ACCOUNTING STANDARD

advertisement

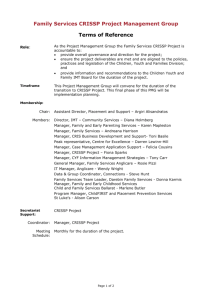

Session on Accounting Standards & convergence to IFRS Institute of Management Technology (IMT), Nagpur Guest Speaker : Pankaj Vasani IMT, Nagpur l Sept 5 , 2010 September 5, 2008 CA.Pankaj Vasani Introduction of the guest faculty Mr. Pankaj Vasani is a qualified Chartered Accountant and Lawyer, specializing in India and International taxes. He is currently the Head of Tax at Sapient Corporation Pvt. Ltd. Pankaj has vast experience and a strong track record in automotive, beverage, software and service industry. In his prior assignments, he has worked with Coca-Cola, Subros Ltd., and also in an advisory role. He is a master draftsman having excellent interpretative/ logical reasoning skills and is very well known in the tax fraternity. Pankaj has been a frequent contributor and speaker at various tax seminars/ conferences, and is also a guest faculty at B-schools. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani History of accounting Bible and Islamic Quran contains mention about Simple trade accounting. Luca Pacioli (1445-1517) is to be credited for “birth of accountancy” It was because of his mathematical knowledge that “double accounting system” was introduced The First book on accounting in English language was published in London by John Gouge (or Gough) in 1543 described as ‘A Profitable Treaty called the instrument’ --- It helped us to learn good order of keeping of the famous reconynge, called in Latin Dare and Habere, In English Debtors and Creditors Fine art of accounting was present in India even in Vedic times. Rig-Vedas having references to words Kraya (sale),Vanij (Merchant), Sulka (Price) As observed by Prof.Max Mueller there is very evidence of highly developed Hindu Accounting tradition in “Arthashatra” written by Kautilya around 300 B.C. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Agenda Accounting Standards Convergence of Accounting Standards with IFRS IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Foreword OBJECTIVE Financial reporting not an end AS to bring qualitative improvement in FR ICAI- leadership role-ASB Legal recognition by Co Act & SEBI To harmonize different accounting policies and practices in use in a country Seek to bring about uniformity in accounting practices Reduce alternativebound of rationalitycompatibilityinformed decision At par with IAS. ASI + Guidance note IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Accounting Standard Board ICAI constituted an Accounting Standards Board (ASB) on 21st April, 1977 Main function of ASB is to formulate accounting standards so that such standards may be established by the Council of the Institute in India. ASB takes into consideration the applicable laws, customs, usages and business environment The Institute is one of the Members of the International Accounting Standards Committee (IASC) and has agreed to support the objectives of IASC. While formulating the Accounting Standards, ASB gives due consideration to International Accounting Standards, issued by IASC and tries integrate them, to the extent possible, in the light of the conditions and practices prevailing in India ASB issues guidance notes on the Accounting Standards and give clarifications on issues arising therefrom - also reviews the AS at periodical intervals Established by an Act IMT, Nagpur l Sept 5 , 2010of Indian Parliament “The Chartered Accountants Act, 1949” The Institute of Chartered CA.Pankaj Accountants of IndiaVasani Procedure for issue of AS Council of the Institute Determine broad area where AS is needed Assisted by Study Groups Considers draft Makes amendment; if necessary Hold dialogue with Govt, PSU & industry Exposure draft prepared- for comments AS issued under the authority of Council Response received - draft finalized IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani APPLICABILITY OF ACCOUNTING STANDARDS ICAI, not being a legislative body, can enforce compliance with its standards only by its members. However, Section 211(3A) of the Companies Act requires companies to present their profit and loss accounts and balance sheets in compliance with the accounting standards SEBI and the RBI also require compliance with the Accounting Standards issued by the ICAI Insurance Regulatory and Development Authority (IRDA) (Preparation of Financial Statements and Auditor’s Report of Insurance Companies) Regulations, 2000 requires insurance companies to follow the Accounting Standards issued by the ICAI. The statutory auditors of every company are required to report whether the AS have been complied with or not Accounting Standard and Income Tax Act Guidance Note on Audit u/s 44AB of Income Tax Act, requires all financial statements prepared under mercantile system of accounting to comply with all applicable mandatory accounting standards issued by the Institute. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Accounting Standards : 1 ~ 32 IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARDS AS 1 Disclosure of Accounting Policies AS 2 Valuation of Inventories AS 3 Cash Flow Statements AS 4 Contingencies and Events Occurring after the Balance Sheet Date AS 5 Net Profit or Loss for the period, Prior Period Items and Changes in Accounting Policies AS 6 Depreciation Accounting AS 7 Construction Contracts (revised 2002) AS 8 Accounting for Research and Development AS 9 Revenue Recognition AS 10 Accounting for Fixed Assets AS 11 The Effects of Changes in FEx Rates AS 12 Accounting for Government Grants AS 13 Accounting for Investments AS 14 Accounting for Amalgamations AS 15 (revised 2005) Employee Benefits AS 16 Borrowing Costs AS 17 Segment Reporting AS 18 Related Party Disclosures AS 19 Leases AS 20 Earnings Per Share AS 21 Consolidated Financial Statements AS 22 Accounting for Taxes on Income. AS 23 Accounting for Investments in Associates in Consolidated Financial Statements AS 24 Discontinuing Operations AS 25 Interim Financial Reporting AS 26 Intangible Assets AS 27 Financial Reporting of Interests in Joint Ventures AS 28 Impairment of Assets AS 29 Provisions, Contingent` Liabilities and Contingent Assets AS 30 Financial Instruments: Recognition and Measurement AS 31 Financial Instruments: Presentation AS 32 Financial Instruments: Disclosures IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani 5 ACCOUNTING STANDARD-1 DISCLOSURE OF ACCOUNTING POLICIES – – Applicable to: all enterprises since 1-4-93. Deals with: the disclosure of significant