Investment

advertisement

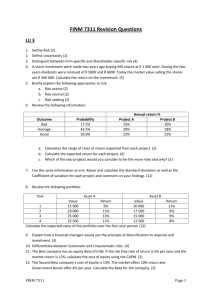

FEM 3204 : 3 (2+1) Perancangan Kewangan Dalam Pasaran Global Financial Planning in a Global Market HUSNIYAH BT. ABD. RAHIM BILIK A2-14 Jabatan Pengurusan Sumber & Pengajian Pengguna Fakulti Ekologi Manusia Chapter 6 Investment & Risk Management Choices Investment: Principles One financial management strategy is to obtain the most from income, this involve the investing of the surplus of income Successful budgeting creates savings for emergency funds & other short-term & long-term financial needs The income saved can thus be invested either in short-term or long-term investments Investment is the basis for an improved financial position & long-term financial security The principle in investment: High risk, high return; low risk, low return Investment: Principles (cont.) Components of the risk factor Inflation risk Interest rate risk Business failure risk Market risk Global investment risk Investment: Principles (cont.) Components of the risk factor Inflation risk Inflation is the rise in the general level of prices High inflation reduce the value of ringgit One ringgit placed in a safe-deposit box has less buying power in the future Interest rate risk The interest rate for investments are the results of changes in the interest rate in the economy When overall interest rate decreases, the value of the investment rises & vice-versa Investment: Principles (cont.) Business failure risk Business failure risk (eg. bad management, product failure, competition) is associated with investments in common stock, corporate bond Lower profit leads to lower or no dividends Market risk Prices of stocks, bonds, mutual funds may fluctuate due to market behavior of investors Global investment risk Risks faced in stocks, bonds issued by foreign firms & global mutual funds Investment: Strategies Long-term Strategy Buy-and-hold technique, dollar cost averaging, direct investment and dividend reinvestment plans 1. Buy-and-hold technique Holding the stock for several years and let the value or price increase Entitled to dividend (subject to approval by board directors) The stock may split (increase number of stocks but may have different price) – may increase in future value over time Investment: Strategies 2. Dollar cost averaging Investors purchase an equal dollar (ringgit) amount of the same stock at equal intervals (number of shares might differ) Average cost determined: dividing total investment in RM by the total number of shares Eg. Buy stock RM2,000 for 3 years Year 1: RM50/share => No. stock = 40 Year 2: RM65/share => 30.8 Year 3: RM60/share => 33.3 Sum RM6,000;No stocks=104.1;average cost: RM57.64 You make profit if you sell the stock more than RM57.64 Investment: Strategies 3.Direct investment and dividend reinvestment plans Buy directly from corporation without using brokerage firm or account executive Dividend reinvestment plan – enable to reinvest the dividend to purchase companies’ stocks Avoid commission to brokerage firm Can take advantage of dollar cost averaging Investment: Strategies Short-term Strategies: risky methods selling short, buying stock on margin, trading in options Be experienced in the long-term strategies first before venturing in this short-term strategies Selling short: Selling stock that has been borrowed from brokerage firm and must be replaced later (without own money) Used when the value of stock is expected to decrease First, borrow from brokerage firm eg 100 shares, sell at RM40/share , valued at RM4,000. with that buy another 100 shares later (few months later) at lower price eg. RM30/share, value is RM 3,000. return back the 100 shares borrowed from brokerage firm. Gain gross profit RM 1,000. net profit less the fees. Investment: Strategies Buying stock on margin Borrow part of the needed to buy stock Margin requirement set by Securities Commission eg. Only 50% borrowed & one have a minimum amount of cash eg RM2,000 Allows investor to buy more shares than the amount of money they have in cash Eg. If one has RM5,000 & borrow through broker RM5,000, can buy 10,000 stocks at RM10/share. Stock certificate as loan security At the time to sell, price RM14/share, sold at total RM14,000, gross profit RM4,000 after deduct the RM5,000 loan net profit less RM4,000 (deduct fees) Investment: Strategies Trading in options Gives you the right to buy or sell stock at a predetermined price during a specified period of time Options available for 3, 6, 9-months period If you assume the price will increase in short time, you can buy call option Call option –is sold by stockholder and gives the buyer the right to buy 100 shares of stock at a guaranteed price before a specified expire date A put option – the right to sell 100 shares of stock at a guaranteed price before a specified expire date If the price changes does not occur before expire date, you lose the money you paid for the option Investment: Choices Factors Affecting Choice of Investments 1. Safety & risk 2. Investment income 3. Investment growth 4. Investment liquidity Investment: Choices Factors Affecting Choice of Investments 1. Safety & risk Safety in an investment means minimal risk of loss Risk in an investment means a measure of uncertainty of the outcomes Investment