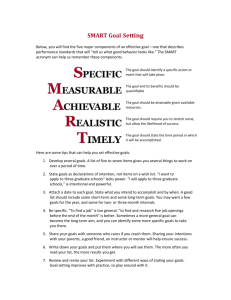

organisationally thick RIS (diversified / specialised)

advertisement

Experiences from 16 European regions working on Smart Specialisation Michaela Trippl CIRCLE, Lund University CRU Seminar: Implementing Smart Specialisation 2 September 2015, Aalborg University, Denmark This project has received funding from the European Union’s Seventh Framework Programme for research, technological development and demonstration under grant agreement number 320131. SmartSpec Introduction Project: “Smart Specialisation for Regional Innovation” (Seventh Framework Programme) 2014-2016 Eleven Partners (Cardiff (coordinator), CIRCLE Lund, Newcastle, Groningen, Utrecht, Prague, Padua, Deusto, amongst others) Research in five WPs: WP 1: Entrepreneurial Search Dynamics WP 2: Social Innovation WP 3: Regions with Less Developed Research and Innovation Systems WP 4: Underpinning Effective Strategy Design WP 5: Regional Living Laboratories SmartSpec WP5: Aims & Methods Aims: Analysis of smart specialization approaches and practices in different regional contexts in Europe Comparative assessment of 16 European regions: how do different types of regions engage in smart specialization approaches? how do these approaches (and barriers to them) differ? Towards a better understanding of place-based characteristics of smart specialisation approaches Mixed-methods approach: Secondary data analysis Desk-based analysis of policy documents & evaluative material In-depth interviews with key stakeholders (160 in Phase I) Focus group meetings & additional interviews (Phase II) SmartSpec Regional innovation scoreboard Unemployment rate (2012) (EU-27: 10.4) GDP per inhabitant PPS (2011) (EU-28: 100) Scania (South Sweden), SI Leader 9.9 107 6 27 Tampere (West Finland), FI Leader 8.5 105 8 66 Bremen, DE Follower 6.7 158 39 38 More and Romsdal (Vestlandet), NO Follower 2.9 142 --- --- Navarre, ES Follower 16.2 124 98 131 Flanders, BE Follower 4.5 120 48 20,26,35,44 Limburg, NL Follower 4.9 116 26 17 Provence-Alpes-Cote d’Azur, FR Follower 10.1 104 96 125 Zahodna Slovenija, SE Follower 7.6 100 117 112 Northern Ireland, UK Follower 7.4 78 43 140 Murcia, ES Moderate 27.9 79 90 181 South Moravia (Jihovychod), CZ Moderate 7.6 73 133 168 Basilicata, IT Moderate 14.5 71 180 227 Vzhodna Slovenija, SI Moderate 10.0 71 117 155 Lodz, PL Modest 11.1 60 151 197 Eszak Alfold, HU Modest 13.9 43 129 231 North East Romania, RO Modest 15 191 251 SmartSpec 4.3 EQI RCI 2013 WP 5 Approach Phase I Regional Profiles Phase II Analysis of Smart Specialisation Practices In-depth review of key themes Socio-economic characteristics RIS transformation and the role of universities in S3 Beyond policy-dominated prioritisation processes in less developed RIS Innovation performance Intraregional & interregional connectedness Social innovation Economic structure & Specialisation Role of institutions, institutional bottlenecks and needs for reform RIS organisations Governance structures, policy capabilities & quality of governance Role of a strong research sector in less-developed RIS Complex evolving multigovernance settings Multi-level & multi-actor governance Internationalisation of S3 & policy coordination across borders Role of social innovation in S3 Policy monitoring Strategy, implementation and assessment of S3 SmartSpec Role of clusters & crossfertilization between clusters RIS transformation & new path development Widening university participation & involvement of MNCs Configurations of RIS and transformation challenges Regions exhibit distinctive regional innovation system (RIS) configurations & face unique transformation challenges regarding their organisational & institutional structures Three main types of RIS (Isaksen & Trippl 2014; Trippl, Asheim & Miörner 2015) Organisationally thin RIS Organisationally thick and specialised RIS Organisationally thick and diversified RIS SmartSpec RIS with weak innovation capabilities: organisationally thin RIS Industrial structures Dominance of traditional economic activities: agriculture, furniture, food, textile, tourism (Basilicata, Murcia, Lodz, North East Romania) Co-existence of large, externally controlled firms (performing low value-added activities) & SMEs with limited innovation capabilities (Murcia and Basilicata) Innovative MNC & SMEs with limited innovation capacity and ambitions (Eszak-Alfold) Few branches with functioning cluster structures (Eszak-Alfold: pharmaceutical & food) Knowledge & supporting organisations Presence of universities and research organisations but weak connections to local firms (inappropriate incentives, reward systems, unfavourable academic mindset, weak technology transfer structures, mutual mistrust, low demand for university knowledge) In some regions universities play an important role at a more strategic level (e.g.: involvement in smart spec strategies: North East Romania, Eszak Alfold) Support organisations lack size, overlap or are missing (TTOs (Basilicata, North East Romania), organisations promoting DUI innovation mode of (Murcia) SmartSpec RIS with weak innovation capabilities: organisationally thin RIS Institutional configurations: variety of systemic and institutional bottlenecks Limited tradition of cooperation & low levels of trust among key stakeholders (both within and between triple/quadruple helix actors) (Murcia, Lodz, Eszak-Alfold) Silo approach in government and political instability (Slovenia) Weak coordination between support organisations; fragmented institutional support structures (Basilicata, Lodz) Lack of governance mechanisms that allow for the involvement of stakeholders (Slovenia) SmartSpec RIS with strong innovation capabilities: organisationally thick RIS (diversified / specialised) Industrial structures Regions with highly diversified economic structures: PACA, Scania Regions with rather specialised industrial structures (e.g. More and Romsdal (traditional manufacturing industries); Tampere (mechanical engineering and automation, ICT); Navarre (automotive industry, agribusiness, machinery) Knowledge & supporting organisations Well endowed with knowledge and support organisations organisationally thick structures Stronger connections between universities and firms & active involvement in development of