Ratio Analysis

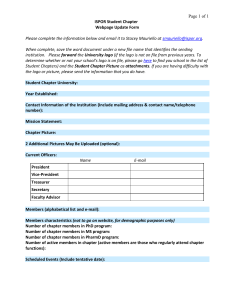

advertisement

c A FARMER FRIENDLY BANK www.ppcbl.com.pk Internship Report On The Punjab Provincial Co-operative Bank Ltd LOGO Introduction! Student Name Muhammad Zubair Anjum Student ID BC080201453 Degree Program BS-Business Administration Area of Specialization Finance your family site your site here LOGO Contents! Intro of the Organization 1 Org Hierarchy Chart 2 your family site Training Program 3 Ratio Analysis 4 your site here Conclusion 5 6 Recommendation LOGO Organization Introduction! Creation of Bank PPCBL created through cooperative societies act 1924 Funding to central cooperative banks & societies your family site Setup was created at Tehsil & District Level Major Objectives your site here To promote cooperation through cooperative societies To reduce poverty by providing less markup loans To increase production of agriculture sector LOGO Organization Introduction! Products Bank provides two types of loaning products Crop loans to cooperative societies your family site Loans like goat sheep finance to individual farmers Medium term tractor finance & livestock projects finance Services your site here Remittance Crop insurance, Pension scheme Utility bills collection & lockers facilities LOGO Organization Introduction! Branch Network Extensive network of 159 branches Eight zonal offices throughout Punjab your family site Head office bank square Share-Qaid-E-Azam Lahore Business Volume your site here Approximately 14.35 billion rupees in total assets Approximately 4.65 billion rupees liabilities Shareholders equity is 6 Billion LOGO Detailed Business Volume Description of Accounts In 2009 Rs.(Mil ) In 2010 Rs.(Mil) In 2011 Rs.(Mil) Profit Before tax (979.071) (174.826) 508.403 (979.071) 87.361 8177.689 13711.922 (179.626) 2304.214 7385.647 15245.873 479.773 6089.755 6020.045 14359.198 Profit After Tax / Net Inc your family site Equity balance total Advance and Net Total Assets your site here Deposits & Other A/C Investments Total Current Liabilities 1837.175 3820.343 451.012 799.673 10016.170 9355.390 2443.098 1503.620 4655.248 Earning Per Share (225.80) 110.53 (41.41) LOGO Organization Competitors Farmer Banking Competitors Zarrai Taraqiati Bank Ltd Khushali Bank Ltd General Banking Competitors your family site MCB Bank Limited Habib Bank Limited SILKBANK Limited your site here United Bank Limited Allied Bank Limited Askari Commercial Bank Limited Habib Metropolitan Bank Limited LOGO Organizational Hierarchy Chart Boar of Directors your family site Board Sub Committee of Audit Secretary your site here President / CEO LOGO Organizational Hierarchy Chart President / CEO C.F.O Head C.R.M.D & CAD Head Operation I.T Head SAM & Legal Head H.R Head Internal Cont & Compliance Deputy Head Reconciliation Deputy Head Credit Risk Deputy Head Operations Deputy Head SAM Deputy Head Admin & Estt Deputy Head Internal Control Deputy Head Accounts Deputy Head C.A.D Deputy Head I.T Deputy Head Legal Deputy Head Staff Benefit & Tax Deputy Head Compliance Deputy Head Training Compliance Officers your family siteHead Business Developm ent Deputy Head Retail / Corporate your site hereBanking Deputy Head Treasury Deputy Head Engineering & Properties LOGO Organizational Hierarchy Chart Zonal / Divisional Head your family site Deputy Zonal Head (Operation & H.R) your site here Officer(s) Deputy Zonal Head Credit & Recovery Deputy Zonal Head Statistics & Consolidation