INTRODUCTION TO

CORPORATE FINANCE

Laurence Booth • W. Sean Cleary

Prepared by

Ken Hartviksen

CHAPTER 3

Financial Statements

Lecture Agenda

•

•

•

•

•

•

•

Learning Objectives

Important Terms

Accounting Principles

Organizing a Firm’s Transactions

Preparing Accounting Statements

The Canadian Tax System

Summary and Conclusions

– Concept Review Questions

CHAPTER 3 – Financial Statements

3-3

Learning Objectives

1.

2.

3.

4.

5.

6.

7.

The importance of preparing financial statements in

accordance with a given set of guidelines or principles, and

what the most important principles are

The fact that preparing accounting statements involves the

use of judgement

How the basic financial statements for a company are

constructed

The important information that can be found on a company’s

balance sheet, income statement and cash flow statement

Why accounting income differs from income for tax purposes

How the capital cost allowance (CCA) system works

How different forms of investment income are taxed for

corporations and for individuals.

CHAPTER 3 – Financial Statements

3-4

Important Chapter Terms

•

•

•

•

•

•

•

•

•

•

Amortization

Balance sheet

Capital gain

Capital loss

Cash flow from

operations

Cash flow statement

CCA recapture

Current assets

Depreciation

Free cash flow

• Generally accepted

accounting principles

(GAAP)

• Half-year rule

• Income statement

• Liquidity

• Operating loss

• Terminal loss

• Traditional cash flow

• Undepreciated capital cost

(UCC)

CHAPTER 3 – Financial Statements

3-5

Importance of Understanding Accounting

• Accounting is an organized way of summarizing

the activities of business.

• Internal and external users of accounting

information rely on accounting information to

make decisions.

• A strong understanding of accounting is

required of financial managers because they

use that information to make significant

management decisions that will affect the future

financial reports of the organization.

CHAPTER 3 – Financial Statements

3-6

Accounting Principles

• Generally Accepted Accounting Principals

(GAAP) are contained in the CICA

Handbook and have the force of law in

Canada.

• The Income Tax Act (ITA) requires use of

the CICA Handbook, except where

specifically, the Act requires other

treatment.

– This has led to the practice of Canadian

companies reporting to shareholders using CICA

GAAP, and preparing separate financial

statements for Canada Revenue Agency (CRA)

• Reporting of financial performance in a

consistent manner over time and between

firms enhances the usefulness of those

reports allowing comparative analysis.

CHAPTER 3 – Financial Statements

3-7

Accounting Principles

International Convergence

• Different countries have different accounting standards:

– Canada – (CICA) Canadian Institute of Chartered Accountants

Handbook

– United States – (FASB) Financial Accounting Standards Board

– Japan – (ASBJ) Accounting Standards Board of Japan

• Given the growing importance of international trade,

integration of product and financial markets, there is a

need for countries to move to a common set of

accounting standards.

– (IASB) London-based International Accounting Standards Board

has been working with FASB and other accounting boards from

numerous countries to work toward a common standard.

CHAPTER 3 – Financial Statements

3-8

Accounting Principles

Recent Accounting Scandals

• ENRON

– Bankruptcy of one of the largest U.S. firms because of

financial statement misrepresentation involving the

external auditor (Arthur Andersen), management, and

financial partners including Merrill Lynch, Citigroup,

CIBC and others

• Other accounting/investment scandals involving

WorldCom, Tyco, Bristol-Myers, Nortel and

others demonstrate that the ENRON issue was

not an isolated incident.

CHAPTER 3 – Financial Statements

3-9

Accounting Principles

Impact of Recent Accounting Scandals

• Investors base investment decisions and

estimate the value of stock using accounting

information.

• Recent accounting scandals where financial

statements were found either to misstate the

financial results, or later required revision has

shaken the confidence of investors in financial

markets.

• U.S. Congress in 2002 passed the SarbanesOxley Act (SOX) in an attempt to restore

investor confidence.

