Correlations of Private Commercial Bank

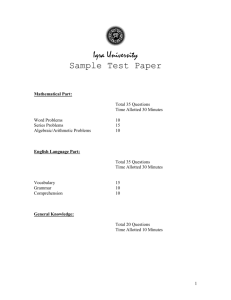

Objectives

This report is a material of the project work. So there are some objectives of making the report

To understand the context of customer satisfaction in banking sector.

To identify how to the customer satisfaction impact on banking service.

To identify the factors influences the customer satisfaction.

Comparison customer satisfaction of Private Bank and Nationalized Commercial Banks

(NCBs).

Current scenario of customer satisfaction in Banking sector.

Scope of the Report

The project paper is comprehensive study of the customer satisfaction of Nationalized

Commercial Banks (NCBs) and private commercial Bank. Every service business needs to productively define and measure customer satisfaction. Waiting for customers to complain in order to identify problems in the service delivery system of gauging the firm’s progress in customer satisfaction based on the number of complaints received is naive. For this reason this project works significant impact on Banking Sector. That’s why customer satisfaction is on of the important factor to continue for banking activities. I think after this all kind of Bank will provide better services for their customer satisfaction.

Methodology

NATURE OF THE RESEARCH

The nature of the study is exploratory. It is designed as a descriptive research study.

1

SOURCE OF DATA

Data were collected from the field research as well as desk research. Data are classified into two categories. Data collected from field survey, which is termed as primary data and data collected from desk research, which is termed as secondary data.

PRIMARY DATA

Primary data are collected with the help of a structured questionnaire from a number of sources. In some cases interview of respective personnel and telephone contact was made. My observation was another way for the primary data.

The sources are given below:

For Private Commercial Bank:

Executive Officers.

Managing Director.

Architecture.

Graduate students.

For Nationalized Commercial Banks (NCBs):

Government officers.

Government Teachers.

Government service holder.

Other professionals.

SECONDARY DATA

Secondary data were collected from the following sources.

Internet

Reports

2

Articles

Magazines

Annual Reports

Study Instrument

Structured questionnaires were provided to collect information from the respondents, because questionnaires method is more flexible and acceptable than the other methods. It is also consume less time. Both open-ended and close ended questions were used to design the questionnaires.

The questionnaires were used to conduct the research.

Same Questionnaires for All.

Limitations

The main limitations of this report are:

Only Customers of Dhaka City was interviewed. The view of Customer outside Dhaka is not reflected in the report.

Lack of data about in Bangladesh management.

Lack of understanding the questionnaires by the recipients .

3

4

Contents

PAGE NO

1. History of Banking --------------------------------------------------------- 10

2. History of Banking System in Bangladesh ------------------------------ 10-12

3. Number and Types of Banks ---------------------------------------------- 13-15

4. Customer satisfaction ------------------------------------------------------ 16-18

5. Measuring Customer Satisfaction ---------------------------------------- 19

6. Why customer satisfaction is important? -------------------------------- 19

7. Factors that Affect Customer Satisfaction ------------------------------- 20

8. Customer satisfaction research -------------------------------------------- 21

9. Indicators of customer satisfaction --------------------------------------- 21-22

10. Major Considerations in Improving Satisfaction ---------------------- 22

11. Measuring Customer Satisfaction in a Bank --------------------------- 22

12. The Service bank offer to public ----------------------------------------- 23

13. The Service Private Commercial bank offer to public ----------------24-30

14. Service quality of Private Commercial Bank ---------------------------31-32

15. The Services (NCBs) offer to public ------------------------------------33-35

16. Problems of (NCBs) in Bangladesh ------------------------------------- 35

5

17. Results and Analysis from Questionnaire Survey ---------------------36-64

18.

Recommendation ---------------------------------------------------------- 65

1. History of Banking

The Jews in Jerusalem introduced a kind of banking in the form of money lending before the birth of Christ. The word 'bank' was probably derived from the word 'bench' as during ancient time Jews used to do money -lending business sitting on long benches.First modern banking was introduced in 1668 in Stockholm as 'Svingss Pis Bank' which opened up a new era of banking activities throughout the European Mainland. In the South Asian region, early banking system was introduced by the Afgan traders popularly known as Kabuliwallas. Muslim businessmen from Kabul, Afganistan came to India and started money lending business in exchange of interest sometime in 1312 A.D. They were known as ‘kabuliwallas’.

2. History of Banking System in Bangladesh

The banking system at independence consisted of two branch offices of the former State Bank of Pakistan and seventeen large commercial banks, two of which were controlled by Bangladeshi

6

interests and three by foreigners other than West Pakistanis. There were fourteen smaller commercial banks. Virtually all banking services were concentrated in urban areas. The newly independent government immediately designated the Dhaka branch of the State Bank of

Pakistan as the central bank and renamed it the Bangladesh Bank. The bank was responsible for regulating currency, controlling credit and monetary policy, and administering exchange control and the official foreign exchange reserves. The Bangladesh government initially nationalized the entire domestic banking system and proceeded to reorganize and rename the various banks.

Foreign-owned banks were permitted to continue doing business in Bangladesh. The insurance business was also nationalized and became a source of potential investment funds. Cooperative credit systems and postal savings offices handled service to small individual and rural accounts.

The new banking system succeeded in establishing reasonably efficient procedures for managing credit and foreign exchange. The primary function of the credit system throughout the 1970s was to finance trade and the public sector, which together absorbed 75 percent of total advances. The government's encouragement during the late 1970s and early 1980s of agricultural development and private industry brought changes in lending strategies. Managed by the Bangladesh Krishi Bank, a specialized agricultural banking institution, lending to farmers and fishermen dramatically expanded. The number of rural bank branches doubled between

1977 and 1985, to more than 3,330. Denationalization and private industrial growth led the

Bangladesh Bank and the World Bank to focus their lending on the emerging private manufacturing sector. Scheduled bank advances to private agriculture, as a percentage of sectoral GDP, rose from 2 percent in FY 1979 to 11 percent in FY 1987, while advances to private manufacturing rose from 13 percent to 53 percent. The transformation of finance priorities has brought with it problems in administration. No sound project-appraisal system was in place to identify viable borrowers and projects. Lending institutions did not have adequate autonomy to choose borrowers and projects and were often instructed by the political authorities. In addition, the incentive system for the banks stressed disbursements rather than recoveries, and the accounting and debt collection systems were inadequate to deal with the problems of loan recovery. It became more common for borrowers to default on loans than to repay them; the lending system was simply disbursing grant assistance to private individuals who qualified for loans more for political than for economic reasons. The rate of recovery on agricultural loans was only 27 percent in FY 1986, and the rate on industrial loans was even worse. As a result of this poor showing, major donors applied pressure to induce the government and banks to take

7

firmer action to strengthen internal bank management and credit discipline. As a consequence, recovery rates began to improve in 1987. The National Commission on Money, Credit, and

Banking recommended broad structural changes in Bangladesh's system of financial intermediation early in 1987, many of which were built into a three-year compensatory financing facility signed by Bangladesh with the IMF in February 1987. One major exception to the management problems of Bangladeshi banks was the Grameen Bank, begun as a government project in 1976 and established in 1983 as an independent bank. In the late 1980s, the bank continued to provide financial resources to the poor on reasonable terms and to generate productive self-employment without external assistance. Its customers were landless persons who took small loans for all types of economic activities, including housing. About 70 percent of the borrowers were women, who were otherwise not much represented in institutional finance. Collective rural enterprises also could borrow from the Grameen Bank for investments in tube wells, rice and oil mills, and power looms and for leasing land for joint cultivation. The average loan by the Grameen Bank in the mid-1980s was around Tk2, 000

(US$65), and the maximum was just Tk18, 000 (for construction of a tin-roof house). Repayment terms were 4 percent for rural housing and 8.5 percent for normal lending operations. The

Grameen Bank extended collateral-free loans to 200,000 landless people in its first 10 years.

