The need for Revenue Generation in Today*s

advertisement

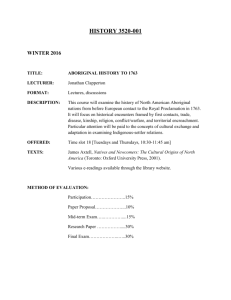

The 16th ANNUAL BENEFITS CONFERENCE Watson Parojcic Financial Niagara Falls, ON “Aboriginal Financial Literacy Initiatives” June 6, 2013 Paulette Tremblay, PhD, MA, B.Ed, BA, ICD.D, CAPA Mohawk of the Six Nations Grand River Territory, Turtle Clan AFOA Canada - Director, Education and Training Presentation Overview AFOA Canada What is Financial Literacy? AFOA Canada Aboriginal Financial Literacy Initiatives Demystifying Finance for Elected Aboriginal Leaders Dollars & Sense International Literature Review of Indigenous Financial Literacy OFIFC – Train the Trainer in Financial Survival Skills Atlantic Chiefs & CFOs – Community Financial Needs 2 AFOA Canada – Founded in 1999 1- Vision & Mission Vision AFOA Canada is the centre for excellence, information and certification in Aboriginal management. Mission Building management proficiency and connections that enhance effective Aboriginal governance, administration and self-reliance. AFOA Canada 2- How we do this. 1. Education & Certification 2. Professional Development 3. Networking and knowledge sharing 4. Capacity development research 5. Participate in development of financial management, accounting, reporting standards, and senior administration 6. Promote what works well 7. Supporting Aboriginal accountability and governance efforts 8. Encourage Aboriginal youth to enter the profession – Youth awards and scholarships AFOA Canada 3 – Who we are. Head Office in Ottawa 8 Chapters Aboriginal controlled Governed by Board of Directors Non-profit Non-political AFOA Canada 4 – Membership AFOA’s membership is comprised of: Chiefs, Band Administrators Aboriginal Financial Managers Directors & Officers Program Managers Economic Development Consultants Tribal Council members Chief Financial Officers Accountants Chief Executive Officers Government Regional Composition March 2013 STATISTICS Total members: 1,583 350 300 317 287 267 235 238 250 200 150 100 72 42 50 18 38 46 22 1 0 BC AB SK MB ON QC ATL YT NT NU Corp Inter'l Aboriginal People 1- Definition Section 35 of the Constitution Act, 1982 recognizes three original peoples of Canada: First Nations (Indians), Inuit and Métis. Each population is distinct from the others and has a unique history. Within each group there is also considerable diversity. 2- Aboriginal Population in Canada In 2011: 1, 400, 685 Aboriginal people – 4.3% total Canadian population 851,560 identified as First Nations – 60.8% total Aboriginal population 451,795 identified as Métis – 32.3% total Aboriginal population 59,445 identified as Inuit – 4.2% total Aboriginal population National Household Survey, 2011, Statistics Canada Financial Literacy – Financial Know How 1 - Definition Having the knowledge to understand personal and broader financial matters Having skill to apply that knowledge and understanding to everyday life Having the confidence to use the skills and knowledge to make responsible financial decisions that are appropriate to the individual’s situation. Task Force on Financial Literacy (Appointed June 2009) 9 Financial Literacy – Financial Know How 2 – Aboriginal Financial Literacy Great need to build math and money skills and how to make financial decisions Journal of Aboriginal Management (JAM, Issue 11, October 2012) 10 Aboriginal Financial Literacy Initiatives 1A.-Demystifying Finance for Elected Aboriginal Leaders (2011) One day workshop and guidebook Purpose – Provide elected officials in First Nations with the knowledge to understand and interpret financial reporting and information Plan to develop part 2 to this workshop 11 Aboriginal Financial Literacy Initiatives 1B.-Demystifying Finance for Elected Aboriginal Leaders (2011) Building Financial Literacy – Topics Covered Leadership Roles & Responsibilities -Chief & Council, Admin, Finance Dept Basic Financial Concepts & Reporting -Accounting, Bookkeeping, GAAP Financial Reports – the Financial Statements, Statement of Financial Position, the Common Government Reporting Model, Statement of Operations, Cash Accounting vs. Accrual Accounting, the Audit Budgets & Budget Controls Financial Governance and Decision Making – Finance Committee, Audit Committee, Policies, Procedures, Regular Financial Reviews 12 Aboriginal Financial Literacy Initiatives 2A. Dollars & Sense Development Aboriginal youth and finance November 2010 - TD Bank Financial Group provided the funding that made this project possible. AFOA would like to thank them for this significant contribution. November 2010 – Engaged firm to develop materials for this project. March 2011 – Development of a half day workshop with a Youth Manual, Facilitator Manual and Videos was completed. 13 2B. Dollars & Sense - Why Important? Increase financial knowledge to: Handle finances and use money wisely. Make informed decisions. Determine real costs of products and services. Build financial resources by saving. Develop good savings habits. AVOID – high levels of debt, financial problems in the future, and being a victim of fraud. 