See CHS Project Report Here

advertisement

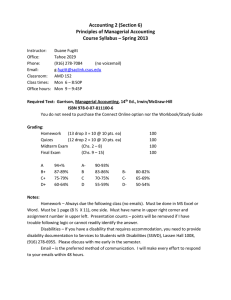

CHS ∙ 1 Leadership Development and Succession Planning at Community Health Systems Emily Abernathy, Allison Buchignani, Elisa Dubiel, Zac Ford, and Ryan Seiberling Vanderbilt University CHS ∙ 2 Executive Summary Community Health Systems (CHS) is one of the largest hospital management corporations in the U.S., currently 131 hospitals. CHS grows by acquiring hospitals with weak financial positions and making capital available to them for improvements and revenueincreasing projects. Much of CHS’ success is due to 14 years of consistent leadership at the CSuite level, and their effective use of corporate strategy. Under current leadership, CHS has grown their net revenue by an additional $1 billion a year (chs.net, 2010). To measure performance, CHS relies on a tailored program enacted by the Studer Group, a consulting firm that created retention manuals, evaluation models, and rewards systems to help CHS retain talent. CHS offers several programs for ongoing development, including tuition reimbursement, online classes, and specialist and assistant CEO positions to give experience and decision-making opportunities to promising candidates. Though CHS has strong training offerings and effectively develops specialist positions, it fails to develop the majority of its staff. Change looms at CHS as many corporate executives and hospital CEOs will soon retire. Of the 35 top corporate officers, 15 will likely retire in 5-7 years. (Andrews-Emery, personal communication, Nov. 4, 2011). Currently, a selection process begins after an executive announces retirement, usually 6-9 months before his departure. The current system is adequate, but with the large number of potential openings, it may not continue to be successful. To capitalize on the industry’s expected $50 billion increase in revenue over the next 10 years, CHS must assess its ever-increasing gap in technology infrastructure investments and make changes accordingly (Andrews-Emery, personal communication, Sept. 23, 2011). Data can be gathered and analyzed, helping identify prospects earlier, and allowing time for an effective, personalized mentoring period. CHS must improve its succession planning process to attract and retain top-level talent for the next generation of leaders. CHS ∙ 3 Organizational Overview Mission, Strategy, and Values Community Health Systems (CHS) owns and operates an aggregate of 131 hospitals with more than 19,800 beds located in 29 different states. It employs over 90,000 people. CHS’ business model is simple and effective. CHS focuses on “integrating and improving the financial and operating performance of newly acquired hospitals,” and uses its ability to develop “strong community relations as a competitive advantage” (chs.net, 2010). After becoming affiliated with CHS, hospitals are encouraged to maintain their local brand and identity (Andrews-Emery, personal communication, Nov. 4, 2011). CHS hospitals are eligible to take advantage of CHS’ significant capital, which can be used for revenue-increasing projects like renovations, expansions, information systems upgrades, equipment upgrades, etc. (chs.net, 2010). CHS has had strong, consistent leadership over the last two decades. Its leaders have established a strong company culture, which emphasizes commitment to employees, patients, and physicians. CHS highly values sustainability as it seeks to follow Green Guides and advocates for sustainable healthcare (chs.net, 2010). History 1985 Community Health Systems (CHS) was founded 1996 CHS combined its Houston corporate headquarters and Nashville operations 1996 Forstmann Little & Co. acquired the company in a $1.1 billion leveraged buyout 1997 Wayne T. Smith was recruited as President and Chief Executive Officer 2000 CHS was again taken public on the NYSE (CYH) at a price of $13 per share 2007 CHS acquired Triad Hospitals, adding 50+ hospitals to the organization (chs.net, 2010) CHS ∙ 4 Leadership CHS has a small Board of Directors, comprised of the President & CEO, Wayne T. Smith, the Executive VP & CFO, Larry Cash, and 6 other members (chs.net, 2010). Smith has been CEO for more than 14 years and has one of the industry’s most successful records. Under Smith, CHS has grown from $742 million in annual net revenue in 1997 to over $13 billion in 2010 (chs.net, 2010). Mr. Cash also has a proven record and high status in the healthcare industry (chs.net, 2010). Smith and Cash lead a team comprised of 17 other corporate officers, who focus on either the corporate offices or division operations (see Appendix A). Each hospital affiliated with CHS retains its own leaders. Though corporate leaders have been strong, consistent, and stable for a number of years, change is looming. The HR team is well aware that many of the key leaders