Most of its customers had never dealt with formal lending institutions before. The most remarkable accomplishment was the phenomenal recovery rate; amid the prevailing pattern of bad debts throughout the Bangladeshi banking system, only 4 percent of Grameen Bank loans were overdue. The bank had from the outset applied a specialized system of intensive credit supervision that set it apart from others. Its success, though still on a rather small scale, provided hope that it could continue to grow and that it could be replicated or adapted to other development-related priorities. The Grameen Bank was expanding rapidly, planning to have 500 branches throughout the country by the late 1980s. Beginning in late 1985, the government pursued a tight monetary policy aimed at limiting the growth of domestic private credit and government borrowing from the banking system. The policy was largely successful in reducing the growth of the money supply and total domestic credit. Net credit to the government actually declined in FY 1986. The problem of credit recovery remained a threat to monetary stability, responsible for serious resource misallocation and harsh inequities. Although the government had begun effective measures to improve financial discipline, the draconian contraction of credit availability contained the risk of inadvertently discouraging new economic

8

activity. Foreign exchange reserves at the end of FY 1986 were US$476 million, equivalent to slightly more than 2 months worth of imports. This represented a 20-percent increase of reserves over the previous year, largely the result of higher remittances by Bangladeshi workers abroad. The country also reduced imports by about 10 percent to US$2.4 billion. Because of

Bangladesh's status as a least developed country receiving concession loans, private creditors accounted for only about 6 percent of outstanding public debt. The external public debt was

US$6.4 billion, and annual debt service payments were US$467 million at the end of FY 1986.

3. Number and Types of Bank

The number of banks in all now stands at 49 in Bangladesh. Out of the 49 banks, four are

Nationalized Commercial Banks (NCBs), 28 local private commercial banks, 12 foreign banks and the rest five are Development Financial Institutions (DFIs).

Sonali Bank is the largest among the NCBs while Pubali is leading in the private ones. Among the

12 foreign banks, Standard Chartered has become the largest in the country. Besides the scheduled banks, Samabai (Cooperative) Bank, Ansar-VDP Bank, Karmasansthan (Employment)

Bank and Grameen bank are functioning in the financial sector.The number of total branches of all scheduled banks is 6,038 as of June 2000. Of the branches, 39.95 per cent (2,412) are located in the urban areas and 60.05 per cent (3,626) in the rural areas. Of the branches NCBs hold

3,616; private commercial banks 1,214 foreign banks 31 and specialised banks 1,177.Bangladesh

Bank (BB) regulates and supervises the activities of all banks. The BB is now carrying out a reform programme to ensure quality services by the banks.

BB

NCBs

PCBs

Specialised Banks

9

Bangladesh Bank

Bangladesh Bank (BB) has been working as the central bank since the country's independence.

Its prime jobs include issuing of currency, maintaining foreign exchange reserve and providing transaction facilities of all public monetary matters.

The BB has a governing body comprising of nine members with the Governor as its chief. Apart from the head office in Dhaka, it has nine more branches, of which two in Dhaka and one each in Chittagong, Rajshahi, Khulna, Bogra, Sylhet, Rangpur and Barisal.

Nationalized Commercial Banks (NCBs)

Name Telephone

1. Sonali Bank

2. Janata Bank

3. Agrani Bank

4. Rupali Bank

9550426-34, 8614588

9560072-80, 9560042-43

9566153-54, 9566160-69,9555179-80

9551624-25, 9554122, 9552183-4

Private Commercial Banks (PCBs)

1.Pubali Bank

2.Uttara Bank

9569050-2, 9551614-7

9566067-9,9551162-63,

10

3.National Bank Ltd.

4.The City Bank Ltd.

5.United Commercial Bank Ltd.

6. Arab Bangladesh Bank Ltd.

7.IFIC Bank Ltd.

8.Islami bank Bangladesh Ltd.

9.Al Baraka Bank Bangladesh Ltd.

10.Eastern Bank Ltd.

11.National Credit & Commerce Bank Ltd.

12.Prime Bank Ltd.

13.South East Bank Ltd.

14.Dhaka Bank Ltd.

15.Al-Arafah Islami Bank Ltd.

16.Social Investment Bank Ltd.

17.Dutch-Bangla Bank Ltd.

18.Mercantile Bank Ltd.

19.Standard Bank Ltd.

20.One Bank Ltd.

21.EXIM Bank

22.Bangladesh Commerce Bank Ltd.

23.Mutual Trust Bank Ltd.

9563081-5, 9561201

9565925-34

9560585

95608878, 9560312-6

9562062, 9563020-29

9552897,-8, 9563040,

9563768-9, 9565031-2

9556371,9556361-2

9561902-4

9567265-70, 9564677

9550081-5, 9551575,

9556587-10, 9556583,

9564255-6

9559014, 9554855

9568537-39

9559333

9667224, 9667802

9564249, 7551799,

9553925, 9553872,

9559831-32, 9668170

9569318, 7113239

11

24.First Security Bank Ltd.

25.The Premier Bank Ltd.

26.Bank Asia Ltd.

27.The Trust Bank Ltd.

28. Shah Jalal Bank Limited (Based on Islamic Shariah)

Foreign Banks

1.American Express Bank

2.Standard Chartered Grindlays Bank

3.Habib Bank Ltd.

4.State Bank Of India

5.Credit Agricole Indosuez (The Bank)

6.National Bank of Pakistan

7.Muslim Commercial Bank Ltd.

8.City Bank NA

9.Hanvit Bank Ltd.

10.HSBC Ltd.

11.Shamil Islami Bank Of Bahrain EC

12.Standard Chartered Bank

Development Banks

1.Bangladesh Krishi Bank

9560229, 9564733

9566418

8117055, 8117066

9870011 Extn-4191

9556011

9561751-52, 9561496-97,

9561465, 9550181-90

9551228, 9555091-2,

9554251,9553371

8111959

9560248-9

9563649, 9563650

9550063-64

8813270-73

9563043-5

9666701-5

9561465, 881718-9

9560021-5, 9560031-35

12

2.RajshahiKrishiUnnayan Bank

3.Bangladesh Shilpa Bank

4.Bangladesh Shilpa Rin Sangstha

9555150-9, 9566114

9565818,9565046

5.Bank of Small Industries & Commerce Bangladesh Ltd. 9564830, 9658190

Maister, (1995)stated that the importance of Customer Satisfaction cannot be overstated.

Customer satisfaction is a very important thing in a Bank. Because without customers the bank has no reason to exist. Every service business needs to productively define and measure customer satisfaction. That’s why customer satisfaction is on of the important factor to continue for banking activities.

4. Customer satisfaction

Pizam (2005) Stated that Customer satisfaction is a psychological concept that involves the feeling of well-being and pleasure that results from obtaining what one hopes for and expects from an appealing product and/or service. customers purchase goods and services with prepurchase expectations about anticipated performance. Once the product or service has been purchased and used, outcomes are compared against expectations. When outcome matches expectations, confirmation occurs. Disconfirmation occurs when there are differences between expectations and outcomes. Negative disconfirmation occurs when product/service performance is less than expected. Positive disconfirmation occurs when product/service performance is better than expected. Satisfaction is caused by confirmation or positive disconfirmation of consumer expectations, and dissatisfaction is caused by negative disconfirmation of consumer expectations.