CHAPTER 3 – Financial Statements

3 - 10

Accounting Principles

Main Provisions Sarbanes-Oxley Act 2002

• Creation of the Public Company Accounting Oversight Board

– Register and inspect public accounting firms

– Establish audit standards

• Separation of the audit function from other services provided

by auditing firms

• Improve governance standards

– Separate board committees for finance and audit

– External auditors must report to the audit committee

– Audit committee independence (membership must be dominated by

external directors) and financial expertise

• Requires the annual report to indicate the state of the firm’s

internal controls and assess their effectiveness

• CEO and CFO must ‘certify’ that the firms financial statements

“fairly present in all material respects, the operations and

financial condition of the issuer”

CHAPTER 3 – Financial Statements

3 - 11

Organizing a Firm’s Transactions

Bookkeeping Versus Accounting

Bookkeeping

• is the mechanical act of managing and

recording transactions.

Accounting

• is the application of GAAP principles and

conventions to the bookkeeping data to

produce financial statements that fairly

represent the financial condition and operations

of the economic entity.

CHAPTER 3 – Financial Statements

3 - 12

Organizing a Firm’s Transactions

Accounting Conventions: The Basic Principles

The most basic principles of GAAP are:

1.

2.

3.

4.

5.

6.

The entity concept

The going concern principle

A period of analysis

A monetary value

The matching principle

Revenue recognition

CHAPTER 3 – Financial Statements

3 - 13

Organizing a Firm’s Transactions

Accounting Conventions: The Basic Principles

The most basic principles of GAAP are:

1.

The entity concept

•

2.

The going concern principle

•

3.

Historical costs are used because the objectivity inherent in arms-length

transactions

The matching principle

•

6.

Usually a fiscal year, although quarterly and monthly financial statements

are also produced

A monetary value

•

5.

The statements are prepared on the basis that the economic entity will

continue to operate into the future (hence liquidation values, for example,

are not relevant)

A period of analysis

•

4.

The accounting is for a specific economic entity

Expenses incurred must be matched to the revenue earned in the period of

analysis.

Revenue recognition

•

Revenue is recognized when it has been earned (even though the cash

may not yet have been received).

CHAPTER 3 – Financial Statements

3 - 14

Organizing a Firm’s Transactions

Accounting Conventions: The Basic Principles

The major conventions of GAAP are:

1.

2.

3.

4.

5.

Procedures

Standards

Consistency

Materiality

Disclosure

CHAPTER 3 – Financial Statements

3 - 15

Organizing a Firm’s Transactions

Accounting Conventions: The Basic Principles

The major conventions of GAAP are:

1. Procedures

•

Assets are on the left, liabilities and equities on the right-hand side

of the balance sheet

2. Standards

•

CICA Handbook

3. Consistency

•

The firm should consistently apply the same accounting principles

over time to ensure comparability of financial statements from prior

periods

4. Materiality

•

All significant information is disclosed

5. Disclosure

•

The financial statements should fully and fairly disclose the firm’s

financial position. Objectivity, consistency and conformity to GAAP

are all aspects of full disclosure

CHAPTER 3 – Financial Statements

3 - 16

Preparing Accounting Statements

The Balance Sheet

• The balance sheet is a financial ‘snapshot’ at

one point in time (usually on the last day of the

firm’s fiscal year)

• It is an ‘inventory’ of what the firm owns

(assets) and how those assets were financed

(liabilities and owners equity)

– Left-hand side lists assets

– Right-hand side list liabilities and owners equity

– Top to bottom items are listed from most liquid, to

least liquid

CHAPTER 3 – Financial Statements

3 - 17

Preparing Accounting Statements

The Balance Sheet – Basic Structure

Basic Balance Sheet Structure

ABC Corporation Limited

Balance Sheet

as at March 31, 200X

Cash

Marketable Securities

Accounts Receivable

Inventory

Net fixed assets

Total assets

5

10

10

25

100

150

Accrued wages and taxes

Accounts payable

Long-term debt

Common stock

Retained earnings

Total liabilities and owners equity

CHAPTER 3 – Financial Statements

5

5

20

40

80

150

3 - 18

Preparing Accounting Statements

The Income Statement

• Also known as the profit and loss statement

• Reports the income earned over a given period

of time

– Usually prepared to report on one fiscal year

– Can be prepared for a quarter of a year (3 months) or

even a month

• Reports expenses incurred in order to earn that

income (application of the matching principle)

• Shows sales, expenses and net profit for a given

period.