at the C-level are nearing retirement age (Andrews-Emery, personal communication, Nov. 4, 2011). CHS is at a pivotal point as it faces the transition of leaders since “Succession is very difficult, which is why companies so often fail at it. It takes a tremendous amount of discipline, focus, and support to do well” (Mulcahy, 2010, p. 48). Talent Management Succession Planning In the past, executives at CHS’ corporate office have generally given 6 to 9 months notice before retiring. Recently, CHS has replaced 4 retiring executives. Statistics show a 50% internal promotion rate at CHS. Since its inception in 1985, CHS has had a very low executive turnover rate, but in the next 5-7 years, CHS expects 15 of its 35 corporate executives to exit, including 3 top executives. 131 hospitals have leaders that will eventually retire in addition to the 15 out of 35 corporate executives. HR leaders are considering plans for the successors of the 15 corporate officers that are expected to retire, but they have not yet projected how many hospital CEOs will need to be replaced (Andrews-Emery, personal communication, Sept. 23, 2011). CHS ∙ 5 CHS generally follows a horse-race structure when selecting a new C-Suite candidate. There is no formal naming of possible candidates, though the culture seems to informally point to a few standouts. Department heads are given some power to suggest a candidate, but CEO Wayne Smith makes the final decision. Smith’s successful record earned him referent hiring power; the board of directors simply gives the rubber stamp of approval to his choice as a formality. CHS is not immune to the potential consequences of a horse-race succession system. Experience has shown that accommodations must be made for those promising candidates not selected (Andrews-Emery, personal communication, Sept. 23, 2011). HR leaders at CHS agree with Anne Mulcahy in her Harvard Business Review article when she says, “I don’t believe in having people face off against each other for the CEO job in a classic horse race…I didn`t want to lose the three players who weren’t going to get the job” (Mulcahy, 2010, p. 49). Often, to modify the race and minimize the negative consequences, CHS gives runners-up a slightly elevated position with more responsibility and more pay. CHS makes an effort to keep leaders from leaving (Andrews-Emery, personal communication, Nov. 4, 2011). Environmental Changes Currently in a stable situation, CHS has not faced large-scale leadership turnover in the past 2 decades (Andrews-Emery, personal communication, Nov. 4, 2011). It is likely that high levels of turnover could negatively affect performance and organizational effectiveness if the changes are not handled cautiously, especially since high turnover is projected to occur at a time when healthcare legislation may change business practices. Though CHS hopes to capitalize on its share of the healthcare industry’s expected $50 billion revenue increase in the next 10 years, strong strategy and culture will be essential during these changes (AndrewsEmery, personal communication, Sept. 23, 2011). Performance Evaluation CHS uses 3 accountability tools to ensure its C-Suite personnel reach the expectations of the CHS Accountability Team, which includes the CEO and the Board. These accountability CHS ∙ 6 tools include Leader Evaluations, Monthly Report Cards, and 90-Day Plans, all of which were adapted from the StuderGroup Leadership Evaluation Tools Manual (Andrews-Emery, personal communication, Nov. 4, 2011). These tools focus on organization-wide goals, which fall under the 5 pillars of CHS: Service, People, Quality, Finance, and Growth (StuderGroup, 2003). CHS’ Leader Evaluations contain 3 main sections: Goals by Pillar, Weight, and Goal ranges and scores (see Appendix B). Every goal developed by CHS’ leadership is assigned to at least 1 of the 5 pillars. Each goal is assigned a weight between 0 and 100 percent as well as a score between 1 and 5 (StuderGroup, 2003). In addition to annual evaluation, each C-Suite member’s performance is measured throughout the year using a Monthly Report Card and 90 Day Plan. These tools give the Accountability Team a means of tracking the progress (or lack of progress) being made by the executive toward organization-wide goals. The Monthly Report Card uses the same format as the Leader Evaluations (StuderGroup, 2003). When reviewing a Monthly Report Card, like that shown within the StuderGroup Leadership Evaluation Tools Manual, CHS includes a Goal (which is assigned to a Pillar), a method of measurement, monthly values, and fiscal year averages (StuderGroup, 2003). The 90-Day Plans are identical to the monthly report cards except that they include Action Steps and 3 “Managing Up Levels,” which describe interventions and descriptions of Accountability Team involvement in managing outcomes (StuderGroup, 2003). There are 3 performance interventions used at CHS: 1. Full speed ahead, no action required by CEO 2. Full speed ahead, but let me know before you launch 3. Do not move ahead without permission These 3 interventions directly correlate to the Team Leadership Model, which states, “The leader’s job is to monitor the team and then take whatever action is necessary to ensure team effectiveness” (Northouse, 2010). At CHS, the leader is the CEO and the “team” is the C-Suite. Accountability tools such as Leadership Evaluations provide the feedback necessary for C-Suite personnel to improve performance. Most employees who reach the C-Suite level are CHS ∙ 7 motivated intrinsically by desire for achievement, and like many organizations, CHS also uses a robust extrinsic rewards system to motivate C-Suite personnel to meet organization goals. CHS uses an incentive strategy that is based on overall scores on performance evaluations (StuderGroup, 2003). For example, if a member at CHS received an overall score of 3 (1-5 scale), he or she may get a 3.0% base pay raise. Due to confidentiality, CHS does not release exact incentive scores, but confirms that significant incentives are linked with positive performance evaluation. CHS leadership defines C-Suite goals, clarifies the path for achieving these goals, removes obstacles, and provides support to C-Suite leadership. CHS’ successful record shows that its version of Path Goal Theory is effective and practical in leadership development and overall performance (Northouse, 2010). Professional Development & Retention The CHS Corporate Development and Retention Team reports to Robert A. Horrar, Vice President, Administration and Human Resources. The team administers a Leadership University, which provides more than 30 different classes, such as Essential Skills of Leadership, Leading through Change, Managing Teams, and Providing Performance Feedback (chs.net, 2010). The courses are online and instructor-led, and they require self-enrollment. Although these offerings exist, there is no development process in place that facilitates the learning of a newly hired employee. There is no on-boarding program or orientation that is used universally among the hospitals in the system (AndrewsEmery, personal communication, Nov. 4, 2011). Some hospital managers support their employees by setting up development plans and following up on their progress, but corporate regulations do not mandate training, leaving many hospital employees very little motivation to enroll in classes. In contrast, CHS’ development team does give significant attention to employees in the Specialist role, a position that serves as a stepping stone to hospital management (See model to the left). Specialists receive CHS ∙ 8 a development guide with steps and required classes, which they complete during their tenure as specialist (Andrews-Emery, personal communication, Sept. 23, 2011). In order to retain talent, the Corporate Development and Retention Team created a manual to serve as a framework for recruiters and managers wishing to increase or maintain a high retention rate. Recently, monthly calls between the corporate team and the individual recruiters were established (Andrews-Emery, personal communication, Nov. 4, 2011). These discussions improved information flow and provided opportunities to react to discrepancies quickly, greatly impacting retention. CHS SWOT Analysis Strengths · Access to training and development resources · Development of specialists · Retention strategies Weaknesses · Development of C-Suite assistants · Out-dated leadership practices · Fragmented succession plan Opportunities · New generation of leadership and technological tools they can utilize Threats · Negative feelings of those being acquired · Limited talent supply outside the organization Strengths Access to training and development resources. One of CHS’ strengths is that employees have access to an extensive supply of training and development materials. Training resources include The “Community” College, Online Training Courses, the Nursing Scholarship Program, mentorship, and tuition reimbursement programs (chs.net, 2010). These resources are easy to access as many are online. With so many classes and programs at their fingertips, employees have the resources they need to become the most effective employees for CHS. Development of specialists. In addition to providing extensive training and development resources, HR takes initiative to develop those with the Specialist title. This is a strength because, as the popular “Mack Truck” theory suggests, companies need to develop CHS ∙ 9 future leadership early just in case a senior leader becomes unavailable very suddenly. CHS focuses on finding talent in the lower ranks because, according to Ms. Andrews-Emery, promoting internal candidates