Vavra’s (1997) Stated that Customer satisfaction can also be defined as satisfaction based on an outcome or a process. outcome definition of customer satisfaction characterizes satisfaction as the end-state resulting from the experience of consumption. This end state may be a cognitive state of reward, an emotional response to an experience or a comparison of rewards and costs

13

to the anticipated consequences. Vavra also puts forth a definition of customer satisfaction based as a process, emphasizing the perceptual, evaluative and psychological processes contributing to customer satisfaction. In this definition, assessment of satisfaction is made during the service delivery process.

Ashish Bhave stated that Major attributes of customer satisfaction can be summarized as:

Product Quality

Product Packaging

Keeping delivery commitments

Price

Responsiveness and ability to resolve complaints and reject reports

Overall communication, accessibility and attitude.

Anders Stated that Customer satisfaction represents a modern approach for quality in enterprises and organizations and serves the development of a truly customer-focused management and culture. Measuring customer satisfaction offers an immediate, meaningful and objective feedback about clients’ preferences and expectations. In this way, company’s performance may be evaluated in relation to a set of satisfaction dimensions that indicate the strong and the weak points of a business organization. This paper presents an original customer satisfaction survey in the private bank sector. The implemented methodology is based on the principles of multicriteria analysis and preference disaggregation modelling. The most important results are focused on the determination of the critical service dimensions and the segmentation to customer clusters with distinctive preferences and expectations.

Customer satisfaction refers to the extent to which customers are happy with the products and services provided by a business. Customer satisfaction levels can be measured using survey techniques and questionnaires. Gaining high levels of customer satisfaction is very important to

14

a business because satisfied customers are most likely to be loyal and to make repeat orders and to use a wide range of services offered by a business.

There are many factors which lead to high levels of customer satisfaction including:

Products and services which are customer focused and thence provide high levels of value for money.

Customer service giving personal attention to the needs of individual customers.

After sales service - following up the original purchase with after sales support such as maintenance and updating (for example in the updating of computer packages).

What is clear about customer satisfaction is that customers are most likely to appreciate the goods and services that they buy if they are made to feel special. This occurs when they feel that the goods and services that they buy have been specially produced for them or for people like them. This relates to a wide range of products such as razors that are designed for ease of use and good quality finish, petrol products that are environmentally friendly and customized to meet the needs of particular types of engines, etc.

Customer satisfaction refers to the extent to which customers are happy with the products and services provided by a business. Customer satisfaction levels can be measured using survey techniques and questionnaires. Gaining high levels of customer satisfaction is very important to a business because satisfied customers are most likely to be loyal and to make repeated orders and to use a wide range of services offered by a business. The need to satisfy customer for success in any commercial enterprises is very obvious. The income of all commercial enterprises is derived from the payments received for the products and services to its external customers.

Customers are the sole reason for the existence of commercial establishments.

Since sales are the most important goal of any commercial enterprise, it becomes necessary to satisfy customers. For customer satisfaction it is necessary to establish and maintain certain important characteristics like: a. Quality

15

b. Fair prices c. Good customer handling skills d. Efficient delivery e. Serious consideration of consumer complaints.

Satisfaction is the feeling of pleasure or disappointment attained from comparing a products perceived performance (outcome) in relation to his or her expectations. If the performance falls short of expectations, the customer is dissatisfied. If the performance matches the expectations, the customer is satisfied.

5. Measuring Customer Satisfaction

Measuring satisfaction is necessary because it reveals the voice of your customer. Properly done, this tells you which aspects of your product, service or brand will return the greatest impact on the outcome called loyalty behavior. First customers must be surveyed to identify what they consider important or significant about your product and product category. This qualitative information then drives design of your satisfaction survey, so you can be sure you are tracking things that matter to customers. This process reveals "customer requirements." Watch out for too much company input (rather than customer input) in your questionnaire design.

Being customer-centric means you understand quality is defined by customers. If you use too much management judgment in questionnaire design your results may be accurate but still misleading. Use the questionnaire for diagnosis rather than confirmation. You can't get the right answers if you don't ask the right questions. Surveying your entire customer population (a census) may be cost prohibitive. In that case you need a SAMPLE survey that produces statistically useful generalizations about your overall customer population and any relevant subsets. Random samples must be drawn and the sample size must be large enough so that it holds down the degree of sampling error. Market research companies can help with this

16

6. Why customer satisfaction is important?

Don't underestimate the value of customer satisfaction. It's becoming an important area of competition. A high level of satisfaction can deliver many benefits, including:

Loyalty: a highly satisfied customer is a loyal customer.

Repeat purchase: A highly satisfied customer buys more products.

Referrals: a highly satisfied customer tells their family and friends about the product or service.

Retention: a highly satisfied customer is less likely to switch brands.

Reduced costs: a highly satisfied customer costs less to serve than a new customer.

Premium prices: a highly satisfied customer is willing to pay more for the product or service.

7. Factors that Affect Customer Satisfaction

17

8. Customer satisfaction research

18

Satisfaction surveys are an important method for collecting information about how your customers think and feel about your brand, product or service.

A satisfaction survey can help you to understand the expectations of your customers, determine whether your customers believe you are meeting those expectations, identify new customer requirements or trends in the market and determine what areas of your business need investment.

A good customer satisfaction survey will also help you to understand the causes of dissatisfaction among your customers. Once you've identified these issues, you'll be able to implement new practices to improve customer satisfaction.

Many businesses systematically measure customer satisfaction through independent surveys, feedback forms, mystery shopping and focus groups. Some third party surveys also compare the customer satisfaction of major competitors, which allows companies to benchmark themselves in their relevant sector.

Measuring customer satisfaction doesn't have to be expensive. It can be as simple as preparing a short feedback form or conducting a brief telephone interview that asks the customer to rate the product or service on a number of criteria.

9. Indicators of customer satisfaction

An important indicator of customer satisfaction is the customer retention rate. To calculate your customer retention rate, you will need to capture data about the total number of customers and the number of customers switching brands. If you track this information over time, you'll be able to see whether you are improving your customer retention and satisfaction.

Another tool that has been introduced in Australia is the Net Promoter Scores, which provide a new metric for measuring customer loyalty. The Net Promoter Scores ask one simple question about whether a customer would recommend a product or service to a friend or colleague. This question has been identified as the ultimate determinant of customer satisfaction or loyalty.

Research in the UK and the US has found a clear correlation between the Net Promoter Scores

19

and revenue growth, illustrating the importance of customer satisfaction to future growth potential.

10. What are some of the Major Considerations

in Improving Satisfaction?

When a company becomes customer focused, everything starts to look different. That is because everything in a business can be viewed from a customer perspective. For this reason good customer satisfaction and loyalty programs span the entire organization. Here are the essential elements of satisfaction and loyalty programs:

Linkage to corporate vision, goals and strategies

Measurement of customer satisfaction and loyalty

Authorization and completion of relevant improvement projects

Linkage of metrics to employee rewards and recognition

Program management to assure the above items are done well

11. Measuring Customer Satisfaction in a Bank

Anders Stated that Customer satisfaction represents a modern approach for quality in enterprises and organizations and serves the development of a truly customer-focused management and culture. Measuring customer satisfaction offers an immediate, meaningful and objective feedback about clients’ preferences and expectations. In this way, company’s performance may be evaluated in relation to a set of satisfaction dimensions that indicate the strong and the weak points of a business organization. This paper presents an original customer satisfaction survey in the private bank sector. The implemented methodology is based on the principles of multicriteria analysis and preference disaggregation modelling. The most important results are focused on the determination of the critical service dimensions and the segmentation to customer clusters with distinctive preferences and expectations.