CHAPTER 3 – Financial Statements

3 - 19

Preparing Accounting Statements

The Income Statement – Basic Structure

Basic Income Statement Structure

ABC Corporation Limited

Income Statement

for the year ended March 31, 200X

Revenues

Cost of goods sold

Gross margin

Selling and administrative expenses

Earnings before Interest and Taxes

Interest expense

Earnings before tax

Income taxes

Net income

Dividends

Retained earnings

$6,700,000

4,020,000

2,680,000

1,500,000

1,180,000

450,000

730,000

233,600

$496,400

Variable

Costs

including

direct

materials

and direct

labour.

$100,000

$396,400

CHAPTER 3 – Financial Statements

3 - 20

Preparing Accounting Statements

The Income Statement – Basic Structure

Basic Income Statement Structure

ABC Corporation Limited

Income Statement

for the year ended March 31, 200X

Revenues

Cost of goods sold

Gross margin

Selling and administrative expenses

Earnings before Interest and Taxes

Interest expense

Earnings before tax

Income taxes

Net income

Dividends

Retained earnings

$6,700,000

4,020,000

2,680,000

1,500,000

1,180,000

450,000

730,000

233,600

$496,400

Fixed period

costs

including

salaries, rent

and

depreciation.

$100,000

$396,400

CHAPTER 3 – Financial Statements

3 - 21

Preparing Accounting Statements

The Income Statement – Basic Structure

Basic Income Statement Structure

ABC Corporation Limited

Income Statement

for the year ended March 31, 200X

Revenues

Cost of goods sold

Gross margin

Selling and administrative expenses

Earnings before Interest and Taxes

Interest expense

Earnings before tax

Income taxes

Net income

Dividends

Retained earnings

$6,700,000

4,020,000

2,680,000

1,500,000

1,180,000

450,000

730,000

233,600

$496,400

Financing

costs.

Interest

expense is

taxdeductible.

$100,000

$396,400

CHAPTER 3 – Financial Statements

3 - 22

Preparing Accounting Statements

The Income Statement – Basic Structure

Basic Income Statement Structure

ABC Corporation Limited

Income Statement

for the year ended March 31, 200X

Revenues

Cost of goods sold

Gross margin

Selling and administrative expenses

Earnings before Interest and Taxes

Interest expense

Earnings before tax

Income taxes

Net income

Dividends

Retained earnings

$6,700,000

4,020,000

2,680,000

1,500,000

1,180,000

450,000

730,000

233,600

$496,400

Profit after

tax may be

retained in

whole or in

part to be

reinvested in

the firm and

fuel the firm’s

growth.

$100,000

$396,400

CHAPTER 3 – Financial Statements

3 - 23

Preparing Accounting Statements

Changing Accounting Assumptions

• GAAP provides flexibility in the accounting treatment of

things such as:

– When to recognize revenue

– Capitalizing expenses as assets versus expensing expenditures

– Rates of accounting depreciation

• Managements may have strong pressures on them to

make the financial performance of the firm look as good

as possible (indeed often their personal compensation

may be affected by the accounting results)

– Consequently, managements may seek to change accounting

assumptions (within the limits allowed by GAAP) to suit their

needs and current circumstances facing the firm.

• Any change in application of GAAP must be disclosed in the audited

financial statements and could jeopardize the audit opinion offered

by the external auditors.

CHAPTER 3 – Financial Statements

3 - 24

Preparing Accounting Statements

Tax Statements

• In Canada businesses must report to CRA and remit income

taxes in accordance with the Income Tax Act.

– They are required to use CCA instead of depreciation

• Firms in Canada also tend to produce a separate set of

financial statements for shareholders, prepared in accordance

with GAAP.

• Because CCA is an ‘accelerated’ method of amortization, and

because assets are often replaced more frequently than they

are fully depreciated, then

– Actual income tax liability in accordance with ITA using CCA is usually

less than what is ‘estimated’ when reporting to shareholders.

