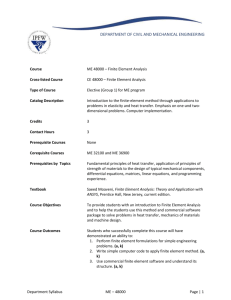

What is Finite Risk Insurance?

advertisement

FINITE RISK INSURANCE PROGRAMS Outline Conceptual model, and analysis of so-called “finite risk” or “finite premium” environmental insurance programs What is finite risk insurance? Structuring transactions using finite risk insurance Current state of the finite risk market Comparison of environmental risk transfer programs using finite risk versus other insurance structures Benefits/disadvantages of finite risk insurance Case studies 2 What is Finite Risk Insurance? Single, comprehensive definition does not capture all economic concepts and benefits of finite risk. Generally, a risk financing or insurance contract between insured and insurer where future losses are funded up to a finite limit, over a specific time period. Under a finite risk insurance contract, the insurer assumes timing risk, investment income risk, and underwriting risk. Insured funds expected losses, but insurer assumes timing and investment risk within the funded loss amount by having the insured pay net present value of expected cash flows. Key assumptions impacting finite risk pricing: Discount rate Inflation rate 3 Structuring a Finite Risk Transaction Estimation and modeling of remediation/long-term care costs Estimation of key economic inputs, project duration Selection of risks to be underwritten Drafting of insurance contract manuscript Analysis of premium Comparative analysis of finite risk with other insurance options (cost cap, captive) Unique to finite risk – Commutation account provisions Program management 4 Current State of the Finite Risk Market Capacity Participating markets Existing finite risk programs Key market drivers Profile of good and poor project candidates for finite risk programs 5 Comparative Analysis – Finite Risk versus Other Environmental Insurance Programs Cost Duration Deal complexity Effectiveness GAAP accounting impacts Value analysis 6 Benefits of Finite Risk Insurance Complexity Duration Economic incentives to insured Credit risks Market/investment risks 7 Case Studies Oil refinery – high cost exposure (>$70MM), long duration Multi-site portfolio – medium cost exposure (<$20MM), long duration, unique client objectives, high deal complexity 8 How EMSOURCE Risk Transfer Works Project Risk Analysis – environmental, regulatory and economic reviews, modeling, scenario analysis Environmental Risk Underwriting – insurance analysis, carriers review risks Transaction Structuring – manuscripting insurance, financial elements, regulatory oversight, transaction document Transaction Closing – risk transfer contract, regulatory agreements, real estate transfers, insurance program Compliance Program – transition into ongoing tasks 9 EMSOURCE Risk Transfer Model Indemnification Liabilities Funds CLIENT Premium EMSOURCE, LLC Coverage Insurer 10 Typical Risk Transfer Structure Cleanup Costs Worst Case Insurance Limits Cost Cap Insurance Buffer Expected Case Best Case 11 Expected Cost – Remediation and O&M SIR Risk Transfer Transaction Elements Insurance-backed indemnification – Competitive underwriting for remediation and long-term care risks, future unknowns, legal defense, 3rd party tort liability Environmental liability and management transfer agreement – Contractual transfer of liabilities (and real estate, if desired) Project finance structure – Simple trust fund, QSF trust, finite, or captive risk structures to meet the needs of client Regulatory agreements – Transfer of regulatory responsibility to EMSOURCE (consent orders, VRA, other) 12 Why Risk Transfer ? Cap total financial exposure and mitigate risks Liberate and focus resources for high-visibility projects and new sites Reduce internal management costs, obligations, and responsibilities Improve balance sheet and shareholder value (unwind reserves, tax savings) Facilitate real estate transfer and reuse 13 EMSOURCE Capabilities Environmental risk transfer and liability acquisition Portfolio structuring Risk and decision analysis Captive feasibility analysis & management Trust fund and investment management Environmental insurance advisory Technical, financial, legal, regulatory and administrative coordination and oversight Management and maintenance of institutional and engineering controls