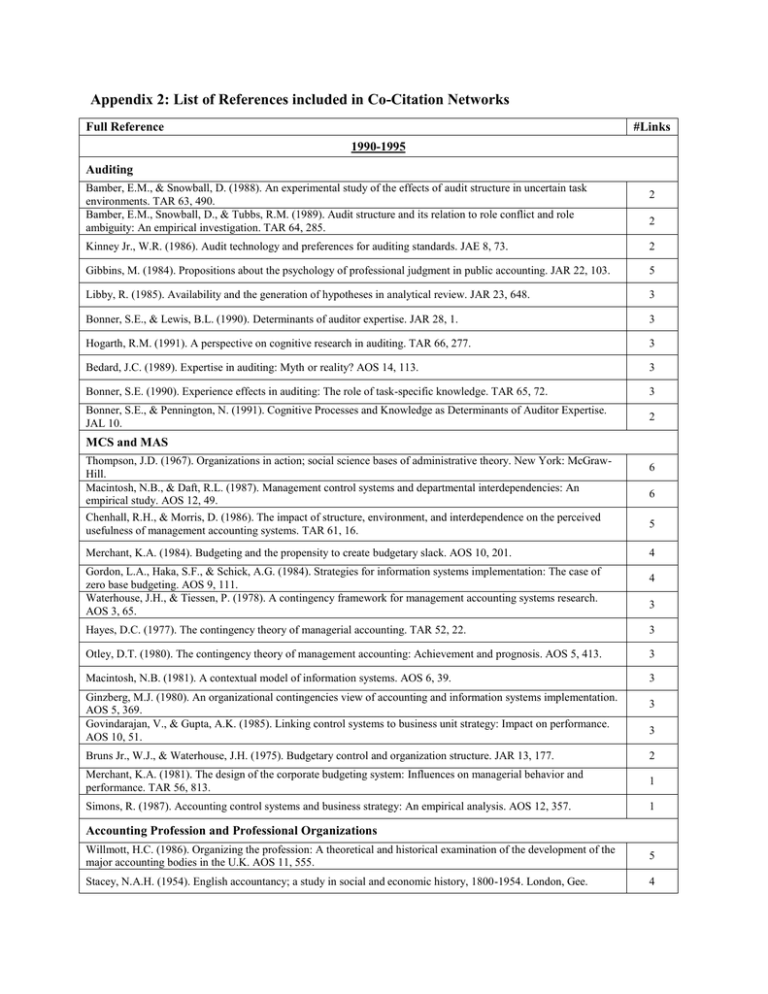

Appendix 2: List of References included in Co

advertisement

Appendix 2: List of References included in Co-Citation Networks Full Reference #Links 1990-1995 Auditing Bamber, E.M., & Snowball, D. (1988). An experimental study of the effects of audit structure in uncertain task environments. TAR 63, 490. Bamber, E.M., Snowball, D., & Tubbs, R.M. (1989). Audit structure and its relation to role conflict and role ambiguity: An empirical investigation. TAR 64, 285. 2 2 Kinney Jr., W.R. (1986). Audit technology and preferences for auditing standards. JAE 8, 73. 2 Gibbins, M. (1984). Propositions about the psychology of professional judgment in public accounting. JAR 22, 103. 5 Libby, R. (1985). Availability and the generation of hypotheses in analytical review. JAR 23, 648. 3 Bonner, S.E., & Lewis, B.L. (1990). Determinants of auditor expertise. JAR 28, 1. 3 Hogarth, R.M. (1991). A perspective on cognitive research in auditing. TAR 66, 277. 3 Bedard, J.C. (1989). Expertise in auditing: Myth or reality? AOS 14, 113. 3 Bonner, S.E. (1990). Experience effects in auditing: The role of task-specific knowledge. TAR 65, 72. 3 Bonner, S.E., & Pennington, N. (1991). Cognitive Processes and Knowledge as Determinants of Auditor Expertise. JAL 10. 2 MCS and MAS Thompson, J.D. (1967). Organizations in action; social science bases of administrative theory. New York: McGrawHill. Macintosh, N.B., & Daft, R.L. (1987). Management control systems and departmental interdependencies: An empirical study. AOS 12, 49. 6 6 Chenhall, R.H., & Morris, D. (1986). The impact of structure, environment, and interdependence on the perceived usefulness of management accounting systems. TAR 61, 16. 5 Merchant, K.A. (1984). Budgeting and the propensity to create budgetary slack. AOS 10, 201. 4 Gordon, L.A., Haka, S.F., & Schick, A.G. (1984). Strategies for information systems implementation: The case of zero base budgeting. AOS 9, 111. Waterhouse, J.H., & Tiessen, P. (1978). A contingency framework for management accounting systems research. AOS 3, 65. 4 3 Hayes, D.C. (1977). The contingency theory of managerial accounting. TAR 52, 22. 3 Otley, D.T. (1980). The contingency theory of management accounting: Achievement and prognosis. AOS 5, 413. 3 Macintosh, N.B. (1981). A contextual model of information systems. AOS 6, 39. 3 Ginzberg, M.J. (1980). An organizational contingencies view of accounting and information systems implementation. AOS 5, 369. Govindarajan, V., & Gupta, A.K. (1985). Linking control systems to business unit strategy: Impact on performance. AOS 10, 51. 3 3 Bruns Jr., W.J., & Waterhouse, J.H. (1975). Budgetary control and organization structure. JAR 13, 177. 2 Merchant, K.A. (1981). The design of the corporate budgeting system: Influences on managerial behavior and performance. TAR 56, 813. 1 Simons, R. (1987). Accounting control systems and business strategy: An empirical analysis. AOS 12, 357. 1 Accounting Profession and Professional Organizations Willmott, H.C. (1986). Organizing the profession: A theoretical and historical examination of the development of the major accounting bodies in the U.K. AOS 11, 555. 5 Stacey, N.A.H. (1954). English accountancy; a study in social and economic history, 1800-1954. London, Gee. 4 Jones, E. (1981). Accountancy and the British economy 1840-1980. London: Batsford Ltd. Millerson, G. (1964). The qualifying associations; a study in professionalization. London; New York: Routledge & Paul; Humanities Press. Brown, R., Mackay, J.S., Row Fogo, E.B.J., & Sloan, A. (1905). A history of accounting and accountants: Edinburgh, T.C. & E.C. Jack. 4 2 2 Macdonald, K.M. (1985). Social Closure and Occupational Registration. SOC 19, 541. 2 Richardson, A.J. (1988). Accounting knowledge and professional privilege. AOS 13, 381. 1 Accounting Data and Budgeting Brownell, P., & Hirst, M.K. (1986). Reliance on acct. info, budgetary participation, and task uncertainty: Tests of a three-way interaction. JAR 24, 241. 5 Southwood, K.E. (1978). Substantive Theory and Statistical Interaction: Five Models. AMJSOC 83, 1154. 4 Govindarajan, V. (1984). Appropriateness of accounting data in performance evaluation: An empirical examination of environmental uncertainty as an interv. AOS 9, 125. 4 Kahn, R.L. (1964). Organizational stress: Studies in role conflict and ambiguity. New York: Wiley. 4 Cronbach, L.J. (1951). Coefficient alpha and the internal structure of tests. PSYCHOMET 16, 297. 3 Brownell, P. (1983). The motivational impact of management-by-exception in a budgetary context. JAR 21, 456. 2 Otley, D.T. (1978). Budget and managerial performance. JAR 16, 122. 