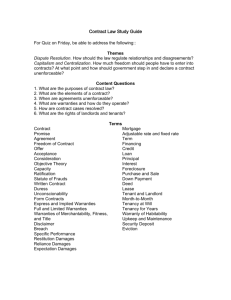

formation defenses, performance excuses, contracts premised on

advertisement

Econ 522 Economics of Law Dan Quint Fall 2012 Lecture 13 Logistics HW3 is online, due next Thursday (Nov 8) Next Monday: guest speaker to begin tort law Second midterm November 19 Cumulative, through end of contract law More weight on more recent material 1 Last week… Default rules Contracts which won’t be enforced Derogation of public policy Formation defenses and performance excuses Incompetence But not drunkenness – why? Today: more ways to get out of a contract 2 Discussion question Old urban legend: A man bought a box of extremely rare and expensive cigars, and insured them against loss or damage. After smoking them, he filed an insurance claim, saying they had been destroyed in 20 separate small fires. The insurance company refused to pay, the man sued and won. But as he was leaving the courtroom, he was arrested on 20 counts of arson. Serious question: If the intent of a contract is clear, but different from the literal meaning, which should be enforced? 3 Another formation defense: dire constraints 4 Dire constraints Necessity I’m about to starve, someone offers me a sandwich for $10,000 My boat’s about to sink, someone offers me a ride to shore for $1,000,000 Contract would not be upheld: I signed it out of necessity Duress Other party is responsible for situation I’m in “I made him an offer he couldn’t refuse” Contract signed at gunpoint would not be legally enforceable 5 Duress source: http://news.yahoo.com/man-sues-former-hostages-saysbroke-promise-190902970.html 6 Friedman on duress Example Mugger threatens to kill you unless you give him $100 You write him a check Do you have to honor the agreement? “Efficiency requires enforcing a contract if both parties wanted it to be enforceable” He did – he wants your $100 You did – you’d rather pay $100 than be killed So why not enforce it? Makes muggings more profitable leads to more muggings Tradeoff: refuse to enforce a Pareto-improving trade, in order to avoid incentive for bad behavior 7 Friedman on duress Example Mugger threatens to kill you unless you give him $100 You write him a check Do you have to honor the agreement? “Efficiency requires enforcing a contract if both parties wanted it to be enforceable” He did – he wants your $100 You did – you’d rather pay $100 than be killed So why not enforce it? Makes muggings more profitable leads to more muggings Tradeoff: refuse to enforce a Pareto-improving trade, in order to avoid incentive for bad behavior 8 What about necessity? Same logic doesn’t work for necessity You get caught in a storm on your $10,000,000 sailboat Tugboat offers to tow you to shore for $9,000,000 (Otherwise he’ll save your life but let your boat sink) Duress: if we enforce contract, incentive for more crimes Here: if we enforce contract, incentive for more tugboats to be available for rescues – why is that bad? Social benefit of rescue: value of boat, minus cost of tow Say, $10,000,000 – $10,000 = $9,990,000 If tugboat gets entire value, his private gain = social gain So tugboat captain would invest the efficient amount in being available to rescue you So what’s the problem? 9 What about necessity? What about your decision: whether to sail that day 1 in 1000 chance of being caught in a storm If so, 1 in 2 that a tugboat will rescue you Private cost of sailing: 1 in 2000 you lose boat, 1 in 2000 you pay tugboat captain value of boat $10,000,000/2000 + $10,000,000/2000 = $10,000 So you’ll choose to sail if your value is above $10,000 Social cost: 1 in 2000 boat is lost, 1 in 2000 boat is rescued $10,000,000/2000 + $10,000/2000 = $5,005 Efficient to sail when your value is above $5,005 When your value from sailing is between $5,005 and $10,000, you “undersail” If the price of being towed was just the marginal cost, your private cost = social cost and you would sail the efficient amount 10 Friedman’s point Same transaction sets incentives on both parties Price that would be efficient for one decision, is inefficient for other “Put the incentive where it would do the most good” Least inefficient price is somewhere in the middle And probably not the price that would be negotiated in the middle of a storm! 11 Friedman’s point Same transaction sets incentives on both parties Price that would be efficient for one decision, is inefficient for other “Put the incentive where it would do the most good” Least inefficient price is somewhere in the middle And probably not the price that would be negotiated in the middle of a storm! So makes sense for courts to overturn contracts signed under necessity, replace them with ex-ante optimal terms More general point Single price creates multiple incentives May be impossible to get efficient behavior in all dimensions 12 Real duress versus fake duress Court won’t enforce contracts signed under threat of harm “Give me $100 or I’ll shoot you” But many negotiations contain threats “Give me a raise, or I’ll quit” “$3,000 is my final offer for the car, take it or I walk” The difference? Threat of destruction of value versus failure to create value A promise is enforceable if extracted as price of cooperating in creating value; not if it was extracted by threat