accounting policies followed / method adopted in preparing and presenting financial statements. Fundamental accounting assumption: Going Concern Consistency Accrual Disclosure of AP: One place Part of FS No remedy for wrong or inappropriate treatment Any change… Consideration in selection of AP: Prudence Substance over form (actual happening Vs legal form) Materiality (information – influence- judgment) Change in AP when: Reqd by statute Better/more appropriate presentation Compliance with AS IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 2 VALUATION OF INVENTORIES – – Applicability: to all enterprises since 1-4-1999 [originally issued in june-1981] Deals with: accounting for inventories other than: AS-7, service providers; financial instruments held as stock-in-trade; and Producers inventories of livestock, agricultural and forest products, … OBJECTIVE: Method of computation of cost of stock Determine value of C/stock - at which it will be shown in BS – till it is not sold and recognized as revenue Major point of valuation of inventory Determine cost of inventory (CP+CoA+ CoC) Determine NRV of inventory Lower taken (SP-CP-CoS) INVENTORY: Inventories are assets consisting of : Finished goods WIP & Raw Material other stores, spares, raw material & consumables DISCLOSURE IN FS AP adopted for measuring inventory & Cost Formula used Classification of inventory like Finished, WIP & its Carrying cost IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani AS-2 and International Accounting Standard (IAS)-2: both are similar ACCOUNTING STANDARD- 3 CASH FLOW STATEMENTS – – Applicability: Mandatory to Level III enterprises (since 1-4-2004) Deals with / explains : cash movement under following heads Cash flow from operating Cash flow from investing activities activities (sum of these 3 reflect inc/dec in cash & cash equivalent) Definitions Operating Activity Cash: comprises cash on hand and demand deposits with banks. (Principal revenue producing activity) Cash equivalents: short term, highly liquid investments having maturity of less than 3 months can readily be convertible into cash w/o risk of changes in value Investing activity (Acquiring/disposing long term asset & other investment) Financing activity (result in change in size/composition of owner’s capital/ borrowing of Org Cash flow from financing activities Cash received from sale of good/service Cash received from royalty, fee, comm.. Cash payment for goods/services, tax payment Cash payment on behalf of employee Cash received from sale of FA/ITA Cash payment for acquiring FA & ITA Cash payment / investment in JV and other Co. Cash received from sale of share, issue of shares Cash payment for buy back of shares, interest/dividend payment IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Note: Non-cash Transactions are to be excluded from cash flow statement ACCOUNTING STANDARD- 4 CONTINGENCIES AND EVENTS OCCURRING AFTER THE BALANCE SHEET DATE – – Applicability: Mandatory to all enterprises (since 1-4-1998) Deals with : treatment in financial statements of contingency & events occurring after the balance sheet date. Existing condition/situation Result of which is not know Result will be know on happening/non-” Result may be gain/loss Contingency E.g.: litigation, claim, obligation etc Contingency must exist on a B.S date No contingency- no provision /notes to a/c Prudence- contingent loss only recognized Events occurring after B.S date May have favorable/ un-” effect Occurs b/w date on which B.S made and approved by BOD Requires either adjustment to asset/liability or disclosure E.g.: debtor insolvent, going concern, MV of investment, dividend etc. Relate to event existing on BS date Do not relate to event existing on BS date Events which take place after BS but require adjustment in assets/liability Event after acceptance of a/c – disclosure in board report Following information should be provided in disclosure: the nature of the event; IMT, Nagpur l Sept 5 , 2010 an estimate of the financial effect, or a statement that such an estimate cannot be CA.Pankaj made Vasani ACCOUNTING STANDARD- 5 NET PROFIT OR LOSS FOR THE PERIOD, PRIOR PERIOD ITEMS AND CHANGES IN ACCOUNTING POLICIES – – Applicability: Mandatory to all enterprises (since 1-4-1996) Deals with : the following Presenting P&L from ordinary activities, extraordinary items & prior period items in P&L a/c; a accounting for changes in accounting estimates, and disclosure of changes in accounting policies. Ordinary activities Ordinary activities undertaken by an enterprise as part of its business and related activities arising due to these activities. All items of income and expense which are recognized in a period should be included in the determination of net profit or loss for the period unless an Accounting Standard requires or permits otherwise. Prior period item “Material charges” or “credits” that arise in current period as a result of error and omission in past period Generally infrequent Separate disclosure – nature and amount- impact E.g. dep faulty calc or mathematical error Extraordinary item Income/exp arising – distinct from ordinary activity – expected to be infrequent Vis-à-vis business ordinarily carried on.- Subjective - Abnormal not necessarily extraordinary E.g. Natural disaster, expropriation of asset by state, change in govt fiscal policy, business segment discontinuance Part of net P&L for the period – separate disclosure – size, nature & amount Accounting estimate Many FS item cannot be measured with precision but can only be estimated E.g. provision for debtor/creditor, any liability , useful life of asset etc. 5 Revision of estimate does not bring adjustment CA.Pankaj Vasani IMT, Nagpur l Sept 5 , 2010 ACCOUNTING STANDARD- 6 DEPRECIATION ACCOUNTING – Applicability: to all enterprises since 1-4-1995 – Deals with: depreciation accounting and applies to all depreciable assets Depreciation: a measure of the wearing out, consumption or other loss of value of a depreciable asset arising from use, efflux, passing of time or obsolescence through technology and market changes. Depreciation includes amortization of assets whose useful life is predetermined – more than 1 year No depreciation on land, but applicable on leasehold land Depreciation as per St. line method: (Cost – scrap value) / estimated useful life Depreciation as per WDV: 1-N (Scrap value/ cost) N = estimated useful life Note: Companies Act, under Schedule XIV gives minimum amount of depreciation and not the maximum An