8 Brownell, P. (1982). The role of accounting data in performance evaluation, budgetary participation, and organizational effectiveness. JAR 20, 12. Schoonhoven, C.B. (1981). Problems with Contingency Theory: Testing Assumptions Hidden within the Language of Contingency "Theory. ADSCIQ 26, 349. Chenhall, R.H., & Brownell, P. (1988). The effect of participative budgeting on job satisfaction and performance: Role ambiguity as an intervening variable. AOS 13, 225. Milani, K. (1975). The relationship of participation in budget-setting to industrial supervisor performance and attitudes: A field study. TAR 50, 274. Hopwood, A.G. (1972). An empirical study of the role of accounting data in performance evaluation. JAR 10 156. Brownell, P., & McInnes, M. (1986). Budgetary participation, motivation, and managerial performance. TAR 61, 587. Mahoney, T.A. (1963). Development of managerial performance; a research approach: Cincinnati, South-western Pub. Co. Hirst, M.K. (1983). Reliance on accounting performance measures, task uncertainty, and disfunctional behavior: Some extensions. JAR 21, 596. Hirst, M.K. (1981). Accounting information and the evaluation of subordinate performance: A situational approach. TAR 56, 771. Kenis, I. (1979). Effects of budgetary goal characteristics on managerial attitudes and performance. TAR 54, 707. 7 5 5 5 5 4 3 3 2 1 Culture and Management Accounting Soeters, J., & Schreuder, H. (1988). The interaction between national and organizational cultures in accounting firms. AOS 13, 75. Hofstede, G.H. (1980). Culture's consequences: International differences in work-related values. Beverly Hills, Calif.: Sage Publications. Hofstede, G.H. (1983). The cultural relativity of organizational practices and theories. JINTBUS 14, 75. Child, Cummings, L.L., & Staw, B.M. (1981). Research in organizational behavior: An annual series of analytical essays and critical reviews. Vol. 2. Daley, L., Jiambalvodo, J., Sundem, G.L., & Kon, Y. (1985). Attitudes toward financial control systems in the United States and Japan. JINTBUS 16, 91. 6 4 4 4 3 Schein, E.H. (1985). Organizational culture and leadership. San Francisco: Jossey-Bass Publishers. 2 Birnberg, J.G., & Snodgrass, C. (1988). Culture and control: A field story. AOS 13, 447. 2 Accounting and Power Burchell, S., Clubb, C.D.B., & Hopwood, A.G. (1985). Accounting in its social context: Towards a history of value added in the United Kingdom. AOS 10, 381. 6 Miller, P., & Rose, N. (1990). Governing Economic Life. ECONSOC 19, 1. 6 Hopwood, A.G. (1987b). The archeology of accounting systems. AOS 12, 207. 6 Miller, P., & O'Leary, T. (1987). Accounting and the construction of the governable person. AOS 12, 235. 5 Hacking, I. (1983). Representing and intervening: Introductory topics in the philosophy of natural science. Cambridge ; New York: Cambridge University Press Miller, P. (1986). Accounting for progress — National accounting and planning in France: A review essay. AOS 11, 83. Hoskin, K.W., & Macve, R.H. (1988). The genesis of accountability: The west point connections. AOS 13, 37. Latour, B. (1987). Science in action: How to follow scientists and engineers through society. Cambridge, Mass.: Harvard University Press. Hoskin, K.W., & Macve, R.H. (1986). Accounting and the examination: A genealogy of disciplinary power. AOS 11, 105. 4 4 4 3 3 Foucault, M. (1977). Discipline and punish: The birth of the prison. New York: Pantheon Books 2 Miller, P. (1987). Domination and power. London; New York: Routledge & Kegan Paul. 2 Foucault, M., & Gordon, C. (1980). Power/ Knowledge: Selected interviews and other writings, 1972-1977. New York: Pantheon Books. 1 Rose, N., & Miller, P. (1992). Political Power beyond the State: Problematics of Government. BRITJSOC 43, 173. 1 Miller, P., & O'Leary, T. (1989). Hierarchies and American Ideals, 1900-1940. AMR 14, 250. 1 Burchell, S., Clubb, C.D.B., Hopwood, A.G., Hughes, J.S., & Nahapiet, J.E. (1980). The roles of accounting in organizations and society. AOS 5, 5. 1 Solomons, D. (1978). The politicization of accounting. JACC 146, 65. 1 Accounting and Gender Crompton, R. (1987). Gender and accountancy: A response to Tinker and Neimark. AOS 12, 103. 4 Hopwood, A.G. (1987a). Accounting and gender: An introduction. AOS 12, 65. 4 Burrell, G. (1987). No accounting for sexuality. AOS 12, 89. 3 Tinker, T., & Neimark, M.D. (1987). The role of annual reports in gender and class contradictions at General Motors: 1917-1976. AOS 12, 71. Ciancanelli, P., Gallhofer, S., Humphrey, C., & Kirkham, L. (1990). Gender and accountancy: Some evidence from the UK. CPA 2, 117. Lehman, C.R. (1992). "Hirstory" in accounting: The first eighty years. AOS 17, 261. 3 3 1 Institutionalism DiMaggio, P.J., & Powell, W.W. (1983). The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. AMSOCREV 48, 147. Meyer, J., & Rowan, B. (1977). Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am J Soc 83, 340. Tolbert, P.S., & Zucker, L.G. (1983). Institutional Sources of Change in the Formal Structure of Organizations: The Diffusion of Civil Service Reform, 1880-1935. ADSCIQ 28, 22. 7 7 6 Scott, W.R. (1987). The Adolescence of Institutional Theory. ADSCIQ 32, 493. 6 Zucker, L.G. (1988). Institutional patterns and organizations: Culture and environment. 6 Covaleski, M.A., & Dirsmith, M.W. (1988). An Institutional Perspective on the Rise, Social Transformation, and Fall of a University Budget Category. ADSCIQ 33, 562. DiMaggio, P.J. (1988). Interest and Agency in Institutional Theory. In L.G. Zucker, Institutional Patterns and Organizations. Powell, W.W. (1985). Review: The Institutionalization of Rational OrganizationReview: The Institutionalization of Rational Organization. CONSOC 14, 564. 6 5 4 Mezias, S.J. (1990). An Institutional Model of Organizational Practice: Financial Reporting at the Fortune 200. ADSCIQ 35, 431. 3 Meyer, J.W., & Scott, W.R. (1983). Organizational environments: Ritual and rationality: Beverly Hills: Sage. 3 Meyer, J.W. (1986). Social environments and organizational accounting. AOS 11, 345. 3 Covaleski, M.A., & Dirsmith, M.W. (1986). The budgetary process of power and politics. AOS 11, 193. 2 Pfeffer, J. (1981). Power in organizations. Marshfield, Mass. : Pitman Pub. 1 1996-2001 Auditing Ashton, A.H. (1991). Experience and error frequency knowledge as potential determinants of audit expertise. TAR 66, 218. Libby, R., & Luft, J.L. (1993). Determinants of judgment performance in accounting settings: Ability, knowledge, motivation, and environment. AOS 18, 425. Nelson, M.W., Libby, R., & Bonner, S.E. (1995). Knowledge structure and the estimation of conditional probabilities in audit planning. TAR 70, 27. Frederick, D.M., & Heiman-Hoffman, V.B. (1994). The Structure of Auditors' Knowledge of Financial Statement Errors. AUDJPRACT 13, 1. 9 8 6 5 Tubbs, R.M. (1992). The effect of experience on the auditor's organization and amount of knowledge. TAR 67, 783. 5 Libby, R. (1990). Experience and the ability to explain audit findings. JAR 28, 348. 5 Libby, R. (1995). The Role of Knowledge and Memory in Audit Judgment. In A. Ashton, Judgment and Decision Making Research in Accounting and Auditing: Cambridge University Press. Bonner, S.E., & Walker, P.L. (1994). The effects of instruction and experience on the acquisition of auditing knowledge. TAR 69, 157. Choo, F., & Trotman, K.T. (1991). The relationship between knowledge structure and judgments for experienced and inexperienced auditors. TAR 66, 464. 5 4 3 Libby, R. (1985). Availability and the generation of hypotheses in analytical review. JAR 23, 648. 3 Nelson, M.W. (1993). The effects of error frequency and accounting knowledge on effort diagnosis in analytical review. TAR 68, 804. 3 Bonner, S.E., & Lewis, B.L. (1990). Determinants of auditor expertise. JAR 28, 1. 3 Bonner, S.E. (1990). Experience effects in auditing: The role of task-specific knowledge. TAR 65, 72. 2 Bonner, S.E., & Pennington, N. (1991). Cognitive Processes and Knowledge as Determinants of Auditor Expertise. JAL 10. 2 Libby, R., & Tan, H.T. (1994). Modeling the determinants of audit expertise. AOS 19, 701. 2 Libby, R., & Trotman, T. (1993). Audit Review as a Control for Biased Recall of Evidence in Decision Making. AOS 18, 559. 1 Culture and Management Accounting Otley, D.T. (1980). The contingency theory of management accounting: Achievement and prognosis. AOS 5, 413. 2 Merchant, K.A. (1981). The design of the corporate budgeting system: Influences on managerial behavior and performance. TAR 56, 813. 2 Langfield-Smith, K. (1997). Management control systems and strategy: A critical review. AOS 22, 207. 1 Harrison, G.L. (1992). The cross-cultural generalizability of the relation between participation, participation, budget emphasis and job related attitudes. AOS 17, 1. Chow, C.W., Kato, Y., & Shields, M.D. (1994). National culture and the preference for management controls: An exploratory study of the Firm-labor market interface. AOS 19, 391. 10 9 Kenis, I. (1979). Effects of budgetary goal characteristics on managerial attitudes and performance. TAR 54, 707. 9 Birnberg, J.G., & Snodgrass, C. (1988). Culture and control: A field story. AOS 13, 447. 8 Child, Cummings, L.L., & Staw, B.M. (1981). Research in organizational behavior: An annual series of analytical essays and critical reviews. Vol. 2. 