ACCOUNTING

PRINCIPLES

SIXTH CANADIAN EDITION

Chapter 7

Internal Control and Cash

Prepared by:

Debbie Musil

Kwantlen Polytechnic University

Internal Control and Cash

• Internal control

– Fraud

– Internal controls and activities

– Limitations of internal control

• Cash controls

– Internal controls over cash receipts and

payments

• Using a bank

– Using and reconciling a bank account

• Reporting cash

Copyright John Wiley & Sons Canada, Ltd.

2

CHAPTER 7:

Internal Control and Cash

LEARNING OBJECTIVES:

1. Explain the activities that help prevent fraud and

achieve internal control.

2. Apply control activities to cash receipts.

3. Apply control activities to cash payments,

including petty cash.

4. Describe the control features of a bank account

and prepare a bank reconciliation.

5. Report cash on the balance sheet.

Copyright John Wiley & Sons Canada, Ltd.

3

Fraud

• An intentional dishonest act

• Results in personal financial benefit by:

– Misappropriating (stealing) assets, or

– Misstating financial statements

• Three factors that contribute to fraud:

– Opportunity to commit fraud

– Financial pressure

– Rationalization (justify their actions)

Copyright John Wiley & Sons Canada, Ltd.

4

Internal Control

• Related methods and measures that management

designs and implements to help achieve:

– Reliable financial reporting

– Effective and efficient operations

– Compliance with laws and regulations

• Effective internal control systems have five basic

components:

–

–

–

–

–

Control environment

Risk assessment

Control activities

Information and communication

Monitoring

Copyright John Wiley & Sons Canada, Ltd.

5

Internal Control Systems

• Control environment

– Create a culture that values clear rules

and expects everyone to follow the rules

• Risk assessment

– Identify and analyze factors that create

risk, and determine how to manage

• Control activities

– Design policies and procedures to

address the risks faced by the company

Copyright John Wiley & Sons Canada, Ltd.

6

Internal Control Systems 2

• Information and communication

– Identify, collect and communicate

relevant information to appropriate

parties

• Monitoring

– Identifying and reporting problems to

appropriate levels where action can be

taken

Copyright John Wiley & Sons Canada, Ltd.

7

Control Activities

• Establishment of responsibility

– Make specific employees responsible for

specific tasks, including authorization

• Segregation of duties

– Duties are divided in a manner that

eliminates the ability to commit a fraud

and cover it up

• Documentation procedures

– Rules covering the handling and control

of documents (such as pre-numbering)

Copyright John Wiley & Sons Canada, Ltd.

8

Control Activities 2

• Physical and IT controls

– Over access to and use of assets and records

• Independent checks of performance

– Reviews of records and performance by

independent employees or external parties

• Human resource controls

– Bonding, rotation of duties, requiring vacations,

background checks

Copyright John Wiley & Sons Canada, Ltd.

9

Limitations of Internal

Control

• Reasonable assurance: cost of internal

control should not be more than expected

benefit

• Human element: fatigue, carelessness,

indifference, lack of training

• Collusion: two or more employees working

together to overcome segregation control

• Size of business: effective controls are

more difficult in smaller organizations

Copyright John Wiley & Sons Canada, Ltd.

10

CHAPTER 7:

Internal Control and Cash

LEARNING OBJECTIVES:

1. Explain the activities that help prevent fraud and

achieve internal control.

2. Apply control activities to cash receipts.

3. Apply control activities to cash payments,

including petty cash.

4. Describe the control features of a bank account

and prepare a bank reconciliation.

5. Report cash on the balance sheet.

Copyright John Wiley & Sons Canada, Ltd.

11

Cash Controls

• Effective control over cash is essential to:

– Safeguard cash

– Ensure the accuracy of accounting records

• Types of cash receipts:

–

–

–

–

Over-the-counter

Bank debit and credit card transactions

Mail-in receipts

Receipts via electronic funds transfer (EFT)

Copyright John Wiley & Sons Canada, Ltd.

