cash receipts journal

advertisement

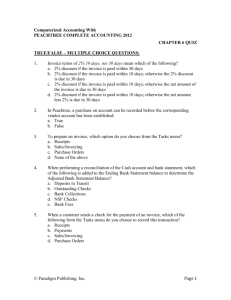

Chapter 10 Cash Receipts and Cash Payments 1 College Accounting 10th Edition McQuaig McQuaig Bille Bille Nobles PowerPoint presented by Douglas Cloud Professor Emeritus of Accounting, Pepperdine University 10–1 © 2011 Cengage Learning Credit Terms The credit period is the time the seller allows the buyer before full payment has to be made. A cash discount is an amount that a customer can deduct if a bill is paid within a specified time. The discount is based on the total amount of the invoice after any returns and allowances and freight charges on the invoice have been deducted. 1/15, n/60: The seller offers a 1 percent discount if the bill is paid within 15 days after the invoice date. 2/10, EOM, n/60: The seller offers a 2 percent discount if the bill is paid within 10 days after the end of the month, and the whole bill must be paid within 60 days after the last day of the month. 10–2 Sales Discounts Transaction (b). On August 10, received check from Mesa River Raft Company for $1,894.83 in payment of invoice no. 9384, less discount of $38.67. $1,933.50 x .02 10–3 Sales Discounts 10–4 Sales Returns Transaction (a). On September 1, Whitewater Raft Supply sold merchandise on account to Rugged River Company, $3,614, invoice no. 9391, terms 2/10, n/30. 10–5 Sales Returns Transaction (b). On September 5, Rugged River Company returned $254 worth of the merchandise. Whitewater Raft Supply issued credit memorandum no. 1069 and recorded the transaction. 10–6 Sales Returns Transaction (c). On September 8, received a check from Rugged River Company for $3,292.80 in payment of invoice no. 9391, less return and cash discount. ($3,614 ‒ $254) x .02 10–7 Sales Returns 10–8 No Sales Discount Involved Transaction (a). On April 1, Blue Merchandise Company sold merchandise on account to Yellow Company, invoice no. 1294, $9,540, terms 2/10, n/30, and recorded the sale in the general journal. 10–9 No Sales Discount Involved Transaction (b). On April 26, received check from Yellow Company for $9,450 in payment of invoice no. 1294. Since Yellow Company did not make payment within 10 days, the discount was not applied to the invoice amount. 10–10 Posting to the General Ledger and Subsidiary Ledger—A Computerized Approach Most computer accounting software allows businesses to post cash receipts for sales and apply discounts. Here, cash receipt of $1,894.83 in payment of invoice no. 9384 is recorded into the accounting software. 10–11 The accountant records the discount into the system. 10–12 After the discount has been applied, the invoice now shows as paid, and the balance due is $0.00. 10–13 Purchase Discounts The Purchase Discounts account, like Purchases Returns and Allowances, is a contra account. The Purchase Discounts account is treated as a deduction from Purchases on the buyer’s income statement. 10–14 Purchase Discounts Transaction (a). On August 2, Whitewater Raft Supply bought merchandise on account from Pataponia, Inc., invoice no. 2706, $1,710; terms 2/10, n/30; dated July 31; FOB San Francisco, freight prepaid and added to the invoice, $85.50. 10–15 Purchase Discounts Transaction (b). On August 8, issued Ck. No. 2076 to Pataponia, Inc., in payment of invoice no. 2706, less cash discount of $34.20, $1,761.30. The cash payment was determined as follows: $1,710 ‒ $34.20 + $85.50 (continued) $1,710 x .02 10–16 Purchase Discounts 10–17 No Purchase Discounts Involved Transaction (a). On November 1, Blue Merchandise Company bought merchandise on account from Grey, Inc., invoice no. 3901, $4,600; terms 2/10, n/30, dated October 31. 10–18 No Purchase Discounts Involved Transaction (b). On November 28, issued Ck. No. 1151 to Grey, Inc., in payment of invoice no. 3901, $4,600. 10–19 Computerized Approach to Posting The accountant records the payment of the invoice by selecting the correct invoice due. Computerized Bill Payment The bill payment check screen shows that payment has been applied to the invoice. Partial Income Statement 10–22 Trade Discounts Manufacturers and wholesalers publish catalogs listing their products at retail prices. These organizations offer their customers substantial reductions, called trade discounts, from the list prices. Trade discounts are not journalized because they are not related to cash payments. Manufacturers and wholesalers use trade discounts to avoid the high cost of reprinting catalogs when selling prices change. Neither the seller nor the buyer records trade discounts in the accounts; they enter only the selling price. 10–23 Trade Discounts as a Chain of Percentages A distributor of automobile parts grants discounts of 30 percent, 10 percent, and 10 percent off the listed catalog price of $900. List or catalog price $900.00 Less 1st trade discount of 30% 270.00 Remainder after 1st discount $630.00 Less 2nd trade discount of 10% 63.00 Remainder after 2nd discount$567.00 Less 3rd trade discount of 10% 56.70 Selling price $510.30 10–24 Seller’s Transactions Buyer’s Transactions 10–25 Purchases and Sales Transactions 10–26 The Cash Receipts Journal A cash receipts journal contains all transactions in which cash is received, or increased. When a cash receipts journal is used, all transactions in which cash is debited must be recorded in it. A cash receipts journal may be used for a service as well as a merchandising business. 