to destroy value 13 Example: Alaska Packers’ Association v Domenico (US Ct App 1902) Captain hires crew in Seattle for fishing expedition to Alaska In Alaska, crew demands higher wages or they’ll quit, captain agrees Back in Seattle, captain refuses to pay the higher wages, claiming he agreed to them under duress Court ruled for captain Since crew had already agreed to do the work, no new consideration was given for promise of higher wage 14 A performance excuse: impossibility 15 Next doctrine for voiding a contract: impossibility When performance becomes impossible, should promisor owe damages, or be excused from performing? A perfect contract would explicitly state who bears each risk Contract may give clues as to how gaps should be filled Industry custom might be clear But in some cases, court must fill gap 16 Next doctrine for voiding a contract: impossibility In most situations, when neither contract nor industry norm offers guidance, promisor is held liable for breach But there are exceptions Change “destroyed a basic assumption on which the contract was made” 17 Next doctrine for voiding a contract: impossibility In most situations, when neither contract nor industry norm offers guidance, promisor is held liable for breach But there are exceptions Change “destroyed a basic assumption on which the contract was made” Efficiency requires assigning liability to the party that can bear the risk at least cost How to determine who that is? 18 Who is the efficient bearer of a particular risk? Friedman offers several bases for making this determination Spreading losses across many transactions Moral hazard: who is in better position to influence outcome? 19 Who is the efficient bearer of a particular risk? Friedman offers several bases for making this determination Spreading losses across many transactions Moral hazard: who is in better position to influence outcome? Adverse selection: who is more aware of risk, even if he can’t do anything about it? “…The party with control over some part of the production process is in a better position both to prevent losses and to predict them. It follows that an efficient contract will usually assign the loss associated with something going wrong to the party with control over that particular something.” 20 That’s why Hadley v Baxendale was “surprising” Baxendale (shipper) could influence speed of delivery, Hadley could not So Baxendale was efficient bearer of the risk of delay Court ruled he didn’t owe damages for lost profits, forcing Hadley to bear much of this risk Only makes sense as a “penalty default” Rule creates incentive for Hadley to reveal urgency of this shipment 21 Contracts based on bad information 22 Contracts based on faulty information Four doctrines for invalidating a contract Fraud Failure to disclose Frustration of purpose Mutual mistake 23 Fraud Fraud: one party was deliberately tricked source: http://www.wyff4.com/r/29030818/detail.html 24 What if you trick someone by withholding information? Under the civil law, there is a duty to disclose If you fail to supply information you should have, contract will be voided – failure to disclose Less so under the common law Seller has to share information about hidden dangers… …but generally not information that makes a product less valuable without making it dangerous Exception: new products come with “implied warranty of fitness” Another exception: Obde v Schlemeyer 25 Duty to disclose under common law Under common law, seller required to inform buyer about hidden safety risks, generally not other information But… Obde v Schlemeyer (1960, Sup Ct of WA) Seller knew building was infested with termites, did not tell buyer Termites should have been exterminated immediately to prevent further damage Court in Obde imposed duty to disclose (awarded damages) 26 Duty to disclose under common law Under common law, seller required to inform buyer about hidden safety risks, generally not other information But… Obde v Schlemeyer (1960, Sup Ct of WA) Seller knew building was infested with termites, did not tell buyer Termites should have been exterminated immediately to prevent further damage Court in Obde imposed duty to disclose (awarded damages) Some states require used car dealers to reveal major repairs done, sellers of homes to reveal certain types of defects… 27 Failure to disclose? source: http://kdvr.com/2012/10/26/chinese-man-sues-wife-for-being-ugly-wins-120000/ 28 What if both parties were misinformed? Frustration of Purpose Change in circumstance made the original promise pointless Coronation Cases “When a contingency makes performance pointless, assign liability to party who can bear risk at least cost” 29 What if both parties were misinformed? Frustration of Purpose Change in circumstance made the original promise pointless Mutual Mistake Mutual mistake about facts Coronation Cases “When a contingency makes performance pointless, assign liability to party who can bear risk at least cost” Circumstances had already changed, but we didn’t know Logger buys land with timber on it, but forest fire had wiped out the timber the week before Mutual mistake about identity Disagreement over what was being sold 30 Another principle for allocating risks efficiently: uniting knowledge and control