Mobile TV

Tata Teleservices – Mobile TV

Presented by:

Devendra Ingole – 118

Chirag Junjani – 119

Dalton Monteiro – 131

Ramachandran Ananthan – 140

Rajkumar Sahajwani – 143

Tata Teleservices – Mobile TV

TATA Teleservices

• Tata Teleservices spearheads the Group's presence in the telecom sector.

• Committed investment of INR 36,000 Crore (US$ 7.5 billion) in telecom (FY

2008), the Group has a formidable presence across the telecom value chain.

• Incorporated in 1996, Tata Teleservices was the first to launch CDMA mobile services in India with the Andhra Pradesh circle.

• Starting with the major acquisition of Hughes Tele. com (India) Limited [now renamed Tata Teleservices (Maharashtra) Limited] in December 2002 the company swung into an expansion mode.

• With the total Investment of Rs 19,924 Crore, Tata Teleservices has created a Pan India presence spread across 22 circles.

• Partnered with Motorola, Ericsson, Lucent and ECI Telecom for the deployment of a reliable, technologically advanced network.

Product and Services

Mobile services

Wireless Desktop Phones

Public Booth Telephony and Wireline services

Value added services like voice portal, roaming, post-paid Internet services, 3-way conferencing, group calling, Wi-Fi Internet,

USB Modem, data cards.

Product and Services

Calling card services and

Enterprise services

Prepaid wireless desktop phones.

Public phone booths.

New mobile handsets

New voice & data services such as BREW games, Voice Portal, picture messaging, polyphonic ring tones, interactive applications like news, cricket, astrology, etc

There are three types of TV-like service:

Broadcast: Material from linear, continuous channels transmitted to many viewers simultaneously over a terrestrial or satellite broadcast network, rather than the mobile network.

Video streams: Linear, continuous content is delivered to individual viewers over the mobile network.

On-demand access: Users download material from a host server through an individual connection. Each user can watch a piece of content from the start. This type of service can offer libraries of material, including personal content.

Mobile TV ……

The term "mobile TV" refers to any linear, continuous content that is streamed or broadcast over a network to mobile phones. This is often referred to as "live" or "real time" TV.

Market

Customer benefits

Partner

Benefits

TATA

Benefits

Why Mobile TV

Network Technology allows the Live TV signals straight to customers a) Instant access to news, channels & entertainment

(Music videos, humor) on the move.

b) Never miss a program c) Individual consumption at home a) Additional TV and Video on Demand (VOD) Usage.

b) New revenues from short formats on demand c) Expected advertising revenues when mass market penetration acheived a) Facilitate customer acquisition b) Improve ARPU from subscriptions, usage and advertising

Indian Telecom :

Large Growing Penetration / Subscriber Base

• 140 million phones with Teledensity of 12.75 (Mar. 2006)

• 90 million mobile phones including WLL-M (Teledensity -

8.25)

• 50 million fixed phones (Teledensity - 4.5)

• Out of 32 million phones added during last year, about 31 million are mobile phones

• More than 4 million subscribers added per month (growing at ~35% p.a.)

• No. of TVs- 100 million

• No. of Cable TV Connections- 62 million

• Internet Connections- 7.5 million (30 million users @ 4 users per connection)

Mobile devices will be the biggest mass market reach platform!

Ringtones,

21%

VAS - Business Share

Games,

6%

Voice Based,

11%

Wallpapers,

5%

Text Based ,

31%

CRBT,

26%

Segmentation & Targeting

Youth and Business people on the move.

Age group of 18-34 Yrs ( Tech Savvy )

TODAY’S YOUTH: TOMORROW’S MARKET

The first generation in history to grow up with internet, 24 hr

TV and mobile phones.

Multitasking: 44 hrs of activity in a day! (Av 2-3 other tasks while watching TV)*

Key needs community, self-expression, and personalization: best met through music, the Internet, and mobile devices*

TV serves as a mechanism for escape and entertainment.

* Yahoo!-OMD study of 13-24 yr olds in 11 countries, Jul-Aug 2005

Positioning w.r.t Technology Adoption Life Cycle

Innovators & Early Adopters

• Video on Demand

• One free channel of customers choice

• Provide free clips ( Video / music)

LU

EA

EM

Time

LM

La

Positioning w.r.t Technology Adoption Life Cycle

Early Majority & Late Majority

• Innovate on Handsets picture quality

• Try and improve the network

• Bundled offers for handsets and services

• Provide free clips ( Video / music)

LU

EA

EM

Time

LM

La

Positioning w.r.t Technology Adoption Life Cycle

Laggards

1) Free usage for one month

2) Bundled products ( handsets and services)

LU

EA

EM

Time

LM

La

Product – Mobile TV

Mobile TV is not a substitute for traditional television - it will

Complement, not replace, the media that preceded it

This means different usage patterns than traditional TV implications for programming

TV snacking, not TV dinners. Around 2-3 minutes per session

Different usage scenarios

While commuting

Watching mobile TV while waiting or queuing for something

At work during breaks – presumably at lunchtime and coffee breaks!

Watching mobile TV at home during peak time TV viewing

Devices…….