12

Control Over Cash Receipts

• Responsibility:

– Only designated personnel are

authorized to handle cash receipts

• Segregation of duties:

– Different individuals receive and record

cash receipts, have custody of cash

• Documentation procedures:

– Use remittance advices, cash register

tapes, deposit slips

Copyright John Wiley & Sons Canada, Ltd.

13

Control Over Cash Receipts 2

• Physical controls:

– Store cash in safes and bank vaults

– Limit access

– Use cash registers

– Deposit cash daily

• Independent checks of performance:

– Daily cash counts and comparisons of

receipts

• Human resource controls:

– Bonding; require vacations

Copyright John Wiley & Sons Canada, Ltd.

14

Debit Card Transactions

• Sales using debit cards are considered

cash transactions

– Retailer receives cash directly into bank

account at some regular interval (e.g. daily)

– Proceeds received are net of transaction fees

Copyright John Wiley & Sons Canada, Ltd.

15

Bank Credit Card Transactions

• Sales using bank credit cards are also

considered cash transactions

– Retailer receives cash directly into bank

account

– Proceeds received are net of transaction fees

• Fees are generally higher than debit card fees

Copyright John Wiley & Sons Canada, Ltd.

16

Mail-in and Electronic

Receipts

• Mail-in receipts:

– Open mail in presence of two clerks

– Remittance slips sent to Accounting

independently of cash

• Electronic receipts:

– On-line banking: cash transferred from

customer’s bank account to company’s bank

account

– Company journalizes from its bank statement

– Pre-authorized payments: company initiates

payment and automatically journalizes

Copyright John Wiley & Sons Canada, Ltd.

17

CHAPTER 7:

Internal Control and Cash

LEARNING OBJECTIVES:

1. Explain the activities that help prevent fraud and

achieve internal control.

2. Apply control activities to cash receipts.

3. Apply control activities to cash payments,

including petty cash.

4. Describe the control features of a bank account

and prepare a bank reconciliation.

5. Report cash on the balance sheet.

Copyright John Wiley & Sons Canada, Ltd.

18

Control Over Cash Payments

• Made by cheque, EFT or petty cash

• Establish responsibility:

– Only designated individuals can sign cheques

• Segregation of duties:

– Different people approve and make payments

• Documentation procedures:

– Use pre-numbered cheques and account for

numerical continuity

– Supported by approved invoice or similar

Copyright John Wiley & Sons Canada, Ltd.

19

Control Over Cash

Payments 2

• Physical and IT controls:

– Secure blank cheques and restrict

access

– Print cheques electronically or use writer

• Independent checks of performance:

– Compare cheques to invoices

– Reconcile bank statement regularly

• Human resources:

– Hire bonded personnel

Copyright John Wiley & Sons Canada, Ltd.

20

Petty Cash Fund

• Used to pay small amounts

• To establish a petty cash fund:

– Appoint a custodian who is responsible for it

– Determine the appropriate size of the fund

Copyright John Wiley & Sons Canada, Ltd.

21

Petty Cash Fund 2

• Making payments from the fund:

– Usually limited in size and type of transaction

– Documented on a pre-numbered receipt

– No accounting entry when payment is made

• Replenishing the fund:

– Done when fund reaches some set minimum

– Custodian prepares a summary of payments,

supported by receipts and other documents

– Reviewed and approved independently

– Used as a basis for accounting entry

Copyright John Wiley & Sons Canada, Ltd.

22

Petty Cash Fund 3

• Cash shortage or overage

– Recognized when fund replenished

– Becomes an expense or revenue

• Fund can be increased (if not large enough) or

decreased (if too large) when replenished

Copyright John Wiley & Sons Canada, Ltd.

23

CHAPTER 7:

Internal Control and Cash

LEARNING OBJECTIVES:

1. Explain the activities that help prevent fraud and

achieve internal control.