20

12. The Service bank offer to public

Banks are financial service firms, producing and selling professional management of the public funds as well as performing many other roles in the economy. The multiplicity of bank services and functions has led to banks being labeled as “financial department stores.” Their success hinges on their ability to identify the financial services the public demand, produce those services efficiently, and sell them at a competitive price. And what services does the public demand from banks today? In this section, we present an overview of banking’s service menu.

Carry out Currency Exchanges

Discounting Commercial Notes and Making Business Loans

Offering Savings Deposits

Safekeeping of Valuables and Certification of Value

Supporting Government Activities with Credit

Offering Checking Accounts (Demand Deposits)

Offering Trust Services

Internet Banking

Home Banking

Electronic Banking services for windows (EBSW)

Automated Teller Machine (ATM)

Tele Banking

Granting Consumer Loans

Financial Advising

Cash Management

Offering Equipment Leasing.

Making Venture Capital Loans

Selling Insurance Services

Offering Security Brokerage and Security Underwriting Services

Offering Mutual Funds and Annuities

21

13. The Service Private Commercial bank offer to public

Services Banks Have Offered Throughout History

Carry out Currency Exchanges:

History shows that one of the first services offered by banks was currency exchanges, a bank stood ready to trade one form of currency, such as dollars, for another, such as Euro or Yen, in return for a service fee. Such exchanges were important to travelers in the ancient world, as they are today, because the travelers’ survival and comfort depended on gaining access to the local currency of the country or city through which they were journeying. In today’s financial marketplace, trading in foreign currency is carried out primarily by the largest banks due to the risks involved and the expertise required carrying out such transactions.

Discounting Commercial Notes and Making Business Loans:

Early in their history. Bankers began discounting commercial notes; in effect making loans to local merchants who sold the debts (accounts receivable) they held against their customers to a bank to raise cash quickly. It was a short step from discounting commercial notes to making direct loans to businesses for purchasing inventories of goods or for constructing new facilities.

Offering Savings Deposits:

One of the earliest sources of funds consisted of offering savings deposits, interest-bearing funds left with banks for a period of weeks, months, or years, sometimes bearing relatively high rates of interest. According to historical records, banks in ancient Greece paid as high as 16 percent in annual interest to attract savings deposits from wealthy patrons and then made loans to ship owners sailing the Mediterranean Sea at loan rates double or triple the interest rate that bankers were paying to their savings deposit customers.

22

Safekeeping of Valuables and Certification of Value:

During the middle Ages, banks began the practice of holding gold, securities, and other valuables owned by their customers in secure vaults. They would also, when asked, assay the market value of their customers' valuables, especially gold and jewelry, and certify whether or not these so-called

"valuables" were worth what others had claimed.

Supporting Government Activities with Credit:

During the middle Ages and the early years of the Industrial Revolution, the ability of bankers to mobilize large amounts of funds and make loans came to the attention of governments in Europe and America. Frequently, banks were chartered under the proviso that they would purchase government bonds with a portion of any deposits they received. This lesson was not lost on the fledgling American government during the Revolutionary War. During the Civil War, Congress created a whole new federal banking system, agreeing to charter national banks provided these banks purchased government bonds, which were used to help fund that war.

Offering Checking Accounts (Demand Deposits):

The Industrial Revolution in

Europe and the United States ushered in new banking practices and services. Probably the most important of the new services developed during this period was the demand deposit, a checking account that permitted the depositor to write drafts in payment for goods and services that the bank had to honor immediately. Offering demand deposits proved to be one of the industry's most important services because it significantly improved the efficiency of the payments process, making business transactions easier, faster, and safer. Now the checking account concept has been extended to the Internet and to so-called smart cards, which represent funds that can be spent electronically to pay for purchases of goods and services.

Offering Trust Services:

For many years banks have managed the financial affairs and property of individuals and business firms in return for a fee that is often based on the value of properties or the amount of funds under management. This property management function is

23

known as trust services. Most banks offer both personal trust services to individuals and families and commercial trust services to corporations and other businesses. Through a personal trust department, customers can set aside funds for the education of their children, for example, with the bank managing and investing the money until it is needed. Even more commonly, banks act as trustees for wills, managing a deceased customer's estate by paying claims against the estate, keeping valuable assets safe and productively invested, and seeing to it that the legal heirs receive their rightful inheritance. In their commercial trust departments, banks manage security portfolios and pension plans for business firms and act as agents for corporations issuing stocks and bonds. !his requires the trust department to pay interest or dividends on the corporation's securities and retire maturing corporate securities by paying off their holders.

Special Services Due to Change in Technology:

Internet Banking:

Customers need an Internet access service. As an Internet Banking customer, he will be given a specific user ID and a confident password. The customer can then view his account balances online. It is the industry-standard method used to protect communications over the Internet.

To ensure that customers' personal data cannot be accessed by anyone but them, all reporting information has been secured using Version and Secure Sockets Layer (SSL).

Home Banking:

Home banking frees customers of visiting branches and most transactions will be automated to enable them to check their account activities transfer fund and to open L/C sitting in their own desk with the help of a PC and a telephone.

Electronic Banking Services for Windows (EBSW):

Electronic Banking Service for

Windows (EBSW) provides a full range of reporting capabilities, and a comprehensive range of transaction initiation options. The customers will be able to process all payments as well as initiate L/Cs and amendments, through EBSW. They will be able to view the balances of all accounts, whether with Standard Chartered or with any other banks using SWIFT. Additionally, transactions may be approved by remote authorization even if the approver is out of station.

24

Automated Teller Machine (ATM):

Automated Teller Machine (ATM), a new concept in modern banking, has already been introduced to facilitate subscribers 24 hour cash access through a plastic card. The network of ATM installations will be adequately extended to enable customers to non-branch banking beyond banking.

Tele Banking:

Tele Banking allows customers to get access into their respective banking information 24 hours a day. Subscribers can update themselves by making a phone call. They can transfer any amount of deposit to other accounts irrespective of location either from home or office.

Swift:

Swift is a Bank owned non-profit co-operative based in Belgium servicing the financial community worldwide. It ensures secure messaging having a global reach of 6,495 Banks and

Financial Institutions in 178 countries, 24 hours a day. SWIFT global network carries an average

4 million message daily and estimated average value of payment messages is USD 2 trillion.

Swift is a highly secured messaging network enables Banks to send and receive Fund Transfer,

L/C related and other free format messages to and from any banks active in the network. Having

SWIFT facility, Bank will be able to serve its customers more profitable by providing L/C,

Payment and other messages efficiently and with utmost security. Especially it will be of great help for our clients dealing with Imports, Exports and Remittances etc.

Services Banks Have Developed More Recently

Granting Consumer Loans:

Historically, most banks did not actively pursue loan accounts from individuals and families, believing that the relatively small size of most consumer loans and their relatively high default rate would make such lending unproved- table. Early in this century, however, bankers began to rely more heavily on consumers for deposits to help fund their large corporate loans. Then, too, heavy competition for business deposits and loans caused bankers increasingly to turn to the consumer as a potentially more loyal customer.

25

Financial Advising:

Bankers have long been asked for financial advice by their customers, particularly when it comes to the use of credit and the saving or investing of funds. Many banks today offer a wide range of financial advisory services, from helping to prepare tax returns and financial plans for individuals to consulting about marketing opportunities at home and abroad for their business customers.

Cash Management:

Over the years, banks have found that some of the services they provide for themselves are also valuable for their customers. One of the most prominent examples is cash management services, in which a bank agrees to handle cash collections and disbursements for a business firm and to invest any temporary cash surpluses in short- term interest-bearing securities and loans until the cash is needed to pay bills. While banks tend to specialize mainly in business cash management services, there is a growing trend today toward offering similar services for consumers.