to these leadership roles “greatly increas[es] their likelihood of success.” In addition, because Specialists work closely with the people whom they may eventually succeed, current managers can “identify and mentor them as future leaders and anticipate skills gaps” (Andrews-Emery, 2010). CHS hires high-potential candidates from Master of Healthcare Administration and Master of Business Administration programs. When these hires enter CHS, they typically work as administrative specialists in big hospitals. They experience coaching, on-the-job training led by executives, management development training, and networking opportunities (AndrewsEmery, 2010). These strategies will allow CHS to meet long-term human capital needs. Retention strategies. CHS’ retention strategy is also strong. Carefully choosing employees with expertly conducted interviews and the online proprietary profile increases the chance that candidates fit the organization and specific job well enough to avoid burnout. HR professionals, including recruiters, work with employees after they join the organization (Andrews-Emery, 2010). Recruiters maintain relationships with their recruits and even conduct quarterly Stay Interviews with them. In addition, executive coaches help leaders work through problems that may make their jobs stressful (Talent Acquisition and Retention Manual, n.d.). These proactive strategies and resources help maintain talent, avoiding expensive turnover. Weaknesses Development of C-Suite assistants. CHS does not appear to make all high potential leaders take advantage of training resources. Specialists do follow a specific training curriculum. However, assistants to the C-Suite do not. Assistants shadow current C-Suite leaders to learn about the jobs (Andrews-Emery, personal communication, Nov. 4, 2011). By neglecting to fully develop key employees, CHS risks wasting talent. CHS ∙ 10 Out-dated leadership practices. A second weakness of CHS is the outdated leadership style of its senior leaders. The current corporate officers are not interested in making capital investments in technology infrastructure. Employees are ready for new leadership because of what they perceive as generational differences. Because these leaders have resisted change in tech systems, the company spends more time on manual work than necessary and cannot take full advantage of data mining or gather and transfer large amounts of core information across the organization (Andrews-Emery, personal communication, Nov. 4, 2011). Not only does this weakness fail to capitalize on performance improving infrastructure, but it also affects vitality and creates an obstacle for leaders in favor of advancing technology. Fragmented succession plan. By not clearly defining a more detailed succession plan, CHS wastes valuable development time for high potential candidates. Lack of a concrete, consistently followed plan puts CHS at risk for forgetting to complete important succession planning tasks before it is too late. If CHS fails to prepare to groom new leaders early, the organization cannot remain nimble enough to survive in its quickly changing environment. If the company does not become more intentional about succession, successors may not receive the mentoring and knowledge transfer they need to succeed on the job without causing disruptions in the organization’s processes by the time they need to fill the position. Opportunities New generation of leadership and new technological tools. One opportunity the organization faces is the fresh approach to leadership the next generation of leaders can offer. Ms. Andrews-Emery expects the next generation of leaders to improve technological systems at the company (Andrews-Emery, personal communication, Nov. 4, 2011). HR plans to “implement a companywide human resource information system to develop feedback loops between performance expectations and actual performance, evaluate performance metrics, introduce a range of performance review techniques, and store information about employees” (Andrews- CHS ∙ 11 Emery, 2010). As new leaders assume high positions at CHS, changes like this are likely to occur in order to monitor talent development, track progress, and improve performance. Threats Negative feelings of those being acquired. Because CHS focuses on acquiring hospitals that need to be bought because they are going under, employees of hospitals that CHS acquires are often unhappy and underdeveloped (Andrews-Emery, personal communication, Nov. 4, 2011). Thus, employees at future acquisition sites threaten CHS’ stability and high performance record. Limited talent supply outside the organization. Ms. Andrews-Emery states, “Because there is a limited talent pool of chief executive officers, chief financial officers, chief operating officers and chief nursing officers with for-profit health care