– This ‘inter-temporal’ difference in tax liability is called ‘deferred taxes’

and capitalized on balance sheets when reporting to shareholders.

NOTE: deferred taxes DOES NOT mean that the firm hasn’t paid its full tax

liability to the government…it has.

CHAPTER 3 – Financial Statements

3 - 25

Preparing Accounting Statements

Accounting Income, Income for Tax and Economic Income

Accounting Income

– Net profit arrived at using GAAP and accounting depreciation

Income for Tax Purposes

– Net profit arrived at using GAAP and CCA in accordance with ITA

Economic Income

– The amount of funds a firm could withdraw from the firm at the end of an

accounting period, and leave the firm in the same income earning

position as it started the period

Generally:

Accounting Income > Tax Income > Economic Income

– Accounting income is usually greater than income for tax because the CCA

deductions are usually greater than accounting depreciation

– Economic income is less than income for tax because CCA and accounting

depreciation amounts are based on historical cost, and this understates the

amount of money the firm must retain, to replace its asset base at higher

replacement costs.

CHAPTER 3 – Financial Statements

3 - 26

Preparing Accounting Statements

Cash Flow Statements

•

•

•

•

Accounting profit may not reflect the cash flow reality

facing the firm.

The cash flow statement helps to provide a clearer

picture of where cash is coming from and where it is

going.

Analysts are very interested in the cash flow realities of

the firm because they realize that accounting profit is

often not available to manage to pay bills.

There are two ways to calculate the cash flow

statement:

1. Examine changes in the balance sheet accounts

2. Add by non-cash items to net income.

CHAPTER 3 – Financial Statements

3 - 27

The Cash Flow Statement

Changes in Balance Sheet Accounts

Sources of Cash

–

–

–

–

Any decrease in an asset

Any increase in a liability

Any increase in common stock (capital account)

Any increase in retained earnings

Uses of Cash

– Any increase in an asset

– Any decrease in a liability

CHAPTER 3 – Financial Statements

3 - 28

The Cash Flow Statement

Changes in Balance Sheet Accounts - Example

Example of Sources and Uses of Funds

Sources and Uses of Funds for Jim's Widgets

Sources of Funds

Increase in payables

Increase in accruals

Increase in loans

Increase in deferred taxes

Increase in owner's equity

Increased retained earnings

Total sources of cash

$5,000

1,000

10,000

1,500

44,000

2,000

63,500

Uses of Funds

Increase in receivables

Increase in inventory

Increase in prepaid expenses

Increase in machinery

Total uses of cash

Increase in cash

$5,000

2,000

3,500

28,000

38,500

25,000

CHAPTER 3 – Financial Statements

3 - 29

The Cash Flow Statement

Net Income Plus Non-cash Items

– Start with net income

– Add back the non-cash items in the income

statement (usually depreciation/amortization and

deferred income taxes)

CHAPTER 3 – Financial Statements

3 - 30

The Cash Flow Statement

Net Income Plus Non-cash Items - Example

Example of Cash Flow Statement

Cash Flow Statement for Jim's Widgets

Net income

Depreciation

Deferred income taxes

Traditional cash flow

Increase in receivables

Increase in prepaids

Increase in inventory

Increase in accruals

Increase in payables

Increase in net working capital

Cash flow from operations

Capital expenditures

Free cash flow

CHAPTER 3 – Financial Statements

$2,000

2,000

1,500

5,500

-5,000

-3,500

-2,000

1,000

5,000

-$4,500

1,000

-30,000

-29,000

3 - 31

The Canadian Tax System

• Federal and Provincial Governments in Canada tax

individuals and corporations based on income earned.

• Corporations pay income taxes, and then, out of after-tax

profit, distribute dividends to shareholders.

• Dividends received by shareholders are taxed again as

one form of personal investment income.

– Recognizing the double-taxation of dividends, dividends from

Canadian corporations are given some partial relief through the

‘dividend gross-up, tax credit system’

– Dividends received from non-Canadian companies do not qualify

for this special tax treatment.