Organisation can provide more depreciation – disclosure- effect – reason Change in method- to be disclosed in notes Disclosure Total cost of each class of asset Totall Sept depreciation for the period IMT, Nagpur 5 , 2010 Accumulated depreciation Depreciation Method CA.Pankaj Vasani ACCOUNTING STANDARD- 7 CONSTRUCTION CONTRACTS – – Applicability: to all enterprises (since 01-04-02) Deals with: the accounting treatment of revenue and costs associated with construction contracts Construction contract: a contract specifically negotiated for construction of an asset or a combination of assets Types that are interrelated or interdependent in terms of their design, technology and function or of closely Contract : their ultimate purpose or use. Like Fixed contract price contract: for construction in this of the bridge, contractor building, agrees damtoetc a fixed contract price, or a fixed rate per unit of output, which in some cases is subject to cost escalation clauses. Cost plus contract: in this the contractor is reimbursed for allowable or otherwise defined costs, plus percentage of these or a fixed Before the revision of thiscosts AS, there were fee two methods to determine profit. Percentage of completion method >> Post revision of AS only this to be used revenue recognized in method methods used to methods used to aggregate amount of Completed contract the period determine the contract determine the stage of costs incurred and completion of contracts recognised profits in progress D i s c l o s amount of advances u received r IMT, Nagpur l Sept 5 , 2010 e amount of retentions gross amount due from customers CA.Pankaj Vasani ACCOUNTING STANDARD- 8 Accounting for Research and Development In view of operation of AS 26, this Standard stands withdrawn IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 9 REVENUE RECOGNITION – – Applicability: to all enterprises (since 01-04-93) Deals with: the bases for recognition of revenue Revenue: the gross inflow of cash, receivables or other consideration arising in the course of the ordinary activities of an enterprise from a. the sale of goods, b. the rendering of services and c. the use by others of enterprise resources yielding interest, royalties and dividends Revenue recognition in case of rendering of Services: when service is performed & no significant uncertainty exists Performance is measured either: Completed service contract method: recognizes revenue only when the rendering of services under a contract is completed or substantially completed, or Proportionate completion method: recognizes revenue proportionately with the degree of Revenue recognition in case of: a contract. completion of services under Consignment sale – when agent sells Interest- when accrued Advertisement – when displayed to public Dividend: when Co. declares or individual has right IMT, Nagpur l Sept to receive etc5 , 2010 Revenue recognition in case of Sale of Goods: property in the goods has been transferred to the buyer for a consideration, Or significant risks and rewards of ownership has been transferred to the buyer; and seller retains no effective control of ownership of the goods transferred; and Uncertainty - Provision Postponed no significant uncertainty exists - disclosure regarding the amount of the consideration. CA.Pankaj Vasani ACCOUNTING STANDARD- 10 ACCOUNTING FOR FIXED ASSET – – Applicability: to all enterprises (since 01-04-93) Deals with: accounting for FA Fixed Assets: is an asset which is: Expected to be used for more than 1 accounting period Not held for sale in normal course of business Self made asset – only direct cost recorded Held with the intention of production of good or rendering of service – no profit margin Asset exchanged: 3 scenarios Gross book value: - Not similar asset – FMV of asset given up historical cost .When this amount is shown net of accumulated depreciation, it is termed as net book - Similar asset- FMVof asset value acquired/given or WDV - Shares issued – FMV of share/asset – whichever higher Fair market value: the price that would be agreed to in an open and Valuation of FAmarket in special cases: unrestricted between knowledgeable and Gain/loss on sale of FA- generally willing Hire Purchase – cost price parties dealing at arm's length who are fully recognized in PnL informed and are not under any compulsion to Jointly held asset- Prorata cost FeX fluctuation – adjusted in cost of transact Acquired at consolidated price – valuer’s value FA Dividend: when Co. declares or individual has right Improvement cost – capitalised to receive etc Repair – debit to PnL IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 11 ACCOUNTING FOR EFFECT OF CHANGES IN FOREIGN EXCHANGE RATE – Deals in: accounting for transaction in foreign currency translating the FS of foreign branch Reporting currency: currency of country where FS are prepared Foreign currency: currency other than reporting currency TRANSLATION OF FS OF FOREIGN BRANCHES Average rate: mean of exchange rate during the period fortnight, etc) inventories Revenue items,(week, except openingmonth and closing Closing rate: Exchange rate at BS date and depreciation- average rates. Forwards rate: agreed exchange rate b/w 2 partiesinventories for exchange of 2 at currencies at a specified Opening – rate the commencement of the date in a foreign currency shouldaccounting Afuture transaction be recordedperiod. Closing in the reporting currency by applying to the foreigninventories, Monetary items, - closing rate or realisable value. currency amount the exchange rate between the reporting currency and the foreign currency at monetary the date items - rate prevalent at the date of the Non of the transaction. transaction. Fixed TO assets- rate prevalent at the date of the transaction CHANGES IN EXCHANGE RATE SUBSEQUENT Contingent Liabilities- closing rate, translation does not INITIAL RECOGNITION result in any exchange difference Adjusted to the carrying amount of the fixed assets. In case the fixed assets are revalued the necessary adjustments should be given effect to the revalued asset IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 12 ACCOUNTING FOR GOVERNMENT GRANTS – Applicability: Mandatory for all enterprises with respect from 01/04/1994 Government Grants are : assistance by government in cash or kind for past or future compliance with certain conditions Government Grants should be recognized where Government grants may be received in following ways: Grants related to acquisition of fixed assets