14 2C. Dollars & Sense Key Themes of Workshop Introduction Activity Theme 1 – Principles of Effective Money Management Theme 2 – Income and Expenses, Budgeting and Goal Setting, Saving and Investing Theme 3 – Purchasing, Consumer Awareness, Credit and Risk, Banking That’s Right for You Theme 4 – How Sound Financial Practices Impact You and Your Community Closing Activity 15 2D. Dollars & Sense Initial Delivery September 2011 – Saskatoon Tribal Council engaged AFOA to deliver 8 Dollars and Sense workshops in six schools. November 2011 – May 2012 - Six workshops were conducted in 6 First Nations schools: - 3 schools - K to G9; - 2 schools – K to G7; and - 1 school – SK to G8. Approximately 120 students attended the workshops. 16 2E. Dollars & Sense Results Recommended Revisions Timing to reflect school schedule Pace was too fast – too much to cover Use of applicable examples & story telling based on experiences More interactive exercises to engage students Consider reading levels and attention deficit students Consider students with parents on social assistance Less Powerpoint and more interaction 17 2F. Dollars & Sense - Pilot Revised workshop materials – developed module for students in grades 11 & 12. Customized agenda to match school periods. November 2012 – delivery of secondary school module in First Nations community in Ontario Twenty students participated in the session. Conducted pilot evaluation of delivery. Students rated the session on all items an average of 84% to 92% in terms of finding the session to be practical, applicable to community, well organized, and presented in appropriate manner. 18 2G. Dollars & Sense Future Direction DEVELOPMENT OF MODULES Secondary School Module – G 11 & 12 Middle School Module – G 7 & 8 Elementary School Module – G 3 & 4 Customized Modules 19 2G. Dollars & Sense Delivery of Modules At targeted grade levels within modules Customized to meet needs of school(s) Selecting module facilitators Training sessions for facilitators 20 Aboriginal Financial Literacy Initiatives 3A. International Literature Review of Indigenous Financial Literacy December 2012 – Applied for and received grant from the TD Financial Literacy Grant Fund Objective – Conduct an international literature review and produce a research report on the current state of Indigenous financial literacy in Canada, United States, Australia and New Zealand Project Timeline – January – December 2013 Future – Hold international conference 21 3B. International Literature Review of Indigenous Financial Literacy – Research Questions 1. What has been done over the last 12 years – 2000 – 2012? 2. What relevant Indigenous financial literacy education and training programs and curriculum exist across the four stages of the life cycle: children; adolescents, adults, and elderly? 3. Where are the gaps? 4. What education and training programs are most needed to address Indigenous learning gaps and priorities? 22 3C. International Literature Review of Indigenous Financial Literacy – Project Steps 1. February 2013. Engaged an Aboriginal consultant to conduct research. 2. May 2013. Set up an international Advisory Committee to review materials produced and oversee the study. 3. March & May 2013. Preliminary search of primary sources produced very little Indigenous financial literature studies. Search of secondary sources has produced approximately 50 relevant Indigenous studies. 4. June 2013. First Advisory Committee teleconference to review findings and provide feedback. 23 Aboriginal Financial Literacy Initiatives 4 – OFIFC – Train the Trainer in Financial Survival Skills October 2012 – Asked to write proposal for development of a ten hour workshop to train Friendship Centre trainers Financial Literacy – Defined as knowledge of financial concepts, skills and attitudes where knowledge is translated into behaviours that result in good financial outcomes. Financial Survival Skill Topics Financial planning, budgeting & savings Borrowing & investing Earning Income – employment, business, self employment Government programs – student loans, EI, Disability, Retirement Life events & financial stability Financial negotiation Banking and banking services 24 Aboriginal Financial Literacy Initiatives 5 – Atlantic Chiefs & CFO’s Community Financial Needs WHO. Working with the Assembly of First Nations (AFN), Aboriginal Affairs and Northern Development Canada (AANDC), Atlantic Chiefs and CFOs PURPOSE. Identify financial literacy and acumen needs of First Nations communities. INTENT. Based on needs and gaps, AFOA Canada to develop materials and workshops. TIMELINE. Project just beginning – complete by end of fiscal period, March 31, 2014. 25 Questions & Answers Nia:wen!! Thank You!! For more information please contact: Dr. Paulette Tremblay, PhD, MA, BEd, BA, ICD.D, CAPA Director of Education & Training ptremblay@afoa.ca Randy Mayes, CAFM Manager, Education & Membership rmayes@afoa.ca Odessa Belanger CAPA Administrative Assistant obelanger@afoa.ca Telephone: Website: (866) 722-2362 www.afoa.ca