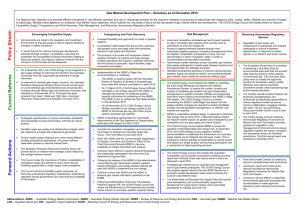

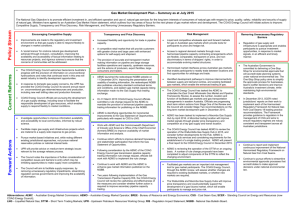

Issues Paper - Energy Council

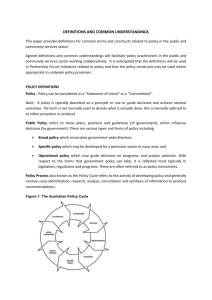

advertisement