Offering Equipment Leasing:

Many banks have moved aggressively to offer their business customers the option to purchase needed equipment through a lease arrangement in which the bank buys the equipment and rents it to the customer. Regulations originally required customers using equipment leasing services to make lease payments that would eventually cover the full cost of purchasing the rented equipment and to be responsible for any repairs and taxes incurred.

Making Venture Capital Loans:

Increasingly, banks have become active in financing the start-up costs of new companies, particularly in high-tech industries. Because of the added risk involved in such loans, this is generally done through a venture capital firm, a subsidiary of a bank holding company such as Citigroup Venture, Inc. Bankers may also bring in other investors to help share the risk.

Selling Insurance Services:

For many years, bankers have sold credit life insurance to their customers receiving loans, thus guaranteeing loan repayment if borrowers die or become disabled. Moreover, in the 19th and early 20th century, many bankers sold insurance and

26

provided financial advice to their customers, literally serving as the local community's all-around financial service store.

Selling Retirement Plans:

Bank trust departments are active in managing the retirement plans that most businesses make available to their employees, investing incoming funds and dispensing payments to qualified recipients who have reached retirement or become disabled.

Banks also sell deposit retirement plans (known as IRAs and Keoghs) to individuals holding these deposits until the funds are needed for income after retirement .

Offering Security Brokerage and Security Underwriting Services:

Allover the world the largest banks are seeking to become "financial department stores," hoping to fulfill all the financial service needs of their customers with one stop, becoming all-purpose financial firms. One of the biggest of all banking service targets in recent years, particularly in the United

States, has been dealing in securities, executing buy and sell orders for security trading customers (referred to as security brokerage services) and marketing new securities to raise funds for corporations and other institutions (referred to security under writing services.)

Offering Mutual Funds and Annuities:

Concerned that many banks have offered toolow interest rates on traditional deposit accounts, many customers have come to demand socalled investment products from their banker, especially mutual fund accounts and annuities that offer the prospect of higher yields than are currently available on conventional bank deposits. These products also carry more risk. Annuities consist of long-term savings plans that promise the payment of a stream of income to the annuity holder beginning on a designated future date (such as at retirement). In contrast, mutual funds are professionally managed investment programs that acquire stocks, bonds, and other securities that appear to "fit" the funds' announced goals (such as to maximize income or to achieve long-term capital appreciation). Some banking firms have organized special subsidiary organizations to market these services (e.g., Citicorp's Investment Services) or entered into joint ventures with security brokers and dealers.

Offering Merchant Banking Services:

Bank today are following the footsteps of leading financial institutions all over the globe in offering merchant banking services to larger corporations. These services are officially defined as the temporary purchase of corporate

27

stock to aid the launching of a new business venture or to support the expansion of an existing company. Hence, a banker providing this service becomes a temporary stockholder and bears considerable risk that the stock purchased may decline in value. In practice, merchant banking services often encompass the identification of possible merger targets, providing strategic marketing advice, and offering hedging services to help customers manage risk, especially the risk of loss due to changing currency prices and interest rates.

Private

Commercial

Bank

28

Figure: 2 Services Private Commercial Banks offer to Public

29

14. Service quality of Private Commercial Banks

Customers of Private Commercial Banks have a good perception about the quality of service provided by them. From our survey we found that customers are satisfied with the overall service of Private

Commercial Banks. All the offers provided by Private Commercial Banks are very beneficial for the customers. But in case of service benefit is not the alone factor that determines the level of satisfaction.

There are many other things that take control over the overall satisfaction. For instance, service having attractive offers may fail only because of rude behavior or carelessness of the provider. So it is very important to ensure other factors that are related with the success of the service. There are five major factors identified by the experts that are essential to assure the quality of better service that will lift the level of satisfaction. They are reliability, responsiveness, assurance, empathy and tangibles. These five factors determines the quality of interaction between customer and provider, the quality of Physical environment quality and out come quality of the service which leads the overall service to the position of excellence of quality. From our survey we found that how these factors affect their satisfaction level.

Reliability:

It means ability to perform the promised service accurately. In case of banking reliability is very important. Because if the client pretends that the company is not able to continue its service proper in the future they will not interested to banking with Private Commercial Banks . From our survey we see that most of the customers chose Private Commercial Banks because they think it is reliable compare to others in case of providing various unique features (Bangladesh international). On the whole customers have a perception that Private Commercial Banks is capable to provide all the services they offered.

Responsiveness:

It is another vital factor that controls customers’ perception about quality of service.

It means willingness of the employees to help the customers. According to the perception of customers responsiveness is very important to increase the quality of the service. Even the customers ranked the importance of responsiveness in banking 7 out of 9. If employees do not response immediately to the need of the customers, valuable time of the customers will be spent unnecessarily. Even the customer may

30

become frustrated whether he will get the service or not. The customers of Private Commercial Banks replied that Private Commercial Banks responses promptly.

Assurance:

It means the knowledge and ability of the employees to develop trust in the mind of the clients about the completion of the task properly and on time. Customers have a great perception about

Private Commercial Banks that they perform according to their promise.

Empathy:

To ensure better service it is very important for the employees to have empathy. Empathy means giving individual attention and taking extra care of the customer. Private Commercial Banks has young and energetic employs that interact with customers nicely and they continuously ask about their satisfaction and dissatisfaction of every individual.

Tangibles:

Tangibles are very important factor because it directs the customer mind about the quality of the service. Tangibles are physical facilities, equipment etc used in the context of service company. Interior decoration, sitting arrangements, temperature of the room, cleanness everything controls the perception of customers about the quality of the service. Private Commercial Banks has confirmed well interior decoration in all there branches and they try keep the standard of there services cape same all over the world.

31

Reliability

Interaction quality

Situationa l factors

Responsivene ss

Assurance

Physical environmen t quality

Service quality

Customer satisfaction

Empathy

Tangibles

Outcome quality

Personal factors

Figure: 3 Factors that determine service quality and customer satisfaction

15. The Service Nationalize Commercial Bank (NCBs) bank offer to public

There are some limitations of Nationalize Commercial Bank that’s why Nationalize Commercial

Banks offer fewer services than the Private Commercial Banks to public.Thats are under describe.

Carry out Currency Exchanges:

History shows that one of the first services offered by banks was currency exchanges, A bank stood ready to trade one form of currency, such as dollars, for another, such as

Euro or Yen, in return for a service fee. Such exchanges were important to travelers in the ancient world, as they are today, because the travelers’ survival and comfort depended on gaining access to the local currency of the country or city through which they were journeying. In today’s financial marketplace, trading in foreign currency is carried out primarily by the largest banks due to the risks involved and the expertise required carrying out such transactions.

Discounting Commercial Notes and Making Business Loans:

Early in their history.

Bankers began discounting commercial notes; in effect making loans to local merchants who sold the debts

32

(accounts receivable) they held against their customers to a bank to raise cash quickly. It was a short step from discounting commercial notes to making direct loans to businesses for purchasing inventories of goods or for constructing new facilities.

Offering Savings Deposits:

One of the earliest sources of funds consisted of offering savings deposits, interest-bearing funds left with banks for a period of weeks, months, or years, sometimes bearing relatively high rates of interest. According to historical records, banks in ancient Greece paid as high as 16 percent in annual interest to attract savings deposits from wealthy patrons and then made loans to ship owners sailing the Mediterranean Sea at loan rates double or triple the interest rate that bankers were paying to their savings deposit customers.

