The Negotiating Game - IEEE-USA

advertisement

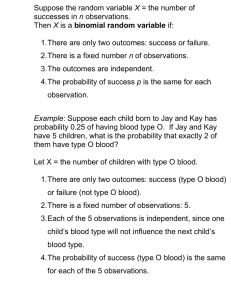

GETTING STARTED Tips for Survival © Jay E. Simpson 2001 Who am I? Jay E.Simpson Office: 952-937-8556 Fax: 952-937-8820 jaysimpson@mn.rr.com Business Law Specialist & General Counsel “Providing Solutions for the Life of Your Business” © Jay E. Simpson 2001 What Is My Story? • 2000-Present JAY SIMPSON, LLC • 1998-2000 Senior Counsel, Jostens, Inc., Bloomington, MN • 1997-1998 Contract General Counsel, American Chiropractic Network, Inc., Minnetonka, MN • 1994-1997 General Counsel Zeos International, Ltd., Minneapolis, MN • 1993-1994 Of Counsel Contract Attorney with O’Connor & Hannon, Minneapolis, MN • 1989-1993 Assistant General Counsel and Assistant Secretary, DataServ, Inc., Eden Prairie, MN • 1985-1989 Corporate Counsel and Corporate Secretary, KeithStevens Incorporated, Eden Prairie, MN © Jay E. Simpson 2001 Today’s “Presentation” • Five Common Legal Structures • Practical “TIPS” • Contracts 101 • Questions © Jay E. Simpson 2001 CHOOSE YOUR TEAM • People in the Business: Experience, Marketplace • Academics • Lawyers • Accountant/Tax • Marketing/Sales © Jay E. Simpson 2001 “A Guide to Starting a Business in Minnesota” Minnesota Department of Trade and Economic Development 651-296-3871 or 1-800-657-3858 Updated each January IT’S FREE! © Jay E. Simpson 2001 Five Common Legal Structures • Sole Proprietorship • Partnership • Regular Corporation (C-Corporation) • S-Corporation • Limited Liability Company (LLC) © Jay E. Simpson 2001 Sole Proprietorship • Simplest Form of Legal Structure • You and the Business are the Same • Business Licenses (if applicable) • • Register Business Name (if not owners first and last) Federal and State Tax ID Numbers if Employees Unemployment Comp Tax Number Workers Comp Insurance • Sales/Use Tax (if applicable) • Unlimited Personal Liability © Jay E. Simpson 2001 Partnerships • • • • • • • • General Partnership: 2 or More People Share Equally the Right and Responsibility to Manage Each Partner is Responsible for all Debts and Obligations Any Partner Can Legally Bind the Partnership Requires Federal and State Tax ID Numbers Partnership Not Taxed, Must File Annual Federal and State “Informational” Returns with IRS/MDR Unlimited Personal Liability Partnership Agreements: STRONGLY RECOMMENDED © Jay E. Simpson 2001 Regular Corporation (C-Corp) • • • • • • • Separate Legal Entity Owned by One or More Shareholders Board of Directors Responsible for Management and Control of the Corporation Limited Personal Liability: Corporation is Responsible for Debts and Obligations Corporation Federal and State Tax ID Numbers and Unemployment Comp ID Number Corporate Formalities Issue Stock Corporate Minute Book Shareholder Records Books of Account Initial Meeting of the Board of Directors or Shareholders Must File Corporate Tax Returns for Both Federal and State DOUBLE TAXATION TRAP © Jay E. Simpson 2001 S-Corporation • • • • • S-Corp is a Separate Legal Entity from the Individuals who Own or Operate it Unanimous Shareholder Election to be an S-Corp (IRS Form) Limited Personal Liability NO DOUBLE TAX: Taxed at Individual Shareholder Rates Statutory Animal Not More than 75 Shareholders No Non-Individual Shareholders No Non-Resident Alien Shareholders Only One Class of Stock © Jay E. Simpson 2001 Limited Liability Company (LLC) • Limited Personal Liability Like a Corporation • Business Income and Loss are passed onto the Owners of the Business • Articles of Organization vs. Articles of Incorporation • Formalities Similar to a Corporation • Many S-Corp Restrictions do NOT apply © Jay E. Simpson 2001 Insuring Your Business • Required for Most Types of Business • Get Property and Liability Coverage to Protect Yourself from Common Claims • “Errors and Omissions” Policy • Keep Costs Down with High Deductible Policies • Home Insurance Policies MAY NOT Cover Business Property and Liabilities © Jay E. Simpson 2001 Elevator Story: What Do You Offer? • Write Down Offerings • One Minute - Practice • References: Who are they? What did they say? © Jay E. Simpson 2001 How Can You Be Reached? • Be Accessible • Return Calls © Jay E. Simpson 2001 Getting Clients/Customers • Tell Everyone • Join Trade Groups - - - - Get Connected • On-Line • Web Page © Jay E. Simpson 2001 PRICING: Do Your Homework – Know the Range • • • • • Identify the Competition Competitor Offerings and Pricing Experience Unique/Special Skills Low, Mid-Range, Upper End Pricing Strategies (know yourself) • Be Reasonable © Jay E. Simpson 2001 CONTRACTS 101 Put “It” in Writing • Good idea to put your “deals” into writing (“cocktail napkin”) • Read the “contract” • Develop your own Mutual Confidentiality/NonDisclosure Agreement • Develop your own “standard” agreement • Ask for it (Thanks, Mom!) © Jay E. Simpson 2001 Warranties I • What should you agree to: That the deliverables will “substantially” comply with the specifications - That you have the right to perform the services and deliver the goods free from any third party claims • Disclaim implied warranties • Disclaim warranty of merchantibility • Disclaim warranty of fitness for a particular purpose - © Jay E. Simpson 2001 Warranties II • What shouldn’t you agree to: - That services, software or deliverables will be “error” or “bug” free - That the services, software or deliverables will meet the client’s “needs” or “ “objectives” - That the services, software or deliverables will be free from defects in materials and workmanship © Jay E. Simpson 2001 Limitation of Liability • ABSOLUTELY ESSENTIAL! - Disclaim “INCIDENTAL, CONSEQUENTIAL, INDIRECT AND SPECIAL DAMAGES” - Limit damages to cost of performing services and/or delivering goods - Make sure that Limitation of Liability is separate from warranty obligations © Jay E. Simpson 2001 Audits • • • • • • • • IRS: Are Personal Expenditures being Claimed as Business Expenses? Separate Checking Account and Credit Card for Business NEVER USE BUSINESS ACCOUNTS FOR PERSONAL EXPENSES Maintain Vehicle Log of Business vs. Personal Use Education Expense is deductible if Related to your Current Business, Trade or Occupation Meals 50% Deductible Maintain Accounting Records for at Least 6 Years No Receipts Required for Items Under $75.00 – Reasonable, Ordinary and Necessary © Jay E. Simpson 2001 SUMMARY • Assemble Your Team • • • • Get Set Up Tell the World Written Contracts are Good Do what you Enjoy, and never Work a Day in your Life © Jay E. Simpson 2001