Government Grants related to revenue grants can be accounted either by using capital or bycontribution using Grants relatedapproach to promoter’s income Grantsapproach related to compensation for Capital approach: The grant is treated as expenses part of shareholder’s funds. Income approach: The grant is taken to income over one or more periods to match Contingency related to Govt. Grant them with the related costs A contingency related to Govt. grant receivable and refundable should be treated in accordance with AS-4. IMT, Nagpur l Sept 5 , 2010 there is reasonable assurance that : the enterprise will comply with the conditions attached to them; and the grants will be received. Amount of Grant: Monetary Grant: Amount earned should be the value of grant. Non- Monetary Grant: ++ Where grants are given at concessional rate, then such assets are accounted for at their acquisition cost. ++ Where grants are given free of cost, then such Disclosures: assets are recorded at nominal value The accounting policy adopted The nature and extent of govt. grants recognized in the financial statements CA.Pankaj Vasani ACCOUNTING STANDARD- 13 ACCOUNTING FOR INVESTMENT – – Applicability: mandatory to all enterprises (since 01-04-93) Deals with: Accounting for investments in the financial statements of enterprises and related disclosure requirements INVESTMENTS are assets held by an enterprise for earning income by way of dividends, interest, and rentals, for capital appreciation, or for other benefits to the investing enterprise. CARRYING OF INVESTMENTS Assets heldAMOUNT as stock-in-trade are not ‘investments’ Current Investments - At Lower of cost or fair value. Long term investments - At Cost. INVESTMENTS TYPE: Long term investment Short term investment DISCLOSURE Classification of investments, Accounting policies used Amounts included in PnL for interest, dividends, rentals Realisability of investments or the remittance of income and proceeds of disposal Any reduction in the carrying amount should be charged to the profit and loss statement However, in case of a permanent decline, provision DISPOSAL OF INVESTMENT for diminution shall be made When any investments is sold, the difference between the carrying amount and net sale proceeds should be charged or credited to the profit and loss statement In case of partial disposal, the carrying amount to be allocated to that part is to be determined IMT, Nagpur l Sept , 2010 on the basis of 5the average carrying amount of the total holding of the investment CA.Pankaj Vasani ACCOUNTING STANDARD- 14 ACCOUNTING FOR AMALGAMATION – Deals with: Accounting for amalgamations Treatment of any resultant goodwill or reserves It does not deal with acquisition by one company of another company in consideration for payment in cash or by issue of shares TYPES OF AMALGAMATION NATURE OF MERGER - Pooling of interest method NATURE OF PURCHASE - Purchase method POOLING OF INTEREST METHOD The assets, liabilities and reserves are recorded at their existing carrying amounts Uniform set of accounting policies is adopted The difference between the share capital issued and the share capital of the transferor company should be adjusted in reserves. IMT, Nagpur l Sept 5 , 2010 PURCHASE METHOD The assets & liabilities are recorded either at existing carrying values or by allocating the consideration on the basis of Fair values on the date of amalgamation. The reserves of the transferor company, other than the statutory reserves, should not be included in the financial statements of the transferee company CA.Pankaj Vasani ACCOUNTING STANDARD- 15 ACCOUNTING FOR RETIREMENT BENEFIT – Deals with: the accounting treatment of the cost of the retirement benefits in the financial statements of employers Retirement benefit schemes are: Legal contractual arrangement Where employer provides benefit to employee On leaving service, retirement or at death Liability arises at the due date for the payment of liability These benefits do not accrue at the time of death, resignation etc Retirement Benefits consists of : 1. Provident Fund 2. Superannuation / Pension (20 years) 3. Gratuity (5 yrs) 4. Leave Encashment Benefit (leave not taken ~ cash) 5. Other Retirement Benefits There are 3 stages of payment of expense Expense arise Enforceable claim against the Co. Payment of expense Disclosure: Method by which retirement benefit costs for the period have been defined When accounting is made as per actuarial valuation, date on which such valuation was conducted IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 16 BORROWING COST – Applicability: mandatory to all enterprises – Deals with: whether the cost of borrowing should be included in cost of asset or not BORROWING COST Interest and commitment charges on bank & other short term Borrowing costs are interest and other costs borrowings incurred by an enterprise in connection with the Amortisation of discounts or premiums relating to borrowings borrowing of funds Amortisation of ancillary costs incurred in connection with the arrangement of borrowings Qualifying asset is an asset that necessarily takes a Finance substantial period of time to get ready for itscharges intendedof assets acquired under finance leases or under other use or sale E.g. construction process, patent etcsimilar arrangements RECOGNITION Exchange differences arising from foreign currency Capitalize borrowing costs that areborrowings directly attributable to the to the extent that they are regarded as an acquisition, construction or production of a qualifying asset adjustment to interest costs These should be capitalized only if: ++ it is probable that they will result in future economic benefits to the enterprise and DISCLOSURE ++ costs can be measured reliably The policy adopted for borrowing costs. ++ other borrowing costs to be accounting expensed off. The amount of borrowing costs capitalised during the period IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 17 SEGMENT REPORTING – Deals with: Reporting financial information about: Different types of products and services an enterprise produces, and Different geographical areas in which it operates. APPLICABILITY: BUSINESS SEGMENT is a distinguishable component of an enterprise Accounting period commencing on or after April 1, 2001 in respect of enterprises: that is engaged in providing an individual product or service or following a group of related products services and LISTED ENTERPRISES or those whichorare in the process of Listing that is subject