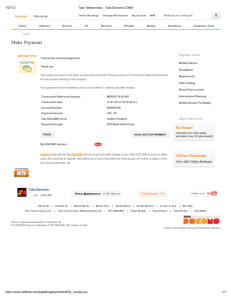

Pricing Models

Being the innovative technology – TATA’s would go for “Market Skimming”.

Mobile TV Handset will cost INR 15,000 – 25,000

Services Will be the combination of monthly Subscriptions and payments for individual programs :

Two Types of models :

Flat Rate Subscription ( Very Rare!!)

Rs 500 Per month for 5-12 Channels (Upto 100MB max)

Pay-per Use : An Easy Model to Launch

INR 150 Subscription Charges.

Download charges – Rs 5 Min or Rs 10 / MB for 5-12 Channels.

Pricing Models

Other Options :

Pay – Per – View or Pay – per – Content

More Flexible options

Eg.: View a cricket game only , subscribe to a specific channel

Diversified all-you-can eat bundles

Various packages including mobile TV channels.

Place & Promotion

Place:

Delhi, Rajasthan, Karnataka, Andhra Pradesh, Punjab and

Maharashtra are amongst the top circles in VAS revenues.

Hence we target Delhi , Rajasthan, Karanataka,AP,Punjab

& Maharashtra Circles for launching the services.

Promotions :

Major Promotions will be through the following mediums:

Advertising through prints ads and TV ads.

Sponsorships ( College events or office seminars)

Through SMS’s.

Through websites.

Porters Five forces Model

Threat of New Entrants

High Competition

High Initial Investment

High Gestation period

Bargaining power of customers

High potential competition among service providers

Bargaining Power of

Suppliers

Various Chinese

Manufacturers

Intense competition with

Reliance and BSNL

Threat of Substitutes

Dynamic Industry.

Innovation in Technology

Ansoff’s Product- Grid –Mobile TV

Existing Product New Product

Market Penetration Product Development

New Product in India / New Application

Product is already available across the globe.

Market

Development

Diversification

Business Model

Combined offering between mobile operators and

Broadcasters

Content Provider

Broadcaster

Tata Indicom

Broadcast network operator

Content Flow

(Broadcast)

Content flow

(interactive)

Customer

Revenue Flow

Strengths and Weakness

Strengths

• Good Quality & Strong Network.

• Tie up with TATA sky to provide more channels

• Value Added Services (VAS) like Internet on mobile etc

• Strong Channel

• Capitalisation of Brand TATA.

Strengths and Weakness

Weakness

• Customer care

• Weak Marketing communications

• High Churn.

• Handset Selection

Issues and Opportunities

• Opportunities

Consumer or Market Opportunity.

Broadcaster Opportunity.

Operator Opportunity.

• Issues

Technology issues

Regulatory issues

Consumer / market opportunity

• Forecasters’ numbers differ but all agree the opportunity is enormous

• Strategy Analytics: “Mobile Broadcast TV: caution needed as the bubble grows”.

Hype out of proportion with consumer interest

Development vendor driven

• Not functionality, not news/immediacy

“COOL” is and will be the driver of all consumer technology

• The challenge is not to interest the consumer but to find the right mix of content and price

In India…

• Single TV homes counter to youth need for personalization

• Mobile devices enable personal space

• No. of video-capable handsets just over 1 mn in the US; 76 mn in India #

• Indian youth are ahead of the curve in adoption of new mobile applications*

# eJournal USA , March 2006

* Yahoo!-OMD study of 13-24 yr olds in 11 countries, Jul-Aug 2005

• Broadcaster Opportunity

– Extend reach: add people who are not in front of a TV

– Extend prime time: making dead time alive – commuting; waiting; lunch time

– Sampling: short duration content to draw audience into channel for main telecast

• Operator Opportunity

– Falling ARPU VAS

– Customer Acquisition

Issues

• Technology Issues:

Spectrum Allocation

Cost of mobile TV compatible handsets

Speed of video streaming

• Regulatory Issues

3-G Policy for faster downloads

Broadcast Law limited to cable act

Broadcast content regulation and watershed policy : Will apply to Mobile TV ?

IPR Laws

In Conclusion…

Strategic Planning Assumptions

• At least 40% of subscribers will be using mobile video download and or/streaming services by 2012 ( 0.7%

Probability).

• At least one in 10 subscribers to mobile networks will adopt mobile TV services by 2009 (0.8 probability)

• By 2012, 30% of mobile phones sold will support a TV broadcasting technology (0.7 probability)

Recommendations-1

• TATA’s should transmit programs with a broad appeal over broadcast networks, along with premium content offered on a subscription and/or pay-per-view basis

• TATA’s should use existing 2.5G video services as a guide to overall demand, the type of content viewers like, and how much they will pay for it.

• Advertising should be carefully considered as a way to subsidize free-to-air content, as it may alienate some users

Recommendations-2

• Content owners should sort out the rights to new media.

This is a new area and there is a lot of confusion.

• Manufacturers should produce phones that although optimized to watch mobile TV remain primarily a phone as users that have a phone that supports TV services with them all the time will watch such services more