Assets = Liabilities + Owner's Equity

advertisement

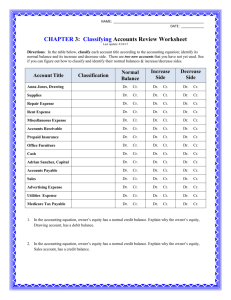

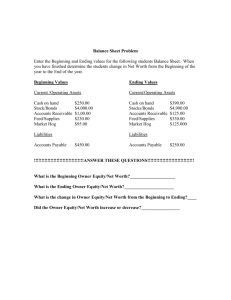

WELCOME! Haven’t seen you for some time! 会计英语 ACCOUNTING 辽宁对外经贸学院外语系 李海红 UNIT ONE Financial Position and Accounting Equation Financial position: economic resources belonging to a company and the claims (equities) against those resources at a point in time. Economic resources = equities Economic resources =creditor’s equity + owner’s equity Accounting equation: assets = liabilities + owner’s equity four types of transactions that affect owner’s equity Owner’s investments Owner’s equity revenues Owner’s withdrawals expenses The full form of accounting equation: Assets=Liabilities + Owner’s Equity + Revenue - Expenses Owner’s equity Definition: the residual interest in the assets of an entity that remains after deducting its liabilities. Owner’s equity = assets – liabilities Owner’s equity = net assets Liabilities Definition: probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. Kinds of liabilities: current liabilities and long-term liabilities Assets Definition : probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events; economic resources owned by a business that are expected to benefit future operations. Kinds of assets:current assets, fixed assets and intangible assets. Economic resources are referred to as assets and creditors’ equities are referred to as liabilities. Equities: creditor’s equity and owner’s equity Current assets: cash, accounts receivable, inventories, Fixed assets: land, buildings,and equipment Intangible assets: patent, trademark and brand name, copyright, franchise Current liabilities: accounts payable, salaries payable, taxes payable, Long-term liabilities: bonds payable CLASSROOM EXERCISES Indicate below whether each account is an assets (A), liabilities (L), or a part of owner’s equity (OE). Cash Salaries Payable Accounts Receivable Johnson, Capital Land Accounts Payable Supplies Classroom exercises: 1. Identify the following transactions by type of owner’s equity transaction by marking each as either an owner’s investment (I), owner’s withdrawal (W), revenue (R), expense (E) or not an owner’s equity transaction (NOE). a. Received cash for providing a service. b. Took assets out of business from a personal account. C. Received cash from a customer previously billed for a service. d. Transferred assets to the business from a personal accout. e. Paid service station for gasoline. f. Performed a service and received a promise of payment. g. Paid cash to purchase equipment. h. Paid cash to employee for services performed. Part 2 ILLUSTRATIVE TRANSACTIONS Transactions 1. John begins his business by depositing $50,000 in a bank account in the name of Shannon Realty. (investment) Assets 1 Bal = Liabilities + Owner’s Equity $50,000 $50,000 . $50,000 $50,000 2. John purchases a lot for $10,000 and a small building on the lot for $25,000 with cash.(purchase of assets with cash) Assets = Liabilities + Owner’s Equity $50,000 $50,000 2. +10,000 (land) +25,000 (building) -35,000 (cash) Bal. $50,000 $50,000 3. John buys some office supplies for $500 on credit. (Purchase of assets by incurring a liability) Assets = Liabilities + Owner’s Equity $50,000 3. +$500 (supplies) Bal. $50,500 $50,000 +$500(accounts payable) $500 $50,000 4. John pays $200 of the $500 owed for the supplies. (payment of a liabilities) Assets = $50,500 -$200 (cash) Bal. $50,300 Liabilities + Owner’s Equity $500 $50,000 -$200(accounts payable) $300 $50,000 5. Shannon Realty sells a house and receives a commission in cash of $1,500. Assets = $50,300 Liabilities + $300 5. +$1,500 (cash) Bal. $51,800 Owner’s Equity $50,000 +$1,500(revenue) $300 $51,500 6. John sells a house calling for a commission of $2,000, but John agrees to wait for the payment. (revenue on credit) Assets = $51,800 Liabilities + $300 Owner’s Equity $51,500 $2,000 (accounts receivable) $2,000 (revenue) Bal. 53,800 $53,500 $300 7. A few days later Shannon receives $1,000 from the client. Assets = Liabilities + $53,800 $300 Owner’s Equity $53,500 7. +$1,000(cash) -$1,000(accounts receivable) bal. $53,800 $300 $53,500 8. John Shannon pays $1,000 to rent some equipment for the office . Assets = Liabilities $53,800 $300 8. -$1,000(cash) bal. $52,800 $300 + Owner’s Equity $53,500 -$1,000(expense) $52,500 9. John pays $400 in wages to a part-time helper. (expense) Assets = $52,800 9. -$400(cash) Bal.