Supporting Government Activities with Credit:

During the middle Ages and the early years of the Industrial Revolution, the ability of bankers to mobilize large amounts of funds and make loans came to the attention of governments in Europe and America. Frequently, banks were chartered under the proviso that they would purchase government bonds with a portion of any deposits they received. This lesson was not lost on the fledgling American government during the Revolutionary War. During the Civil War,

Congress created a whole new federal banking system, agreeing to charter national banks provided these banks purchased government bonds, which were used to help fund that war.

Offering Checking Accounts (Demand Deposits):

The Industrial Revolution in Europe and the

United States ushered in new banking practices and services. Probably the most important of the new services developed during this period was the demand deposit, a checking account that permitted the depositor to write drafts in payment for goods and services that the bank had to honor immediately.

Offering demand deposits proved to be one of the industry's most important services because it significantly improved the efficiency of the payments process, making business transactions easier, faster, and safer. Now the checking account concept has been extended to the Internet and to so-called smart cards, which represent funds that can be spent electronically to pay for purchases of goods and services.

33

Automated Teller Machine (ATM):

Automated Teller Machine (ATM), a new concept in modern banking, has already been introduced to facilitate subscribers. But only one Nationalize Commercial Bank

(NCB) offers this service.

Granting Consumer Loans:

Historically, most banks did not actively pursue loan accounts from individuals and families, believing that the relatively small size of most consumer loans and their relatively high default rate would make such lending unprof- itable. Early in this century, however, bankers began to rely more heavily on consumers for deposits to help fund their large corporate loans. Then, too, heavy competition for

.

Financial Advising:

Bankers have long been asked for financial advice by their customers, particularly when it comes to the use of credit and the saving or investing of funds. Many banks today offer a wide range of financial advisory services, from helping to prepare tax returns and financial plans for individuals to consulting about marketing opportunities at home and abroad for their business customers.

Offering Mutual Funds and Annuities:

Concerned that many banks have offered too-low interest rates on traditional deposit accounts, many customers have come to demand so-called

investment products from their banker, especially mutual fund accounts and annuities that offer the prospect of higher yields than are currently available on conventional bank deposits. These products also carry more risk. Annuities consist of long-term savings plans that promise the payment of a stream of income to the annuity holder beginning on a designated future date (such as at retirement). In contrast,

mutual funds are professionally managed investment programs that acquire stocks, bonds, and other securities that appear to "fit" the funds' announced goals (such as to maximize income or to achieve longterm capital appreciation). Some banking firms have organized special subsidiary organizations to market these services (e.g., Citicorp's Investment Services) or entered into joint ventures with security brokers and dealers.

16. Problems of Nationalize Commercial Bank (NCBs) bank in Bangladesh

34

Reduction of Bank Rate and Lending Rate.

Slow services.

Limitation of efficient employees.

Lack of Modern equipments.

Physical out look is not attractive.

Linking Classified Loan Level to Large Loan Sanctioning.

Measures for Loan Recovery.

Revision of Delegation of Power and Responsibility between Board of Directors and the

Management.

Decision on Cash Reserve Ratio Requirement.

17. Results and Analysis from Questionnaire Survey

35

Gender

Valid female male

Total

Frequency Percent Valid Percent

11 36.7

36.7

19 63.3

63.3

30 100.0

100.0

Cumulative

Percent

36.7

100.0

Gender

20

15

10

5

0 female male

Gender

We have surveyed on 30 recipients and on this surveyed both male and female customers are involved. In the figure we can see that male customer was 63.3% and female customer was 36.7%.

36

Age

Valid 18-22

23-30

31-40

Above 40

Total

Frequency Percent

1 3.3

12

13

4

30

40.0

43.3

13.3

100.0

Valid Percent

3.3

40.0

43.3

13.3

100.0

Cumulative

Percent

3.3

43.3

86.7

100.0

Age

10

8

6

4

2

0

14

12

18-22 23-30

Age

31-40 Above 40

37

We have surveyed on 30 recipients and they are mostly ranged between 31 to 40 years 43.3% and other consumers are 23 to 30years 40.0%, above 40 years 13.3% and 18 to 20 years 3.3%.

Occupation

Valid Service holder

Businessman

Student

Others

Total

Frequency Percent Valid Percent

9 30.0

30.0

11

6

36.7

20.0

36.7

20.0

4

30

13.3

100.0

13.3

100.0

Cumulative

Percent

30.0

66.7

86.7

100.0

38

Occupation

Service holder

Businessman

Student

Others

Most of our surveyed consumers are Business (11 out of 30) 36.7% and others are service holder 30.0%, student 20.0% and others are 13.3%.

39

Income per month

Valid Under 5000 taka

5000-10000 taka

10000-20000 taka

Over 20000 taka

Total

Frequency Percent

1 3.3

4

11

14

30

13.3

36.7

46.7

100.0

Valid Percent

3.3

13.3

36.7

46.7

100.0

Cumulative

Percent

3.3

16.7

53.3

100.0

Income per month

4

2

0

8

6

14

12

10

Under 5000 taka 5000-10000 taka 10000-20000 taka Over 20000 taka

Income per month

Customers income level ranges mostly over 20,000 taka 46.7%, and 10,000 to 20,000 taka 36.7%, 5,000 to

10,000taka 13.3%, and under 5,000 taka 3.3%.

40

Valid Private Commercial Bank

Nationalized Commercial

Banks (NCBs)

Both

Total

Which type of bank you have got any services?

Frequency Percent Valid Percent

15 50.0

50.0

5 16.7

16.7

10

30

33.3

100.0

33.3

100.0

Cumulative

Percent

50.0

66.7

100.0

Which type of bank you have got any services?

Private Commercial Bank

Nationalized Commercial

Banks (NCBs)

Both

Our next question was to the respondent, which type of bank you have got any services. in the figure we can see that 50.0% customers was got services from Private Commercial Bank, and 16.7% customers was

41

got services from Nationalized Commercial Bank (NCB) and 33.3% customer was got services from Both type of bank.

How satisfied with the se rvices provi ded by Private Com me rcia l Ba nk?

Valid Completely Satisfied

Very s atisfied

Fairly satis fied

Total

Frequency

8

10

7

25

Percent

32.0

40.0

28.0

100.0

Valid Perc ent

32.0

40.0

28.0

100.0

Cumulative

Percent

32.0

72.0

100.0

How satisfied with the services provided by Private Commercial Bank?

Completely Satisfied

Very satisfied

Fairly satisfied

42

Our next question was to the respondent, how satisfied with the Services provided by private commercial bank? In the figure we can see that 40.0% customers are very satisfied, 32.0% are completely satisfied, and

28.0% are fairly satisfied .

How would you asses the gretting from the bank employee while you enter any Private Commercial Bank?

Valid Very Good

Good

Average

Total

Frequency Percent

6

10

9

25

24.0

40.0

36.0

100.0

Valid Percent

24.0

40.0

36.0

100.0

Cumulative

Percent

24.0

64.0

100.0

43

How would you asses the gretting from the bank employee while you enter any Private Commercial Bank?

Very Good

Good

Average

Next question was to the respondent, how would you assess the greeting from the bank employee while you enter any private commercial bank? In the figure we can see that 40.0% customers said good, 36.0% customers said Average and 24.0% customers said very good.

44

How m uch tim e do you have to wai t in the private com me rcia l Ba nk to get your w ork done?

Valid Short t ime

Long t ime

Total

Frequency

11

14

25

Percent

44.0

56.0

100.0

Valid P erc ent

44.0

56.0

100.0

Cumulative

Percent

44.0

100.0

How much time do you have to wait in the private commercial Bank to get your work done?

10

8

6

4

14

12

2

0

Short time Long time

How much time do you have to wait in the private commercial Bank to get your work done?