CHAPTER 3 – Financial Statements

3 - 32

Corporate Income Taxation

• Corporate tax is paid at a ‘flat’ or fixed rate on ‘taxable income’

– Small businesses (income of $300,000 or less) face approximately (the

actual rate varies by province) a 20% tax on income (combined federal

and provincial)

• Companies are free to chose their own taxation year (fiscal

year) but once established cannot alter it without justification

and approval.

• Taxable income generally is income earned during the fiscal

year less expenses incurred in order to earn that income.

– The income statement shows that variable costs and period overhead

costs can be subtracted in determining EBIT

– For tax purposes, the ITA requires that the Capital Cost Allowance

system be used instead of accounting depreciation (amortization)

– Interest expense on debt borrowed to earn income is generally

deductible from earnings before the tax is determined.

CHAPTER 3 – Financial Statements

3 - 33

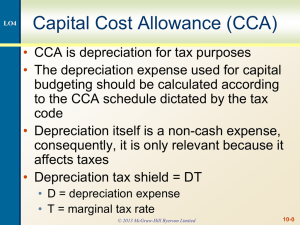

CCA

Capital Cost Allowance (CCA) is the

‘depreciation’ method used by taxpayers in

Canada when reporting business income to

CRA Canada Revenue Agency for tax purposes.

CHAPTER 3 – Financial Statements

3 - 34

Importance of CCA to Financial

Decisions

• Taxation issues must be explicitly addressed in

each financial decision you make.

• Since CCA affects the net income from a

business (and especially affects net cash flow),

knowledge of the CCA system is essential for all

business decision-makers.

CHAPTER 3 – Financial Statements

3 - 35

CCA gives rise to a ‘Tax Shield Benefit’ to

the Company

•

•

•

•

CCA is a non-cash deduction from income that would otherwise be

subject to income taxation.

As a result of the CCA deduction, taxable income is reduced.

This results in a savings in tax payable.

The tax shield benefits is equal to: T(CCA)

t = corporate tax rate

CCA = the dollar amount of CCA claimed

•

A firm with a 40% corporate tax rate and a $2,000 CCA deduction

will save $800 in taxes.

Tax Savings on CCA Corporate Tax Rate CCA

40% $2,000 $800

CHAPTER 3 – Financial Statements

3 - 36

Example:

Consider two firms that report $10,000 in earnings before CCA and taxes, face a 40% tax rate. One

firm has no CCA to claim, the other can claim $2,000 in CCA

Company A

Earnings Before CCA & Tax

CCA

Taxable Income

Taxes @ 40%

Net Income

Add back non-cash expense

Cash flow from Operations

$10,000

2,000

$ 8,000

3,200

$ 4,800

2,000

$ 6,800

Company B

$10,000

0

$ 10,000

4,000

$ 6,000

0

$ 6,000

Note that company A is better off by $800 because of the $2,000 non-cash

deduction of CCA. That is the amount of taxes saved.

If you look at net income, Company A appears to be worse off, however, that is

only an accounting illusion!!

CHAPTER 3 – Financial Statements

3 - 37

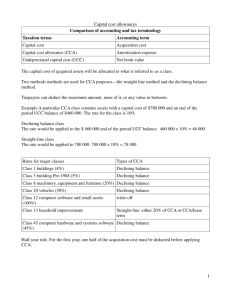

CCA vs. Accounting Depreciation

CCA

Accounting Depreciation

•

•

•

•

•

like assets are grouped into

pools or classes

the CCA rate used in each

asset class is setout in the

regulations to the Income

Tax Act and may or may not

reflect economic wastage

of the asset

no estimate of useful life or

of salvage value

as long as the firm remains

in existence, and assets

remain in the pool, residual

UCC values will remain in

the pool.

•

•

choose the method that will

best represent the

economic wastage of the

asset (declining balance,

sum-of-the-year’s digits,

straight-line, etc.)

individual assets are

depreciated

estimate of useful life and

salvage value is included

CHAPTER 3 – Financial Statements

3 - 38

CCA Over Time - A Simple Example

Assume you acquire a depreciable asset with a cost base of $100,000 and there are no

other assets in this pool. The CCA rate for the pool is 10%. Note you are allowed only

1/2 the regular CCA rate on the net additions to the pool in the year of acquisition.

