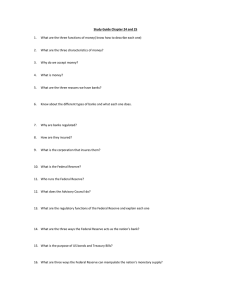

Chapter 6 The Health of the Economy

advertisement

Chapter 6 The Health of the Economy 1 Section 6.1 Economic Ups and Downs Objectives Describe the phases of the business cycle; Analyze the effects of economic conditions on consumers; Discuss factors that affect the state of the economy; and Explain measurements used to gauge the state of the economy. 2 Business Cycle – the ups and downs of the economy Peak Expansion Contraction Trough 3 Types of Business Cycles Contraction – business activity slows down •If the contraction last long enough and is deep enough, the economy goes into recession Trough – at the lowest point in the cycle, business activity levels off Expansion - the economy begins to recover •People spend more money and open more businesses, demand brings more production of goods and services and employment rises Peak – a period of prosperity marks the highest point of the cycle •Eventually, however a contraction occurs and the cycle starts over again 4 Recession – is a period of significant decline in the economy Lasts about 6 months 1 year •The economy produces more than people can consume •Businesses don’t make money and have to lay off workers •Workers don’t have money and therefore cannot spend •Recession can lead to DEPRESSION 5 Depression – a major economic slowdown, longer lasting and more serious The Great Depression – dominated the world economy in the 1930’s •Some believe that the stock market crashing had very little to do with it, they believe it was poor policy decisions by the government •Lasted until WWII 6 Inflation – prolonged rise in the price of goods and services •It affects consumers by reducing their purchasing power •When prices rise sharply, your dollar buys fewer goods and services than before 7 Interest – fee paid for the opportunity to use someone else’s money over a period of time •Inflation also affects consumers who borrow, lend, or invest money •Inflation can also benefit someone who has borrowed money at a fixed interest rate that is lower than the rate of inflation 8 Factors Affecting Ups and Downs •Consumer Confidence Psychological factor – based on the feelings of the consumer •Technological Innovation Spurred by inventions Can transform the economy, the workplace, and the culture •Government Policies Can either help or hurt the economy •War Government pumps billions of dollars into the economy to support troops in need of goods and services 9 Measuring the Economy’s Performances Economic Indicators – measurements used to monitor the health of the economy •Gross Domestic Product (GDP) – is the total dollar value of goods and services produced in a country during the year •Unemployment Rate High unemployment rate means the economy is ailing •Consumer Price Index (CPI) – measures the change in prices over time of a specific group of goods and services Market Basket – 200 categories of goods and services that average household uses Each month the Bureau of Labor Statistics reports the percentage change in CPI 10 Local, National, and Global Economics Conditions Affecting the Economy •Weather •Natural disasters •Population shifts •Availability of workers •Local government policies •Fortunes of local businesses 11 Section 6.2 Deficits and Debt Objectives Distinguish between a budget surplus and a budget deficit; Identify reasons for deficit spending by governments; and Analyze the effects of the national debt on consumers. 12 The Budget Process Budget – is an estimate of anticipated income and expenses for a certain period of time. •It is created by federal, state, and local governments •It is based on Fiscal Year (Begins Oct. 1 each year) •The goal is to balance the budget so that planned spending does not exceed projected revenue •The house approves final budget, then becomes law 13 Budget Surplus – when more money was collected than spent at the end of the fiscal year. •More common to be the opposite Deficit Spending – the practice of spending more money than was received in revenue Budget Deficit – the amount by which spending exceeds revenue 14 Various Causes of Budget Deficits: •War •Recession •Policy decisions by Congress and President National Debt – (Public Debt) total amount of money that the federal government owes 15 Government Also Needs to Borrow Money Selling various types of securities: •Saving Bonds •Treasury Bills 16 What’s the Impact? •Some are not worried about the debt, because it has decreased since WWII •Some are worried, because the interest takes up about 10-20% of the federal budget each year 17 Section 6.3 Stabilizing the Economy Objectives Compare and contrast fiscal and monetary policy; Explain the role of the Federal Reserve System; and Analyze how the Fed’s actions affect consumers. 18 Section 6.3 Stabilizing the Economy Two Types of Policies 1. Fiscal Policy – refers to the federal government’s use of taxing and spending policies to help stabilize the economy • They raise or lower taxes and increase or decrease government spending • Can take months before it affects the economy • Carried out by the President and Congress 19 2. Monetary Policy - to regulate the money supply •Money Supply – total amount of money in circulation at any given time •Carried out by nations central bank 20 The Federal Reserve System – (Fed) is the central bank of the U.S. •Provides financial services to the banking industry and government •It regulates banks to make sure that they follow the law •Primary responsibility is to set Monetary Policy •Federal Reserve Board – (Board of Governors) runs the Federal Reserve System. •Federal Open Market Committees (FOMC) – seven members nominated by the President and five presidents of district Federal Reserve Banks. •Their decisions affect the stock market 21 The Fed and the Money Supply •Increase money supply, credit becomes more available and less costly, which helps consumers and businesses to spend more •Decrease money supply, credit becomes harder to get and more expensive, which causes consumers and businesses to spend less 22 Fed can manipulate the money supply in three ways: 1. Engage in open market operations 2. Raise and lower the discount rate 3. Adjust the reserve requirement 23 Open Market Operations •Most frequently used tool in selling or buying government securities – stocks, bonds, and other financial assets in the open market •Decreased money supply, government sells holdings of government securities, buyers will pay for these and therefore takes money out of the circulation 24 •Opposite affect cause them to buy securities, which puts money back into circulation •Federal Funds Rate – this is the interest rate at which banks lend money to one another overnight •Not controlled by the Fed, but strongly influenced •Tends to trigger changes in the interest rate that financial institutions charge consumers and businesses 25 The Discount Rate •Sometimes banks have to borrow money from the Fed to encourage them to give discounts to consumers and businesses •Discount Rate – interest rate that banks pay to the Fed. •The direct affect of the discount rate on money supply is usually very small 26 Reserve Requirements •Reserve Requirements - The % of a bank’s deposit that it must keep on hand •Holding money in reserve helps take money out of circulation. 27 Effects on Consumers •What you’ll pay for goods and services •Your ability to get credit and the interest rates you will pay •What you will earn in interest •Your job stability and the wages you are paid 28