinational Enterprises and Foreign Direct Investment Theories Some of the problems they create for the home and host countries. The most controversial of the alleged harmful effects of MNEs on the home country is the loss of domestic jobs resulting from foreign direct investments. Another possible harmful effect of MNEs on the home country can result from transfer pricing and similar practices. Host countries have even more serious complaints against MNEs because of their domination of economies. 11.3 Multinational Enterprises and Foreign Direct Investment Theories Foreign Direct Investment Theories FDI is real investments in factories, capital goods, land, and inventories where both capital and management are involved and the investor retains control over use of the invested capital. Any purchase of 10 percent or more of the stock of a firm, however, is defined as direct investment by the U.S. government. In the international context, FDI is usually undertaken by multinational enterprise engaged in manufacturing, resource extraction, or services. 11.3 Multinational Enterprises and Foreign Direct Investment Theories FDI Flows to the U.S. in Selected Years, 1980-2001 (billions of U.S. dollars) Year FDI Year FDI 1980 12.2 1991 25.5 1981 23.2 1992 15.3 1982 10.8 1993 26.2 1983 8.1 1994 45.6 1984 15.2 1995 57.2 1985 23.1 1996 79.9 1986 39.2 1997 69.7 1987 40.3 1998 215.3 1988 72.7 1999 275.0 1989 71.2 2000 335.6 1990 65.9 2001 132.9 11.3 Multinational Enterprises and Foreign Direct Investment Theories FDI typically occurs when: The parent company obtains sufficient common stock in a foreign company to assume voting control. The parent company acquires or constructs new plants and equipment overseas. The parent company shifts funds abroad to finance an expansion of its foreign subsidiary. Earnings of the parent company’s foreign subsidiary are reinvested in plant expansion. 11.3 Multinational Enterprises and Foreign Direct Investment Theories Potential Benefits Increased of Foreign Direct Investment output Increased wages Increased employment Increased exports Increased tax revenues Realization of scale economies Provision of technical and managerial skills and of new technology Weakening of power of domestic monopoly 11.3 Multinational Enterprises and Foreign Direct Investment Theories Potential Disadvantages Adverse of Foreign Direct Investment impact on the host country's commodity terms of trade Decreased domestic savings Decreased domestic investment Instability in the balance of payments and the exchange rate Loss of control over domestic policy Increased unemployment Establishment of local monopoly Inadequate attention to the development of local education and skills