at one end consists of very safe instruments eg. Government bonds, savings accounts, certificates of deposits, certain stocks & bond, may include also mutual & real estate This attract conservative investors, especially those near retirement as they dare not to lose their money – no time to replace the money Low chance of become worthless Investment: Choices (cont.) At the other end of the investment spectrum are speculative investments Speculative investments – are high risk investment with high expectation of large profit in a short time High loss to the extent of losing the initial investment are possible Eg. Speculative stocks, certain bonds, real estate, commodities, precious metals or stones Too risky for beginning investors Investment: Choices (cont.) 2. Investment income Invest to obtain predictable source of income The safest investments – savings accounts, certificates of deposits, savings bonds – are the most predictable income The interest rate is known or almost known & also the income generated from it on a specific time are known Other than that, can choose from government bonds, corporate bonds, utility stocks, selected common stocks Mutual funds & real estate rental property The higher risk investments offer low potential for regular income Investment: Choices (cont.) 3. Investment growth Growth in investments means that the investments will increase in value Common stocks offers such investment eg. Stocks issued by corporations in the electronics, technology, health care products Sacrifice immediate cash dividends for the higher future amount of money Profits that are supposed to be paid as dividends are reinvested in the form of retained earnings The retained earnings increases the value of a share of stock Investment: Choices (cont.) 4. Liquidity Is the ability to buy or sell investment quickly without affecting the investment’s value Ranges from near-cash to frozen investments Checking & savings account are very liquid – can obtain cash easily without reducing the value Certificates of deposits impose penalty for withdrawing money before maturity date However, market condition, economic condition might affect the liquidity Investment: Choices (cont.) Investment Alternatives Stock or equity financing Corporate & government bonds Mutual funds/unit trusts Real estate Others Investment in Equity With investment in equity or shares or stock, investors have equity ownership Investor own the company according to their shares or their equity in the company Companies don’t have to repay the money a stockholder/shareholder pays for the stock Stockholders may sell their stock to another individual Selling price depends on demand for the stock Dividends not mandatory Dividends paid out of profit, approved by board of directors Investment in Equity Investor’s right in shares ownership (equity ownership) 1. Ordinary shares (aka common stock) Shares that have equal value and equal rights of investors in that shares (rights in the profit value & voting) 2. Preferences shares (aka preferred stock) Shares that have benefits that are not the same as the ordinary shares Existed as companies wants to increase capital & thus offer some specialty that are unlike the other shares Investment in Equity Among the special treatments for preferences shares are: Have priority in profit payment (not less than 5%), the balance distributed equally among ordinary shareholder Given a fixed annual dividend no matter the performance of the company Given back perfect share values if company was closed down; the balance distributed equally among ordinary shareholder Have more than one vote in grand annual meeting Have pre-emptive rights where they were given priority in the offer to buy newly introduced shares by the same company Investment in Equity Evaluation of a Stock Issue can be assessed through the classification of stocks 1. Blue-chip stock: Safe investment attracts conservative investor Offered by strongest & most-respected companies, eg Nestle Their characteristic: leadership in the industrial group, history of stable earning, consistency in paying dividends Investment in Equity 2. Income stock: Pays higher than average dividends Steady corporation, predictable source of income eg. Shell Stocks offered by telephone companies, utility companies, eg TENAGA Investment in Equity 3. Growth stock: Corporation that has potential to earn profits above average profits of all firms in the economy Companies offer expanding products & an effective research & development department, retail expansion, expansion into international markets eg. Air Asia Bonds Instruments offered by government or companies for them to obtain loans from investors In general, bond holders are paid an amount of fixed return (coupon) every 6 months and at the maturity date, investors receive the face value of the bond Eg. If you buy an RM1,000 bond, & it gives a 5% return each 6 months, then you’ll be receiving RM1,000 plus the accumulated returns from each of the 6 months (RM50 or more) at maturity time Have a fixed period of time Bonds Bond’s price fluctuates as share prices Bonds can be transacted before its maturity date The factor that determine the bond’s price is the market interest rate If interest rate increase, bond’s price also