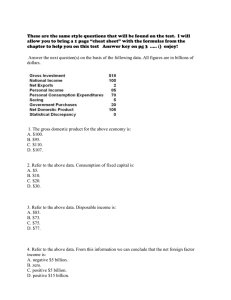

Gross National Disposable Income

advertisement

Ecological Economics Lecture 06 05th May 2011 rmota@ist.utl.pt Rui Mota and Tiago Domingos Environment and Energy Section Department of Mechanical Engineering What is Sustainable Development? • Brundtland report (1987) – “Development that meets the needs of the present without compromising the ability of future generations to meet their own need.” – Intra- and inter-generational equity – Anthropocentric • Sustainability of what? – – – – non-declining aggregate output or consumption, non-declining utility, non-declining aggregate resources (productive base), non-increasing pollution, … • Weak vs. Strong Sustainability • We choose non-declining utility as the criterion for sustainable development – some call this Weak Sustainability, but we don’t agree – this still misses the intra-generational component National Accounting: Keywords • • • • • • • • Flow of income in the economy GDP Savings Net vs Gross Domestic vs National CPI Inflation Real vs Nominal Aggregates National Accounts • The System of National Accounts is a comprehensive accounting framework within which economic data can be compiled and presented in a format that is designed for purposes of economic analysis, decisiontaking and policy-making. • Integrates a set of macroeconomic accounts, balance sheets and tables based on a set of internationally agreed concepts, definitions, classifications and accounting rules. • Accounts compiled for a succession of time periods, thus providing a continuing flow of information, indispensable for the monitoring, analysis and evaluation of the performance of an economy over time. Aggregation • 5 Sectors: – Households – Firms – Financial Intermediaries (banks, …) – Governments (national and local) – Rest Of the World (ROW) • 4 Markets (Supply and Demand): – Goods and services – Resources (labor, land and capital) – Money (loanable funds) – Foreign exchange Circular flow of income Households € Factor payments: Y Factors € Expenditures: C Output 2 1 3 Firms • • • • • • Factors: Labor, Land, Capital Factor payments: Wage, Rents, Interests, Profits – become income. Expenditures: on goods and services (output) 1 – Income approach: Y = Wage + Rent + interest + operating surplus 2 – Output approach: Y = market value of all produced output (Σ VA) 3 – Expenditure approach: Y = C Circular flow of income ΔGov S FI Households C G Gov. Lend Borrow Tr X T M Y ROW Firms I • Balance to: – Households: Y - Tnet = C + S, Tnet = T- Tr – Firms: Y = C + I + G + X - M – Government: ΔGov = Tnet - G – FI: S + ΔGov + B - L = I – ROW: X - M = L - B - Market for outputs National Accounts Identity C I X M Main Aggregates National (Residence) - Primary income flows to ROW Product / Income + Primary income flows from ROW Domestic (Territory) Net + Consumption Fixed Capital (CFC) Aggregate X - Consumption of Fixed Capital (CFC) Gross X – Domestic produc, Income, Saving, Disposable income, ... Domestic Product vs. National Income • GNI = GDP + Y’RM . Where Y’RM = Net income payable to non-resident units for production factors. 180 160 140 Milliards euros 120 100 80 60 PT Domestic Ireland Domestic 40 PT National Ireland National 20 0 1960 1965 Source: AMECO database 1970 1975 1980 1985 1990 1995 2000 2005 Domestic Product vs. National Income • The value added of a firm owned by Portuguese residents and functioning on our economic territory is part of the Portuguese GDP and GNI. • The wage (or other factor payments) of a resident that during 6 months worked to a firm in Spain is a part of Spanish GDP and Portuguese GNI. • The operating surplus (profits) – capital remuneration of a firm located in Portugal but owned by Germans – sent to Germany, is part of the Portuguese GDP and the German GNI. • The income earned by Portuguese emigrants working abroad as residents is not part of the Portuguese GDP and GNI. Main Aggregates Subtract CFC Gross Domestic Product (GDP) Net Domestic Product (NDP) + Net primary income flows to ROW = Gross National Income (GNI) = Net National Income (NNI) + Current net transfers from ROW = Gross National Disposable Income = Net National Disposable Income - Final consumption (Private and Government) = Gross Saving (S) = Net Saving (NS) Gross Product vs. Net Product [Million euros 2000] 160000 140000 120000 Million euros 100000 GDP 80000 NDP 60000 40000 20000 0 1990 Source: AMECO database 1995 2000 2005 Gross Product per person employed [euros 2000] 3000000 2500000 2000000 1500000 1000000 500000 0 1960 1965 1970 Source: AMECO database 1975 1980 1985 1990 1995 2000 2005 2010 Gross Product per hours worked [euros 2000] 11000000 10500000 10000000 9500000 9000000 8500000 8000000 1986 Source: AMECO database 1991 1996 2001 2006 2011 Net Saving in Portugal [Mrd euros 2000] • Net savings are negative when consumption is higher than net disposable income 1000000 500000 0 1960 1965 1970 -500000 -1000000 -1500000 -2000000 Source: AMECO database 1975 1980 1985 1990 1995 2000 2005 2010 National Disposable Income [Mrd euros 2000] 1200000 1000000 800000 600000 400000 200000 0 1970 1975 Source: AMECO database 1980 1985 1990 1995 2000 2005 2010 Net Lending/Borrowing [% of GDP] • Net resources that the total economy makes available to the rest of the world (if it is positive) or receives from the rest of the world (if it is negative). 0 1977 1982 -1 -2 -3 -4 -5 -6 -7 -8 -9 -10 Source: AMECO database 1987 1992 1997 2002 2007 2012