$52,400 Liabilities + $300 $300 Owner’s Equity $52,500 -$400(expense) $52,100 10. John hasn’t paid the bill of utility expense of $300. Assets = $52,400 10. Bal. $52,400 Liabilities + Owner’s Equity $300 $52,100 +$300(accounts payable)-$300(expense) $600 $51,800 11. John withdraws $600 in cash from Shannon Realty and deposits it in his personal account. Assets $52,400 = 11.-$600(cash) Ba.$51,800 Liabilities + $600 $600 Owner’s Equity $51,800 -$600(capital) $51,200 Classroom exercises Charlene Rudek finished law school in June and immediately set up her own law practice. During the first month of operation she completed the following transactions: 1.Began the law practice by placing $2,000 in a bank account established for the business. 2.Purchased a law library for $900 cash. 3.Purchased office supplies for $400 on credit. 4.Accepted $500 in cash for completing a contract. 5.Billed clients $1,950 for services rendered during the month. 6.Paid $200 of the amount owed for office supplies. 7.Received $1,250 in cash from one client who had been previously billed for services rendered. 8.Paid rent expense for the month in the amount of $1,200. 9.Withdrew $400 from the practice for personal use. On a sheet of paper, list the numbers 1 through 10, with columns for Assets, Liabilities, and Owner’s Equity. In the columns, indicate whether each transaction caused an increase (+), a decrease (-), or no change (NC) in assets, liabilities, and owner’s equity. During the month of April, Grissom Co. had the following transactions: 1.Paid salaries for April, $1,800. 2.Purchased equipment on credit, $3000. 3.Purchased supplies with cash, $100. 4.Additional investment by owner, $4,000. 5.Paid for part of equipment previously purchased on credit, $1,000. 6.Received payment for services performed, $600. 7.Billed customers for services performed, $1,600. 8.Withdrew cash, $1,500. 9.Received payment from customers billed previously, $300. 10.Received utility bill, $70. . Part 3 Professional Ethics and Accounting Profession 李海红 Professional Ethics and the Accounting Profession Revisions: 1. Accounting equation 2. Use accounting equation to analyze the transactions. Accounting Profession Ethics Management Accounting Public Accounting Government and other Not-for-Profit Accounting Accounting Education Ethics Ethics is the application of a code of conduct to everyday life. It addresses the question of whether actions are good or bad, right or wrong. Ethics actions are the results of individual decisions and you are faced with many ethical situations every day. Management Accounting an accountant who is employed by a business is said to be in management accounting. A small business may have only one person doing this work, though a medium-size or large company may have hundreds of accountants working under a chief accounting officer called a controller, treasurer, or financial vice president. Public Accounting the field of public accounting offers services in auditing, taxes, and management consulting to the public for a fee. Government and Other Not-for-Profit Accounting Agencies and departments at all levels of government hire accountants to prepare reports that officials can responsibly carry out their duties. Not-for-Profit organizations are hospitals, colleges, universities, and foundations. Accounting Education Training new accountants is a challenging and rewarding career, and today instructors of accounting are in great demand.in many schools holding the CPA, CMA, or CIA certificate will help and instructor to advance professionally. Part 4Accounts 李海红 Revisions 1. Professional ethics 2. The classification of the accounting profession Accounts Assets: Cash Notes Receivable Accounts Receivable Prepaid Expenses Land Buildings Equipment Cash Cash is the title of the account used to record increases and decreases in cash. Cash consists of money or any medium of exchange that a bank will accept at face value for deposit. Cash: coins, currency, checks, postal and express money orders, money deposited in a bank or banks, cash on hand. Notes Receivable A promissory note is a written promise to pay a definite sum of money at a fixed future date. Accounts due from others in the form of promissory notes are recorded in an account called Notes Receivable. Accounts Receivable Accounts Receivable is incurred by Credit Sales, or Sales on Account. Credit sales increase Accounts Receivable. Prepaid Expenses Prepaid Insurance Office Supplies Prepaid Rent Store Supplies Prepaid Taxes Land