Estate Planning and Tax Strategies for Executives and Business

advertisement

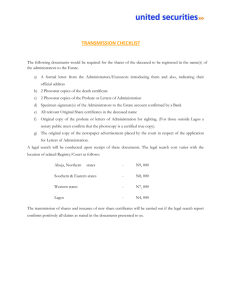

Financial Estate Planning Considerations and Tax strategies for Executives and Business Owners Whitney Hammond CFP, CLU Scott Sadler FSA, FCIA Steve Shillington CA, CFP, TEP Agenda 1. 2. 3. 4. Comprehensive planning Tax and estate planning strategies Life insurance ‘tax shelter’ Questions Total Planning • Financial, estate, tax and business exit strategy planning can’t be done in isolation from personal goals and values • Business exit strategy and succession planning can’t be isolated from: – Personal estate planning – Personal financial planning – Personal tax planning Planning Pyramid Financial Status 3 2 1 Financial Goals Community (Social Capital Legacy) Family (Family Legacy) Self (Financial Independence) Values, Goals & Objectives Planning Pyramid – Business Owners • Financial independence – Create viable exit strategy for current owner – Protect business from others • Family legacy – Preserve business as family heirloom (maybe) – Provide opportunity for family members (maybe) – Distribute estate ‘equitably’ amongst successors/others • Social capital legacy “Exit Strategy” • “Succession plan” too limiting – 30% of family businesses make it to Gen 2 – 5%-10% make it to Gen 3 • Focus on controllable elements – Reduce financial reliance on business – Cover down side-role of savings and insurance – Systematize mgt processes to facilitate succession or maximize value on sale to 3rd party – Let’s make sure you have options Incorporation (professionals) • Creditor protection (business creditors) • Tax deferral if not spending all you earn • Income splitting – Salary to spouse and children (must support $$) – Dividends • With spouse (Where spouse allowed to own shares) • With children age 18+ (to avoid ‘kiddie tax’) $750,000 capital gains exemption • Not realistic in some cases – e.g. doctors can’t sell their ‘book’ • Not always available in many other cases – Buyer generally doesn’t want to buy shares – Passive assets exceed 10% of assets almost immediately • Strategies available to ‘purify’ – E.g. Sister company to hold investments – Consider cost,complexity, likelihood of share sale New Tax Rates: Change in Plans? First $500,000 $500,000-$1,500,000 M&P $500,000-$1,500,000 Other Over $1,500,000 M&P Over $1,500,000 Other Investment income 2009 16.5% 34.3% 37.3% 31.0% 33.0% 48.7% 2013 15.5% 25.0% 25.0% 25.0% 25.0% 44.7% ‘Bonus Down’ Strategy (Active business income > $500,000) Corporate active business income Bonus Remaining income Corporate tax (2012+) Remaining in the company Bonus 1,000.0 -1,000.0 0.0 -0.0 0.0 No Bonus 1,000.0 -0.0 1,000.0 -250.0 750.0 Salary Personal tax (assuming highest rate) After tax personally 1,000.0 -464.1 535.9 0.0 0.0 0.0 535.9 750.0 Money at work after tax ‘Bonus Down’ Strategy (Active business income > $500,000) Bonus Money at work 535.9 ‘Eligible’ dividend paid later n/a Remaining in hands of shareholder 535.9 Extra combined tax No Bonus 750.0 -221.6 528.4 .65% Leaving the income in the company gives the business owner a 21% tax deferral on active business income over $500,000 and combined tax is only slightly higher if and when this surplus is paid out as a dividend. ‘Bonus Down’ Strategy • Consider not ‘bonusing down’ to $500,000 • Some of the other considerations – Maximize CPP? (if not done with base salary) – Maximize RRSP? (if not done with base salary) – Creditor protection (bonus and loan back net if no holding company) – Maintain eligibility for $750K capital gains exemption Holding Company • Holding company Before Owner After Owner 100% Business 100% Holding Company 100% Business Holding Company • Benefits – Asset protection • Tax-free dividend up to Holdco • Loan back as secured note - maintain working capital • Out of reach of general creditors of business – Real estate and portfolio investments • Sisterco to maintain Opco eligibility for $750K CGE – Income splitting-dividends-shares to children(18+) • Note: doesn’t help with 750K CGE purification Estate Freeze • Estate freeze Before Owner 100% Business $2,000,000 After Trustee: Owner, Others Owner 100% Preferred Value today: $2,000,000 Family Trust 100% common Value today: zero Business $2,000,000 Beneficiaries: Owner, spouse, children Estate Freeze • Benefits of a freeze – On future growth (above $2,000,000 in this case) • Defer tax at death by one or more generations • Multiply $750,000 capital gains exemption – Sprinkle dividends to low income family members • Benefits of discretionary family trust – Defer decision on who gets shares (by 21 years) – Ability to reverse freeze – distribute to parents Personal strategies-Investments • TFSA: re-contribution pitfall • Spousal loan • Gift of marketable securities Will and Probate Planning • Estate administration tax (EAT) – Probate of a will: • Establishes legitimacy of the ‘executor/administrator’ • Frees financial institutions to release assets • A ‘probate’ judge certifies the will – Probated will subject to EAT (‘probate tax’) • $5/$1,000 on 1st $50,000, $15/$1,000 on excess • Applicable to ALL assets that pass through that will e.g. $2,000,000 estate attracts $30,000 of EAT Strategies to Reduce EAT • Dual wills – separate will for shares of and debt receivable from private companies • Spouses hold assets in joint tenancy • Named beneficiaries on RRSPs, insurance • Inter-vivos Trust • Don’t let EAT planning drive bad decisions – e.g. Insufficient assets to pay tax/final expenses – e.g. Joint ownership with children -triggers capital gain Testamentary Trusts • Control and protection – Creditor protection – Protection from family law claims • Spousal – Assets must ‘vest indefeasibly’ • Children and grandchildren – Allow beneficiary to become trustee – Don’t force the trust to be wound up at certain age • Tax savings – Annual tax savings of up to $18,000/yr. – Depends on size of trust and other income of beneficiary Estate Gifts • Will must name charity • Will must specify dollar amount or % of residual • Donation can be used on final tax return of deceased or by estate Insured Gift of Private Corp. Shares • Will amended to bequeath shares to charity • Insurance equal to value of shares purchased • At death – Shares bequeathed to charity by Estate – Company redeems shares using insurance proceeds – Residual capital dividend account created by insurance proceeds-used to distribute other surplus or future earnings to the heirs as tax free capital dividends Insured Gift of Private Corp. Shares • Example – – • $2,000,000 of shares $1,000,000 of life insurance Options – – – Do nothing Estate gives $1,000,000 of shares to the Charity Estate gives $1,000,000 of shares to the Charity and the Company purchases $1,000,000 insurance to redeem those shares at death Insured Gift of Private Corp. Shares Family Charity Tax No Donation $ 1,536,000 $ 0 $ 464,000 Donation of $1,000,000 Shares $ 1,000,000 $ 1,000,000 $ 0 Insured Donation of Shares $ 1,000,000 $ 1,000,000 $ CDA $ $ $ 1,000,000 0 0 Additional win for life insurance if it’s less expensive than alternatives for funding share redemption Asset diversification • Cash, fixed income, equities, real estate • Private business – Entrepreneurs comfortable with heavy focus on one investment (the business) – Foolish to suggest there are better investments – However, viewing business in context of investment asset allocation is legitimate consideration Net Worth Statement Life insurance cash value RRSP Non-registered and RESP Shares of holding company Real estate Financial assets Home Household effects (est.) Total assets Total liabilities Net worth Mr. Mrs. Total 20,000 0 20,000 95,000 18,000 113,000 3,000 2,000 5,000 4,775,000 0 4,775,000 315,000 0 315,000 5,208,000 20,000 5,228,000 0 380,000 380,000 40,000 40,000 80,000 5,248,000 440,000 5,688,000 0 33,000 33,000 5,248,000 407,000 5,655,000 88% of financial net worth is in equities *including the business) and real estate Value of Holding Company Value of operating company (subsidiary) 2,275,000 Real estate 1,500,000 Investibles-equities 500,000 Investibles-fixed income 500,000 FMV of shares of holding company 4,775,000 Life Insurance Strategies • • • • • • Participating life insurance a.k.a. ‘Investment grade’ permanent insurance Return of profit mechanism (‘dividends’) Values vest at each anniversary (can’t go down) Stable patterns of cash and death benefit growth Largely backed by fixed income Insured Asset Transfer • Reposition non-registered assets into permanent life insurance – Tax shelter fixed income – Cash value growth is tax deferred – Cash value growth is tax free to extent left until death • Can be done personally or inside corporation Corporate Insured Asset Transfer an example • • • • Clients are married couple Both age 55 Standard medical rating, non-smokers $1,000,000 coverage suggested to cover tax at death • Range of options considered: – Minimum funded universal life – Participating whole life with maximum funding Corporate Insured Asset Transfer an example • Product: maximum funded whole life – 10 annual deposits of $42,582 – Owned in holding company • Compare to fixed income investments – Earning 5% interest – Taxed at 47.7% (passive income) • Compare asset in company and net amount paid to executor of estate Estate and Cash Position $3,000,000 $2,000,000 $1,000,000 $65 75 Age 85 95 Net Estate-Insurance Corporate Asset-Insurance Cash Surrender Value Corporate Asset-Investment Net Estate-Investment No values guaranteed-not valid without accompanying illustrations of policy values including disclaimers and sensitivity analyses Enhanced Retirement Income Assumptions • Male 42, standard, non-smoker • Considering $5M cash value life insurance policy to diversify portfolio –Premiums are $170K x 5 years • At age 65, assign insurance policy to a bank as collateral for annual loan advance –Annual draw is $130K to age 90 –Tax free under current Canadian tax law Enhanced Retirement Income • Deposits and loan advances occur at the beginning of year, values at end of year • Life insurance cash values based on current dividend scale • Collateral Loan based on 7.5% gross rate • Loan interest is deductible • Tax savings applied to reduce loan balance Enhanced Retirement Income Capital Efficiency Test • Life Insurance – Annual $130K loan advance (tax-free) to age 90 • Equities – $169K pre-tax nets $130K @ 23.2% tax • Fixed Income – $242K pre-tax nets $130K @ 46.4% tax • Dividends – $189K pre-tax nets $130K @ 31.3% tax Capital Efficiency Test To Provide an Equivalent After-tax Income Why Life Insurance? • • • • • One tool in your financial planning toolkit Tax sheltered growth, no CRA deposit limit Creditor protected Free from probate if properly structured A private tool for wealth transfer to future generations • An efficient use of fixed income assets Questions Thank you for participating in our presentation today. Whitney Hammond and team can be reached at: 905-637-3500 627 Guelph Line, Burlington, L7R 3M7 www.sovereignwealth.ca