7 Chow, C.W., Shields, M.D., & Chan, Y.K. (1991). The effects of management controls and national culture on manufacturing performance: An experimental investigation. AOS 16, 209. Chow, C.W., Kato, Y., & Merchant, K.A. (1996). The use of organizational controls and their effects on data manipulation and management myopia: A Japan vs. U.S. comparison. AOS 21, 175. Merchant, K.A., Chow, C.W., & Wu, A. (1995). Measurement, evaluation and reward of profit center managers: A cross cultural field study. AOS 20, 619. O'Connor, N.G. (1995). The influence of organizational culture on the usefulness of budget participation by Singaporean-Chinese managers. AOS 20, 383. 6 6 6 6 Brownell, P., & McInnes, M. (1986). Budgetary participation, motivation, and managerial performance. TAR 61, 587. 6 Milani, K. (1975). The relationship of participation in budget-setting to industrial supervisor performance and attitudes: A field study. TAR 50, 274. 6 Hofstede, G.H. (1991). Cultures and organizations: Software of the mind. London; New York: McGraw-Hill. 5 Onsi, M. (1973). Factor analysis of behavioural variables affecting budgetary stock. TAR 48, 535. 5 Hofstede, G.H. (1980). Culture's consequences: International differences in work-related values. Beverly Hills, Calif.: Sage Publications. Harrison, G.L. (1993). Reliance on accounting performance measures in superior evaluative style - The influence of national culture and personality. AOS 18, 319. 3 3 Hofstede, G.H. (1968). The game of budget control. London, Tavistock; Assen, Van Gorcum. 3 Merchant, K.A. (1985). Budgeting and the propensity to create budgetary slack. AOS 10, 201. 1 Hopwood, A.G. (1976). Accounting and human behaviour. Englewood Cliffs, N.J.: Prentice-Hall. 1 Accounting Data and Budgeting Brownell, P. (1982). The role of accounting data in performance evaluation, budgetary participation, and organizational effectiveness. JAR 20, 12. 9 Briers, M., & Hirst, M.K. (1990). The role of budgetary information in performance evaluation. AOS 15, 373. 9 Brownell, P., & Hirst, M.K. (1986). Reliance on acct. info, budgetary participation, and task uncertainty: Tests of a three-way interaction. JAR 24, 241. Brownell, P., & Dunk, A.S. (1991). Task uncertainty and its interaction with budgetary participation and budget emphasis: Some methodological issues and empirical. AOS 16, 693. 8 8 Brownell, P. (1983). The motivational impact of management-by-exception in a budgetary context. JAR 21, 456. 5 Dunk, A.S. (1989). Budget emphasis, budgetary participation and managerial performance: A note. AOS 14, 321. 5 Hopwood, A.G. (1972). An empirical study of the role of accounting data in performance evaluation. JAR 10 156. 5 Dunk, A.S. (1993). The effect of budget emphasis and information asymmetry on the relation between budgetary participation and slack. TAR 68, 400. 4 Otley, D.T. (1978). Budget and managerial performance. JAR 16, 122. 4 Argyris, C. (1952). The impact of budgets on people. New York: Controllership Foundation, 1952 3 Lau, C.M., Low, L.C., & Eggleton, I.R.C. (1995). The impact of reliance on accounting performance measures on jobrelated tension and managerial performance: Additional evidence. AOS 20, 359. Hirst, M.K. (1983). Reliance on accounting performance measures, task uncertainty, and dysfunctional behavior: Some extensions. JAR 21, 596. Govindarajan, V. (1984). Appropriateness of accounting data in performance evaluation: An empirical examination of environmental uncertainty as an interv. AOS 9, 125. 3 3 1 MCS and MAS Miles, R.E., & Snow, C.C. (1978). Organizational strategy, structure, and process. New York: McGraw-Hill. 7 Bruns Jr., W.J., & Waterhouse, J.H. (1975). Budgetary control and organization structure. JAR 13, 177. 5 Simons, R. (1987). Accounting control systems and business strategy: An empirical analysis. AOS 12, 357. 5 Chenhall, R.H., & Morris, D. (1986). The impact of structure, environment, and interdependence on the perceived usefulness of management accounting systems. TAR 61, 16. 4 Govindarajan, V., & Gupta, A.K. (1985). Linking control systems to business unit strategy: Impact on performance. AOS 10, 51. Khandwalla, P.N. (1972). The effect of different types of competition on the use of management controls. JAR 10, 275. 4 4 Dent, J.F. (1990). Strategy, organization and control: Some possibilities for accounting research. AOS 15, 3. 4 Snow, C.C., & Hrebiniak, L.G. (1980). Strategy, Distinctive Competence, and Organizational Performance. ADSCIQ 25, 317. 4 Hayes, D.C. (1977). The contingency theory of managerial accounting. TAR 52, 22. 