2. Apply control activities to cash receipts.

3. Apply control activities to cash payments,

including petty cash.

4. Describe the control features of a bank account

and prepare a bank reconciliation.

5. Report cash on the balance sheet.

Copyright John Wiley & Sons Canada, Ltd.

24

Use of a Bank Account

• Strengthens internal controls over cash

– Minimizes the amount of cash on hand

– A clearing house for receipts and cheques

– Provides a double record of cash transactions

• Bank deposits and cheques

– Duplicate deposits slips are stamped by bank

– Cheques usually require two authorized

signatures

• Bank reconciliation compares bank’s

balance with company’s balance and

explains any differences

Copyright John Wiley & Sons Canada, Ltd.

25

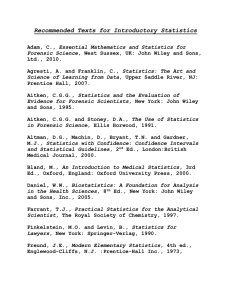

Bank Statement

Copyright John Wiley & Sons Canada, Ltd.

26

Reconciling the Bank

Account

• Bank balance almost never agrees to

depositor’s balance

– Due to time lags and errors in recording

transactions

• The two balances must be reconciled

– Called preparing a bank reconciliation

– Done by an employee who has no

responsibilities related to cash

• Balance per books and per bank are both

reconciled to their adjusted (correct)

balance

Copyright John Wiley & Sons Canada, Ltd.

27

Reconciling Items per Bank

Balance per bank

+ Deposits in transit

– Deposits recorded by depositor that have

not been recorded by bank

- Outstanding cheques

– Cheques issued & recorded by company

that have not been presented to bank

± Bank errors

= Adjusted cash balance per bank

Copyright John Wiley & Sons Canada, Ltd.

28

Reconciling Items per Books

Balance per books

+ Credit memoranda

– Amounts credited to company by bank, such as

interest earned, EFT deposits, etc.

- Debit memoranda

– Charges levied by bank against depositor’s

account – service charges, NSF charges, etc.

± Company errors

= Adjusted cash balance per books

Copyright John Wiley & Sons Canada, Ltd.

29

Entries from Bank

Reconciliation

• Each reconciling item required to

calculate adjusted cash balance per

books must be journalized

– To ensure that these are accounted for

by company

• Each reconciling item required to

calculate adjusted cash balance per

bank is NOT journalized

– Will be recorded by bank when received

Copyright John Wiley & Sons Canada, Ltd.

30

CHAPTER 7:

Internal Control and Cash

LEARNING OBJECTIVES:

1. Explain the activities that help prevent fraud and

achieve internal control.

2. Apply control activities to cash receipts.

3. Apply control activities to cash payments,

including petty cash.

4. Describe the control features of a bank account

and prepare a bank reconciliation.

5. Report cash on the balance sheet.

Copyright John Wiley & Sons Canada, Ltd.

31

Reporting Cash

• Cash on the balance sheet includes:

– Coins, currency, cheques, money on deposit

– Bank debit and credit card transactions

– Cash equivalents: investments with a term of

three months or less that are easily sold

• Listed first on the balance sheet, as it is the

most liquid

• Bank overdrafts are reported as a liability

• Restricted cash is reported separately

Copyright John Wiley & Sons Canada, Ltd.

32

Copyright

Copyright © 2013 John Wiley & Sons Canada, Ltd. All rights

reserved. Reproduction or translation of this work beyond

that permitted by Access Copyright (the Canadian copyright

licensing agency) is unlawful. Requests for further

information should be addressed to the Permissions

Department, John Wiley & Sons Canada, Ltd. The purchaser

may make back-up copies for his or her own use only and

not for distribution or resale. The author and the publisher

assume no responsibility for errors, omissions, or damages

caused by the use of these files or programs or from the use

of the information contained herein.

Prepared by:

A. Davis, MSc, BComm, CA, CFE

Copyright John Wiley & Sons

Canada, Ltd.

33