The Source of Capitalism

advertisement

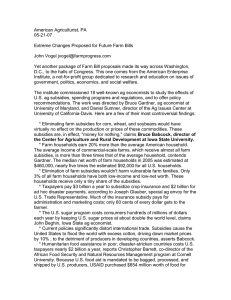

The Source of Capitalism Why is Government in My Market? Mark Chabot Political Economy Dr. Lutz There is a tradition in America of always promoting strict capitalism in the name of fostering a free market. This has resulted in an attitude that looks at government intervention in the market as a hindrance to the economy. Most view this as an act of socialists attempting to progress their agenda. The irony in this, as M`edaille claims, is that “capitalism requires socialism for its very stability.”1 Very few, if any, economists in the neoclassical school of thought would be able to recognize just how much truth is in this claim. It explains the reasoning as to how the federal government believes it to be necessary to give tax dollars to private corporations in an effort to save the paydays of many rich and irresponsible CEOs. Also the purpose of subsidies such as agriculture or, in the modern sense, the notion of “green energy,” and lastly, how all of this ties in to our ever expanding government that has run up a massive deficit that only shows promise of growing. The first piece of evidence for the need of socialism in a capitalist market is one we as a nation have had plenty of experience with throughout the last decade. This is the matter of the federal government believing they have the ability to hand public funds over to private companies in an effort to keep these companies floating along and not going bankrupt immediately. In order to defend these actions, the president, be it Bush or Obama, repeated the mantra “too big to fail.” This meant that a corporation was indispensable because of the fact that they employed a multitude of laborers. What was really happening was the person who was in charge was worried about increasing the already high unemployment rate. In order to keep that from happening it was necessary for government to intervene in the market and “bailout” these companies. Really it did not matter to them whether these people had good and sustainable jobs, 1 John M`edaille, Toward a Truly Free Market, (United States: Intercollegiate Studies Institute, 2010), P. 177. but rather it was a mechanism to garner votes in the next election cycle. Did it ever occur to these politicians that allowing the corporation to fold into bankruptcy could be beneficial for the company? All that bailouts bring are irresponsible management and the propping up of a dying industry. M`edaille devotes an entire chapter to the cost of government and throughout his criticisms is the ever present subsidy. This is a problem that has persisted within America ever since Reconstruction and growing faster since the Great Depression. After the defense and international aid budgets, M`edaille starts looking in to the damage that agriculture subsidies breed. In one sentence, he says about farm subsidies, “the original (intent) was to stabilize the ‘family farm,’ but the actual effect has been to replace the family farm with agribusiness.”2 As a worker in a produce department at a local grocery store, I have seen this kind of practice. It is strange to me to see vegetable coming from California or fruits coming from South America. I have wondered how it is possible for it to be more efficient to sell and buy goods that are not remotely near their final destination. Obviously I understand the problem of scarcity within regions, for example, it is impossible to grow anything in northern Indiana through the months of October to April at the earliest. The problem I am attempting to communicate is that large corporations are able to increase their influence over multiple regions because of government subsidies. With the growth of one large business typically comes the collapse of many more. So what has the effect of these policies been on America throughout our history? To find this answer one does not have to look much farther than the massive federal debt that has accumulated over the last century, and most recently tripled within the last decade. America has been allowed to do this by being subsidized itself by other countries, such as China. In effect the 2 Free Market, p. 171. government has become bloated beyond any quick relief, something that requires much more help than what one Gas-X could provide. The federal government has now stretched itself to being involved in any matter that it sees fit. This includes not only the economy but also the education, private lives, foreign affairs, and state’s rights. For the federal government to be able to continue its existence, it will be necessary to immediately reduce the strain that this immoral and unjust deficit has on the present and future state of the government. In order to reduce the deficit, common sense solutions need to be proposed. Raising income taxes, as most Democrats propose, would help to raise much needed revenue to pay down this debt. There are a couple of issues to be had with this. The first of which is, is it just to involuntarily take money from one person in order to survive? The obvious answer to this ethical question is no, and when someone does this to another it is called theft. However if that person is wearing a suit and badge with the acronym IRS on it, then the theft suddenly becomes tolerated and sometimes praised. I am not denying the necessity of taxes. Paying taxes is an inherent part of being a citizen of a country. The problem is that there must be a point that taxes can no longer be looked to as a viable option to raise revenue for a government that has shown a bad track record with handling its citizen’s property. The Republicans have decided to go a different route. This party recognizes government spending as the main contributor to increasing power and size at the federal level. In order to cut the deficit, they propose cutting so-called “entitlement programs.” This would include programs such as social security, Medicare, Medicaid, and other welfare programs. The problem with this proposal is that it does not come close to cutting enough while at the same time it cuts services that people have come to rely on, which at the same time is not right but must be tolerated for the moment. They champion these cuts while at the same time promoting looser restrictions and higher subsidies for large corporations. This is all without even mentioning the adamancy of keeping a bloated military budget but that subject could be the topic of a paper in itself. Both parties have chosen to completely ignore a very basic principle that explains exactly how a large bureaucracy, aka the federal government, should be run. That principle is subsidiarity and has to deal with government’s proper role. M`edaille says in regards to subsidiarity that, “we have stood the natural order of government and social life on its head, with the most remote becoming more important than the local.”3 M`edaille is essentially saying here is that we, as citizens, cannot look towards the federal government as the ultimate protector of all of us from all of our ills. What the federal government should be doing is allowing a relationship to foster between the people and the government of their city, county, or state, in that order and allowing the smaller governments perform these duties as they pertain to their own responsibilities. It should be recognized that a distributist is not a radical that simply wants to eliminate government all together. Distributism is instead just a realization that government has overstepped the boundaries that were set for it and in the process has hurt the country and slowly eroded away at the freedoms that were once enjoyed. The principles that founded the country, the rights of life, liberty, and pursuing happiness, have been handed over to the responsibility of two parties of politicians that have no issues with eliminating those rights in pursuit of their own intentions. If America is ever to be great again we must recognize that capitalism is just as volatile as socialism and its collapse is as inevitable as the collapse of the Soviet Union. The question we must ask ourselves now is, where do we go afterwards? 3 Free Market, p. 159. Bibliography Médaille, John C.. Toward a Truly Free Market: A Distributist Perspective on the Role of Government, Taxes, Health Care, Deficits, and More. (Wilmington, Del.: ISI Books, 2010).