Next question was to the respondent, how much time do you have to wait in the private commercial Bank to get your work done? In the figure we can see that 56.0% customers said long time and 44.0% customers said short time.

45

Valid

How friendly are the employee's of priva te com mercial bank?

Very friendly

Satisfactory

Not friendly

Total

Frequency

9

15

1

25

Percent

36.0

60.0

4.0

100.0

Valid P erc ent

36.0

60.0

4.0

100.0

Cumulative

Percent

36.0

96.0

100.0

How friendly are the employee's of private commercial bank?

15

12

9

6

3

0

Very friendly Satisfactory Not friendly

How friendly are the employee's of private commercial bank?

46

How friendly are the employee’s of private commercial bank? In figure we can see that most of the 60.0% customers said they are satisfactory and 36.0% customers said they are very friendly and

4.0% said they are not friendly.

How know ledgea ble are the em ployees of priva te com mercial bank in answe ring your e nquirie s/questi ons?

Valid Very good

Satisfactory

Total

Frequency Percent Valid P erc ent

12 48.0

48.0

13 52.0

52.0

25 100.0

100.0

Cumulative

Percent

48.0

100.0

47

How knowledgeable are the employees of private commercial bank in answering your enquiries/questions?

Very good

Satisfactory

.

Next question was to the respondent, how knowledgeable are the employees of private commercial bank in answering your enquiries/questions? In the figure we can see that most of the 52.0% customers said they are satisfactory and 48.0% customers said they are very good.

48

Do you think the private commercial bank ATM service is easy to access?

Valid Very easy

Easy

Not so easy

Complicated

Total

Frequency

5

10

9

1

25

Percent

20.0

40.0

36.0

4.0

100.0

Valid Percent

20.0

40.0

36.0

4.0

100.0

Cumulative

Percent

20.0

60.0

96.0

100.0

Do you think the private commercial bank ATM service is easy to access?

Very easy

Easy

Not so easy

Complicated

Next question was to the respondent; do you think the private commercial bank ATM service is easy to access? In the figure we can see that most of the 40.0% customers said Easy, 36.0% customers said not so easy 20.0% customers are said very easy and 4.0% customer said complicated.

49

Are you satisfied with the installment procedure and interest rate that you have to pay after taking loan in private commercial bank?

Valid Highly satis fied

Satisfied

Not satisfied

Total

Frequency Percent

5

9

11

25

20.0

36.0

44.0

100.0

Valid Percent

20.0

36.0

44.0

100.0

Cumulative

Percent

20.0

56.0

100.0

Are you satisfied with the installment procedure and interest rate that you have to pay after taking loan in private commercial bank?

12

10

8

6

4

2

0

Highly satisfied Satisfied Not satisfied

Are you satisfied with the installment procedure and interest rate that you have to pay after taking loan in private commercial bank?

Are you satisfied with the installment procedure and interest rate that you have to pay after taking loan in private commercial bank? In the figure we can see that most of the 44.0% customers said they are not satisfied 36.0% customers said they are satisfied and 20.0% customers said they are highly satisfied.

50

Do you satisfied with the time that takes for loan approval in private commercial bank?

Valid Highly satis fied

Satisfied

Not satisfied

Total

Frequency

3

8

14

25

Percent

12.0

32.0

56.0

100.0

Valid Percent

12.0

32.0

56.0

100.0

Cumulative

Percent

12.0

44.0

100.0

51

Do you satisfied with the time that takes for loan approval in private commercial bank?

Highly satisfied

Satisfied

Not satisfied

Do you satisfied with the time that takes for loan approval in private commercial bank? In the figure we can see that most of the 56.0% customers said they are not satisfied 32.0% customers said they are satisfied and 12.0% customers said they are highly satisfied.

52

Do you think number of Liquidity that private commercial bank have, is sufficient to provide good service?

Valid Sufficient

Not sufficient enough

Ins ufficient

Total

Frequency

9

14

2

25

Percent

36.0

56.0

8.0

100.0

Valid Percent

36.0

56.0

8.0

100.0

Cumulative

Percent

36.0

92.0

100.0

14

12

10

8

6

4

2

0

Do you think number of Liquidity that private commercial bank have, is sufficient to provide good service?

Sufficient Not sufficient enough Insufficient

Do you think number of Liquidity that private commercial bank have, is sufficient to provide good service?

Do you think number of Liquidity that private commercial bank have, is sufficient to provide good service?

In the figure we can see that most of the 56.0% customers said not sufficient enough 36.0% customers said sufficient and 8.0% customers said insufficient.

53

Are you sa tisfied with the Opera ting hours of private comm ercial bank?

Valid Highly satisfied

Satisfied

Not satisfied

Total

Frequency

2

11

12

25

Percent

8.0

44.0

48.0

100.0

Valid P erc ent

8.0

44.0

48.0

100.0

Cumulative

Percent

8.0

52.0

100.0

Are you satisfied with the Operating hours of private commercial bank?

Highly satisfied

Satisfied

Not satisfied

Are you satisfied with the Operating hours of private commercial bank? In the figure we can see that most of the 48.0% customers said they are not satisfied 44.0% customers said they are satisfied and 8.0% customers said they are highly satisfied.

54

The se rvices provided by private com mercial bank is ____tha n Nationali zed

Comm erci al Banks (NCBs).

Valid More excellent

Better

Total

Frequency Percent Valid P ercent

7 28.0

28.0

18

25

72.0

100.0

72.0

100.0

Cumulative

Percent

28.0

100.0

The services provided by private commercial bank is ____than Nationalized

Commercial Banks (NCBs).

More excellent

Better

55

Our next question was to the respondent, the services provided by private commercial bank is ____than

Nationalized Commercial Banks (NCBs).In the figure we can see that most of the customers 72.0% said better and 28.0% customers said more excellent.

How satisfied with the se rvices provided by Natina lized Comm ercial Bank(NCBs)?

Valid Fairly satis fied

Some what dis satisfied

Very dissatisfied

Total

Frequency

2

4

9

15

Percent

13.3

26.7

60.0

100.0

Valid P erc ent

13.3

26.7

60.0

100.0

Cumulative

Percent

13.3

40.0

100.0

56

How satisfied with the services provided by Natinalized Commercial Bank

(NCBs)?

Fairly satisfied

Some what dissatisfied

Very dissatisfied

Our next question was to the respondent, how satisfied with the Services provided by Nationalized commercial bank (NCB)? In the figure we can see that 60.0% customers are very dissatisfied, 26.0% are some what dissatisfied, and 13.3.0% customers are fairly satisfied .

57

How w oul d you a sses the gre tting from the bank em ployee whi le you enter any Nationa lize d Comm ercial Bank (NCBs)?

Valid Average

Poor

Total

Frequency Percent Valid P erc ent

6 40.0

40.0

9 60.0

60.0

15 100.0

100.0

Cumulative

Percent

40.0

100.0

How would you asses the gretting from the bank employee while you enter any Nationalized Commercial Bank (NCBs)?

Average

Poor

Next question was to the respondent, how would you assess the greeting from the bank employee while you enter any Nationalized commercial bank (NCB)? In the figure we can see that 60.0% customers said poor, 40.0% customers said Average.

58

How m uch tim e do you ha ve to w ait i n the Na tina lize d comm ercial Bank(NCBs) to get your work done ?

Valid Long time

Very long t ime

Total

Frequency Percent Valid P ercent

8

7

15

53.3

46.7

100.0

53.3

46.7

100.0

Cumulative

Percent

53.3

100.0

6

4

2

How much time do you have to wait in the Natinalized commercial Bank(NCBs) to get your work done?

