General Principles of Financial Planning

advertisement

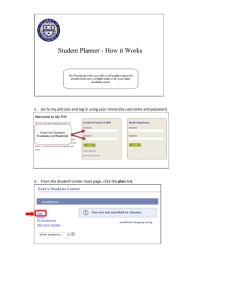

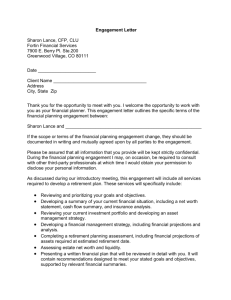

General Principles of Financial Planning Topic 1: Financial Planning Process • Learning Objectives (a) Diagram the personal financial planning process as defined by the CFP Board’s Job Task Domains and Financial Planning Practice Standards. (b) Recognize unethical practices in the financial planning profession based on the CFP Board Standards of Professional Conduct. Topic 1: Financial Planning Process • • • • • • Purpose and benefits Six step process Responsibilities Financial planning methodology Ethical issues Assessing risk tolerance Topic 1: Purpose and Benefits of the Financial Planning Process • Purpose – To prepare a road map for clients to follow in accomplishing their financial objectives • Benefits – To derive various solutions toward the accomplishment of significant goals and the satisfactory resolution of client issues Topic 1: Six Steps in the Financial Planning Process (EGADIM) 1. 2. 3. 4. 5. 6. Establish and define the relationship Gather client data, including goals and objectives Analyze information Develop the plan Implement the plan Monitor the plan Topic 1 Step 1: Establishing the ClientPlanner Relationship • Among the topics to be addressed in this step are: – Identifying the services that will be provided – Describing how the planner will be compensated – Identifying the specific responsibilities of both the planner and the client – Deciding on the time frame of the engagement – Discussing any other matters needed to define or limit the engagement’s scope Topic 1: Factors Used to Determine if a Planner is Practicing Financial Planning • Four factors used by CFP Board to determine if a planner is practicing financial planning or the material elements of financial planning – Client’s understanding and intent – Comprehensiveness of data-gathering – Breadth and depth of recommendations – Degree to which multiple subject areas are involved Topic 1: Rule 1.3 • If the services include financial planning or the material elements of the financial planning process, the certificant or the certificant’s employer shall enter into a written agreement governing the financial planning services (“Agreement”). The Agreement shall specify: – The parties to the Agreement – The date of the Agreement and its duration – How and on what terms each party can terminate the Agreement – The services to be provided as part of the Agreement Topic 1: Rule 2.2 • A certificant shall disclose to a prospective client or client the following information: – Description of compensation, including the terms under which the certificant or certificant’s employer may receive any other sources of compensation and what those payments are based on – Conflicts of interest – Material information that could reasonably be expected to affect the client’s decision to engage the certificant, including information about the certificant’s areas of expertise – Contact information for certificant and employer – If the services include financial planning or the material elements of financial planning, these disclosures must be in writing • The certificant shall timely disclose to the client any material changes to the above information Topic 1 Step 2: Establishing the Client’s Goals and Objectives and Gathering Information • Establishing goals and objectives – Quantify specific financial goals in dollar terms and within definite time frames – General aspirations must be specified in detail – Rank the objectives according to the client’s priorities – Examine the objectives with due regard to the client’s limited resources and other constraints Topic 1: Typical Information Gathered • Assets - FMV, basis, date acquired, and related debts • Liabilities - Debts, alimony and support • Life insurance - Policy amounts, beneficiary designations, and premium payments • Income - Wages, salary and other income • Expenditures - Current budget, savings and investments • Investments - Risk-tolerance and investment objectives • Estate planning - Wills, trusts, gifts, inheritances, and impact of future earnings • Retirement planning - Retirement age, travel goals, and part-time consulting • Miscellaneous - Disability income, medical expenses, education, and hobbies Class Exercise • The following list contains common data-gathering questions. Brainstorm ways to change the wording of each question to encourage the client to offer qualitative details. In other words, turn the closed-end question into an openend question. • • • • • • • • • • • 1) How much life insurance do you have? 2) Do you have long-term care insurance? 3) Do you have a will? 4) Who is the beneficiary on your retirement accounts and life insurance policies? 