3 Mia, L., & Chenhall, R.H. (1994). The usefulness of management accounting systems, functional differentiation and managerial effectiveness. AOS 19, 1. Gul, F.A., & Chia, Y.M. (1994). The effects of management accounting systems, perceived environmental uncertainty and decentralization on managerial performance: A test of three-way interaction. AOS 19, 413. Gordon, L.A., & Miller, D. (1976). A contingency framework for the design of accounting information systems. AOS 1, 59. Perrow, C. (1967). A Framework for the Comparative Analysis of Organizations – A Framework for the Comparative Analysis of Organizations. AMSOCREV 32, 194. Simons, R. (1991). Strategic orientation and top management attention to control systems. STRATMAN 12, 49. Simons, R. (1990). The role of management control systems in creating competitive advantage: New perspectives. AOS 15, 127. Gordon, L.A., Haka, S.F., & Schick, A.G. (1984). Strategies for information systems implementation: The case of zero base budgeting. AOS 9, 111. Lawrence, P.R., & Lorsch, J.W. (1967). Organization and environment; managing differentiation and integration. Boston: Division of Research, Graduate School of Business Administration, Harvard University. Waterhouse, J.H., & Tiessen, P. (1978). A contingency framework for management accounting systems research. AOS 3, 65. 2 2 2 2 2 2 1 1 1 Chapman, C.S. (1997). Reflections on a contingent view of accounting. AOS 22, 189. 1 Govindarajan, V. (1988). A contingency approach to strategy implementation at the business-unit level: Integrating administrative mechanisms with strategy. AMJ 31, 828. 1 Simons, R. (1994). How new top managers use control systems as levers of strategic renewal. STRATMAN 15, 169. 1 Accounting and Power Miller, P., & O'Leary, T. (1987). Accounting and the construction of the governable person. AOS 12, 235. 4 Hoskin, K.W., & Macve, R.H. (1986). Accounting and the examination: A genealogy of disciplinary power. AOS 11, 105. 3 Miller, P., & Napier, C.J. (1993). Genealogies of calculation. AOS 18, 631. 2 Foucault, M., & Gordon, C. (1980). Power/ Knowledge: Selected interviews and other writings, 1972-1977. New York: Pantheon Books. 2 Miller, P., Hopper, T., & Laughlin, R.C. (1991). The new accounting history: An introduction. AOS 16, 395. 1 Institutionalism DiMaggio, P.J., & Powell, W.W. (1983). The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. AMSOCREV 48, 147. Meyer, J., & Rowan, B. (1977). Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am J Soc 83, 340. 3 2 Scott, W.R. (1987). The Adolescence of Institutional Theory. ADSCIQ 32, 493. 2 Oliver, C. (1991). Strategic responses to institutional processes. AMR 16, 145. 1 Accounting Profession and Professional Organizations Armstrong, P. (1985). Changing management control strategies: The role of competition between accountancy and other organizational professions. AOS 10, 129. Willmott, H.C. (1986). Organizing the profession: A theoretical and historical examination of the development of the major accounting bodies in the U.K. AOS 11, 555. 3 3 Radcliffe, V.S., Cooper, D.J., & Robson, K. (1994). The management of professional enterprises and regulatory change: British accountancy and the financial services act, 1986. AOS 19, 601. Robson, K., Willmott, H.C., Cooper, D., & Puxty, T. (1994). The ideology of professional regulation and the markets for accounting labor: Three episodes in the recent history of the U.K. accountancy profession. AOS 19, 527. 2 2 Johnson, T. (1977). The professions in the class structure. In R. Scase, Industrial Society: Class, cleavage and control. 2 Rose, N., & Miller, P. (1992). Political Power beyond the State: Problematics of Government. BRITJSOC 43, 173. 1 Armstrong, P. (1987). The rise of accounting controls in British capitalist enterprises. AOS 12, 415. 1 Walker, S.P. (1991). The defense of professional monopoly: Scottish chartered accountants and satellites in the accountancy firmament: 1854-1914. AOS 16, 257. Saks, M. (1983). Removing the blinkers? A Critique of recent contributions to the sociology of professions. SOCREV 31, 1. 1 1 2002-2007 Accounting Change and ABC Gosselin, M. (1997). The effect of strategy and organizational structure on the adoption and implementation of activity-based costing. AOS 22, 105. Foster, G., & Swenson, D.W. (1997). Measuring the Success of Activity-Based Cost Management and Its Determinants. JMAR 1, 109. McGowan, A.S., & Klammer, T.P. (1997). Satisfaction with Activity-Based Cost Management Implementation. JMAR 1, 217. Shields, M.D. (1995). An Empirical Analysis of Firms' Implementation Experiences with Activity-Based Costing. JMAR 1, 146. Shields, M.D., & Young, S.M. (1993). Antecedents and Consequences of Participative Budgeting: Evidence on the Effects of Asymmetrical Information. JMAR 1, 265. Anderson, S.W., & Young, S.M. (1999). The impact of contextual and process factors on the evaluation of activitybased costing. AOS 24, 525. 5 5 4 3 3 3 Kennedy, P. (1992). A guide to econometrics. Cambridge, Mass.: MIT Press. 2 Libby, T., & Waterhouse, J. (1996). Predicting Change in Management Accounting Systems. JMAR 8, 137. 