10–27 Cash Receipts in the General Journal Oct. 1 Sold merchandise on account to Green River Rafts, invoice no. 10050, $3,500; terms 2/10, n/30. 10–28 Cash Receipts in the General Journal Oct. 4 Sold merchandise, $500, and the customer used a credit card. The bank charges 4 percent for credit card transactions. $500 x .04 10–29 Cash Receipts in the General Journal Oct. 5 Collected cash on account from I. R. Ray, a charge customer, $416. 10–30 Cash Receipts in the General Journal Oct. 8 Sold equipment for cash at cost, $500. 10–31 Cash Receipts in the General Journal Oct. 10 Received a check from Green River Rafts for $3,430 in payment of invoice no. 10050, less cash discount. $3,500 x .02 10–32 Cash Receipts in the General Journal Oct. 15 Cash sales for first half of the month, $2,460. 10–33 Cash Receipts Journal Now, let’s record the same transaction that impact cash receipts in a cash receipts journal. The entry of October 1 does not involve cash, so it is not entered in the cash receipts journal. Cash was received on October 4, so the sale of merchandise involving a credit card is entered in the cash receipts journal. 10–34 Cash Receipts Journal Notice that the entry was easier to journalize using the special journal. On October 5, $416 was collected on account from L.R. Ray, a charge customer. The “Account Credited” column is used to identify the customer who made the payment. 10–35 Cash Receipts Journal Identifying Accounts Receivable in the “Account Credited” column would provide no additional information since the special column, “Accounts Receivable Credit” provides this information. 10–36 Cash Receipts Journal On October 7, the owner, D. M. Bruce, invested $9,000 in the business. In this entry, the “Account Credited” column is used to identify the $9,000 in “Other Accounts Credit” credit as a credit to D. M. Bruce, Capital for $9,000. 10–37 Cash Receipts Journal 10–38 Cash Receipts Journal Here are some other transactions made during the month that involved cash. Oct. 16 17 21 30 31 Received a check from Floyd Mercantile for $1,366.12 in payment of invoice no. 10052, less cash discount ($1,394.00 – $27.88 = $1,366.12). Borrowed $9,000 from the bank, receiving cash and giving the bank a promissory note. Received check from Hartman Guides for $3,696.80 in payment of invoice no. 10055, less discount ($3,772.24 – $75.44 = $3,696.80). Received a check from Bowers River Co. for $1,710.00 in payment of invoice no. 10054. (This is longer than the 10day period, so the cash discount is not allowed.) Cash sales for second half of the month, $2,620. 10–39 Cash Receipts Journal Notes Payable is used instead of Accounts Payable because a promissory note was issued. 10–40 Posting from the Cash Receipts Journal 10–41 Proving the Cash Receipts Journal Totals Debit Totals Credit Totals Cash $34,678.92 Accounts Receivable Credit Card Sales Expense 20.00 Other Accounts Sales Discounts 173.32 $34,872.94 $10,792.24 5,580.00 18,000.00 $34,872.24 10–42 Advantages of Using a Cash Receipt Journal 1. Transactions generally can be recorded on one line. 2. All transactions involving debits to Cash are recorded in one place. 3. It eliminates much repetition in posting when there are numerous transactions involving Cash debits. 4. Special columns can be used for specialized transactions and posted as one total. 10–43 The Cash Payments Journal The cash payments journal is a special journal used to record all transactions in which cash goes out, or decreases. When the cash payments journal is used, all transactions in which cash is credited must be recorded in it. The cash payments journal may be used for either a service or a merchandising business. 10–44 Cash Payments Journal Oct. 2 Bought merchandise on account from Pataponia, Inc., invoice no. 2746, $2,500; terms 2/10, n/30; dated September 30; FOB San Francisco, freight prepaid and added to the invoice, $100.25. No cash is involved in this transaction, so the entry is not recorded in the cash payments journal. 10–45 Cash Payments Journal Oct. 8 Issued Ck. No. 2226 to Pataponia, Inc., in payment of invoice no. 2730, less cash discount of $50.00, $2,550.25. Oct. 10 Paid cash for liability insurance, Ck. No. 2227, $4,890. 10–46 Cash Payments Journal Oct. 12 Paid wages for two weeks, Ck. No. 2228, $6,220. Oct. 14 Paid rent for the month, Ck. No. 2229, $2,950. 10–47 10–48 Cash Payments Journal $21,125.25 = $21,125.25 10–49 Proving the Cash Payments Journal Totals Debit Totals Credit Totals Accounts Payable $ 5,004.25 Cash Other Accounts 16,121.00 Purchases Discounts $21,125.25 $21,060.97 64.28 $21,125.25 10–50 Advantages of Using a Cash Payments Journal 1. Transactions generally can be recorded on one line. 2. All transactions involving credits to Cash are recorded in one place. 3. It eliminates much repetition in posting when there are numerous transactions involving Cash credits. 4. Special columns can be used for specialized transactions and posted as one total. 10–51 Using Special Journals Recommended Order of Posting 1. Sales journal 2. Purchases journal 3. Cash receipts journal 4. Cash payments journal 10–53