to risks and returns that50 are different from those of other Enterprises with annual turnover more than Rs. crores business segments. GEOGRAPHICAL SEGMENT is a distinguishable component of an enterprise BENEFIT TO USERS that is engaged in performance providing products or services within a particular Better understanding of the of the enterprise; economic and Assess the risks andenvironment returns of the enterprise. that is subject to risks about and returns that are different from those of Make more informed judgments the enterprise components operating in other economic environments IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 18 RELATED PARTY DISCLOSURE – – Applicability: Mandatory for all enterprises with respect from 01/04/2004 Deals with: Related party relationships; and transactions between a reporting enterprise and its related parties. RELATIONSHIP COVERED RELATED PARTY: Ability to Control of another enterprise (parent); Control ; or Control by another enterprise (subsidiary); Exercise significant influence in making Under common control (fellow subsidiary); financial and/or operating decisions Associates/ joint ventures/ co-venturer; Investor in respect of which the enterprise CONTROLNOT RELATED PARTY SIGNIFICANT INFLUENCE is an associate; Ownership, Two directly companies or indirectly, simply of because more they have Participation a director in in financial and/or operating Individuals owning, directly or indirectly, than 50% of common. the voting power policypower decisions notthem control; voting that but gives control or Control ofAcomposition single customer, of board supplier, of franchise/ distributor significant May be gained by - and their relatives; influence directors a company of Providers of finance, trade unions, public utilities, government Share ownership Key management personnel and their A substantial departments interest inand voting government power (20% agencies in the course of their relatives Statute; and or more) normal dealing agreement Assumed to exist in case of holding of 20% or more voting power directly or indirectly. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 19 ACCOUNTING FOR LEASE – – Applicability: leases commencing on and from 1st April 2001 Deals with: accounting policies & disclosures for lessees & lessors Lease : A lease is an agreement, whereby the lessor conveys to the lessee in return for a payment or series of payments the right to use an asset for an agreed period of time CLASSIFICATION OF LEASES Finance lease is a lease that transfers substantially allOF theFINANCE risks andLEASE rewards incident to EXAMPLE ownership of an asset. Title may or may not transferred eventually Ownershipbe transferred by end of lease term. Lease Operating lease is a lease other than a finance leasecontains bargain purchase option. Lease term for major part of asset’s economic life. Classification depends on substance of the transaction rather than the form of the contract Present value of minimum lease payments Accounting for finance lease amounts to these at least substantial all ofhave asset’s Basic criteria providing guidance in determining whether risks and rewards been Accounting for operating lease fair value. transferred Sale and buy back transaction Leased asset of specialized nature that only lessee can use without major modifications IMT, Nagpur l Sept 5 , 2010 being made CA.Pankaj Vasani ACCOUNTING STANDARD- 20 EARNING PER SHARE – – Applicability: Mandatory w.e.f. 1.04.2001 in respect of Cos listed in India Objective: Comparability enhancement Different enterprises, same period Different periods, same enterprise An enterprise should present BASIC & DILUTED EPS on the face of the statement of profit and loss account for each class of equity shares that has a different right to share in the net profit for the period. EPS to be calculated & presented even inSHARE case of SPLIT losses.etc BONUS ISSUE, SHARE SPLIT, REVERSE RIGHTS ISSUE Basic EPS = Net profit/loss for the period attributable to equity shareholders / Weighted Average No. of Equity Shares Diluted EPS= Adjusted Net profit/loss for the period attributable to equity shareholders. / Weighted Average No. of (Equity Shares + Dilutive Potential Equity Shares) IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 21 CONSOLIDATED FINANCIAL STATEMENT – – Applicability: to all enterprises (since 01-04-93) Deals with: principles and procedures for preparation and presentation of consolidated financial statements APPLICABLE TO FOLLOWING ENTERPRISES Group of enterprises under the control of a parent Investments in subsidiaries EXCLUDED CASES Amalgamations Investments in associates Investments in joint ventures COMPOSITION CONSOLIDATION OF CONSOLIDATED PROCEDURES FINANCIAL STATEMENTS Consolidated balance sheet, BASIC PROCEDURE: statements of the parent and its subsidiaries should be combined Consolidated statement of profitThe andfinancial loss, on a ONE-TO-ONE BASIS by grouping together the like items of assets, liabilities, income and Notes, additional statements and explanatory material that expenses. outline an essential part thereof OTHER PROCEDURE NOTE: Consolidated statements are presented, The holdingfinancial company should eliminate its cost to of investment in each of its subsidiaries the extent possible, in the same format as adopted by the parent for Ifitscost separate financial>statements of investment holding’s share in equity --------- GOODWILL If cost of investment < holding’s share in equity ---------- CAPITAL RESERVE IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 22 ACCOUNTING FOR TAXES ON INCOME – – Applicability: to all enterprises (since 01-04-06) Seeks to: redress the distortions caused by traditional method of accounting for income-taxes by requiring the adoption of deferred tax accounting in respect of timing differences CURRENT TAX The amount that is expected to be paid to the taxation Differences between the two are on account of: authorities. ACCOUNTING INCOME (LOSS) Permanent Differences are the differences between taxable income and accounting income for a Netperiod profit or loss for a period per profit andnot loss statement. that originate in oneas period and do reverse subsequently. DTA/DTL: At the tax rates and Examples: tax laws that have been TAXABLE INCOME (TAX LOSS) Expenditure disallowed as per Income Tax Act (Forever) enacted at the balance sheet Income (loss) for a period determined in accordance withinthe Excess expenditure allowed by Income Tax Act, 1961 