2 Krumwiede, K.R. (1998). The Implementation Stages of Activity-Based Costing and the Impact of Contextual and Organizational Factors. JMAR 10, 239. Firth, M. (1996). The diffusion of managerial accounting procedures in the people's republic of China and the influence of foreign partnered joint ventures. AOS 21, 629. Swenson, D.W. (1995). The Benefits of Activity-Based Cost Management to the Manufacturing Industry. JMAR 1, 167. Malmi, T. (1999). Activity-based costing diffusion across organizations: An exploratory empirical analysis of Finnish firms. AOS 24, 649. Anderson, S.W. (1995). A Framework for Assessing Cost Management System Changes: The Case of Activity Based Costing Implementation at General Motors, 1986-1993. JMAR 1, 1. 2 2 1 1 1 Accounting Data and Budgeting Rockness, H.O., & Shields, M.D. (1984). Organizational control systems in research and development. AOS 9, 165. Brownell, P. (1982). The role of accounting data in performance evaluation, budgetary participation, and organizational effectiveness. JAR 20, 12. Brownell, P., & Dunk, A.S. (1991). Task uncertainty and its interaction with budgetary participation and budget emphasis: Some methodological issues and empirical. AOS 16, 693. Brownell, P., & Merchant, K.A. (1990). The Budgetary and Performance Influences of Product Standardization and Manufacturing Process Automation. JAR 28, 388. Dunk, A.S. (1992). Reliance on budgetary control, manufacturing process automation and production subunit performance: A research note. AOS 17, 195. Harrison, G.L. (1992). The cross-cultural generalizability of the relation between participation, participation, budget emphasis and job related attitudes AOS 17, 1. Abernethy, M.A., & Guthrie, C.H. (1994). An empirical assessment of the "Fit" between strategy and management in information system design. ACCFIN 34, 49. Lau, C.M., Low, L.C., & Eggleton, I.R.C. (1995). The impact of reliance on accounting performance measures on jobrelated tension and managerial performance: Additional evidence. AOS 20, 359. 6 5 5 5 5 5 4 4 Young, S.M. (1985). Participative budgeting: The effects of risk aversion and asymmetric information on budgetary slack. JAR 23, 829. Fisher, J.G., Frederickson, J., & Peffer, S.A. (2000). Budgeting: An experimental investigation of the effects of negotiation. TAR 75, 93. Brownell, P., & Hirst, M.K. (1986). Reliance on acct. info, budgetary participation, and task uncertainty: Tests of a three-way interaction. JAR 24, 241. Simons, R. (1987). Accounting control systems and business strategy: An empirical analysis. AOS 12, 357. O'Connor, N.G. (1995). The influence of organizational culture on the usefulness of budget participation by Singaporean-Chinese managers. AOS 20, 383. Waller, W.S. (1988). Slack in participative budgeting: The joint effect of a truth-inducing pay scheme and risk preferences. AOS 13, 87. Chow, C.W., Cooper, J.C., & Waller, W.S. (1988). Participative budgeting: Effects of a Truth-inducing pay scheme and information asymmetry on slack and performance. TAR 63, 111. Hirst, M.K. (1981). Accounting information and the evaluation of subordinate performance: A situational approach. TAR 56, 771. Merchant, K.A. (1990). The effects of financial controls on data manipulation and management myopia. AOS 15, 297. Harrison, G.L. (1993). Reliance on accounting performance measures in superior evaluative style - The influence of national culture and personality. AOS 18, 319. Hartmann, F.G.H., & Moers, F. (1999). Testing contingency hypotheses in budgetary research: An evaluation of the use of moderated regression analysis. AOS 24, 291. Mia, L., & Chenhall, R.H. (1994). The usefulness of management accounting systems, functional differentiation and managerial effectiveness. AOS 19, 1. 3 3 3 3 3 2 2 2 2 2 2 2 Imoisili, O.A. (1989). The role of budget data in the evaluation of managerial performance 14, 325. 2 Otley, D.T. (1978). Budget and managerial performance. JAR 16, 122. 1 Brownell, P., & McInnes, M. (1986). Budgetary participation, motivation, and managerial performance. TAR 61, 587. 1 Mahoney, T.A. (1963). Development of managerial performance; a research approach: Cincinnati, South-western Pub. Co. 1 Merchant, K.A. (1985). Budgeting and the propensity to create budgetary slack. AOS 10, 201. 1 Shields, J.F., & Shields, M.D. (1998). Antecedents of participative budgeting. AOS 23, 49. 1 Lawrence, P.R., & Lorsch, J.W. (1967). Organization and environment; managing differentiation and integration. Boston: Division of Research, Graduate School of Business Administration, Harvard University. Merchant, K.A., Chow, C.W., & Wu, A. (1995). Measurement, evaluation and reward of profit center managers: A cross cultural field study. AOS 20, 619. 