increase There are 2 advantages for bonds: Consistent income, and alleviated capital at maturity date There are 2 disadvantages The market for bonds are a bit slower, and need large amount of money Unit Trust Investors purchased units of investment from unit trust companies (CIMB Trust Fund, PNB, ASNITA and others) The money is invested by the asset management companies appointed by the unit trust companies The investments are taken care by the trust holders companies appointed by unit trust companies The price for one unit of unit trust investment is lower (<RM1) Low risk compared to equity (ordinary & preference shares) Get higher return in long-term & able to overcome inflation rate Real Estate Investors buy home, shops, apartment for rent Higher capital for the advanced money during purchasing Require longer time & commitment to maintain the fixed asset and ensure rentals collected Other option is to invest in unit trust based on real estate eg PNB properties, Maybank properties Comparison of Types of Investment Type of Investment Unit trust Risk Level low Expected Return Level low high high Bond Real estate Equity shares/stock Protection & Risks: Principles Risk in Takaful & in conventional insurance is the probability of an undesirable future event to occur and further resulted in financial loss. Risk is sometimes simply defined as the uncertainty of the financial loss because of the uncertainty of the perils or misfortune to happen. Risk Management Risk management is an organised strategy for protecting assets & people helps reduce financial losses caused by destructive events a long-range planning process by understanding risks & how to manage risks, you can provide better protection from the financial losses risk management is not limited to buying insurance, other methods may be less costly Risk Management 1. 2. Risks: defined as the uncertainty of the financial loss because of the uncertainty of the perils or misfortune to happen Perils: the cause of a possible loss. Eg. Fire, windstorms, explosions, robbery, accident, premature death Types of risks: Pure risk or insurable risk Speculative risk Risk Management (cont.) 1. 2. Pure risk or insurable risk: there would be a chance of loss only if the specified events occurred It is accidental and unintentional risks for which the nature & financial cost of the loss can be predicted Speculative risk or uninsurable risk: A risk that carries a chance of either loss or gain Eg. Starting a small business that may or may not succeed; gambling Risk Management (cont.) The following are 3 types of pure risk or insurable risks personal risks, property risks, liability risks most common risks are classified under the three types of risks above 1. Personal risks: The uncertainties surrounding loss of income or life due to premature death, accidents, illness, disability, old age or unemployment The risks are faced by the person itself Risk Management (cont.) 2. property risks: Are the uncertainties of direct or indirect losses to personal or real property due to fire, wind-storms, accidents, theft, or other hazards The risks are faced by the property itself 3. liability risks: Possible losses due to negligence resulting in bodily harm or property damage to others Such harm can be caused by automobiles, professional misconduct, injury suffered on one’s property The risks are faced by others Eg. A driver knocked-down a pedestrian, individuals in detention centre being beaten-up by the officers in charge Risk Management (cont.) Methods of Risk Management 1. Risk avoidance 2. Risk reduction 3. Risk assumption 4. Risk shifting 1. Risk avoidance: To avoid the risk is by not involving in activities that gave rise to that risk Eg. Avoid the risk arising from a car accident by not driving to work or by not walking anywhere near a running car Risk Management (cont.) 2. Risk reduction when avoid risk totally is not possible, you can try to reduce risk To reduce the risk is by doing something or having something that will lessen the risks that might be faced Eg. To reduce risk arising from injury in a car accident, wear a seat-belt Eg. to reduce potential damage or to protect life from fire, install smoke alarms & fire extinguisher Eg. Reduce the risk arising from illness, by eating balanced diet & exercising Risk Management (cont.) 3. Risk assumption Means taking responsibility for the loss or injury that may result from a risk Assume risk if the potential loss is small or when risk management has reduced the risk or when insurance coverage is expensive or when there is no other way to obtain protection The risk assumed is self-insured Self-insurance; is the process of establishing a monetary fund to cover the cost of a loss Eg. Don’t purchase insurance for an older car,& if accident occurs, you have to pay with your own money Risk Management (cont.) 4. Risk shifting Most common method used is to shift risk or transfer risk to another party that is the insurance company or other organisation Insurance is the protection against loss make available by the purchase of an insurance policy from an insurance company Involve high cost & a long-term commitment Sought after the risk avoidance, risk reduction or risk assumption are unable to cover the loss from the risk faced