Business Insurance SSSC #5 - Pro

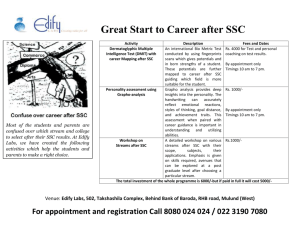

advertisement