1 1 Quality and Strategy Ittner, C.C., & Larcker, D.F. (1995). Total quality management and the choice of information and reward systems. JAR 33, 1. Perera, S., Harrison, G.L., & Poole, M. (1997). Customer-focused manufacturing strategy and the use of operationsbased non-financial performance measures: A research note. AOS 22, 557. Banker, R.D., Potter, G., & Schroeder, R.G. (1993). Reporting Manufacturing Performance Measures to Workers: An Empirical Study. JMAR 1, 33. Sim, K.L., & Killough, L.N. (1998). The Performance Effects of Complementarities Between Manufacturing Practices and Management Accounting Systems. JMAR 10, 325. Ittner, C.D., & Larcker, D.F. (1997). Quality Strategy, strategic control systems, and organizational performance. AOS 22, 293. Govindarajan, V., & Gupta, A.K. (1985). Linking control systems to business unit strategy: Impact on performance. AOS 10, 51. Abernethy, M.A., & Brownell, P. (1997). Management control systems in research and development organizations: The role of accounting, behavior and personnel controls. AOS 22, 233. Ittner, C.D., & Larcker, D.F. (1998). Innovations in Performance Measurement: Trends and Research Implications. JMAR 10 205. Govindarajan, V. (1984). Appropriateness of accounting data in performance evaluation: An empirical examination of environmental uncertainty as an interv. AOS 9, 125. Milgrom, P., & Roberts, J. (1995). Complementarities and fit: Strategy, structure, and organizational change in manufacturing. JAE 19, 179. 6 6 4 3 2 2 2 1 1 1 MCS and MAS Chenhall, R.H., & Morris, D. (1986). The impact of structure, environment, and interdependence on the perceived usefulness of management accounting systems. TAR 61, 16. Chong, V.K., & Ming Chong, K. (1997). Strategic choices, environmental uncertainty and SBU performance: A note on the intervening role of management accounting systems. ACCBUS 27, 268. Chenhall, R.H., & Langfield-Smith, K. (1998). The relationship between strategic priorities, management techniques and management accounting: An empirical investigation using a system approach. AOS 23, 243. Gul, F.A., & Chia, Y.M. (1994). The effects of management accounting systems, perceived environmental uncertainty and decentralization on managerial performance: A test of three-way interaction. AOS 19, 413. Abernethy, M.A., & Lillis, A.M. (1995). The impact of manufacturing flexibility on management control system design. AOS 20, 241. Bouwens, J., & Abernethy, M.A. (2000). The consequences of customization on management accounting system design. AOS 25, 221. Langfield-Smith, K. (1997). Management control systems and strategy: A critical review. AOS 22, 207. Simons, R. (1990). The role of management control systems in creating competitive advantage: New perspectives. AOS 15, 127. Hopwood, A.G. (1996). Looking across rather than up and down: On the need to explore the lateral processing of information. AOS 21, 589. Gietzmann, M.B. (1996). Incomplete Contracts And The Make Or Buy Decision: Governance Design And Attainable Flexibility. AOS 21, 611. 6 6 5 5 4 3 3 3 3 3 Tomkins, C. (2001). Interdependencies, trust and information in relationships, alliances and networks. AOS 26, 161. 3 Meer-Kooistra, J.V.D., & Vosselman, E.G.J. (2000). Management control of interfirm transactional relationship: The case of industrial renovation and maintenance. AOS 25, 51. 3 Foster, G., & Gupta, M. (1994). Marketing, Cost Management and Management Accounting. JMAR 1, 43. 2 Dent, J.F. (1990). Strategy, organization and control: Some possibilities for accounting research. AOS 15, 3. 1 Miles, R.E., & Snow, C.C. (1978). Organizational strategy, structure, and process. New York: McGraw-Hill. 1 Govindarajan, V. (1988). A contingency approach to strategy implementation at the business-unit level: Integrating administrative mechanisms with strategy. AMJ 31, 828. 1 Guilding, C. (1999). Competitor-focused accounting: An exploratory note. AOS 24, 583. 1 Williamson, O.E. (1985). The economic institutions of capitalism: Firms, markets, relational contracting. New York; London: Free Press; Collier Macmillan. 1 Globalization Cooper, D.J., Greenwood, R., Hinings, B., & Brown, J.L. (1998). Globalization and Nationalism in a multinational accounting firm: The case of opening new markets in Eastern Europe. AOS 23, 531. Arnold, P.J., & Sikka, P. (2001). Globalization and the state-profession relationship: The case of the bank of credit and commerce international. AOS 26, 475. Caramanis, C.V. (2002). The interplay between professional groups, the state and supranational agents: Pax Americana in the age of globalisation. AOS 27, 379. Covaleski, M.A., Dirsmith, M.W., & Rittenberg, L. (2003). Jurisdictional disputes over professional work: The institutionalization of the global knowledge expert. AOS 28, 323. 