Year

1

2

3

4

etc.

UCC of pool

$0

95,000

85,500

76,950

Addition CCA @ 10%

$100,000

$5,000

0

9,500

0

8,550

0

7,695

CHAPTER 3 – Financial Statements

3 - 39

CCA Tax Shield Over Time

(Assume a corporate Tax Rate ‘T’ of 40%)

Year

1

2

3

4

5

6

7

8

9

UCC of pool Addition CCA @ 10% T(CCA)

$0 $100,000

$5,000

$2,000

95,000

0

9,500

3,800

85,500

0

8,550

3,420

76,950

0

7,695

3,078

69,255

0

6,926

2,770

62,330

0

6,233

2,493

56,097

0

5,610

2,244

50,487

0

5,049

2,019

45,438

0

4,544

1,818

CHAPTER 3 – Financial Statements

3 - 40

Tax Shield Over Time

(A Graphical Representation)

T(CCA) at 10% on $100,000

4000

3500

3000

2500

Tax Shield 2000

1500

1000

500

0

Asymptotic

Curve

1

3

5

7

9 11 13 15 17 19

Year

CHAPTER 3 – Financial Statements

3 - 41

Observations

• In the foregoing you can now readily see:

CCA a firm claims changes each and every year on a

‘declining balance’-like basis

CCA provides the largest tax shields in the early years

of the asset’s life

residual values remain in the pool long after the asset

was acquired…this means that the firm will never fully

recoup the original cost of the asset … as the firm’s

asset base ages, cash flows generated from CCA will

not enable the firm to replace the original asset.

CHAPTER 3 – Financial Statements

3 - 42

Disposition of Assets and CCA

Capital Gains

• A taxable capital gain would occur if the firm

sold a depreciable asset for greater than it’s

original cost.

Capital Gain = Original Cost Base - Salvage Value

CHAPTER 3 – Financial Statements

3 - 43

Disposition of Assets and CCA

Recapture of Depreciation

• If the salvage value of the asset exceeds the UCC of the

pool there is a recapture of depreciation

• recaptured depreciation is subject to tax

Recaptured Depreciation = UCCpool - Salvage Value

CHAPTER 3 – Financial Statements

3 - 44

Disposition of Assets and CCA

Terminal Loss

• When the last physical asset in the pool is sold and not

replaced, the pool will be closed out.

• If there is a positive balance remaining in the pool after

disposition, that balance is called a terminal loss and is

deductible from income in that year….it is a non-cash

deduction just like CCA.

CHAPTER 3 – Financial Statements

3 - 45

CRA Form for Capital Cost Allowance

An Example

Assume you want to calculate the CCA for Class

Six (10% CCA rate) given an opening UCC of

$91,874; additions to the class of $32,880 and

$25,000 as proceeds on disposals from the

class.

1

Class

number

6

2

Undepreciated

capital cost

(UCC) at the

start of the

year

3

Cost of

additions in

the year

4

Proceeds of

dispositions

in the year

91,874.00 32,880.00 25,000.00

5

6

7

UCC

Adjustments for Base amount

after additions

current year

for capital

and

additions (1/2

cost

dispositions

times (col. 3

allow ance

(col. 2 plus 3

minues 4)) If

(col. 5 minus

minus 4)

negative, enter

6)

99,754.00

3,940.00

8

Rate

%

95,814.00 10%

9

CCA

for the year

(col. 7 times

8 or an

adjusted

amount)

9,581.40

10

UCC at the

end of the

year (col. 5

minus 9)

90,172.60

CCA = $9,581

CHAPTER 3 – Financial Statements

3 - 46

Personal Income Taxation

• Canadians are taxed on their world-wide income

• The taxation year is the calendar year, starting on

January 1 and ending December 31

• The personal tax system is a ‘progressive’ one…as

taxable income increases, it is taxed at progressive

higher rates.

• Table 3 – 7 on the following slide illustrates the top

marginal tax rates in Canada on investment income

(interest, dividends and capital gains).