respect of Scientific Expenditure date. tax laws Accounting income and taxable income for a period are seldom the same Timing Differences are the differences between taxable income and accounting income for a period that originate in one period and are capable of reversal in one or more subsequent periods. Examples: Depreciation rate/method different as per Accounts and Income tax Calculation Expenditure of the nature mentioned in Section 43B (e.g. sales tax charged in account on accrual basis but not paid; such sales tax will be an allowable expenditure in the year of payment and a disallowable expenditure in the year in which accrued) IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 23 ACCOUNTING FOR CONSOLIDATED FINANCIAL STATEMENT – – Applicability: to all enterprises (since 01-04-02) Deals with: to set out principles and procedures for recognizing, in the consolidated financial statements, the effects of the investments in associates on the financial position and operating results of a group. Consolidated financial statements are the financial statements of a group presented as those of a single enterprise IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 24 DISCONTINUING OPERATION – Covers: discontinuing operation and not discontinued operation DICONTINUING OPERATION is a component of an enterprise: (a) that the enterprise, pursuant to a single plan, is: - disposing of substantially in its entirety (example – demerger) - disposing of piecemeal (selling and settling assets and liabilities one by one) EXAMPLE: - terminating through abandonment; and out of a product line or class of service; gradual or evolutionary phasing NOT DICONTINUING OPERATION (b) Thatrepresents a separate major line of business or geographical area of and discontinuing, even if relatively abruptly, several products within anoperations; ongoing line Planned change in product line of business; (c) That can be distinguished operationally and for financial reporting purposes. Abrupt/unplaned change in product line shifting of some production or marketing activities for a particular line of business from one location to another; closing of a facility to achieve productivity improvements or other cost savings; Selling shares of subsidiary whose activities are similar to those of the parent or other subsidiaries. (In case of Consolidated Financial Statements) IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 25 INTERIM FINANCIAL REPORTING – – Applicability: to all enterprises (since 01-04-02) Deals with: reporting for period < 1 year. Clause 41 of listing agreement provides to publish financial result on quarterly basis Timely Interim period is ainterim financial reporting periodimproves shorter than full financial year. creditors, and and reliable financial reporting the a ability of investors, others to understand an enterprise's capacity to generate earnings and cash flows, its financial condition Interim financial report means a financial report containing either a complete set of and liquidity financial statements or a set of condensed financial statements (as described in this Statement) for an interim period During the first year of operations of an enterprise, its annual financial reporting period may be shorter than a financial year. In such a case, that shorter period is not considered as an interim period Minimum Components of an Interim Financial Report A. condensed balance sheet; B. condensed statement of profit and loss; C. condensed cash flow statement; and D. selected explanatory notes IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 26 INTANGIBLE ASSET – – Applicability: to all enterprises (since 01-04-04) Deals with: accounting for intangible assets that are not dealt with specifically in another Accounting Standard An intangible asset is an identifiable non-monetary asset, without physical substance, held for use in the production or supply of goods or services, for rental to others, or for administrative purposes. An asset is a resource: A. controlled by an enterprise as a result of past events; and B. from which future economic benefits are expected to flow to the enterprise. Monetary assets are money held and assets to be received in fixed or determinable amounts of money. Non-monetary assets are assets other than monetary assets. Research is “original” and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding. Development : Converts result of research into marketable product IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 27 FINANCIAL REPORTING OF INTEREST IN JOINT VENTURE – Scope: Applicable in accounting for interests in joint ventures and reporting of joint venture assets, liabilities, income and expenses in the financial statements of venturers and investors A joint venture is a contractual arrangement whereby two or more parties undertake an economic activity, which is subject to joint control OFa JV A venturer is FORMS a party to joint venture and has joint control over that joint venture. jointly controlled operations, controlled An investor in ajointly joint venture is aassets, party toand a joint venture and does not have joint control over that joint venture. jointly controlled entities. Proportionate consolidation is a method of accounting and reporting whereby a venturer's share of each of the assets, liabilities, income and expenses of a jointly controlled entity is reported as separate line items in the venturer's financial statements. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 28 IMPAIRMENT OF ASSET – OBJECTIVE To identify the assets which are sick / unhealthy To ensure that enterprise assets are carried at not more than their recoverable amount If carrying amount < = Recoverable amount : Treatment of impairment loss: AS-28 applies to all assets other than Asset is not impaired 1. Inventories(AS-2) An impairment loss should be recognized against the revaluation reserve, if any, and balance, 2. Assets arising from construction contract (AS-7) if any,If as an expense in the P/Lassets/Investments(AS-13) A/c carrying amount > Recoverable amount : 3. Financial Asset is impaired 4. Deferred tax assets(AS-22) Impairment loss for a Cash Generating Unit should be allocated in the following order Goodwill, if any. Impairment Loss = Carrying Amount – Recoverable Amount Balance, if any, to individual assets in proportion to their carrying cost IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 29 PROVISION, CONTINGENT LIABILTY AND CONTINGENT ASSET PROVISION: CONTINGENT