4 3 2 1 Accounting Profession and Professional Organizations Willmott, H.C. (1986). Organizing the profession: A theoretical and historical examination of the development of the major accounting bodies in the U.K. AOS 11, 555. Chua, W.F., & Poullaos, C. (1998). The dynamics of closure amidst the construction of market, profession, empire and nationhood: An historical analysis of an Australian accounting association, 1886-1903. AOS 23, 155. Chua, W.F., & Poullaos, C. (1993). Rethinking the professions-state dynamic: The case of the Victorian charter attempt, 1885-1906. AOS 18, 691. 15 11 10 Walker, S.P. (1995). The genesis of professional organization in Scotland: A contextual analysis. AOS 20, 285. 10 Annisette, M. (2000). Imperialism in the professions: The education and certification of accountants in Trinidad and Tobago. AOS 25, 631. 7 Macdonald, K.M. (1985). Social Closure and Occupational Registration. SOC 19, 541. 6 Walker, S.P. (1991). The defense of professional monopoly: Scottish chartered accountants and satellites in the accountancy firmament: 1854-1914. AOS 16, 257. Caramanis, C.V. (1999). International accounting firms versus indigenous auditors: Intra-professional conflict in the Greek auditing profession, 1990-1993. CPA 10, 153. Sarfatti Larson, M. (1977). The rise of professionalism: A sociological analysis. Berkeley [u.a.]: University of California Press. Anderson-Gough, F., Grey, C., & Robson, K. (1998). Making up accountants: The organizational and professional socialization of trainee chartered accountants: Aldershot, Hants, England ; Brookfield, Vt., USA: Ashgate Pub. 6 6 6 6 Annisette, M. (1999). Importing Accounting: The case of Trinidad and Tobago. ACCBUSFINHIST 1, 103. 5 Macdonald, K.M. (1984). Professional Formation: The Case of Scottish Accountants BRITJSOC 35, 174. 4 Johnson, T.J. (1972). Professions and power. London: Macmillan. 4 Hanlon, G. (1994). The commercialization of accountancy: Flexible accumulation and the transformation of the service class. Houndmills, Basingstoke, Hampshire; New York: St. Martin's Press. 4 Kirkham, L.M., & Loft, A. (1993). Gender and the construction of the professional accountant. AOS 18, 507. 3 Walker, S.P., & Shackleton, K. (1995). Corporatism and structural change in the British accountancy profession, 19301957. AOS 20, 467. Ramirez, C. (2001). Understanding social closure in its cultural context: Accounting practitioners in France (19201939). AOS 26, 391. Dirsmith, M.W., & Covaleski, M.A. (1985). Informal communications, nonformal communications and mentoring in public accounting firms. AOS 10, 149. Robson, K., Willmott, H.C., Cooper, D., & Puxty, T. (1994). The ideology of professional regulation and the markets for accounting labor: Three episodes in the recent history of the U.K. accountancy profession. AOS 19, 527. Anderson-Gough, F., Grey, C., & Robson, K. (2000). In the name of the client: The service ethic in two professional services firms. HUMREL 53, 1151. Dirsmith, M.W., Jeoam, J.B., & Covaleski, M.A. (1997). Structure and agency in an institutionalized setting: The application and social transformation of control in the big six. AOS 22, 1. Covaleski, M.A., Dirsmith, M.W., Heian, J.B., & Samuel, S. (1998). The Calculated and the Avowed: Techniques of Discipline and Struggles over Identity in Big Six Public Accounting Firms. ADSCIQ 43, 293. Witz, A. (1992). Professions and patriarchy. London; New York Routledge. Hammond, T., & Streeter, D.W. (1994). Overcoming barriers: Early African-American certified public accountants. AOS 19, 271. Sikka, P., & Willmott, H.C. (1995). The power of "independence": Defending and extending the jurisdiction of accounting in the United Kingdom. AOS 20, 547. Anderson-Gough, F., Grey, C., & Robson, K. (2001). Tests of time: organizational time-reckoning and the making of accountants in two multi-national accounting firms. AOS 26, 99. 3 3 3 2 2 2 2 1 1 1 1 Environmental Disclosure Gray, R., Kouhy, R., & Lavers, S. (1996). Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. ACCAUD 2, 47. Patten, D.M. (1992). Intra-Industry environmental disclosures to the Alaskan oil spill: A note on legitimacy theory. AOS 17, 471. Ullmann, A.A. (1985). Data in Search of a Theory: A Critical Examination of the Relationships Among Social Performance, Social Disclosure, and Economic Performance of U.S. Firms. AMR 10, 540. Wiseman, J. (1982). An evaluation of environmental disclosures made in corporate annual reports. AOS 7, 53. Gray, R., Owen, D., & Adams, C. (1996). Accounting & accountability: Changes and challenges in corporate social and environmental reporting. Harlow, England; New York Deegan, C., & Gordon, B. (1996). A study of the environmental disclosure practices of Australian corporations. ACCBUS 26, 187. Neu, D., Warsame, H., & Pedwell, K. (1998). Managing public impressions: Environmental disclosures in annual reports. AOS 23, 265. 4 3 3 2 2 1 1