Hadley v Baxendale (miller and shipper) Hadley knew shipment was time-critical But Baxendale was deciding how to ship crankshaft (boat or train) Party that had information was not the party making decisions Efficiency generally requires uniting knowledge and control Contracts that unite knowledge and control are generally efficient, should be upheld Contracts that separate knowledge and control may be inefficient, should more often be set aside 31 Mutual vs. Unilateral Mistake Mutual mistake: neither party had correct information Contract neither united nor separated knowledge and control Unilateral mistake: one party has mistaken information I know your car is a valuable antique, you think it’s worthless You sell it to me at a low price Contracts based on unilateral mistake are generally upheld 32 Mutual vs. Unilateral Mistake Mutual mistake: neither party had correct information Contract neither united nor separated knowledge and control Unilateral mistake: one party has mistaken information I know your car is a valuable antique, you think it’s worthless You sell it to me at a low price Contracts based on unilateral mistake are generally upheld Contracts based on unilateral mistake generally unite knowledge and control And, enforcing them creates an incentive to gather information 33 Unilateral mistake: Laidlaw v Organ (U.S. Supreme Court, 1815) War of 1812: British blockaded port of New Orleans Price of tobacco fell, since it couldn’t be exported Organ (tobacco buyer) learned the war was over Immediately negotiated with Laidlaw firm to buy a bunch of tobacco at the depressed wartime price Next day, news broke the war had ended, price of tobacco went up, Laidlaw sued Supreme Court ruled that Organ was not required to communicate his information 34 Uniting knowledge and control Laidlaw v. Organ established: contracts based on unilateral mistake are generally valid Agrees with efficiency: these contracts typically unite knowledge and control What about Obde v. Schlemeyer? The termites case was based on unilateral mistake Court still upheld contract, but punished seller for hiding information In that case, contract separated knowledge from control 35 Unilateral mistake: productive versus redistributive information Productive information: information that can be used to produce more wealth Redistributive information: information that can be used to redistribute wealth in favor of informed party Cooter and Ulen Contracts based on one party’s knowledge of productive information should be enforced… …especially if that knowledge was the result of active investment Contracts based on one party’s knowledge of purely redistributive information, or fortuitously acquired information, should not be enforced 36 Other reasons a contract may not be enforced 37 Vague contract terms Courts will generally not enforce contract terms that are overly vague Can be thought of as a penalty default “Punish” the parties by refusing to enforce contract… …so people will be more clear when they write contracts But some exceptions Parties may commit to renegotiating the contract “in good faith” under certain contingencies 38 Adhesion (I): “Shrink-wrap” licenses Back when software came on disks or CDs… Box was wrapped in cellophane Inside, “By unwrapping this box, you agree to the following terms…” “Due to the unscheduled trip to the autowrecking yard the school bus will be out of commission for two weeks. Note by reading this letter out loud you have waived any responsibility on our part in perpetuity throughout the known universe.” Contract is not binding if one party had no opportunity to review it before agreeing 39 Adhesion (II): What if a party chose not to review the contract? Source: http://www.foxnews.com/scitech/2010/04/15/online-shoppers-unknowingly-sold-souls/ 40 Adhesion (II): What if a party chose not to review the contract? British computer game retailer GameStation, on April Fool’s Day, added this to Terms & Conditions customers agreed to before buying online: “By placing an order via this website… you agree to grant us a non-transferable option to claim, for now and for ever more, your immortal soul. Should we wish to exercise this option, you agree to surrender your immortal soul, and any claim you may have on it, within 5 (five) working days of receiving written notification from gamestation.co.uk or one of its duly authorised minions. …If you a) do not believe you have an immortal soul, b) have already given it to another party, or c) do not wish to grant us such a license, please click the link below to nullify this sub-clause and proceed with your transaction.” 