LIABILITY: A provision is a liability which can be measured CONTINGENT ASSETS: A contingent liability only is: by using a substantial degree of estimation. A possible obligation that arises from past events and; A contingent assets is: existence of which will be confirmed by the occurrence or non Treatment : A provision be recognized when:events not wholly within the control of the a possible assetshould occurrence of future An enterprise hasfrom a present obligation enterpriseas a result of past that arises past events event existence of which will be confirmed only by the occurrence or non-occurrence of one or It is probable that an outflow of resources embodying more uncertain future events Treatment: economic benefits will be required to settle the obligation; not wholly within the control of the enterprise. An enterprise should not recognize a contingent liability. It and should be disclosed in financial statements unless the possibility A reliable estimate can be made of the amount of the of outflow is remote. Treatment: obligation. (Prudence) - An enterprise should not recognize a contingent asset. An enterprise should not be disclosed in financial statements. It may be disclosed in the report of approving authority, where an inflow is probable IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani ACCOUNTING STANDARD- 30 Financial Instruments: Recognition and Measurement ACCOUNTING STANDARD- 31 Financial Instruments: Presentation ACCOUNTING STANDARD- 32 Financial Instruments: Disclosures IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Financial instruments Embedded Derivatives Derivatives AS 30, 31, 32 Hedging IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Financial instruments AS 30 AS 31 AS 32 Recognition and derecognizing Measurement of Derivatives and of financial hedge financial instruments accounting Presentation Disclosure instruments IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Market trends as reflected in AS 30, 31 and 32 Key principles of the Standards Harmonisation of markets Increased complexity Detailed disclosures All derivatives are Most financial recognized on the assets measured balance sheet at fair value Use of fair values Reduction of options Measurement of the hedging instrument is the basis for hedge accounting IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Convergence of Accounting Standards with IFRS Why, When, What & How IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani IFRS - International Financial Reporting Standards International Financial Reporting Standards (IFRS) are: “principles-based” IASB is based in London Standards, Interpretations and Framework (SIF) adopted by the International Accounting Standard Board Its overall objective is to create a sound foundation for(IASB). future accounting International Reporting Standards standards thatFinancial are principles-based, internallycomprise: consistent and internationally International Financial Reporting Standards that (IFRS)—standards The converged. principle-based standards have distinct advantage the transactions can not issued after be manipulated easily to2001 achieve a particular accounting International Accounting Standards (IAS)—standards issued The• IASB and the US FASB (the boards) are undertaking the project jointly before 2001 IFRSs lay down treatments based on the economic substance of various events and • Interpretations originated from the International Financial transactions rather than their legal form. Reporting Interpretations Committee (IFRIC)—issued after 2001 • Standing before 2001being The application of thisInterpretations approach mayCommittee result into (SIC)—issued events and transactions for the Preparation and Presentation of Financial presented•inFramework a manner different from their legal form. Statements To illustrate, as per IAS 32, preference shares that provide for mandatory redemption by the issuer are presented as a liability IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani IFRS Structure IAS 1(2007) Presentation of Financial Statements IAS 26 Accounting and Reporting by Retirement Benefit Plans IAS 2 Inventories The term “IFRSs” currently comprises of: IFRS 1 First-time Adoption of International Financial Reporting Standards IAS 27(2008) Consolidated and Separate Financial IAS 7 Statement of Cash Flows 9 IFRSs, 29Payment IASs (originally 41), 18Statements IFRIC and 11 SIC interpretations, plus IFRS>> 2 Share-based IAS 8 Accounting Policies, Changes in Accounting IAS 28 Investments in Associates the Framework Estimates and Errors Combinations IFRS 3 Business IAS 29 Financial Reporting in Hyperinflationary There standards and major projects for which exposure drafts are IAS 10 Eventsare after15 thenew Reporting Period Economies IFRS 4 Insurance Contracts issued IAS 11 Construction Contracts IAS 31 Interests in Joint Ventures IFRS 5 Non-current Assets Held for Sale and Discontinued Operations Final SME standard have been issued in July 2009. IAS 12 Income Taxes IAS 32 Financial Instruments: Presentation IFRS 6 Exploration forEquipment andare Evaluation of Mineral for Resources 8 existing standards being amended which exposure drafts are issued IAS 16 Property, Plant and IAS 33 Earnings per Share IAS 17 Leases IFRS 7 Financial Instruments: Disclosures IAS 18 Revenue IFRS 8 Operating Segments IAS 19 Employee Benefits IFRS 9 Financial Instruments - Assets IAS 20 Accounting for Government Grants and Disclosure of Government Assistance IAS 21 The Effects of Changes in Foreign Exchange Rates IAS 23 Borrowing Costs IAS 24 Related Party Disclosures IMT, Nagpur l Sept 5 , 2010 IAS 34 Interim Financial Reporting IAS 36 Impairment of Assets IAS 37 Provisions, Contingent Liabilities and Contingent Assets IAS 38 Intangible Assets IAS 39 Financial Instruments: Recognition and Measurement IAS 40 Investment Property IAS 41 Agriculture CA.Pankaj Vasani Non-financial Disclosures The Framework recognizes financial statements do not provide all the information required for decisions To achieve, the objective the financial reports may include additional information in the form of non-financial disclosures - that is useful to a wide range of users in making economic decisions Such disclosures are usually contained in Management Report To deal with the aspect, the IASB is developing a separate IFRS on Management Commentary Recently, a discussion paper on the subject has been issued IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani The Global Move Towards IFRS