experience, top-notch C-level hospital executives are rare” (Andrews-Emery, 2010). This is a significant threat to CHS since the company “must identify and match executives to the [specific] needs of each of its 122 affiliated hospitals across the country” (Andrews-Emery, 2010). CHS has a huge number of positions – around 500 to be exact – to fill with a limited supply of prospects. The company’s negative media coverage resulting from the Tenet Healthcare takeover exacerbates this issue by giving CHS a negative reputation in the eyes of prospective employees (Brin, 2011). Not only does this scarcity in labor make acquiring new talent challenging, but it could also cost CHS money by forcing salary and benefit expenditures up. Recommendations In order for CHS to succeed in the face of its current weaknesses and threats, it must recognize opportunities and strengths and prepare a plan to face the expected changes. First, the reward system should be expanded to connect employees with training and development sources. Employees should be incentivized to participate in the programs that the organization finds most useful in leadership development. In order to cope with resistance toward technology, CHS should focus on finding employees who can bridge the gap between older CHS ∙ 12 generation leaders and future leaders. In addition, when filling subsequent leadership roles, the company should choose to hire those who wish to update CHS technologically. In order to encourage current leadership to adopt the talent management technology, HR should research successful talent management models and industry performance management benchmarks and perform a cost-benefit analysis to build a business case showing current leaders this type of performance management system’s value. In order to improve morale among newly acquired hospital employees in the future, HR should have a front-end program explaining that the acquired hospital will be allowed to maintain its culture, identity, and autonomy in many of its processes. CHS should allow as many acquired employees as possible to continue working in their current positions. In addition, CHS should increase transparency in the acquisition process. To attract as many skilled employees as needed, CHS should offer competitive compensation and benefits packages. However, since money and benefits do not meet higherlevel needs on Maslow’s hierarchy, the company should stress to potential employees that they will have extensive development opportunities, such as mentorships and internal promotion. CHS should be mindful of PR issues, like the Tenet lawsuit, and their effects on recruiting. Conclusion CHS is poised and ready to create a succession plan tailored to its situation and develop a task force to oversee the plan’s implementation. The task force or committee will be most successful if it features a few key leaders with influence who can champion the need for a database that will allow HR to track talent, performance, goals met, and other crucial information about the many employees for whom they are responsible. The future is promising for CHS, especially if these gaps in leadership are anticipated and well planned. Succession planning is critical for large companies like CHS. “If you can put your energy into making sure that one person is absolutely the best person for the job, you’ll be in a good place” (Mulcahy, 2010, p. 51). CHS ∙ 13 References Andrews-Emery, A. (2010). Finding top people for top spots. HRMagazine, 8(3), 42. Brin, D. W. (2011). Tenet, Community have work to do after takeover battle. The Wall Street Journal Online. Retrieved from http://online.wsj.com/article/BT-CO-20110511710106.html Community Health Systems. (2010). CHS. Retrieved from chs.net Community Health Systems. (n.d.). Talent acquisition and retention manual. Nashville, TN: CHS. Mulcahy, A. (2010). How I did it…Xerox’s former CEO on why succession shouldn’t be a horse race. Harvard Business Review, 10, 47-51. Northouse, P. G. (2010). Leadership: Theory and practice. Thousand Oaks: Sage Publications. StuderGroup. (2003). Leadership evaluation tools manual. Gulf Breeze, FL: StuderGroup. CHS ∙ 14 Appendix A: Corporate Officers* *From chs.net, 2010 Executive Leadership Wayne T. Smith, Chairman of the Board, President and Chief Executive Officer W. Larry Cash, Executive Vice President and Chief Financial Officer Senior Division Operations Leadership David L. Miller, President, Division I Operations Michael T. Portacci, President, Division II Operations Martin D. Smith, President, Division III Operations William S. Hussey, President, Division IV Operations Thomas D. Miller, President, Division V Operations Senior Corporate Leadership T. Mark Buford, Senior Vice President & Corporate Controller Larry M. Carlton, Senior Vice President - Revenue Management Kenneth D. Hawkins, Senior