(Please see the following slide with Table 3 -7)

CHAPTER 3 – Financial Statements

3 - 47

The Canadian Tax System

Personal Income Taxation

Table 3-7 Top 2007 Personal Tax Rates

Taxable Income

Dividends

Eligible Non-eligible

Ordinary

Income

Capital

Gains

Federal Only

29.00%

14.50%

14.55%

19.58%

Alberta

British Columbia

39.00%

43.70%

19.50%

21.85%

17.45%

18.47%

25.21%

31.58%

Manitoba

46.40%

23.20%

23.83%

36.75%

New Brunswick*

46.95%

23.48%

23.18%

35.40%

Newfoundland and Labrador

48.64%

24.32%

32.52%

37.32%

Non-resident

42.92%

21.46%

21.53%

28.98%

Northwest Territories

43.05%

21.53%

18.25%

29.65%

Nova Scotia

48.25%

24.13%

28.35%

33.06%

Nunavut

40.50%

20.25%

22.24%

28.96%

Ontario

46.41%

23.20%

24.64%

31.34%

Prince Edward Island

47.37%

23.69%

24.44%

33.61%

Quebec

48.22%

24.11%

29.69%

36.35%

Saskatchewan

Yukon

44.00%

42.40%

22.00%

21.20%

20.35%

17.23%

30.83%

30.49%

*New Brunsw ick's 2007 budget revised the top combined rates.

CHAPTER 3 – Financial Statements

3 - 48

The Canadian Tax System

Personal Income Taxation of Investment Income

Investment income can be earned by investors

in three different forms:

– Interest

– Dividends

– Capital gains

CHAPTER 3 – Financial Statements

3 - 49

Taxation of Interest Income

• Interest income is taxed at the person’s personal

marginal tax rate (the same rate that employment and

business income is taxed at)

• We use the ‘marginal’ rate because when a person

invests, they are seeking to add to income in the

future…that added income will face the marginal tax

rate.

• All sources of interest must be claimed each calendar

year (both cash interest received, and interest income

that has accrued)

– Accrued interest is interest that has been earned, but not yet

received (for example, from compound interest Canada Savings

Bonds that have yet to be redeemed)

(Please see the following slide with Table 3 -6)

CHAPTER 3 – Financial Statements

3 - 50

Taxation of Interest Income

Ontario Tax Rates – Interest Income

Table 3-6 Ontario Taxable Income

Lower Limit

Upper

Limit

Basic Tax

Marginal Rate on

Rate on Dividend Capital

Excess

Income

Gains

$ - to

$8,148

$-

$8,149 to

$11,337 to

11,336

14,477

$510

16.00

28.10

3.33

5.63

8.00

14.05

$14,478 to

34,010

1,393

22.05

4.48

11.03

$34,011 to

35,595

5,700

25.15

8.36

12.58

$35,596 to

59,882

6,098

31.15

15.86

15.58

$59,883 to

68,020

13,664

32.98

16.86

16.49

$68,021 to

70,559

16,348

35.39

19.88

17.70

$70,560 to

71,190

17,246

39.41

22.59

19.70

$71,191 to

$115,740

115,739

and up

17,495

36,833

43.41

46.41

27.59

31.34

21.70

23.20

0.00%

0.00%

0.00%

Interest income is

taxed at the

investor’s personal

marginal rate.

All interest income,

whether received

in cash or accrued

is subject to tax in

each tax year.

Source: Ernst & Young w ebsite: <w w w .ey.com>.

CHAPTER 3 – Financial Statements

3 - 51

Taxation of Dividend Income

• Dividends from Canadian companies are taxed

using the ‘gross-up, tax credit system’

– Cash dividends are grossed up by 45% and this total

amount is included in taxable income

– A federal dividend tax credit of 18.97% and provincial

dividend tax credit of 6.5% (Ontario) is deducted from

taxes that would otherwise be payable.

– The effect of this system is to effectively reduce the

marginal tax rate applied to dividend income.