41 Adhesion (general) Contract of Adhesion: standardized “take-it-or-leave-it” contract where terms are not negotiable “Bogus duress” Not illegal per se, but might attract “closer scrutiny” A few state courts have adopted a rule: if I have “reason to believe that the other party would not agree if he knew the contract contained a particular term, the term is not part of the agreement” 42 What if you signed a contract that was dramatically unfair? Under bargain theory, courts should ask only whether a bargain occurred, not whether it was fair Hamer v Sidway (drinking and smoking) But both common and civil law have doctrines for not enforcing overly one-sided contracts Unconscionability/Lesion “Absence of meaningful choice on the part of one party due to one-sided contract provisions, together with terms which are so oppressive that no reasonable person would make them and no fair and honest person would accept them” When “the sum total of its provisions drives too hard a bargain for a court of conscience to assist” Terms which would “shock the conscience of the court” 43 Unconscionability: Williams v WalkerThomas Furniture (CA Dist Ct, 1965) “Unconscionability has generally been recognized to include an absence of meaningful choice on the part of one of the parties together with contract terms which are unreasonably favorable to the other party. …In many cases the meaningfulness of the choice is negated by a gross inequality of bargaining power.” 44 Unconscionability: Williams v WalkerThomas Furniture (CA Dist Ct, 1965) “Unconscionability has generally been recognized to include an absence of meaningful choice on the part of one of the parties together with contract terms which are unreasonably favorable to the other party. …In many cases the meaningfulness of the choice is negated by a gross inequality of bargaining power.” 45 Unconscionability: Williams v WalkerThomas Furniture (CA Dist Ct, 1965) “Unconscionability has generally been recognized to include an absence of meaningful choice on the part of one of the parties together with contract terms which are unreasonably favorable to the other party. …In many cases the meaningfulness of the choice is negated by a gross inequality of bargaining power.” Not normal monopoly cases but “situational monopolies” Think of Ploof v Putnam (sailboat in a storm), not Microsoft 46 Remedies for breach of contract (won’t get to this) 47 Three broad types of remedy for breach of contract Party-designed remedies Remedies specified in the contract Court-imposed damages Court may decide promisee entitled to some level of damages Specific performance Forces breaching party to live up to contract 48 Expectation damages Compensate promisee for the amount he expected to benefit from performance You agreed to buy an airplane for $350,000 You expected $500,000 of benefit from it Expectation damages: if I breach, I owe you that benefit ($500,000 if you already paid, $150,000 if you didn’t) “Positive damages” Make promisee indifferent between performance and breach 49 Reliance damages Reimburse promisee for cost of any reliance investments made, but not for additional surplus he expected to gain Restore promisee to level of well-being before he signed the contract You contracted to buy the plane and built a hangar If I breach, I owe you what you spent on the hangar, nothing else “Negative damages” – undo the negative (harm) that occurred 50 Opportunity cost damages Give promisee benefit he would have gotten from his next-best option Make promisee indifferent between breach of the contract that was signed, and performance of best alternative contract You value plane at $500,000 You contract to buy plane from me for $350,000 Someone else was selling similar plane for $400,000 By the time I breach, that plane is no longer available I owe you $100,000 – the benefit you would have gotten from buying the other seller’s plane 51 Example: expectation, reliance, and opportunity cost damages You agree to sell me ticket to Wisconsin-Ohio State game for $50 Expectation damages: you owe me value of game minus $50 If I pay scalper $150, then expectation damages = $100 Reliance damages: maybe 0, or cost of whatever pre-game investments I made 52 Example: expectation, reliance, and opportunity cost damages You agree to sell me ticket to Wisconsin-Ohio State game for $50 Expectation damages: you owe me value of game minus $50 If I pay scalper $150, then expectation damages = $100 Reliance damages: maybe 0, or cost of whatever pre-game investments I made When you agreed to sell me ticket, other tickets available for $70 Opportunity cost damages: $80 (I paid a scalper $150 to get in; I would have been $80 better off if I’d ignored your offer and paid someone else $70) 53 Ranking damages Contract I Sign Best Alternative Do Nothing = = = Breach + Expectation Damages Breach + Opportunity Cost Damages Breach + Reliance Damages Opportunity Cost Damages Reliance Damages Expectation Damages $100 $80 $15 54 Hawkins v McGee (“hairy hand case”) Hawkins had a scar on his hand McGee promised surgery to “make the hand a hundred percent perfect” Surgery was a disaster, left scar bigger and covered with hair 55 Hawkins v McGee (“hairy hand case”) + Opp Cost Damages + Reliance Damages Initial Wealth Opp Cost Damages Reliance Damages + Expectation Damages Expectation Damages $ Hand Hairy Scarred Next best doctor 100% Perfect 56 Other court-ordered remedies Restitution Return money that was already received Disgorgement Give up wrongfully-gained profits 57 Other court-ordered remedies Restitution Return money that was already received Disgorgement Give up wrongfully-gained profits Specific Performance Promisor is forced to honor promise Civil law: often ordered instead of money damages Common law: money damages more common; S.P. sometimes used when seller breaches contract to sell a unique good Like injunctive relief 58