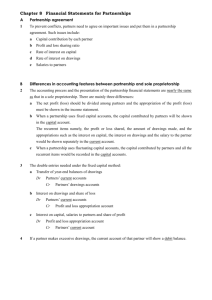

Partnerships

advertisement

PARTNERSHIP ACCOUNTING Partnership accounting revolves around the handling of equity. When two partners are setting up a partnership, each person contributes assets as well as a capital investment. The Initial Investment There would be two opening entries to record this new partnership. For example: Cash Accounts Receivable Office Furniture Partner 1, Capital $2,000 1,500 2,500 Cash Computer Equipment Accounts Payable Partner 2, Capital $1,500 3,500 $6,000 $ 500 4,500 As there are two capital accounts, which will be shown separately on the balance sheet, there are also two drawings accounts, one for each partner. The drawings account for wach partner will be debited when there is: Payments of salaries to partners Withdrawal of assets or cash by a partner Dividing Net Income Partners may make any agreement they wish for division of the partnership’s net income or net loss. One of the most important clauses of the partnership contract is the one stating how these will be shared. Four factors considered by partners are: Payment for amount of work performed; Return on capital; Amount of capital invested; and individual skills, talent, and reputation Methods of Dividing Net Income or Net Loss Among the many methods used to divide net income and net loss are: Fixed ratio; Capital ratio; Salaries, and remaining net income (or net loss) to partners in a fixed ratio; and Interest on capital, salaries, and remaining net income (or net loss) to partners in a fixed ratio. Accounting for Salaries, Interest, and Drawings in a Partnership Salaries and Interest According to the law, a partner participates in a partnership for a share of the earnings of the business, not for a salary or for interest on investment. Therefore, salaries and interest are only used as mathematical factor when dividing net income. Salaries and interest are used in the calculation at the end of the fiscal period. They are then distributed to the partners as part of their share of the next income. But they are not entered into the accounts as salaries and interest. Drawings The partners usually need to receive money from the business during the year. Any such payments are considered to be drawings and are debited to the partners’ respective drawings accounts. The partners should know roughly how well the business is doing. They can draw money based on their anticipated share of the profits. IN some businesses, the amount of the drawings is fixed by formal agreement. The partners’ drawings accounts and their respective shares of the net income are transferred to their capital accounts as part of the closing entry process. Financial Statements for a Partnership Financial statements for a partnership include more than the balance sheet and the income statement. A partnership also requires a statement of distribution of net income, which you have just studied, and a statement of partners’ capital. The financial statements for a partnership have to be prepared in a certain order. This is because information from one statement is needed to complete another. The statements of a partnership are prepared in the following order: 1. Income Statement 2. Statement of Distribution of Net Income 3. Statement of Partners’ Capital 4. Balance sheet The preparation of the four statements for a partnership is studied below. Partnership Exercises: Ex. # 1,2,3 p. 552-553 (t), p. 459-461 (w)