1 Partnership - the Business Notes Wiki!

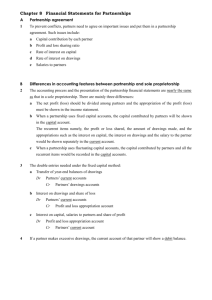

advertisement

1 Partnership Tutor: Marie O’Callaghan Sole Trader Unlimited Liability Company Partnership Limited Liability Partnerships • Professionals such as doctors, lawyers ,dentists, vets, accountants are not allowed to form companies. • There are advantages to partnerships over forming a company from the point of view of tax, accounting and disclosure requirements. • Partnerships do not go through a registration process to form. • Partnership is not a separate legal identity = partners have unlimited liability, unlike directors or shareholders in companies. • The downside is that each partner is liable for the losses of his co-partner in carrying on the partnership business, even where the other partner has defrauded clients of the business. Partnership Act 1890 - Amended 1907 • Partnership Act 1890 defines a partnership and essentially states that where 2 or more people carry on business with a common view of profit, then a partnership exists. • A written partnership agreement is not necessary. • The act applies where no partnership agreement is in place. The Main Provisions 1. 2. 3. 4. 5. 6. 7. 8. P&L must be shared equally No interest paid on capital No remuneration Differences settled by majority Change of business requires consent of all No right to expell a partner No right to retire All Partners have the right: 1. 2. 3. 4. 5. Take part Prevent entry of another partner Examine the books Receive interest 5%PA on loans/advances ex capital Dissolve the partnership 9. does not prevent a former partner from competing after leaving 10. Partnership dissolves automatically on 1. 2. 3. death of partner bankruptcy of partner Illegal activity of partnership Written Agreement Written partnership agreement is crucial to set out: • Function of the partnership • Capital each partner will invest • The profit sharing ratio • The role of each partner • Drawings – remuneration • Expulsion • New partners • non compete agreement • Dissolution • etc. Written Partnership agreement overrides the terms of the act Partnership Accounting Capital A/C • Records the original monies invested • Usually remains fixed unless – More capital introduced – Non-current assets re-valued – Goodwill crystallised and recognised • Credit balance – Credit the giving: partners giving capital to the business 1 ABC Opening credit balances 2 B introduces additional capital 3 C withdraws capital 4 ABC Capital upward adjustment for recognition of goodwill and positive re-valuation of assets Capital Account DATE DETAILS PARTNERS A 3/3/.. 31/12 B Bank Balance c/d DATE DETAILS C X X X X X X X PARTNERS A B C X X X 1/1/.. Balance b/d 2/2/.. Bank 31/12 Goodwill X X X 31/12 Revaluation X X X X X X X X X 1/1/.. Balance b/d X Current A/C • Short term element of each partners capital • Record for each partner – Share of profit/loss – Drawings – Interest on loans given to partnership – Interest on credit capital • Corresponding entry in appropriation Current A/C - Partner A DATE DETAILS 31/12/.. 31/12/.. 31/12/.. DATE DETAILS Drawings 1/1/.. Balance b/d Interest on Draw 31/12/.. Interest on Cr bal 31/12/.. Interest on Cap 31/12/.. Loan Interest 31/12/.. Share of Profits 1/1/.. Balance b/d Balance c/d € € Partner A Debit • Drawings – withdraw from cash instead of salary • Interest on drawings – charge for overdraw Credit • Interest on Credit balance – interest on investment held in the current account • Interest on Capital – interest earned on original investment • Loan Interest – interest due (not yet paid) for a loan given to the partnership • Share Profits – divide of profit Current A/C - Partner B DATE DETAILS 1/1/.. € DATE DETAILS Balance b/d 31/12/.. Interest on Cap 31/12/.. Drawings 31/12/.. Share of Profits 31/12/.. Interest on Drawings 31/12/.. Salary 31/12/.. Interest on Debit bal 31/12/.. Balance c/d 1/1/.. Balance b/d € Partner B Debit • Interest on Debit balance – money take out of the partnership/loan from business – interest charged Credit • Salary – reward for taking extra responsibility or work Current A/C - Partner C DATE DETAILS 31/12/.. 31/12/.. 31/12/.. DATE DETAILS Drawings 1/1/.. Balance b/d Interest on Draw 31/12/.. Interest on Cr bal 31/12/.. Interest on Cap 31/12/.. Salary 31/12/.. Share of Profits 1/1/.. Balance b/d Balance c/d € € Partner C Debit Credit • Capital – partner introduced more capital to the business. Appropriation A/C • In a partnership, the profits earned are due to the various partners in their profit sharing ration and are apportioned to them in the appropriation section on the Statement of Comprehensive Income • 3 Sections – Distributable income (Profit for year) – Balance of Net Profit – Share of Profit (as per PSR) Appropriation Account for year ended 31/12/.. € € Gross Profit X Other Partnership Expenses (X) Interest on Loan by partners to business (X) Profit for Year XX *Other Comprehensive income for the year X Total Comprehensive income for the year X *Distributable income (Profit for year) XX Appropriation Account for year ended 31/12/.. Salaries: A (X) B (X) C (X) Interest on capital Accounts: A (X) B (X) C (X) Interest on Current Accounts: X C (X) A (X) (X) B Interest on Drawings: Balance of Net Profit A (X) (X) X B X C X X XXX Appropriation Account for year ended 31/12/.. € € Share of Profit (as per PSR) A X B X C X XXX Statement of Financial Position • Equity Section – List of the closing balances from the partners capital and current accounts. Statement of Financial Position as at 31/12/.. € Capital Account Current Account A X B X C X A X B (X) C X € X X XX