Canada 2009/11 Europe 2005 United States (2014/15/16?) China 2007 Japan (2016) India 2011 Brazil 2010 Chile 2009 South Africa 2005 Australia 2005 Current or anticipated requirement or option to use IFRS (or equivalent) IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani IFRS Adoption • Approximately 100 countries have adopted or are in the process of adoption China Similar to IFRS (effective for listed entities 2007) • Status of adoption by some countries which compete with India for capital allocation: Brazil 2010 Russia Currently applicable for banks. South Korea 2011 USA 2014/15/16 UK 2005 Nepal 2011 (as per action plan released) IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani IFRS Adoption…contd. BIGGEST STAMP OF APPROVAL Securities and Exchange Commission (SEC), United States of America have permitted Foreign Private Issuers to file IFRS compliant financial statements (as promulgated by the IASB) without reconciliation to US GAAP SEC has issued a proposed roadmap to assess whether US domestic registrants should be permitted to use IFRS IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Convergence of Accounting Standards What is Convergence ? Convergence means eliminating the differences between Indian GAAP and IFRS and/or aligning Indian GAAP more closely to IFRS and/or may be even adopting IFRS as it is. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani WHY IFRS To bring uniformity in reporting systems globally ICAI has decided to implement IFRS in India. Indian companies are listed on overseas stock exchanges and have to recast their to beof compliant withAffairs GAAP requirements of those countries accounts The Ministry Corporate has also announced its commitment to convergence to IFRS by 2011. Foreign companies having subsidiaries in India are having to recast their accounts to meet Indian & overseas reporting requirements which are different Foreign Direct Investors (FDI), overseas financial institutional investors (FII) are more comfortable with compatible accounting standards IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Convergence Project in India In October 2007, ICAI issued concept paper giving the approach and roadmap for convergence Various study groups have been formed The convergence exercise will be taken up in phases - listed and bigger companies initially, smaller public companies thereafter, and eventually all private companies/SMEs The ministry of Company affairs has appointed two working groups, headed by Mr. Y.H. Malegam and Mr. Mohandas Pai to finalise the roadmap to IFRS convergence. SEBI Committee on Disclosures and Accounting Standards (SCODA) is the standing Committee - Voluntary adoption of International Financial Reporting Standards (IFRS) by listed entities having overseas subsidiaries or by all listed entities. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Convergence Project in India…contd. On January 22, 2010 : MCA has released Road Map for convergence with IFRS in India – Phase I - 1st 2011 IFRS in India – Phase II April, - 1st April, 2013 IFRS – For large Companies The following categories of companies will convert opening balance Rs. listed or having atheir net worth exceeding The On companies, April 5, 2010whether : Amendment to not, listing Agreement provides the option of sheets in compliance with the notified accounting standards which are 500 croresofbut not exceeding Rs. 1,000 croresStandards (IFRS) adoption International Financial Reporting by listed convergent with IFRS. These companies are:entities having subsidiaries while declaring Consolidated results/financial statementswhich are part of NSE – Nifty 50 a. Companies Standalone results will beofas per -the existing Indian GAAP b. Companies which are part BSE Sensex 30 IFRS in India – Phase III - 1st April, 2014 c. Companies whose shares or other securities on stock Listed companies which have a net worth ofare Rs.listed 500 crores or less exchanges outside India d. Companies, whether listed or not, which have a net worth in excess of Rs.1,000 crores IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Convergence with IFRSs in India While formulating ASs, ICAI comply IFRSs as far as possible The Preface to the Statements of Accounting Standards, issued by the ICAI, recognizes the same While formulating ASs, the ICAI makes changes from IFRSs only in those cases where these are unavoidable, particularly, considering legal and/ or regulatory framework prevailing in the country IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani IFRS –THE GREY AREAS While IFRS compliance date has been declared by the ICAI, there are several areas which are still not in consonance with such implementation and several accounting standards and statutes will need amendment. Full & unreserved compliance with IFRS is the objective. However, not many entities are aware about the significance or ramifications thereof, which may lead to a rush for compliance later with some undesirable consequences. The onus will be on the management to comply with the requirements and the auditors will only have to comment on whether the management has properly complied with the norms or not. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani IFRS –THE PLAIN AREAS IFRS is itself a moving target, with changes being introduced continually… There are not many trained resources to effect the requisite change. There is a lack of awareness and understanding of the requirements and implications of IFRS transition and compliance Communicating the change and managing the transition properly attains importance in this regard. Training the organizational components will be a huge task. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani IFRS – IMPACT IFRS implementation affects several areas of the business entity, such as: presentation of accounts, accounting policies and procedures, the way legal documents are drafted, the way the entity looks at its assets and their usage, Its communications with its stakeholders and also the way it conducts its business. IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Steps for transition Parallel run and test systems Implement business decisions Train staff Design and implement systems Plan the implementation Think of business issues Scope the impact IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani IFRC & DIRECT TAX CODE (DTC) IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani Thank you! OPEN HOUSE – ASK ME! IMT, Nagpur l Sept 5 , 2010 CA.Pankaj Vasani