5) Do you have a retirement plan at work? 6) Do you have an IRA? 7) What kinds of investments have you owned in the past? 8) What is the purpose of the money in this account? 9) At what age do you plan to retire? 10) What are your financial goals? 11) Are there any “special needs” children or grandchildren in your family? Topic 1: Problems With Gathering Information • If the planner has made reasonable effort to obtain pertinent information from the client but the client has failed to provide the information, the planner may need to: – Redefine the scope of the engagement to exclude the area for which there is missing information – Terminate the engagement Topic 1 – Step 3: Steps for Analyzing and Evaluating the Information Gathered • Review – – – – – – Financial statements Cash flow statements Insurance policies Wills Trusts Buy-sell agreements • Analyze the information – To determine the strengths and weaknesses in the client’s financial position • Evaluate – The client’s objectives in view of available resources – The economic conditions as they relate to future resources and cash flow for the client Topic 1 Step 4: Developing the Plan • Identify the strategies and products available for achieving the client’s objectives – Educate the client as to the alternatives and advantages and disadvantages of each alternative, including maintaining the status quo • Select the most appropriate strategies and products from those available – Provide additional disclosures based on product recommendations Topic 1 Step 5: Implementing the Plan • Work closely with other professionals to carry out the financial plan designed for the client • Define what the planner will do and when, and what the client will do and when Topic 1 Step 6: Monitoring the Plan • Periodically review the plan to determine the significance of any changes in: – – – – Federal tax laws Economic conditions Available investment techniques Client’s goals and objectives • If new areas of planning arise that were not part of the original scope of the engagement, the planner and client will need to go back to step 1 and redefine the scope of the engagement Topic 1: Responsibilities • Typically, the financial planner is responsible for all six steps in the financial planning process • The client will be responsible for: – Providing all of the necessary information – Reviewing the recommended plan – Some of the implementation – Monitoring the plan Topic 1: Financial Planning Methodology • Single-purpose view – A single financial product or service can be considered financial planning • Multiple-purpose view – Financial planning must deal with a broad range of financial concerns, such as investments, insurance, and taxes • Comprehensive view – True financial planning must cover all of the client’s financial concerns and goals • Purist view – Comprehensive planning done in a single client engagement (with ongoing monitoring), on a fee-only basis Topic 1: Ethical Issues • The difference between compliance and ethics – Compliance is upholding the law – Ethics is doing what is morally correct rather than merely doing what is legally acceptable • CFP Board’s Code of Ethics and Professional Responsibility will be discussed in detail in Topics 76 - 78 Topic 1, Part 2: Assessing Risk Tolerance • Four life situations involving risk – Monetary – Physical – Social – Ethical • Planners should not assume monetary risk tolerance based on a client being risk tolerant in other areas Characteristics of Risk Averters versus Risk Takers Risk Averter Perceive risk as danger Tend to overestimate risk Prefer low variability of possible results Focus on worst-case scenario Tend to be pessimistic Tend to like structure Tend to dislike change Prefer certainty Risk Taker Perceive risk as opportunity Tend to underestimate risk Prefer high variability of possible results Focus on best-case scenario Tend to be optimistic Tend to prefer ambiguity Tend to enjoy change Prefer uncertainty Demographics and Risk Tolerance Tendency to be LESS risk tolerant Tendency to be MORE risk tolerant Inherited wealth Lower degree of formal education First-born children Married with dependents Work in public sector Nonprofessional Same job for long time Lower-level managers Compensated by salary Earned wealth Higher degree of formal education Later-born children Single Work in private sector Professional Changes jobs often Upper-level managers Compensated by commission Investment Risk Tolerance • Understanding the trade-off between risk and return • Perceived risk is the individual’s interpretation of a risky situation • Bounded rationality – There are limits on how rationally human beings can act in many situations • Risk tolerance versus risk capacity – Risk tolerance = the amount of risk a client is willing to take on – Risk capacity = the amount of risk the client can afford to take on • Use of risk tolerance questionnaires • End of Topic 1