LECTURE #6: MICROECONOMICS CHAPTER 7

advertisement

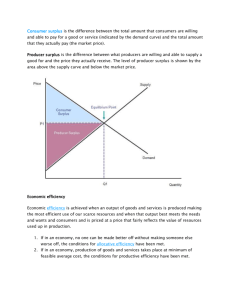

LECTURE #6: MICROECONOMICS CHAPTER 7 Consumer & Producer Surplus Market Efficiency Market Failure Consumer Surplus Welfare Economics How the allocation of resources affects economic well-being Willingness to Pay How much are you willing to pay to acquire a good? If you pay less than the amount you were willing to pay – you have a surplus. The same principle applies in an auction market. Consumer Surplus Lower prices lead to consumer surpluses; e.g. Wal-Mart "Always low prices…" Consumer surplus as a measure of "well being" Economic rationality: Seeking to maximize the surplus The Demand Curve Price of Albums John’s willingness to pay $100 Paul’s willingness to pay 80 70 George’s willingness to pay Ringo’s willingness to pay 50 Demand 0 1 2 3 Quantity of Albums 4 The graph shows the corresponding demand curve. Note that the height of the demand curve reflects buyers’ willingness to pay 4 Measuring Consumer Surplus (a) Price = $80 Price of Albums John’s consumer surplus ($20) $100 (b) Price = $70 Price of Albums John’s consumer surplus ($30) $100 80 70 80 70 50 50 Paul’s consumer surplus ($10) Total consumer surplus ($40) Demand Demand 0 1 2 3 4 Quantity of Albums 0 1 2 3 4 Quantity of Albums In panel (a), the price of the good is $80, and the consumer surplus is $20. In panel (b), the price of the good is $70, and the consumer surplus is $40. 5 Price and Consumer Surplus (b) Consumer surplus at price P2 (a) Consumer surplus at price P1 Price Price A A Consumer surplus P1 C P1 Initial consumer surplus Additional consumer surplus to initial consumers C B B F P2 Demand 0 Consumer surplus to new consumers Q1 Quantity D 0 Demand E Q1 Q2 Quantity In panel (a), the price is P1, the quantity demanded is Q1, and consumer surplus equals the area of the triangle ABC. When the price falls from P1 to P2, as in panel (b), the quantity demanded rises from Q1 to Q2, and the consumer surplus rises to the area of the triangle ADF. The increase in consumer surplus (area BCFD) occurs in part because existing consumers now pay less (area 6 BCED) and in part because new consumers enter the market at the lower price (area CEF). Producer Surplus Willingness to Sell Covering your costs is Job #1. Producer Surplus = Amount Received – Costs Measuring Producer Surplus Higher prices – increase producer surplus Surplus = Sell Price minus Cost to Produce The Supply Curve Price of House Painting Supply $900 800 Mary’s cost Frida’s cost 600 500 Georgia’s cost Grandma’s cost 0 1 2 3 4 Quantity of Houses Painted The graph shows the corresponding supply curve. Note that the height of the supply curve reflects sellers’ costs. 8 Measuring Producer Surplus Price of House Painting (a) Price = $600 Supply Price of House Painting $900 800 $900 800 600 500 600 500 Grandma’s producer surplus ($100) (b) Price = $800 Supply Total producer surplus ($500) Georgia’s producer surplus ($200) Grandma’s producer surplus ($300) 0 1 2 3 4 Quantity of Houses Painted 0 1 2 3 4 Quantity of Houses Painted In panel (a), the price of the good is $600, and the producer surplus is $100. In panel (b), the price of the good is $800, and the producer surplus is $500. 9 Price and Producer Surplus (b) Producer surplus at price P2 (a) Producer surplus at price P1 Price Price P2 P1 B Producer surplus P1 C D E F Producer surplus to new producers B Initial consumer surplus A 0 Supply Additional producer surplus to initial producers Supply C A Q1 Quantity 0 Q1 Q2 Quantity In panel (a), the price is P1, the quantity supplied is Q1, and producer surplus equals the area of the triangle ABC. When the price rises from P1 to P2, as in panel (b), the quantity supplied rises from Q1 to Q2, and the producer surplus rises to the area of the triangle ADF. The increase in producer surplus (area BCFD) occurs in part because existing producers now receive more(area BCED) and 10 in part because new producers enter the market at the higher price (area CEF). Market Efficiency Three Definitions Consumer Surplus = Value Received – Amount Paid Producer Surplus = Amount Received – Cost to seller Total Surplus = C.S. + P.S. When T.S. maximizes, markets are efficient. A market in equilibrium maximizes T.S. (See Figure 7) Problem of Equity arises if surpluses are not evenly distributed Market Efficiency Allocation of Resources in Fee Markets Allocate supply of goods to buyers that value them most highly. Allocate demand for goods to sellers than produce at the least cost. Free markets produce the quantity of goods that maximizes CS and PS. Supply and Demand Curves as measures of Value Supply Curve represents value to producers. Demand curve represents value to consumers Market Efficiency Importance of Equilibrium to Value At quantities below equilibrium, consumer value is greater than producer cost. At quantities above equilibrium, cost to sellers is greater than value to buyers. Market Efficiency And Market Failure Market Efficiency assumes perfectly competitive markets. Market Efficiency reduced if P or C has market power – ability to influence price. Impact of Externalities Side effects that impair total welfare; e.g. pollution Failure to monitor and protect property rights; e.g. patents and copyrights Market Failure = when resources inefficiently allocated Homework Questions for Review: 1, 2, 4, 5 (4Th Ed – same) Problems and Applications: 3, 4, 5 (part a, b) 4Th ED: 2, 3, 4 (part a, b)