smart spec strategies (exception: PACA: “beyond traditional technology push models”) Missing elements in some regions: basic research (More and Romsdal), competence centres (Northern Ireland), technology transfer agencies (Bremen) SmartSpec RIS with strong innovation capabilities: organisationally thick RIS (diversified / specialised) Institutional configurations: favourable institutional set-up but various coordination failures Coordination challenges within complex multilevel governance systems (Tampere) Insufficient collaboration and coordination between knowledge organisations (More and Romsdal); intermediary/support organisations (Northern Ireland, Scania, Tampere, Navarre, PACA) Weakly developed coordination structures between government departments (Northern Ireland) SmartSpec Smart specialisation Overview: Policy contexts and inclusive governance (forms of involvement on nonpolicy actors) Design, implementation and assessment of smart spec strategies Prioritisation challenges Implementation challenges Monitoring and evaluation challenges Smart spec: continuity of or break with past practices SmartSpec Smart spec: Policy contexts Smart spec practices take place in fairly different policy contexts (complex multilevel governance constellations): Regions located strongly centralized policy contexts: Slovenia, Eszak-Alfold Regions with some degree of autonomy: e.g. North East Romania, Scania, Basilicata, Lodz, South Moravia, PACA (strong variation within this group) Regions with strong autonomy: Navarre, Murcia, Northern Ireland Smart spec practices strongly shaped by levels of autonomy & financial resources at the regional level as well as experiences of policy actors Key issues: Sound engagement of various levels of government in regions’ smart spec strategy Coordination mechanisms to ensure that innovation policies from different administrative levels are aligned with the regions’ emerging smart spec strategies SmartSpec Smart spec: Inclusive governance Large variety of forms of involvement of non-policy actors No active involvement of non-policy stakeholders: e.g. Slovenia Involvement of stakeholders but led by regional authorities (workshops, working groups) Narrower set of actors (mainly industries, industry panels or cluster organizations): Northern Ireland and Bremen) Wide variety of stakeholders: South Moravia, PACA, North East Romania, Murcia, Eszak Alfold Institutionalized forms of involvement: Basilicata: partnership among regional stakeholders representing the most important RIS actors (“partenariato”) Scania: involvement of key individuals (not only based on their organizational association but on their personal engagement in innovation issues): Research and Innovation Council FIRS SmartSpec Smart spec: Design, implementation and assessment of smart specialisation strategies Prioritisation challenges Use of data to support selection of priorities: analyses of quantitative data (data routinely collected by statistical agencies, tailored analyses of socioeconomic factors) qualitative data (workshops, thematic studies, extensive interviews, expert rounds) Selected priorities: Very broad (encompassing all sectors) no “real” prioritization – lacking concentration of activities constituting regional strengths (e.g. Slovenia, Murcia) Identification of the strongest sectors (Eszak Alfold, Lodz) reflects rent-seeking behaviour, wish to enhance political legitimacy Wide priorities, reflecting mainly existing economic structure path extension (South Moravia, Bremen, Basilicata) Prioritization reflects new path development: focus on “arenas” and “growth ecosystems” (Scania, Tampere) shift away from sectoral logic to inter-industry cross-overs SmartSpec Example: Arena Approach in Scania (Sweden) SmartSpec Source: Söderström et al. (2012: 4) Example: More and Romsdal (Norway) SmartSpec Smart spec: Design, implementation and assessment of smart specialisation strategies Implementation challenges: In most regions: implementation is still in its infancy Regions without an action plan Regions with an action plan involving a mix of existing instruments Regions with action plan involving a mix of new and existing instruments Most regions belong to the group where an action plan has been formulated in a broad sense and making use of existing policy instruments, but where implementation in practice still is an open question SmartSpec Smart spec: Design, implementation and assessment of smart specialisation strategies Monitoring and evaluation systems Monitoring and evaluation practices are lacking in many regions (Scania, Lodz, Basilicata) but increasing awareness of need for these practices to be put in place Acknowledgement of the need for developing new metrics & output indicators (E.g.: Tampere: shift to arena-based innovation support creates data issues in terms of clear metrics for monitoring) Some of the plans that are better developed include those for South Moravia, PACA, Murcia and North East Romania in which clear monitoring plans, list of indicators and evaluation practices are covered SmartSpec Smart spec: continuity of or break with past practices? Smart specialisation has induced changes in innovation policy making in many regions: break with past practices, but several challenges remain (selection): Broad based innovation policies: too strong focus on STI policies, underrepresentation of DUI policies in some regions; consideration of non-technological innovation, service innovation, public sector innovation, social innovation as key future challenge Involvement of non-policy stakeholders in smart spec policy processes: clear evidence for inclusive approaches; need to solve challenges related to vested interests, institutionalisation of collaboration Selected priorities for policy intervention: reflect modernisation of existing economic strengths (path extension) & support for emerging activities (path renewal & creation); but in some regions: too wide priorities (no ‘real’ prioritisation) & neglect of cross-sectoral activities based on related variety and combinations of knowledge bases External connectedness: creation of links with capacity and capability outside the region is not a widespread phenomenon SmartSpec Many thanks for your attention michaela.trippl@circle.lu.se SmartSpec