(Please see the following slide with Table 3 -6)

CHAPTER 3 – Financial Statements

3 - 52

Taxation of Dividend

Table 3-6 Ontario Taxable Income

Lower Limit

Upper

Limit

Basic Tax

Marginal Rate on

Rate on Dividend Capital

Excess

Income

Gains

$ - to

$8,148

$-

$8,149 to

$11,337 to

11,336

14,477

$510

16.00

28.10

3.33

5.63

8.00

14.05

$14,478 to

34,010

1,393

22.05

4.48

11.03

$34,011 to

35,595

5,700

25.15

8.36

12.58

$35,596 to

59,882

6,098

31.15

15.86

15.58

$59,883 to

68,020

13,664

32.98

16.86

16.49

$68,021 to

70,559

16,348

35.39

19.88

17.70

$70,560 to

71,190

17,246

39.41

22.59

19.70

$71,191 to

$115,740

115,739

and up

17,495

36,833

43.41

46.41

27.59

31.34

21.70

23.20

0.00%

0.00%

0.00%

The dividend

gross-up, tax credit

system makes

dividend income

the lowest taxed

investment income

in the lower tax

brackets.

Source: Ernst & Young w ebsite: <w w w .ey.com>.

CHAPTER 3 – Financial Statements

3 - 53

Taxation of Capital Gain Income

• Only realized capital gains are taxed

– This is a very important feature for high income earners who do

not need investment income to fund their everyday living

expenses…they can afford to wait to sell their investments

indefinitely…and indefinitely delay paying taxes on the capital

gains

• 50% of a realized capital gain is subject to tax at the

person’s marginal tax rate.

• Capital losses can only be used to offset taxable capital

gains.

(Please see the following slide with Table 3 -6)

CHAPTER 3 – Financial Statements

3 - 54

The Canadian Tax System

Personal Income Tax Rates – Capital Gains

Table 3-6 Ontario Taxable Income

Lower Limit

Upper

Limit

Basic Tax

Marginal Rate on

Rate on Dividend Capital

Excess

Income

Gains

$ - to

$8,148

$-

$8,149 to

$11,337 to

11,336

14,477

$510

16.00

28.10

3.33

5.63

8.00

14.05

$14,478 to

34,010

1,393

22.05

4.48

11.03

$34,011 to

35,595

5,700

25.15

8.36

12.58

$35,596 to

59,882

6,098

31.15

15.86

15.58

$59,883 to

68,020

13,664

32.98

16.86

16.49

$68,021 to

70,559

16,348

35.39

19.88

17.70

$70,560 to

71,190

17,246

39.41

22.59

19.70

$71,191 to

$115,740

115,739

and up

17,495

36,833

43.41

46.41

27.59

31.34

21.70

23.20

0.00%

0.00%

0.00%

Source: Ernst & Young w ebsite: <w w w .ey.com>.

CHAPTER 3 – Financial Statements

At the higher

marginal tax

brackets,

taxpayers will

prefer to receive

their investment

income in the form

of capital gains

because they are

taxed at a 23.2%

marginal rate.

Only ‘realized’

capital gains are

subject to tax.

3 - 55

Internet Links

•

•

•

•

•

Canada Revenue Agency – CCA Classes

Canada Revenue Agency – CCA Depreciable Property Described

Canada Revenue Agency – Tax Forms

Canada Revenue Agency – CCA Form 2006 and later years

About Capital Cost Allowance (Small Business Canada)

CHAPTER 3 – Financial Statements

3 - 56

Summary and Conclusions

In this chapter you have developed:

– A basic overview of accounting statements

– An understanding of the importance of generally

accepted accounting principles

– An understanding of the Canadian tax system

and the importance of tax considerations in

financial decision-making.

CHAPTER 3 – Financial Statements

3 - 57

Copyright

Copyright © 2007 John Wiley & Sons Canada, Ltd. All rights

reserved. Reproduction or translation of this work beyond that

permitted by Access Copyright (the Canadian copyright licensing

agency) is unlawful. Requests for further information should be

addressed to the Permissions Department, John Wiley & Sons

Canada, Ltd. The purchaser may make back-up copies for his or her

own use only and not for distribution or resale. The author and the

publisher assume no responsibility for errors, omissions, or damages

caused by the use of these files or programs or from the use of the

information contained herein.

CHAPTER 3 – Financial Statements

3 - 58