Land account is used to record purchases of property to be used in the ordinary operations of the business. Buildings Purchase of structures to be used in the business are recorded in an account called Buildings. Although a building cannot be separated from the land it occupies, it is important to maintain separate accounts for the land and the buildings. Equipment Office Equipment: desks, chairs, office machines, filing cabinets, and typewriters. Store Equipment:cash registers counters, showcases, shelves, and similar items. Machinery and Equipment: lathes, drill presses and other equipment. Trucks and Automobiles. Part 6 Liability and Owner’s Equity 李海红 Revisions Assets: Cash Notes Receivable Accounts Receivable Prepaid Expenses Land Buildings Equipment Liability Notes Payable Accounts Payable Other Short-Term Liabilities Long-term Liabilities Owner’s Equity Capital Account Withdrawals Account Revenues and Expense Notes Payable Notes Payable is the opposite of Notes Receivable. It is used to record increases and decreases in promissory note amounts owed to creditors within the next year or operating cycle. Accounts Payable Accounts Payable is the opposite of Accounts Receivable. It comes from Credit Purchase. Other Short-Term Liability Wages Payable Taxes Payable Rent Payable Interest Payable Unearned Fees Customer Deposit Unearned Revenue Capital Account When someone invests in his or her own company, the amount of the investment is recorded in a capital account. Withdrawal Account A person who invests in a business usually expects to earn an income an to use at least part of the assets earned from profitable operations to pay personal living expenses. Revenue and Expense Accounts Revenues increase owner’s equity, and expenses decrease owner’s equity: Commissions Earned Advertising Fees Earned Wages Expense Supplies Expense Rent Expense Advertising Expense T- Account and Double-Entry System 李海红 Revisions Assets accounts Liabilities accounts Owner’s Equity accounts T – account and Double-Entry System Evolution of the double-entry system The T-account 辽宁对外经贸学院精品课(高职课) 会计英语 主讲人:李海红讲师 ? The accounting equation? Assets = Liabilities + Owner’s Equity The basic rules of T-account? Assets = Liabilities + Owner’s Equity Debit Credit Debit Credit for for for for Increase Decrease Decrease Increase Debit Credit for for Decrease Increase JOURNALS and JOURNALIZING Journals: general journal; special-purpose journal Journalizing: the process of recording transactions in a journal. H Examples The following transactions for the Joan Miller Advertising Agency happened in January: January 1. Joan Miller invested $10,000 to start her own advertising agency. January 2. Rented an office, paying two month’s rent, $800. January 5. Purchased office equipment from Morgan Equipment for $3,000, paying $1,500 in cash and agreeing to pay the rest next month. January 6. Purchased on credit art supplies for $1,800 and office supplies for $800 from Taylor Supply Company. January 19. Performed a service by placing several major advertisement for Ward Department Stores. The fee of $2,800 is billed now but will be collected next month. S Homework Record the following transactions in the general journal. January 8. Paid $480 for a one-year insurance policy with coverage effective January 1. January 9. Paid Taylor Supply Company $1,000 of the amount owed. January 10. Performed a service by placing advertisements for an automobile dealer in the newspaper and collected a fee of $1,400. January 12. Paid the secretary two weeks’ wages, $600. January 15. Accepted $1,000 as an advance fee for art work to be done for another agency. . January 25. Joan Miller withdrew $1,400 from the business for personal living expenses. January 26. Paid the secretary two more weeks’wages, $600. January 29. Received and paid the utility bill of $100. January 30. Received (but did not pay) a telephone bill, $70. General Journal Date Description Post. Debit Credit Ref. 2005 Jan. 1 Cash Joan Miller, Capital Investment in business 111 $10,000 311 $10,000 Date Description Post. Debit Credit Ref. 2005 Jan. 2 Prepaid Rent Cash Paid the office rent in advance 117 111 $800 $800 Date Description Post. Debit Credit Ref. 2005 Jan. 19 Accounts Receivable 113 $4,200 Advertisement Fees Earned 411 Revenue earned , to be collected later $4,200 Date Description Post. Debit Credit Ref. 2005 Jan. 5 Office Equipment Cash Accounts Payable Partial payment of office equipment 146 111 212 $3000 $1,500 $1,500 Date Description Post. Debit Credit Ref. 2005 Jan. 6 Art Supplies Office Supplies Accounts Payable Purchase of supplies on credit 115 116 212 $1,800 $800 $2,600 Date Description Post. Debit Credit Ref. Year Month Day The name of the accounts debited and credited A brief explanation of the transactions Debit Credit amount amount Revisions 1. Posting 2. Ledgers The Trial Balance The equality of debit and credit balances in the ledger should be tested periodically by preparing a trial balance. The steps in preparing a trial balance follow: 1. Determine the balance of each account in the ledger. 