Computer Computer Officer(s) Officer(s) Operator Operator Computer Operator Branch Manager LOGO Organizational Hierarchy Chart Branch Manager your family site Compliance Officer Officer Branch Operation Agri Credit & Recovery Officer(s) Officer(s) Supporting Staff your site here Cashier Messenger / Guards LOGO Training Program Account Opening Department Tasks Filling account opening form Opening accounts & issuing checque books your family site Preparation of vouchers Bill Collection Department Tasks Receiving utility bills your site here Making entries in scroll book Calculation gross amount and commission Printable scroll for balancing & record keeping LOGO Training Program I. T Department Tasks Preparation of weekly / monthly affairs eCIB verification & societies loan statements your family site Printing editing and sharing online documents Agri-Credit & Recovery Department Tasks Filling loan set your site here Calculation of average sale value Markup calculation of borrowers Reminder phone calls to borrowers for installments LOGO Financial Statements Statements are available at! http://www.ppcbl.com.pk http://www.ppcbl.com.pk/financial your family site your site here LOGO Ratio Analysis Ratio Analysis The Punjab Provincial Co-operative Bank Ltd Formula: Net profit / (loss) After Tax / Net sale *100 Year 2009 Year 2010 Year 2011 Net (979071) /1193637 (179626)/1553750 479773/1647318 Profit = = = your family site Margin -82.02 % -11.56 % 29.12% 50 0 your site here -50 -100 Net Profit Margin 2009 2010 2011 -82.02 -11.56 29.12 LOGO Ratio Analysis Ratio The Punjab Provincial Co-operative Bank Ltd Analysis Formula:MarkupEarn–MarkupExpense/MarkupEarn Year 2009 Year 2010 Year 2011 Gross 1193637 / 1570956 1553750 /965655 1647318/386027 = = = yourSpread family site Ratio -31.61 % 37.85 % 76.56% 100.00% your site here 50.00% 0.00% -50.00% Gross Spread Ratio 2009 2010 2011 -31.16% 37.85% 76.56% LOGO Ratio Analysis Ratio Analysis The Punjab Provincial Co-operative Bank Ltd Formula: Non Interest Income/Total Income Year 2009 Year 2010 Year 2011 Non 77394 / 1271031 interest to = your family site total 6.08% income 76830 /1630580 73906 / 1721224 = = 4.71% 4.29% 10.00% your site here 5.00% 0.00% Non Interest Income to Total Income ratio 2009 2010 2011 6.08% 4.71% 4.29% LOGO Ratio Analysis Ratio Analysis The Punjab Provincial Co-operative Bank Ltd Formula: Interest Earned / Interest Expense Year 2009 Year 2010 Year 2011 Spread 1193637 / 1570956 1553750 / 965655 1647318 /386027 Ratio = = = your family site 0.75 times 1.60 times 4.26 times 5 4 your site here 3 2 1 0 Spread Ratio 2009 2010 2011 0.75 1.6 4.26 LOGO Ratio Analysis Ratio Analysis The Punjab Provincial Co-operative Bank Ltd Formula: (Net profit after tax/total assets) * 100 Year 2009 Return (979071)/13711922 on Asset *100 your family site Ratio = -7.1% Year 2010 (179626) /15245873*100 = -1.17% Year 2011 479773 / 14359198*100 = 3.34% 5.00% your site here 0.00% -5.00% -10.00% Return on Asset 2009 2010 2011 -7.10% -1.17% 3.34% LOGO Ratio Analysis Ratio Analysis The Punjab Provincial Co-operative Bank Ltd Formula: Net Income/Sales x Sales/Total Assets x100 Year 2009 Year 2010 Year 2011 DuPont (979071)/1193637 (179626)/1553750 479773/1647318 Return = = = your family site on Asset -7.14 -1.17 3.34 your site here 4 2 0 -2 -4 -6 -8 Dupont Return on Asset 2009 2010 2011 -7.14 -1.17 3.34 LOGO Ratio Analysis Ratio The Punjab Provincial Co-operative Bank Ltd Analysis