PowerPoint - National Association of States United for Aging and

advertisement

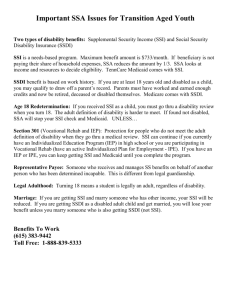

SSA and Medi-Cal Work Incentives: Earning Income and Eliminating Share of Cost Presented by: Karla Bell, Project Specialist & Michael Van Essen, Benefits Establishment Specialist California Health Incentives Improvement Project April 27, 2010 San Diego, CA California Health Incentives Improvement Project (CHIIP) Funded by a Medicaid Infrastructure Grant from the Federal Centers for Medicare and Medicaid Services Goal: To increase the employment rate of people with disabilities by making sure necessary supports are in place, such as access to health care and the ability to use personal assistance services at work Collaborative effort 2 Talent Knows No Limits-social marketing campaign Website & Facebook Promotional Videos: Employer video, I Can Work video Sustainable disability youth transition activities Transition Toolkit targeting youth with disabilities aged 12-21+ CA Youth Leadership Forum YO! Disabled and Proud Initiative GRADS pilot social marketing project-transition of college graduates into competitive employment 3 Sustainable work incentives & benefits planning technical assistance Disability Benefits 101 Veterans Benefits 101 in development Work incentives brochures in 7 languages In-person trainings for consumers & service providers Monthly Webinars Periodic Benefits Planning Summits Train-the-Trainer Club 4 Overview SSI’s 1619(b) program SSDI Work Incentives Aged & Disabled Federal Poverty Level Medi-Cal Program 250% Working Disabled Program AB 1269 Resources Disability Benefits 101 Calculator Example Medi-Cal Programs and Social Security Work Incentives 1. 2. 3. 4. SSI’s 1619(b) program Aged & Disabled Federal Poverty Level Medi-Cal Program 250% Working Disabled Program Medically Needy with Share of Cost 1619(b) Program A provision to Supplemental Security Income Title XVI (SSI) linked Medi-Cal Allows working SSI recipients to keep FREE Medi-Cal (No Share-of-Cost) Medi-Cal retained when SSI payment is reduced to $0.00 per month due to earned income Bottom Line: You won’t “lose” your MediCal if you are on SSI and you earn income 1619(b) Program Earned income threshold in California: $34,324* For the Blind and/or visually impaired: $37,252* Threshold can be adjusted on a case-by-case basis http://www.ssa.gov/disabilityresearch/wi/1619b.htm * Subject to change due to California Budget Crisis SSI’s Earned Income Exclusion SSI Payment $845.00/month $500 Gross Earnings/month -$20 General Income Exclusion -$65 Earned Income Exclusion $415.00 Remainder ÷2 $208.00 Total Countable Income $845.00 Maximum SSI Rate -$208.00 Total Countable Income $637.00 Adjusted SSI Payment $500.00 Gross Earnings +$637.00 SSI $1137.00 Total Income 1619(b) Program Expenses excluded from countable income include: • Blind Work Expenses (BWE) • Impairment Related Work Expenses (IRWE) • Plan to Achieve Self-Support (PASS Plan) • Publicly Funded Personal Attendant • (i.e. In-Home Supportive Services) • Medical Expenses above State Average • See SSA’s Red Book for more information: • http://www.ssa.gov/redbook/ SSI Calculation Example-IRWE $500 Gross Wages -$20 General Income Exclusion -$65 Earned Income Exclusion $415 Remainder -$100 Impairment Related Work Expense $315 ÷2 $158.00 Total Countable Income $845.00 Maximum SSI Rate -$158.00 Total Countable Income $687.00 Adjusted SSI Payment $500.00 Gross Wages +$687.00 SSI -$100 IRWE $1087.00 Total Income 1619(b) Program All Blind and Impairment Related Work Expenses must be verified by your local Social Security field office Provide them with original receipts or canceled checks of the expenses SSI Calculation Example-SSDI & SSI Benefits $520 Unearned Income (SSDI payment) -$20 General Income Exclusion $500 Countable Unearned Income $885 Gross Wages -$65 Earned Income Exclusion $820 Remainder ÷2 $410.00 Countable Earned Income $500.00 Countable Unearned Income +$410.00 Countable Earned Income $910.00 Total Countable Income $845.00 Maximum SSI Rate -$910.00 Total Countable Income $0.00 Adjusted SSI Payment SSDI Work Incentives Trial Work Period (TWP) Allows beneficiary to test work for at least 9 months while receiving full SSDI benefits 2010: $720 gross earnings or 80 hours in selfemployment = TWP month Extended Period of Eligibility Starts after TWP ends Automatic reinstatement for the first 3 years 2010 SGA is $1000/month ($1640 for a Blind individual) Expedited Reinstatement Additional 5 years of reinstatement if work stops and there is no medical improvement What happens to Medicare if SSDI benefits stop? Medicare coverage uninterrupted during Trial Work Period Continues for at least 93 months after the 9 month Trial Work Period After that you may be able to purchase Medicare coverage Aged & Disabled FPL Medi-Cal Aged & Disabled Federal Poverty Level Medi-Cal provides free, full scope Medi-Cal services for disabled or aged individuals who meet the income and asset requirements of the program Blind people are also eligible, but must be determined disabled Typical income threshold is $1133/month* for a single individual or $1525* for a married couple *All $ amounts subject to change Aged & Disabled FPL Medi-Cal Assets may not exceed $2,000 in value ($3,000 for a couple) Assets, like the home you live in and one car, are not counted for this program Assets may include: checking and savings accounts the value of stocks, bonds, and trust deeds additional cars or recreational vehicles promissory notes and loans that are payable to you Medi-Cal 250% Working Disabled Program Provides choice and opportunity to Californians with disabilities who would otherwise be ineligible for No-Share-of-Cost, full scope MediCal coverage due to earned income and work activity California legislation implemented the 250% Working Disabled Program in April 2000 Medi-Cal 250% Working Disabled Program Individuals can earn up to $55,188 gross per year and still qualify for full scope, no share of cost Medi-Cal A working couple can earn up to $73,884 gross per year Higher gross wages possible when there are Impairment Related Work Expenses (IRWEs) Medi-Cal 250% Working Disabled Program Allows the purchase of full scope Medi-Cal Recipient pays a premium Affordable premiums: $20 - $250 (Single Person) $30 - $375 (Couples) SSI Earned Income Calculation applied to earnings SSA’s NESE standards used for SelfEmployment calculation Medi-Cal 250% Working Disabled Program To qualify for the program, individuals must: Be a United States resident and living in California Meet Social Security’s definition of disability (medical definition only, does not count the ability to earn income) Medi-Cal 250% Working Disabled Program Earnings can be as little as $20 per week Work activity can be as simple as pet attending, driving, domestic support services, research, light clerical work Work is undefined: No minimum earnings criteria for eligibility No set amount of hours required Medi-Cal 250% Working Disabled Program Assets must be less than: $2000 for an individual $3000 for a couple One home and one car are not counted for this program All IRS approved retirement accounts are exempt (IRAs, 401K, 403B, etc) Income Exemptions: Disability income is excluded (SSDI, CDB, SDI, Workers Comp., STD, LTD, Veterans’ Benefits, etc.) Medi-Cal 250% Working Disabled Program SSI’s countable income calculation is applied to all wages/salaries Countable Income cannot exceed 250% of Federal Poverty Level (FPL): For individuals: $2257/month For couples: $3036/month Special countable income circumstances in excess of 250% FPL are negotiable 2009 Poverty Guidelines for the 48 Contiguous States Monthly Guidelines Family Size Percent of Poverty 100% 120% 135% 150% 200% 250% 1 $902.50 $1,083.00 $1,218.33 $1,353.75 $1,805.00 $2,256.25 2 $1,214.17 $1,457.00 $1,639.08 $1,821.25 $2,428.33 $3,035.43 3 $1,525.83 $1,831.00 $2,059.83 $2,288.75 $3,051.67 $3,814.57 4 $1,837.50 $2,205.00 $2,480.58 $2,756.25 $3,675.00 $4,593.75 5 $2,149.17 $2,579.00 $2,901.33 $3,223.75 $4,298.33 $5,372.93 6 $2,460.83 $2,953.00 $3,322.08 $3,691.25 $4,921.67 $6,152.08 7 $2,772.50 $3,327.00 $3,742.83 $4,158.75 $5,545.00 $6,931.25 8 $3,084.17 $3,701.00 $4,163.75 $4,626.25 $6,168.33 $7,710.43 Countable Income Example Mary $1,500/month in gross earned income $900/month in SSDI (exempt) $100/month in Impairment-Related Work Expenses (IRWEs) Mary’s Countable Income: $1,500 (earned income) - 20 (general income exclusion) - 65 (earned income exclusion) -100 (IRWE) $1,315 ÷ 2 = $657.50 (countable income) 250% Medi-Cal Working Disabled Program – Premium Chart Countable Earned Income From: Countable Earned Income To: Premium for Eligible Individual Premium for Eligible Couple $1 $600 $20 $30 $601 $700 $25 $40 $701 $900 $50 $75 $901 $1100 $75 $100 $1101 $1300 $100 $150 $1301 $1500 $125 $200 $1501 $1700 $150 $225 $1701 $1900 $175 $275 $1901 $2100 $200 $300 $2101 $2257 $250 $375 $2258 $3036 N/A $375 Medically Needy Share of Cost vs. 250% Working Disabled Program Mary’s Total Income = $2400 Mary’s Working Disabled Program Premium = $25/month If in Medically Needy Share of Cost Program, share of cost = $950 Medi-Cal 250% Working Disabled Program Benefits Medi-Cal Working Disabled Program is NO SHARE OF COST Medi-Cal Continues the Medicare Part B premium “Buy-In” program for the beneficiary Beneficiaries maintain Medicare Part D “LIS” (Low Income Subsidy) http://www.cahealthadvocates.org/_ pdf/facts/E-003-CHAFactSheet.pdf Access IHSS services (not covered by Medicare) Medi-Cal 250% Working Disabled Program To begin enrollment, contact Eligibility Worker County Coordinator may be contacted if Eligibility Worker or Supervisor are unfamiliar with the program: Katherine Trinh (858) 492-2236 Katherine.Trinh@sdcounty.ca.gov Medi-Cal 250% Working Disabled Program Completed application should be submitted in person with: Latest SSA award letter confirming medical disability determination is still active Copies of two most recent payroll checks or stubs (or letter from employer) Copies of two most recent bank statements 250% Working Disabled Program Future Changes Assembly Bill 1269 was signed into law by our Governor on 10/11/09 The new rules will not be implemented until ARRA funds run out 250% Working Disabled Program Future Changes AB 1269 policy changes improves the 250% WDP: Eliminate Age 65 restriction Eliminating the asset limit when money is placed in a separate account Change premium structure Grace period of 26 weeks if employment ends Resources Disability Benefits 101 http://www.disabilitybenefits101.org Talent Knows No Limits http://www.talentknowsnolimits.info World Institute on Disability (510) 763- 4100 http://www.wid.org/ Resources Medi-Cal San Diego (866) 262-9881 http://www.sdcounty.ca.gov/hhsa/programs/ ssp/medi-cal_program/index.html San Diego 250% County Coordinator (for assistance with enrollment): Katherine Trinh (858) 492-2236 Katherine.Trinh@sdcounty.ca.gov http://www.chiip.org/wdp_county_coordinators.html Resources Department of Health Care Services (916) 552-9100 http://www.dhcs.ca.gov/ Free Medicare Counseling (HICAP) 1-800-434-0222 http://www.cahealthadvocates.org/HIC AP/ Resources Advocacy Resources: Health Consumer Alliance http://healthconsumer.org/ 877-734-3258 (Consumer Center for Health Education and Advocacy) Disability Rights California http://www.disabilityrightsca.org/ 800-776-5746/TTY 800-719-5798 Resources SSA Red Book-Guide to Work Incentives http://www.ssa.gov/redbook/ San Diego County Work Incentives Planning and Assistance Project Project Independence Steve Stover, CWIC 6505 Alvarado Rd. Suite 207 San Diego, CA 92120 619-840-6616 Sstover@proindependence.org Resources For more information on outreach and training activities or questions, contact Karla Bell at 619594-5381, kbell@interwork.sdsu.edu Contact Michael Van Essen at (626) 744-5230 Ext. 273 or Mvanessen@pacificclinics.org To order brochures or promotional materials, contact Nicholas Moore at 916-654-8194, Nicholas.Moore@edd.ca.gov Medi-Cal Working Disabled Brochure I Can Work Brochure