2. List each ledger account that has a balance, with the debit balances in the left column and the credit balances in the right column. Accounts are listed in the order they appear in the ledger. 3. Add each column. 4. Compare the totals of each column. Joan Miller Advertising Agency Trial Balance January 31, 2005 Cash Accounts Receivable Art Supplies Office Supplies Prepaid Rent Prepaid Insurance Art Equipment Office Equipment $1,720 2,800 1,800 800 800 480 4,200 3,000 Accounts Payable Unearned Art Fees Joan Miller, Capital Joan Miller, Withdrawal Advertising Fees Earned Office Wages Expense Utility Expense Telephone Expense $3,170 1,000 10,000 1,400 4,200 1,200 100 70 The Measurement of Business Income Net Income Net income is the net increase in owner’s equity resulting from the operations of the company. Net income, in its simplest form, is measured by the difference between revenues and expenses: Net income=revenues-expenses Revenues: in the simplest case, they equal the price of goods sold and services rendered during period of time. Expenses: expenses are the costs of the goods and services used up in the course of gaining revenues. Often called the cost of doing business, expenses include the costs of goods sold, the costs of activities necessary to carry on the business. The Adjustment 1. Apportioning recorded expenses between two or more accounting periods. (deferrals) Prepaid Rent Prepaid Insurance Art Supplies and Office Supplies Depreciation of Plant and Equipment 2. Apportioning recorded revenues between two or more accounting periods: Unearned art fees Prepaid Rent Rent Expense Prepaid Rent 400 400 Prepaid Insurance Insurance Expense Prepaid Insurance 40 40 Art Supplies and Office Supplies Art Supplies Expense 500 Art Supplies 500 Office Supplies Expense 200 Office Supplies 200 Depreciation of Plant and Equipment Depreciation Expense, Art Equipment 70 Accumulated Depreciation, Art Equipment 70 Depreciation Expense, Office Equipment 50 Accumulated Depreciation, Office Equipment 50 Practice During the month of May, Grissom Agency had the following transactions: 1.Paid salaries for April, $1,800. 2.Purchased equipment on credit, $3000. 3.Purchased supplies with cash, $100. 4.Additional investment by owner, $4,000. 5.Paid for part of equipment previously purchased on credit, $1,000. 6.Received payment for services performed, $600. 7.Billed customers for services performed, $1,600. 8.Withdrew cash, $1,500. 9.Received payment from customers billed previously, $300. 10.Received utility bill, $700. Michael Yang finished law school in June and immediately set up his own law practice. During the first month of operation he completed the following transactions: 1. Began the law practice by placing $2,000 in a bank account established for the business. 2. Purchased a law library for $900 cash. 3. Purchased office supplies for $400 on credit. 4. Accepted $500 in cash for completing a contract. 5. Billed clients $1,950 for services rendered during the month. 6. Paid $200 of the amount owed for office supplies. 7. Received $1,250 in cash from one client who had been previously billed for services rendered. 8. Paid rent expense for the month in the amount of $1,200. 9. Withdrew $400 from the practice for personal use. T.EN Framing was started by Jack Wang in a shopping center. In the first month, he completed the following transactions: 1. Deposited $12,000 in a bank account in the name of the center to start a business. 2. Paid current month’s rent, $600. 3. Purchased store equipment on credit, $2,700. 4. Purchased framing supplies for cash, $3,200. 5. Received framing revenues, $1,200. 6. Billed customers for framing services, $700. 7. Paid utility expenses, $350. 8. Received payment from customers in 6, $700. 9. Made payment on store equipment purchased in transaction3, $2,000. 10. Withdrew cash for personal expenses, $700.