Vice President Acquisitions & Development Barbara R. Paul, M.D., Senior Vice President and Chief Medical Officer Martin G. Schweinhart, Senior Vice President Operations J. Gary Seay, Senior Vice President - Chief Information Officer Rachel A. Seifert, Executive Vice President, Secretary and General Counsel Lynn T. Simon, M.D., Senior Vice President and Chief Quality Officer Corporate Officers James W. Doucette Vice President and Treasurer Robert A. Horrar Vice President - Administration and Human Resources Tim G. Marlette Vice President and Chief Purchasing Officer Kathie G. Thomas President - Home Care Division Division I Operations Leadership Shan Carpenter, Vice President - Finance, Division I Operations Woodford H. Fields, Vice President - Division I Operations Todd Hill, Vice President - Practice Management, Division I Operations Eric Roach, Vice President - Finance, Division I Operations Paul Smith, Vice President - Division I Operations Division II Operations Leadership Mike Healey, Vice President - Finance, Division II Operations Robert O. Horrar, Vice President - Division II Operations Leslie Paul Luke - Vice President - Practice Management, Division II Operations David M. Medley, Vice President - Division II Operations Steve Rector, Vice President - Division II Operations Division III Operations Leadership Randy M. Cooper, Vice President - Finance, Division III Operations Edwin M. Corns, IV, Vice President - Physician Practice Operations, Division III Operations Neil Heatherly, Vice President - Division III Operations John McClellan, Vice President - Division III Operations Lynne Mitchell, Vice President - Finance, Division III Operations Division IV Operations Leadership Chuck Anderson, Vice President - Practice Management, Division IV Operations Brad Cash, Vice President - Finance, Division IV Operations Mike Mullins, Vice President - Division IV Operations Tim Hingtgen, Vice President - Division IV Operations Stephanie Moore, Vice President - Finance, Division IV Operations Division V Operations Leadership Michael P. Douzuk, Jr., Vice President - Finance, Division V Operations Doug Eberhard, Vice President - Practice Management, Division V Operations Terry Fowler, Vice President - Finance, Division V Operations Matt Hayes, Vice President - Division V Operations CHS ∙ 15 Corporate Leadership Dan Adkins, Vice President - Physician Business Services Andi Bosshart, Vice President - Corporate Compliance Officer and Privacy Officer Sammy Cantrell, Vice President - Deployment, Information Services Gordon Carlisle, Vice President - Facilities Management James H. Clark, III, Vice President - Collection Services Lisa M. Cline, Vice President - Information Systems Physician Practice Management/Support Debbie Cothern, Vice President - Quality and Resource Management Lola Davis, Vice President - Patient Financial Services Mark Dose, Vice President - Hospitalist Services Patricia Dougall, Vice President and Associate General Counsel - Division III Barry Fitts, Vice President - Financial Application Services Ben Fordham, Vice President and Chief Litigation Counsel Tomi Galin, Vice President - Corporate Communications Matthew S. Gallivan, Vice President - Government Relations Rhea Garrett, Vice President and Senior Employment Counsel Marc Goldstone, Vice President and Associate General Counsel - Division II Cheryl Hammen, Vice President - Health Information Management Kevin Hammons, Vice President - Financial Reporting Eric Harrison, Vice President - Technology and Data Center Operations Terry H. Hendon, Vice President - Acquisitions & Development Jan Hickman, Vice President - Assistant Corporate Controller Debra S. Landers, Vice President and Chief Marketing Officer Michael M. Lynd, Vice President - Internal Audit Kenneth F. King, Vice President - Acquisitions & Development Hal McCard, Vice President and Associate General Counsel - Division IV Michael Miserocchi, Vice President - Operations Support Cindy Parrott, Vice President - Clinical Services, Quality & Resource Management Brian A. Peoples, Vice President - Physician Practice Support R. Craig Pickard, Vice President - Corporate Taxation James Rayome, Vice President and Associate General Counsel - Division V Lizbeth R. Schuler, Vice President - Investor Relations Ron Shafer, Vice President - Physician Practice Services Sharon Stewart, Vice President - Clinical Information Systems Karen Sullivan, Vice President - Risk Management and Insurance Tom Tate, Vice President - Aviation Curtis Watkins, Vice President - Architecture & Strategy, Information Systems David Weil, Vice President and Associate General Counsel - Division I Richard T. Willis, Vice President - Managed Care Michael Yzerman, Vice President - Information Systems CHS ∙ 16 Appendix B: Example of Leadership Evaluation* *From StuderGroup’s manual (Confidential) CHS ∙ 17