8

0

Long time Very long time

How much time do you have to wait in the Natinalized commercial Bank(NCBs) to get your work done?

59

Next question was to the respondent, how much time do you have to wait in the Nationalized commercial

Bank (NCB) to get your work done? In the figure we can see that 53.3% customers said long time and

46.7% customers said very long time.

How friendly are the employee's of National ized comm erci al bank(NCBs)?

Valid Very friendly

Satisfactory

Not friendly

Total

Frequency Percent Valid P erc ent

1

5

9

15

6.7

33.3

60.0

100.0

6.7

33.3

60.0

100.0

Cumulative

Percent

6.7

40.0

100.0

60

4

2

8

6

How friendly are the employee's of Nationalized commercial bank(NCBs)?

10

0

Very friendly Satisfactory Not friendly

How friendly are the employee's of Nationalized commercial bank(NCBs)?

How friendly are the employee’s of Nationalized commercial bank (NCB)? In figure we can see that most of the 60.0% customers said they are not friendly and 33.3% customers said they are satisfactory and 6.7% said they are very friendly.

61

How know ledgea ble are the em ployees of Nati ona lized comm erci al ba nk(NCBs) in answe ring your e nquiries/que stions?

Valid Satisfactory

Poor

Total

Frequency Percent Valid Perc ent

5 33.3

33.3

10 66.7

66.7

15 100.0

100.0

Cumulative

Percent

33.3

100.0

6

4

2

How knowledgeable are the employees of Nationalized commercial bank

(NCBs) in answering your enquiries/questions?

10

8

0

Satisfactory Poor

How knowledgeable are the employees of Nationalized commercial bank

(NCBs) in answering your enquiries/questions?

Next question was to the respondent, how knowledgeable are the employees of Nationalized commercial bank (NCB) in answering your enquiries/questions? In the figure we can see that most of the 66.7% customers said they are poor and 33.3% customers said they are satisfactory.

62

Do you thi nk the National ized comm erci al bank(NCBs) ATM service is e asy to access?

Valid Not so eas y

Complicated

Total

Frequency Percent Valid P ercent

8

7

15

53.3

46.7

100.0

53.3

46.7

100.0

Cumulative

Percent

53.3

100.0

Do you think the Nationalized commercial bank(NCBs) ATM service is easy to access?

Not so easy

Complicated

63

Next question was to the respondent; do you think the Nationalized commercial bank (NCB) ATM service is easy to access? In the figure we can see that most of the 53.3% customers said not so easy, 46.7% customers said complicated.

Are you sa tisfied with the installm ent procedure and interest ra te that you ha ve to pa y a fter taki ng l oan in Nati ona lize d comm ercial bank(NCBs)?

Valid Satisfied

Not satisfied

Total

Frequency Percent Valid P ercent

3

12

15

20.0

80.0

100.0

20.0

80.0

100.0

Cumulative

Percent

20.0

100.0

64

Are you satisfied with the installment procedure and interest rate that you have to pay after taking loan in Nationalized commercial bank(NCBs)?

Satisfied

Not satisfied

Are you satisfied with the installment procedure and interest rate that you have to pay after taking loan in

Nationalized commercial bank (NCB)? In the figure we can see that most of the 80.0% customers said they are not satisfied and 20.0% customers said they are satisfied.

65

Do you sa tisfie d w ith the time tha t ta kes for loan approval i n Na tionaliz ed comm erci al bank(NCBs)?

Valid Satisfied

Not satisfied

Total

Frequency Percent Valid P ercent

4 26.7

26.7

11 73.3

73.3

15 100.0

100.0

Cumulative

Percent

26.7

100.0

Do you satisfied with the time that takes for loan approval in Nationalized commercial bank(NCBs)?

Satisfied

Not satisfied

Do you satisfied with the time that takes for loan approval in Nationalized commercial bank (NCB)? In the figure we can see that most of the 73.3% customers said they are not satisfied 26.7% customers said they are satisfied.

66

Do you think number of Liquidity that Nationalized commercial bank(NCBs) have, is sufficient to provide good service?

Valid Sufficient

Not sufficient enough

Ins ufficient

Total

Frequency Percent

2 13.3

8

5

15

53.3

33.3

100.0

Valid Percent

13.3

53.3

33.3

100.0

Cumulative

Percent

13.3

66.7

100.0

Do you think number of Liquidity that Nationalized commercial bank(NCBs) have, is sufficient to provide good service?

8

6

4

2

0

Sufficient Not sufficient enough Insufficient

Do you think number of Liquidity that Nationalized commercial bank(NCBs) have, is sufficient to provide good service?

Do you think number of Liquidity that Nationalized commercial bank have, is sufficient to provide good service? In the figure we can see that most of the 53.3% customers said not sufficient enough 33.3% customers said insufficient and 13.3.0% customers said sufficient.

67

Valid

Are you satisfied with the Operating hours of Nationalized commercial bank(NCBs)?

Not satisfied

Frequency

15

Percent

100.0

Valid Percent

100.0

Cumulative

Percent

100.0

12

9

Are you satisfied with the Operating hours of Nationalized commercial bank

(NCBs)?

15

6

3

0

Not satisfied

Are you satisfied with the Operating hours of Nationalized commercial bank

(NCBs)?

68

Are you satisfied with the Operating hours of Nationalized commercial bank (NCB)? In the figure we can see that all of the 100.0% customers said they are not satisfied

The se rvices provide d by Na tionaliz ed com mercial bank(NCBs) is ____ than P riva te Com me rcia l Ba nks.

Valid Better

Poorer

Total

Frequency Percent Valid P erc ent

2

13

15

13.3

86.7

100.0

13.3

86.7

100.0

Cumulative

Percent

13.3

100.0

69

The services provided by Nationalized commercial bank(NCBs) is ____than

Private Commercial Banks.

Better

Poorer

Our next question was to the respondent, the services provided by Nationalized commercial bank (NCB) is

____than Private Commercial Banks. In the figure we can see that most of the customers 86.7% said poorer and 13.3% customers said better.

Correlations of Private Commercial Bank

70

Correlations

How satisfied with the services provided by

Private Commercial

Bank?

Pearson Correlation

How satisfied with the services provided by

Private

Commercial

Bank?

1

How would you asses the gretting from the bank employee while you enter any

Private

Commercial

Bank?

.819**

How much time do you have to wait in the private commercial

Bank to get your work done?

.788**

How friendly are the employee's of private commercial bank?

.444*

How knowledge able are the employees of private commercial bank in answering your enquiries/q uestions?

.364

Sig. (2-tailed)

.

.000

.000

.026

.073

N

25 25 25 25 25

How would you asses the Pearson Correlation gretting from the bank employee while you enter

Sig. (2-tailed) any Private Commercial

Bank?

N

.819**

.000

25

1

25

.

.771**

.000

25

.475*

.016

25

.360

.077

25

Do you think the private commercial bank ATM service is easy to access?

.841**

Are you satisfied with the installment procedure and interest rate that you have to pay after taking loan in private commercial bank?

.829**

Do you satisfied with the time that takes for loan approval in private commercial bank?

.774**

Do you think number of

Liquidity that private commercial bank have, is sufficient to provide good service?

.836**

Are you satisfied with the Operating hours of private commercial bank?

.769**

The services provided by private commercial bank is ____ than

Nationalized

Commercial

Banks

(NCBs).

.774**

.000

25

.724**

.000

25

.000

25

.704**

.000

25

.000

25

.576**

.003

25

.000

25

.681**

.000

25

.000

25

.479*

.015

25

.000

25

.563**

.003

25

How much time do you Pearson Correlation have to wait in the private

Sig. (2-tailed) commercial Bank to get

N your work done?

.788**