Formula: Net profit or loss after tax/total Equity x 100 Year 2009 Return (979071)/87361 on = your family site Equity -1120.70 Year 2010 (179626)/2304214 = -7.79 Year 2011 479773/6089755 = 7.87 500 0 your site here -500 -1000 -1500 Return on Equity 2009 2010 2011 -1120.7 -7.79 7.87 LOGO Ratio Analysis Ratio Analysis Debt Ratio your family site The Punjab Provincial Co-operative Bank Ltd Formula: (Total Debt / Total Assets)*100 Year 2009 10016170/ 13711922 = 0.73% Year 2010 9355390/ 15245873 = 0.61% Year 2011 4655248/ 14359198 = 0.32% 0.80% 0.60% your site here 0.40% 0.20% 0.00% Debt Ratio 2009 2010 2011 0.73% 0.61% 0.32% LOGO Ratio Analysis Ratio Analysis The Punjab Provincial Co-operative Bank Ltd Formula: Total Liabilities / Shareholders Equity Year 2009 Debt to 10016170 / 87361 = yourEquity family site Ratio 114.65 % your site here Year 2010 Year 2011 9355390/2304214 4655248/6089755 = = 4.06% 0.76% 200.00% 180.00% 160.00% 140.00% 120.00% 100.00% 80.00% 60.00% 40.00% 20.00% 0.00% Debt / Equity Ratio 2009 2010 2011 114.65% 4.06% 0.76% LOGO Ratio Analysis Ratio Analysis The Punjab Provincial Co-operative Bank Ltd Formula: EBIT / Total Interest Year 2009 Times 591885/1570956 Interest = your family site Earned 0.37 times Year 2010 790829/965655 = 0.81 times Year 2011 894430/386027 = 2.31 times 3 your site here 2 1 0 Time Interest Earned Ratio 2009 2010 2011 0.37 0.81 2.31 LOGO Ratio Analysis Ratio Analysis The Punjab Provincial Co-operative Bank Ltd Formula: Total Advances/ Total Deposits Year 2009 Year 2010 Year 2011 Advances 8177689/1837175 7385647/3820343 Deposit = = your /family site Ratio 4.45 1.93 your site here 6020045/ 2443098 = 2.46 10 8 6 4 2 0 Advances / Deposit Ratio 4.45 1.93 2.46 LOGO Ratio Analysis Ratio Analysis Operating cash flow your family site your site here The Punjab Provincial Co-operative Bank Ltd Formula:Net cash of Operating activities/CurrentLiabilities Year 2009 (321956)/ 10016170 = -0.0321 0 -0.1 -0.2 -0.3 -0.4 -0.5 -0.6 Operating Cash Flow Ratio Year 2010 (2135260)/ 9355390 = -0.2282 Year 2011 (2529962)/ 4655248 = -0.5434 2009 2010 2010 -0.0321 -0.2282 -0.5434 LOGO Ratio Analysis Ratio Analysis The Punjab Provincial Co-operative Bank Ltd Formula: Net income/ Outstanding No. of Shares Year 2009 Earning (979071000) Per /4335068 your family site Share = -225.8 your site here 200 100 0 -100 -200 -300 Earning Per Share Year 2010 (179626000)/ 4337440 =-41.41 Year 2011 479773000/ 4340625 =110.53 2009 2010 2011 -225.8 -41.41 110.53 LOGO Ratio Analysis Dividend Per Share: Due the losses in previous some years bank could not paid any dividends to its shareholders. your family site Price Earning Ratio: data are not available due to unlisted organization. your site here LOGO Conclusion! Increase markup revenue and reduce expenses Increase its non interest income your family site Inefficient utilization of assets in previous years Improve return on equity your site here Improve its debt/equity ratio PPCBL Improve its liquidity LOGO Recommendations! Reduce expenses to better profit margin Increase its non interest income from commissions etc your family site Efficiently utilize assets to increase return on assets Improve ROE so that investors should invest more. your site here For equity investors PPCBL improve its debt/equity ratio PPCBL Improve its liquidity by increasing OCF ratio. LOGO c Thank You! www.ppcbl.com.pk CELL: +92-333-6204958 FAX: +00-0-0000-0000 E-mail:bc080201453@vu.edu.pk LOGO